RoboStreet – October 31, 2024

This week, Big Tech earnings took center stage, featuring key results from Apple ($AAPL), Advanced Micro Devices ($AMD), Meta Platforms ($META), and Alphabet ($GOOGL). Alongside these earnings, major economic updates including job openings, PCE inflation data, and unemployment statistics contributed to heightened market volatility. Here’s a closer look at the week’s highlights, market trends, and what lies ahead.

Big Tech Earnings: A Mixed Bag

Apple’s earnings report showcased a modest beat compared to Wall Street’s expectations, reflecting a cautious market response as shares dipped slightly following the launch of its new software, Apple Intelligence, which aims to encourage device upgrades. Meanwhile, AMD’s strong revenue growth driven by AI captured investor interest, but disappointing forward guidance led to a significant decline in its stock, contributing to broader downturns in the semiconductor sector.

Nvidia also experienced a slight pullback as investors reevaluated the sector’s outlook. In contrast, Alphabet delivered a strong performance, surpassing earnings and revenue forecasts, supported by robust cloud growth, resulting in a notable rise in its shares. However, both Microsoft and Meta faced headwinds despite their strong earnings, as concerns over escalating AI-related costs weighed on investor sentiment, causing declines in their stock prices.

Economic Indicators: Mixed Signals for the Fed

Consumer Confidence reached its highest level since March 2021, with the Conference Board’s index climbing to 108.7 in October, up from 99.2 in September. While this increase reflects growing optimism, job openings fell to 7.44 million from 7.86 million in August, signaling potential caution. ADP payroll data showed a stronger-than-expected rise in private payrolls, while PCE inflation, a key measure for the Fed, rose by 0.2% in September, aligning with forecasts but leaving core PCE inflation slightly above the target range at 2.7%.

This data suggests a resilient labor market and persistent inflation, which may temper expectations for a rapid rate cut- with the market anticipating a 25-basis-point rate cut during the Fed meeting on November 6-7, but upcoming data could change this outlook.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Market Performance and Volatility

Market sentiment was visibly shaken, with the Cboe Volatility Index (VIX) jumping 10% to above 22 amid growing uncertainties. U.S. indexes closed the month lower, with both the Dow and S&P 500 ending multi-month winning streaks. October saw the Dow drop by 0.9% and the S&P 500 decline by 1.9%, while the NASDAQ finished October slightly down, ending a two-month rally streak. Bond yields added to market tension, as the 10-year Treasury yield ranged from 3.6% to 4.4% for the month, while the two-year yield—often an indicator of Fed policy shifts—peaked near 4.2% before settling back at 4.1%.

A Broader Economic Context and Political Considerations

With stronger economic data, bond yields have disrupted the stock market’s previous six-week streak of gains. The Atlanta Fed’s Q3 GDP estimate climbed to 3.4%, thanks to robust retail and job growth. As the presidential election approaches, potential fiscal spending initiatives may impact inflation, adding to the Fed’s challenges. Growing national debt and shifting Fed expectations point toward a slower, more gradual rate-cutting trajectory, suggesting the Fed rate may end 2025 around 3.5%. Political considerations, including debt and fiscal spending debates, add to the market’s cautious tone.

Analyst Outlook: Bullish Sentiment Amid Risks

Analysts generally hold a cautiously optimistic view despite the week’s volatility. Market fundamentals remain favorable, with SPY potentially extending its rally, targeting levels between $600 and $610 in the months ahead. Short-term support around the $540-$550 range reflects resilient economic fundamentals and AI-driven productivity gains. These could drive a soft landing and help normalize the yield curve, broadening market participation. Yet, inflation concerns and recession risks keep analysts on watch, given economic resilience and labor market strength.

In today’s complex market, shaped by mixed earnings, Fed policy shifts, and political uncertainties, investors have key factors to consider. Rising AI costs may weigh on mega-cap earnings even as tech growth continues, while resilient economic data keeps inflation in focus, making near-term rate cuts less likely. Heightened volatility and fluctuating bond yields further reinforce the need for a cautious approach.

Nonetheless, I see long-term potential in equities, particularly with selective buying on pullbacks in economically strong sectors like SPY. A balanced portfolio of equities and fixed-income assets could offer prudent positioning as the Fed’s rate policy stabilizes.

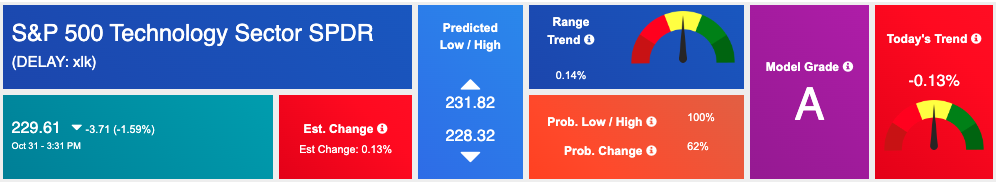

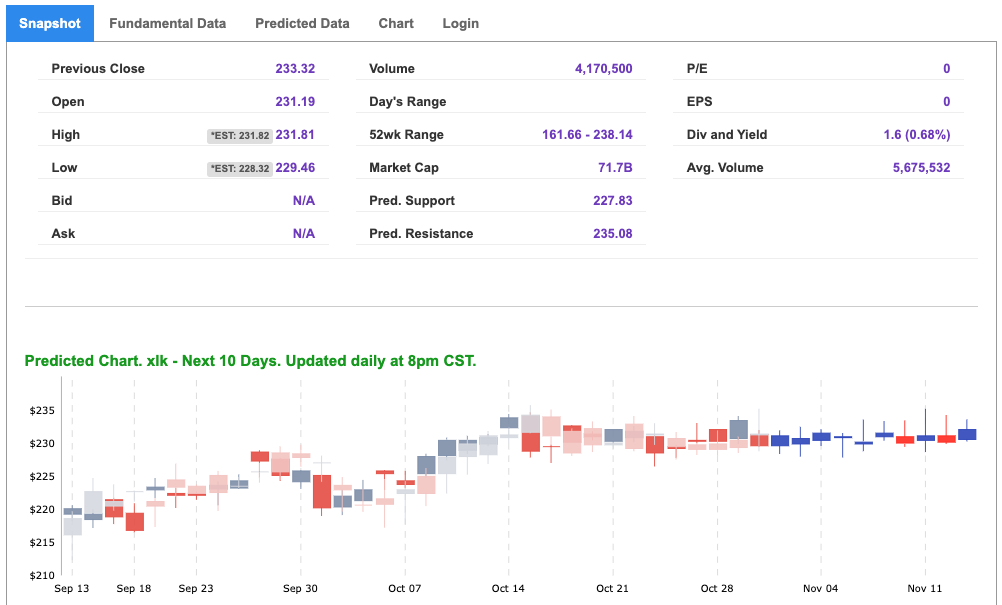

Tech remains particularly compelling in light of recent market trends, with the Technology Select Sector SPDR Fund (XLK) offering exposure to major tech players like Apple, Microsoft, and Nvidia. Although AI-related expenses have risen, robust demand in areas like cloud computing and AI, highlighted by strong earnings from Alphabet and AMD, positions the tech sector well. Additionally, recent bond market volatility makes growth-oriented sectors like tech more appealing. Given resilient consumer spending and mixed inflation signals, these factors may support sustained demand for technology and productivity solutions.

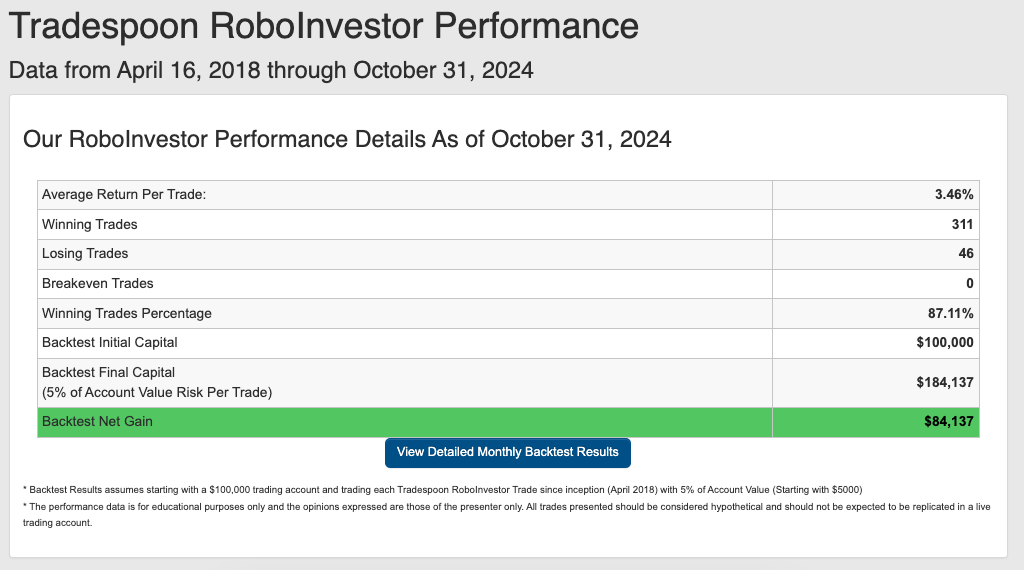

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.11% going back to April 2018.

As we advance further in Q4, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!