This week, the stock market has shown remarkable resilience, with IBM leading a late rally as investors shrugged off Federal Reserve rate concerns, rising geopolitical tensions in the Middle East, and volatile commodities while bracing for key economic data and earnings reports to close out the quarter. U.S. stocks made a surprising recovery on Monday after spending most of the day in negative territory.

On Monday, Federal Reserve Chair Jerome Powell’s remarks earlier in the day added to the initial market turmoil. Speaking at the National Association for Business Economics (NABE) conference, Powell signaled that the central bank might scale back the size of future interest rate cuts, dampening hopes for a more aggressive reduction. While markets briefly slumped on the news, they quickly regained their footing, signaling investor confidence despite the tempered outlook.

Geopolitical concerns have kept markets on edge this week, particularly following a sharp escalation in tensions in the Middle East. Stocks initially fell on the news, but by Wednesday, equities began to rebound as investors looked for buying opportunities. However, the volatility is far from over, as uncertainty surrounding the situation continues to weigh on sentiment.

Commodities markets have reflected these concerns, with gold futures experiencing significant volatility. After some profit-taking, the precious metal remained near its all-time highs, as investors sought safety in gold amid geopolitical instability. Meanwhile, oil prices, which surged earlier in the week, began to ease by mid-week. OPEC+ ministers held a meeting, sticking to their planned output policy. The decision to maintain production levels through December has renewed concerns about a potential supply glut, causing oil prices to retreat from their recent highs.

Amid this uncertainty, there are signs of economic recovery in the U.S., particularly in the labor market. According to the ADP National Employment Report, private sector employers added 143,000 jobs in September—up from the revised 103,000 in August. This marked the first acceleration in job growth in six months and exceeded economists’ predictions of a 128,000 increase.

Notably, the manufacturing sector, which has struggled this year, saw its first increase in jobs since April, suggesting early signs of recovery. The services sector, meanwhile, posted a strong gain of over 100,000 jobs, although the information services industry bucked the trend, recording a decline in positions. Across the U.S., most regions saw an uptick in hiring, with the East South Central region being the only outlier.

This rebound comes on the heels of the Federal Reserve’s recent decision to cut interest rates by half a percentage point, the first such move in years. While the Fed is keenly watching for signs of inflation, the increase in hiring has not yet led to significant wage inflation. In fact, workers changing jobs saw their lowest salary premiums since January, alleviating fears of wage-driven inflation spikes.

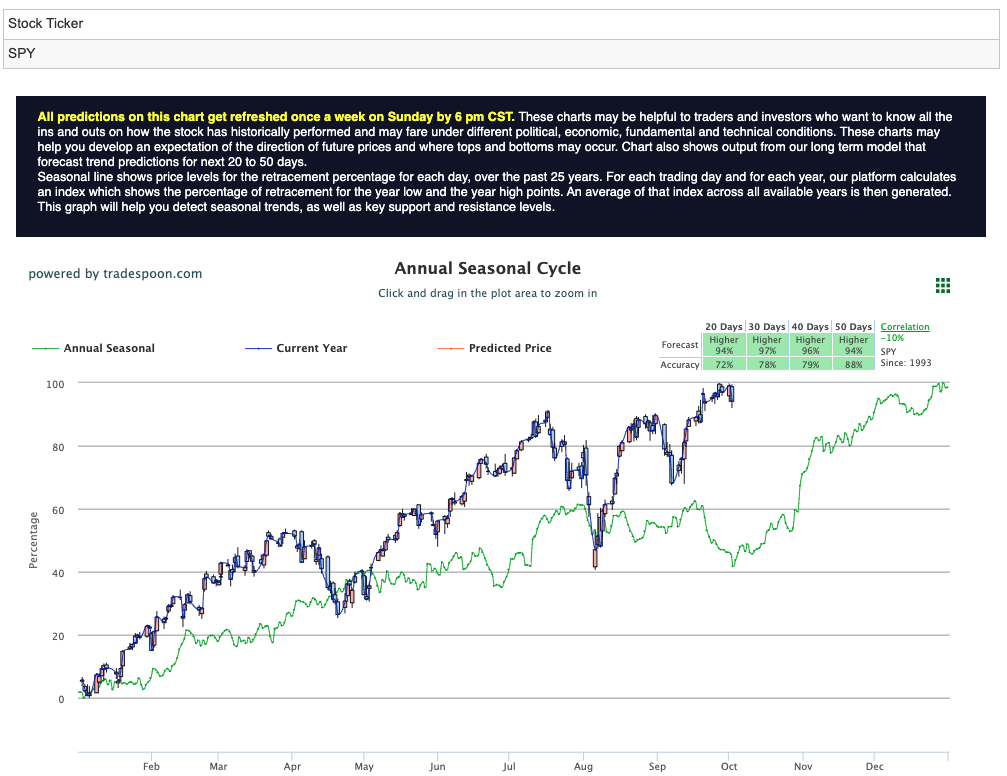

As we move forward, the S&P 500 (SPY) is approaching crucial technical levels. Resistance is expected between $560 and $575, with significant support predicted in the $480 to $510 range in the coming months. The index’s recent performance, coupled with last week’s volatility, suggests that the market is hovering near all-time highs, reflecting a resilient investment landscape despite ongoing challenges. For reference, the SPY Seasonal Chart is shown below:

Last week’s economic data, particularly the Personal Consumption Expenditures (PCE) index, showed signs of moderating inflation, boosting investor confidence. Federal Reserve officials have hinted at potential rate cuts, contributing to the positive market sentiment. Additionally, China’s latest stimulus measures aimed at reviving its economy amid global uncertainties have captured investor attention. However, despite these optimistic developments, concerns over a potential recession continue to loom, keeping cautious sentiment in play.

This week has already brought earnings results from major companies like Carnival Corporation and Nike, with Constellation Brands and Levi Strauss set to report by the end of the week. Investors are closely watching Thursday’s release of key economic data, including weekly unemployment figures, Services PMI, ISM Services, and factory orders. Friday’s spotlight will be on September’s employment report, which could provide further insight into the strength of the labor market and broader economic trends.

Despite a volatile environment driven by Federal Reserve uncertainty and geopolitical risks, the U.S. stock market has demonstrated remarkable resilience. As investors process the latest economic data and earnings reports, attention will be on the technical levels of the major indices and how ongoing developments—particularly in the Middle East—will impact market sentiment. With potential recession risks still on the horizon, the coming weeks will be critical in shaping the direction of the markets as we head into the final quarter of the year.

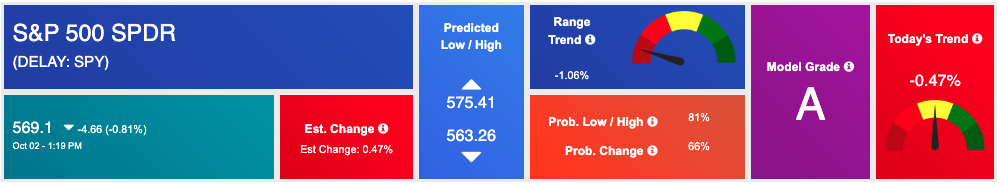

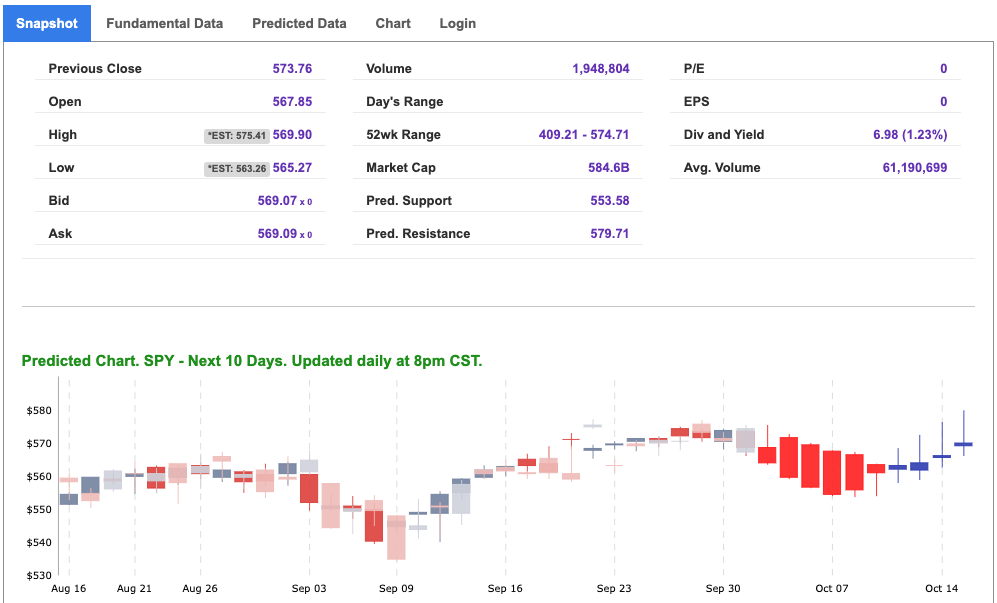

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

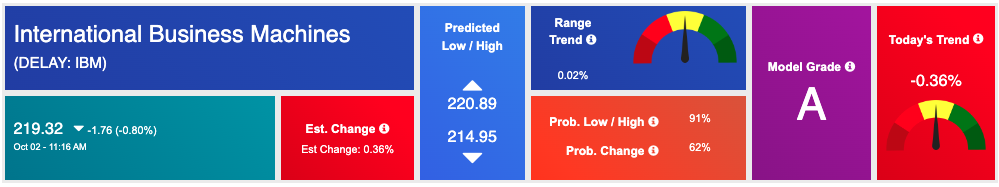

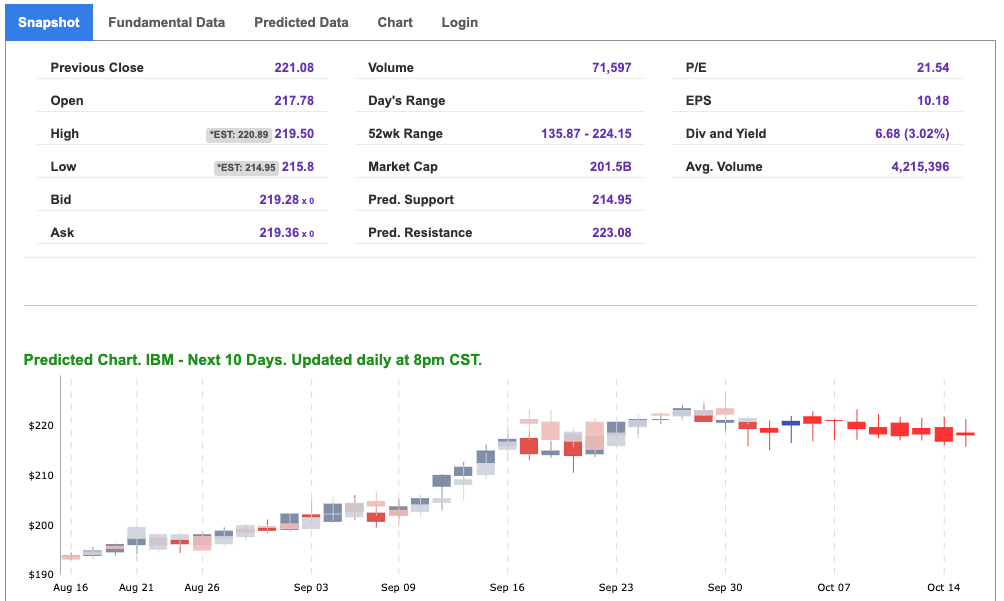

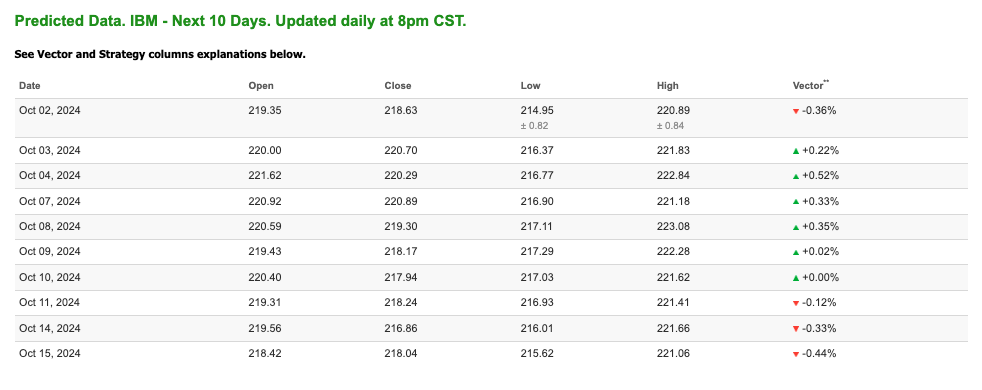

Our featured symbol for Thursday is International Business Co. – IBM is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $219.32 with a vector of -0.36% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, IBM. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

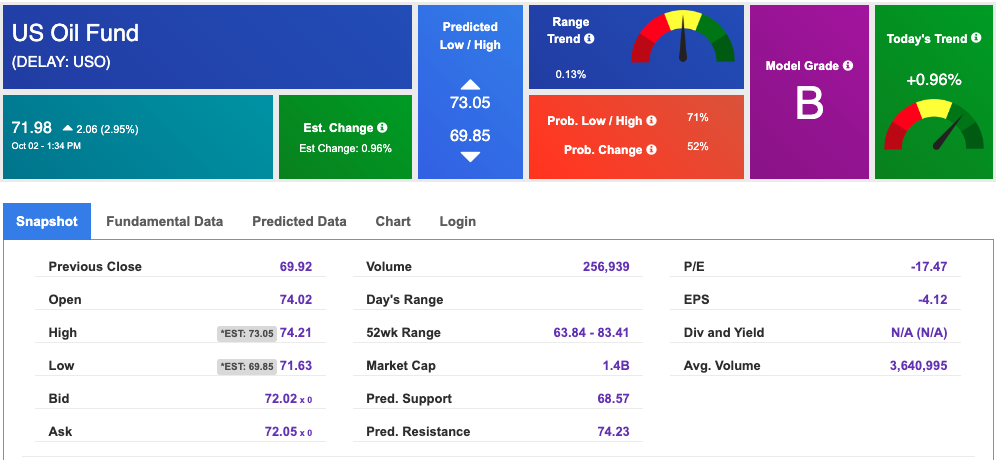

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $70.31 per barrel, up 0.69%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $71.98 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

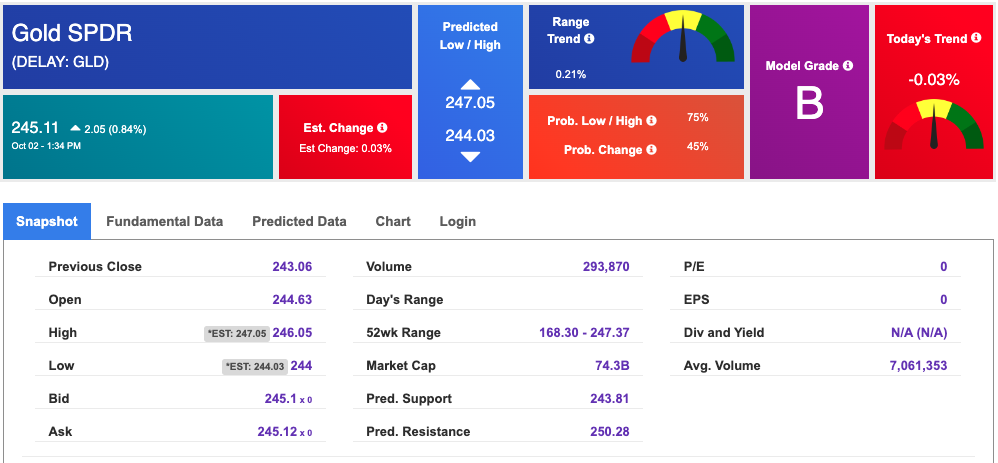

The price for the Gold Continuous Contract (GC00) is down 0.56% at $ 2,674.90 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $245.11 at the time of publication. Vector signals show -0.03% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

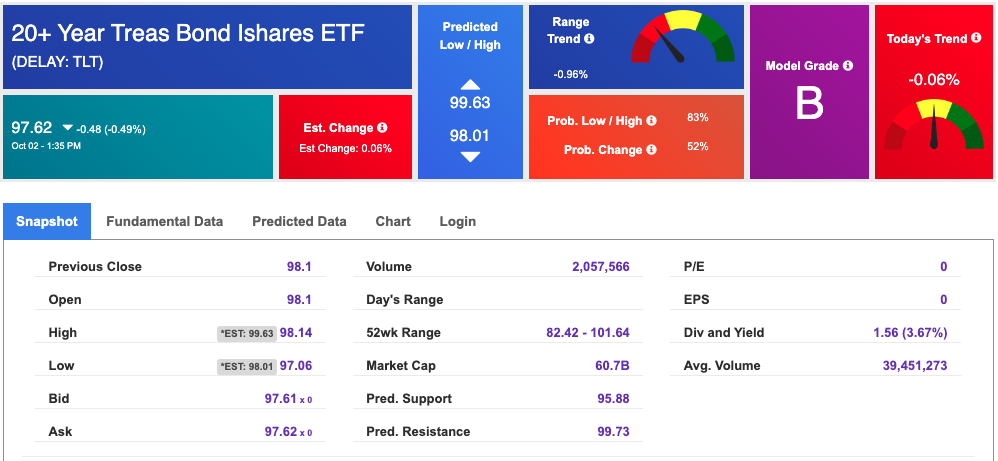

The yield on the 10-year Treasury note is up at 3.788% at the time of publication.

The yield on the 30-year Treasury note is up at 4.134% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

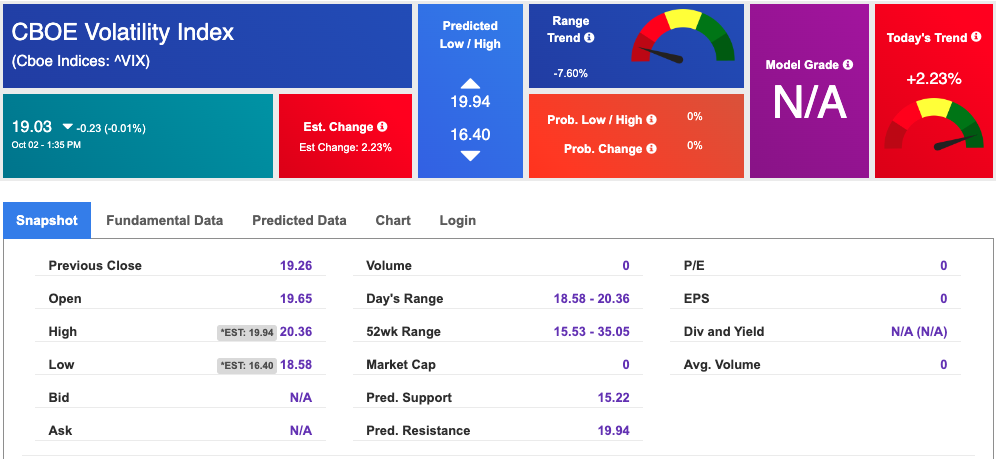

The CBOE Volatility Index (^VIX) is priced at $19.03 down 0.01% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!