Market Outlook: Inflation Worries and Geopolitical Tensions Rattle Wall Street

The new week began with a jolt of uncertainty on Wall Street. Investors found themselves grappling with inflation concerns following last Friday’s unexpectedly strong jobs report. Adding to the tension are escalating conflicts in the Middle East, growing fears around Hurricane Milton, and the intensifying backdrop of a highly contentious U.S. presidential election. This combination has left stocks on shaky ground, amplifying market volatility.

A Week of Mixed Economic Signals

The prior week delivered a whirlwind of economic data that left investors on edge. The Job Openings and Labor Turnover Survey (JOLTS) revealed a drop in job openings, stoking fears that the labor market could be softening. This data reignited debates about a potential economic slowdown, raising concerns over whether the U.S. economy is beginning to lose steam.

Midweek brought some relief with the release of the ADP National Employment Report. The report exceeded expectations, showing that private employers added 143,000 jobs in September, a positive sign for the labor market. Manufacturing jobs, in particular, posted their first increase since April, reinforcing optimism that some sectors remain resilient despite broader economic uncertainty.

By Friday, optimism surged as the Nonfarm Payroll report stunned markets by revealing 254,000 jobs were added in September—far surpassing expectations of 140,000. Even more encouraging were upward revisions for July and August, which reinforced confidence in the labor market’s strength. The unemployment rate also ticked lower than anticipated, alleviating some recession fears. However, the strength in employment numbers could pose a challenge for investors hoping for quick rate cuts from the Federal Reserve.

Federal Reserve’s Delicate Balancing Act

While the robust job market is a positive indicator, it has also raised concerns that the Federal Reserve may delay cutting interest rates as quickly as some had hoped. At the National Association for Business Economics (NABE) conference, Federal Reserve Chair Jerome Powell signaled that the Fed would take a more measured approach to rate hikes, likely weighing incoming economic data before making any aggressive policy shifts. Initially, this news unsettled investors, as many had been anticipating more rapid rate cuts.

However, Powell’s cautious tone seemed to align with the strong employment data from later in the week, calming fears of abrupt monetary policy shifts. This recalibration has led many to expect more gradual interest rate cuts moving forward, rather than the aggressive reductions previously priced into the market.

On the global front, China’s economic stimulus measures have garnered attention, providing a temporary boost to commodities and global markets. While these efforts have eased concerns over a potential global slowdown, the sustainability of China’s recovery remains uncertain, adding another layer of complexity to the market outlook.

Looking Ahead: Earnings Season and Inflation Data in Focus

This week, investor attention will shift to key earnings reports, with major financial institutions like JPMorgan Chase, Delta Airlines, and PepsiCo set to report. These results will provide crucial insights into the U.S. economy’s performance and may further inform the Federal Reserve’s response to inflation pressures.

Additionally, all eyes will be on the upcoming release of critical inflation data, including the Consumer Price Index (CPI) and Producer Price Index (PPI). These reports could shape market expectations around future rate cuts and are expected to heighten volatility.

Following the strong September jobs report, bond yields rose on Monday as traders adjusted their outlook on the Federal Reserve’s rate path. U.S. stock futures pointed to early losses, with rising Treasury yields putting downward pressure on equities as traders scaled back their expectations for immediate rate cuts.

Navigating Market Risks: Stay Cautious as We Enter Q4

As we move into the final quarter of 2024, the risks of a market correction remain high. Despite the recent wave of positive economic data, external pressures—ranging from geopolitical tensions to inflation concerns—pose real risks to the market’s stability. The long-term trend remains intact, but vigilance is crucial as we navigate these uncertain waters.

I continue to advise against chasing rebounds with additional capital. The market’s overall risks remain elevated, and we could still see corrections as the economy cools and unemployment edges up. Additionally, there is rising concern over the potential failure of small banks with significant exposure to commercial and residential real estate. These factors contribute to a cautious market outlook, despite some positive economic signals.

I remain in the Market Neutral camp as inflation appears to be stabilizing within expectations and earnings season is shaping up better than expected. Still, the possibility of a recession looms large, and investors should remain cautious as the broader economy cools and external factors such as geopolitical risks continue to weigh on sentiment.

SPY and Technical Outlook

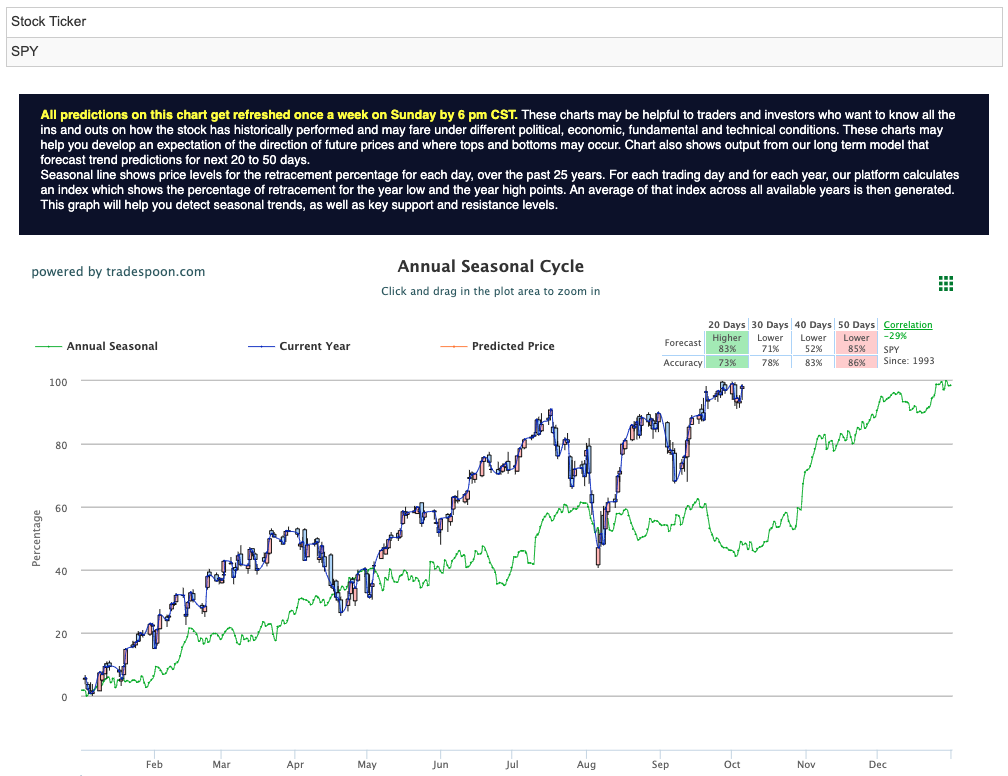

Looking specifically at the S&P 500 (SPY), the rally appears capped in the 570–580 range, while support can be found between 520 and 540 in the coming months. I anticipate the market will trade sideways in the short to medium term, with the long-term trend remaining positive. However, investors should remain cautious as external pressures could still push the market into corrective territory. For reference, the SPY Seasonal Chart is shown below:

With inflation concerns, geopolitical risks, and a highly anticipated earnings season, the final quarter of 2024 is shaping up to be anything but smooth. Investors should remain cautious and avoid overcommitting capital amid the current volatility. While the U.S. economy’s long-term trend remains intact, near-term challenges—from global economic pressures to rising unemployment—could still impact market performance.

For now, staying vigilant and managing risk will be key as Wall Street navigates a complex landscape of inflation, geopolitical tension, and shifting economic data.

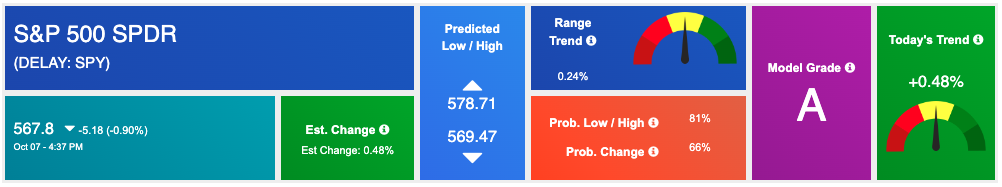

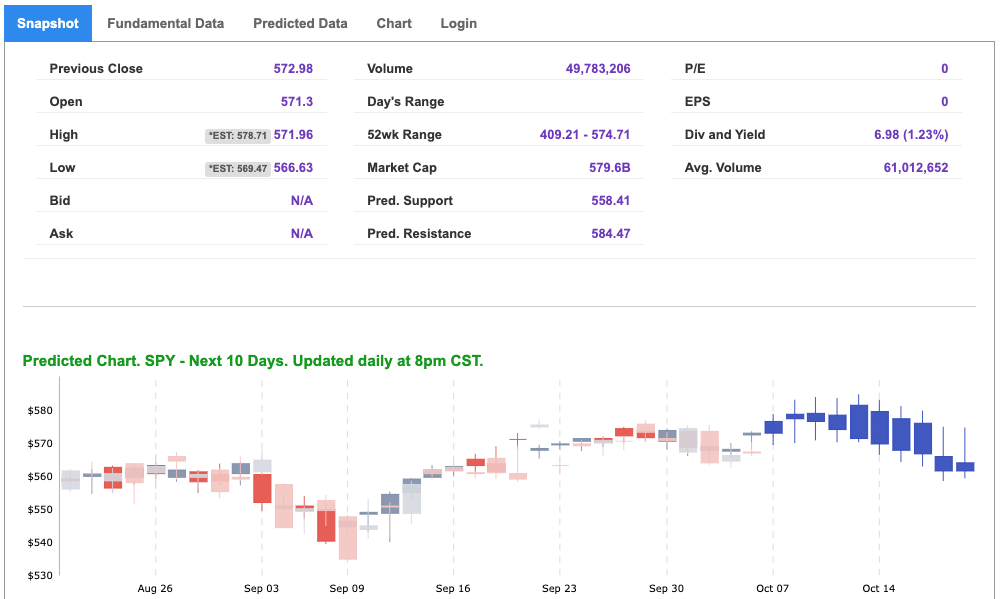

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

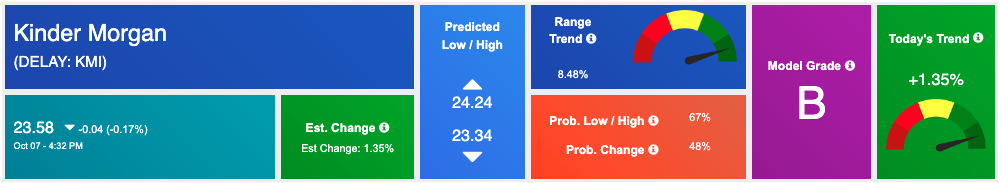

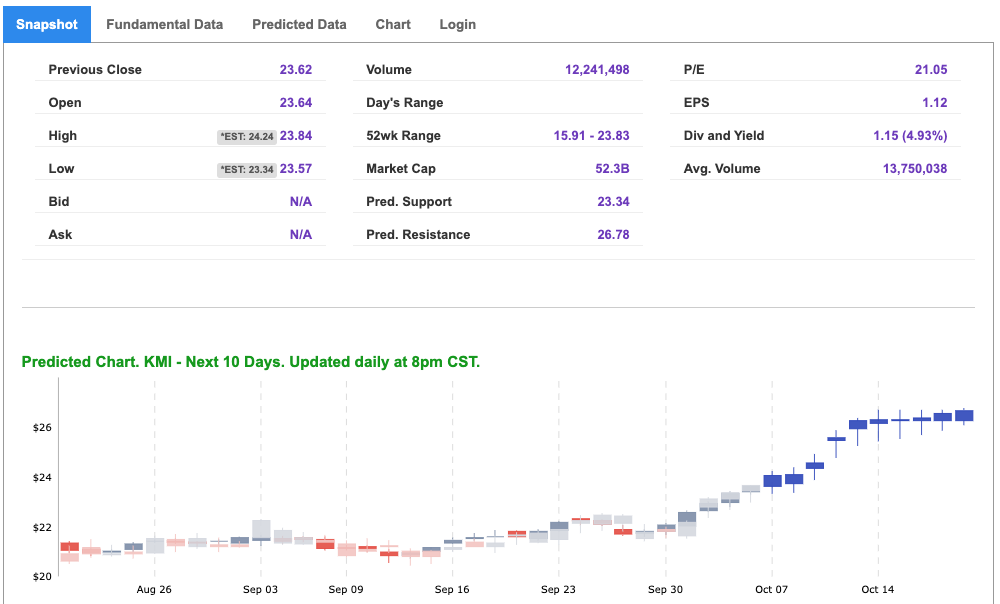

Our featured symbol for Tuesday is Kinder Morgan – KMI is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $23.58 with a vector of +1.35% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, KMI. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

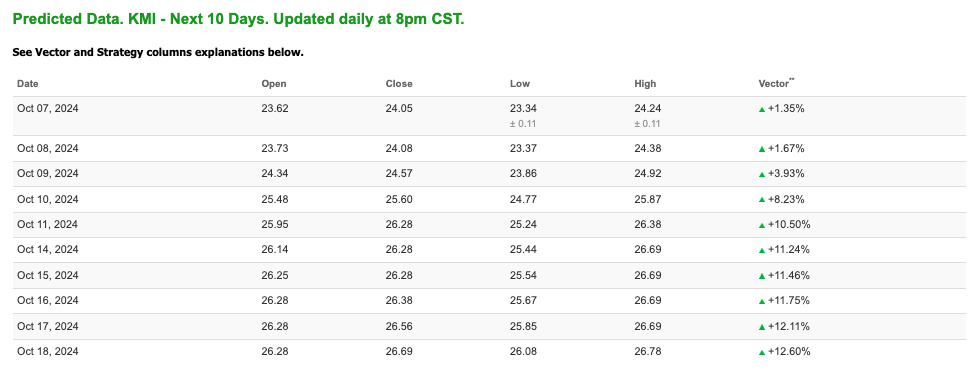

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $77.29 per barrel, up 3.91%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $79.2 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

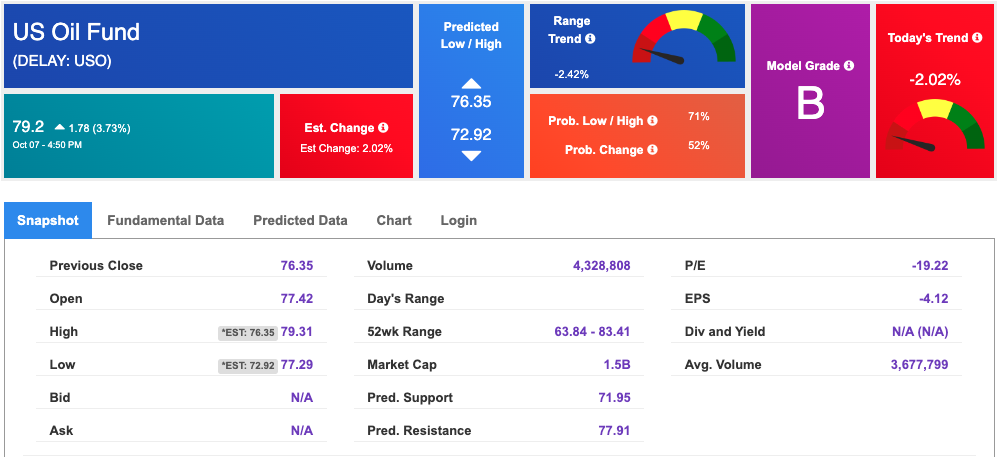

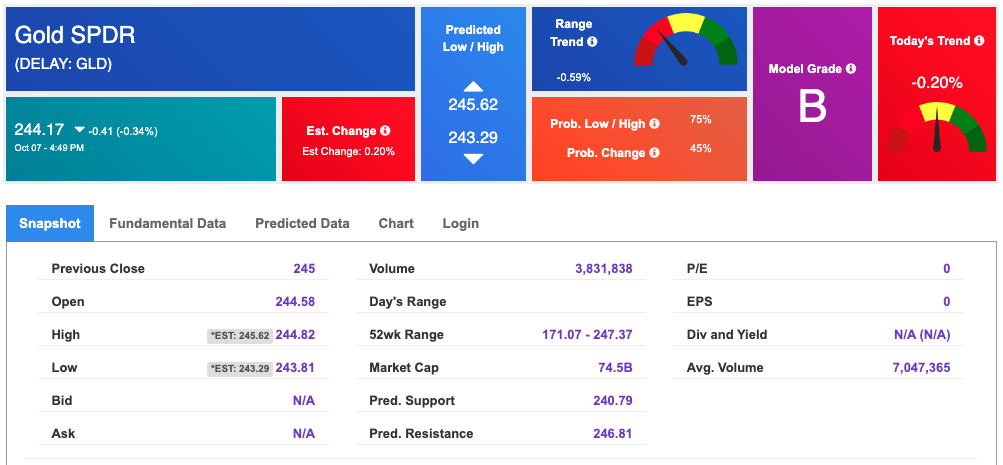

The price for the Gold Continuous Contract (GC00) is down 0.22% at $2,661.90 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $244.17 at the time of publication. Vector signals show -0.20% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

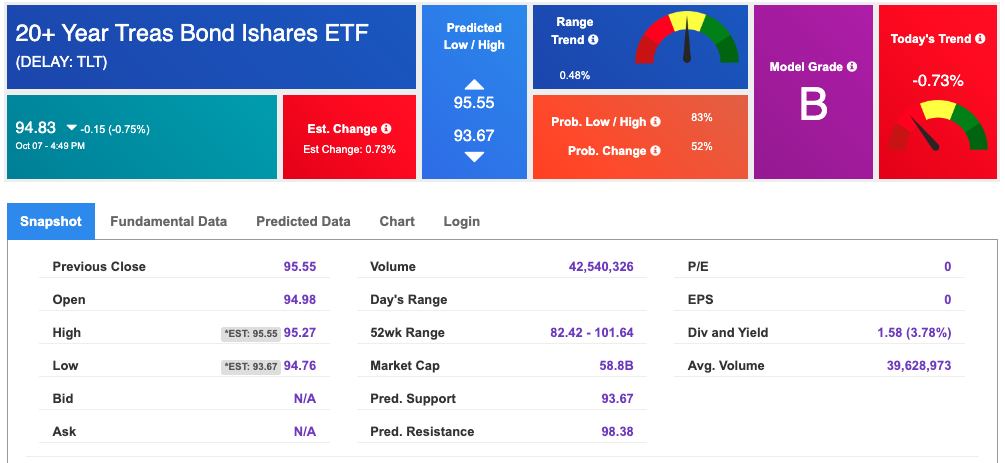

The yield on the 10-year Treasury note is up at 4.033% at the time of publication.

The yield on the 30-year Treasury note is up at 4.309% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

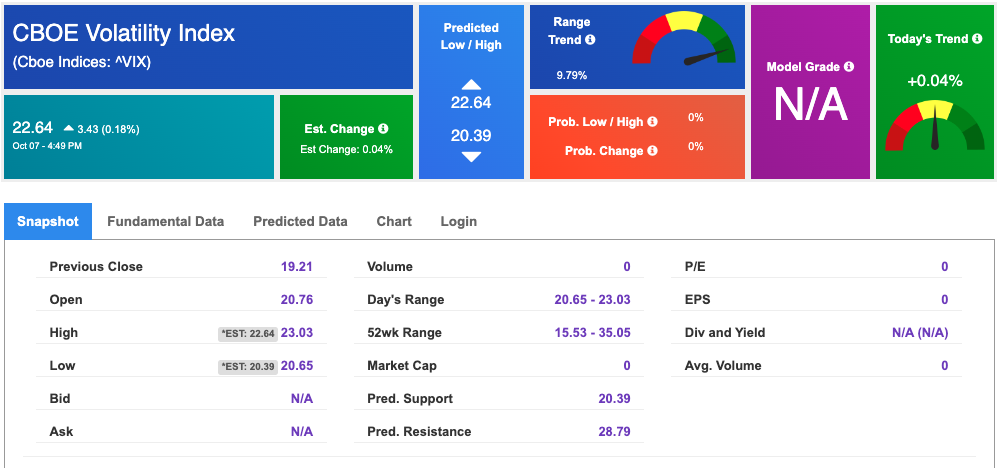

The CBOE Volatility Index (^VIX) is priced at $22.64 up 0.18% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!