RoboStreet – February 13, 2025

The stock market opened the week with modest gains as investors moved carefully, awaiting clarity on potential tariff changes and key economic reports. Equities edged higher despite lingering uncertainty surrounding policy shifts, inflation data, and Federal Reserve commentary that could shape monetary policy in the coming months.

Trade tensions took center stage after President Donald Trump signaled fresh tariff hikes, particularly a proposed 25% tariff on steel and aluminum imports. While domestic steel producers saw short-term gains, European steelmakers faced losses, fueling global concerns. Safe-haven assets like gold surged to fresh highs, while oil prices climbed in response to tariff-related market reactions.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Last week’s heightened volatility followed mixed economic data, corporate earnings, and shifting inflation expectations. A weaker-than-expected University of Michigan consumer sentiment report triggered a sharp market drop on Friday, reflecting renewed inflation concerns. The survey showed a jump in one-year inflation expectations to 4.3% from 3.3% in January, the highest level since November 2023. This unexpected increase unsettled investors, reinforcing fears of persistent inflation despite the Federal Reserve’s tightening measures.

Treasury yields rose as bond traders reassessed the likelihood of future rate cuts. The 10-year yield ticked upward, while the University of Michigan’s consumer sentiment index fell for the second consecutive month to 67.8 from 71.1 in January, missing economist forecasts of 72. This marked the lowest reading since July 2024.

Earnings reports continue to influence market direction, with major technology and consumer-focused firms delivering mixed results. This week, investors will watch earnings from key companies, including Coca-Cola, Humana, CVS Health, Moderna, Shopify, Zillow, DoorDash, Cisco Systems, Airbnb, Coinbase Global, DuPont, Deere, Carrier Global, and GE HealthCare Technologies.

Wholesale inflation remained hot in January, reinforcing concerns about persistent price pressures. The producer price index (PPI) rose by 0.4%, exceeding the 0.2% consensus estimate, following an upwardly revised 0.5% increase in December. Year-over-year, PPI climbed 3.4%, slightly below December’s 3.5% increase. Core PPI, which excludes volatile food and energy prices, increased 0.3% for the month and 3.6% year-over-year.

These figures followed a higher-than-expected consumer price index (CPI) report. CPI surged 0.5% in January, outpacing the anticipated 0.3% increase. Core CPI, which excludes food and energy, rose 0.4%. On an annual basis, headline CPI and core CPI increased 3.0% and 3.3%, respectively.

Food prices were a major inflation driver, rising 0.4% in January. Egg prices soared 15.2%, the largest increase since June 2015, due to an avian influenza outbreak impacting poultry supplies. Grocery prices climbed 0.5%, with meat, poultry, fish, and eggs collectively rising 1.9%.

Despite these inflationary pressures, services-related inflation showed mixed results. Airline fares declined 0.3% after a 5% jump in December, while portfolio management costs edged up 0.4%. Medical services diverged, with dental care prices rising 1.5%, while physician care and hospital outpatient services posted slight declines.

The Federal Reserve remains in a holding pattern, awaiting clearer inflation trends before making policy adjustments. Fed Chair Jerome Powell reiterated the need for sustained progress in cooling inflation before considering rate cuts. The Fed’s preferred inflation gauge, the personal consumption expenditures (PCE) price index, is set for release on February 28, providing further insight.

Market participants are closely watching how these inflation readings may influence the Fed’s next decision. The upcoming FOMC meeting on March 18-19 will incorporate February’s CPI and PPI data, alongside updated labor market reports. Meanwhile, Trump recently called for lower interest rates, but Powell reaffirmed the Fed’s commitment to long-term economic stability over political considerations.

Despite inflation concerns, stocks closed near record highs as the White House clarified that new tariffs wouldn’t take effect before April and could be reduced if trading partners lowered tariffs on U.S. goods. Investors welcomed this news, pushing markets higher.

The Dow Jones Industrial Average gained 350 points (+0.8%), the S&P 500 rose 1% to 6110, and the Nasdaq Composite advanced 1.3%. The S&P 500 is approaching its record high of 6118.71 set on January 23.

The “Magnificent Seven” stocks—Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla—posted gains, reflecting renewed confidence in the tech sector. Nvidia rallied 2.8%, attempting to reclaim its 50-day moving average. Microsoft surged following strong earnings, despite concerns over slowing Azure cloud growth. Meta Platforms hit a new high before dipping 0.3%, potentially ending a 17-day win streak. Apple gained 2.1% but remains below its 50-day line.

Cisco Systems jumped 2.1% after exceeding Wall Street expectations on earnings and revenue. Product orders rose 29% year over year, with AI infrastructure orders surpassing $350 million. The company raised its fiscal-year revenue forecast to $56 billion–$56.5 billion, up from its previous estimate of $55.3 billion–$56.3 billion.

Intel soared 7.3%, extending a three-day rally of nearly 18%, after the U.S. government signaled policy shifts to accelerate AI chip innovation. Meanwhile, Deere fell 2.2% after reporting a sharp earnings decline, with fiscal Q1 profit dropping to $3.19 per share from $6.23 a year earlier. Revenue fell 30% to $8.51 billion, with sales in its precision agriculture division expected to decline by 15%–20% this fiscal year.

The latest jobless claims data indicated continued labor market stability. Initial unemployment claims fell to 213,000 for the week ending February 8, down from 220,000 a week earlier and below economists’ forecast of 214,000. Continuing claims declined to 1.85 million from 1.89 million.

Treasuries gained across most maturities following mixed economic data. The two-year yield declined by 3 basis points, while the 10-year and 30-year yields fell by 5 basis points each, signaling cautious investor sentiment.

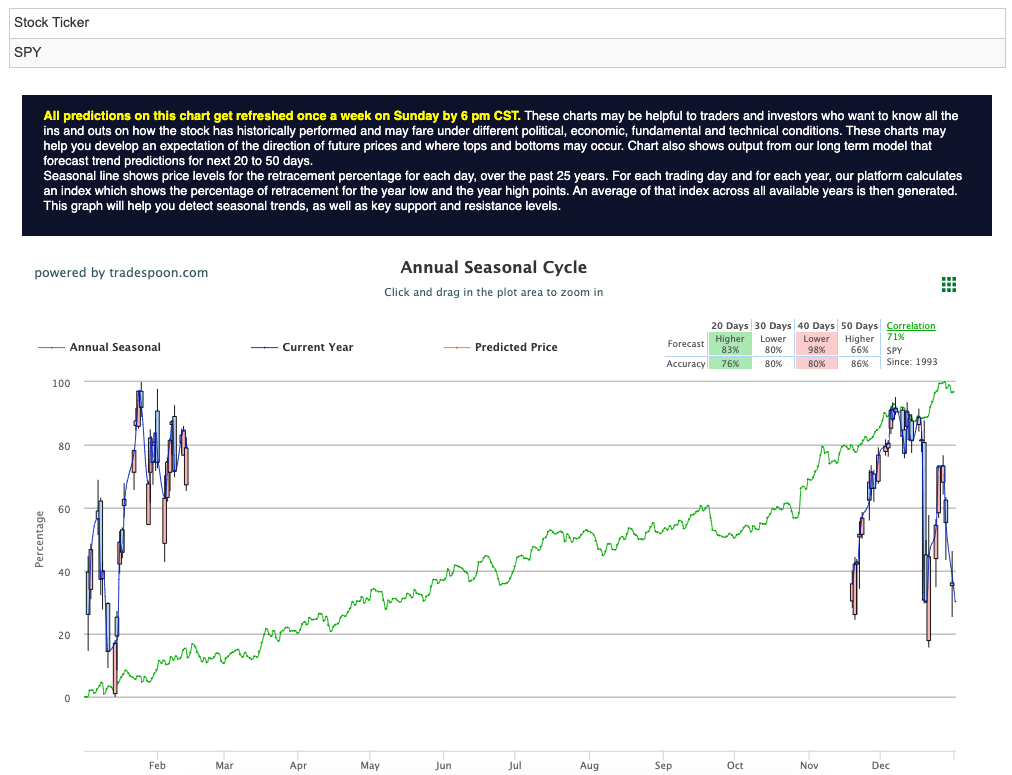

The S&P 500 rally could extend toward the $620–$640 range, with short-term support between $560–$580 in the coming months. While a sideways trading pattern is likely in the near term, the long-term outlook remains positive, driven by earnings resilience and improving economic stability. For reference, the SPY Seasonal Chart is shown below:

While inflation remains within expectations and earnings season has exceeded some forecasts, risks persist. Prolonged higher interest rates, shifting unemployment trends, and geopolitical uncertainty could introduce volatility. Investors should stay informed and adaptable as sentiment continues to evolve, preparing for potential market swings in response to fresh economic developments.

As we move forward, all eyes will be on key economic indicators and Federal Reserve commentary to determine the next major market move.

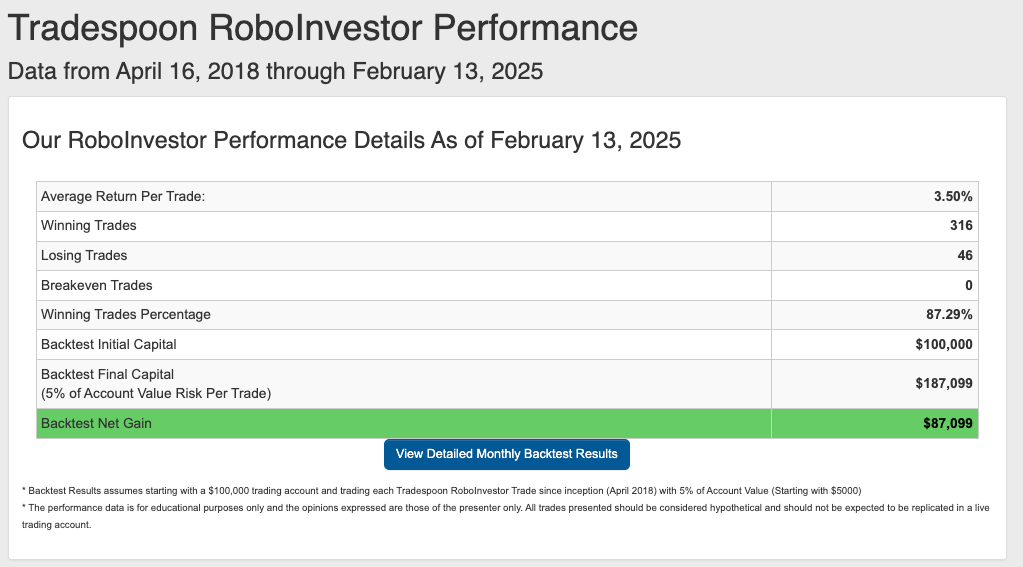

Unlock smarter investment decisions with our RoboInvestor stock and ETF advisory service, powered by advanced AI. This cutting-edge technology identifies trades with high-profit potential, cutting through market noise and eliminating emotional bias. With clear, data-driven insights and strategies, RoboInvestor helps you navigate today’s ever-changing market with confidence and precision.

Every other weekend, subscribers receive an exclusive newsletter packed with my market analysis, technical outlook, updates on existing positions, and one or two fresh trade recommendations to act on when the market opens on Monday.

RoboInvestor is a flexible, unrestricted service. I may recommend blue-chip stocks or ETFs representing major indexes, market sectors, commodities, currencies, interest rates, and even shorting opportunities using inverse ETFs. Our model portfolio typically holds between 12 to 25 positions, adjusting based on market conditions. Recently, we’ve adopted a more cautious approach, focusing on a smaller, more selective set of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.29% going back to April 2018.

As we enter 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!