The stock market has entered a pivotal week with a strong start, as both the Nasdaq and S&P 500 continue to build on last week’s momentum. The Nasdaq’s exit from correction territory has been a key driver of renewed investor confidence, signaling that the bulls may once again have the upper hand. However, this optimism is tempered by the knowledge that the market is on the cusp of receiving critical economic data and guidance from the Federal Reserve, which could significantly influence the direction of the markets in the weeks to come.

Jackson Hole Symposium: The Market’s Focal Point

This week’s highlight is undoubtedly the Jackson Hole Economic Symposium, where the world’s financial eyes will be trained on Federal Reserve Chair Jerome Powell’s speech on Friday. While the release of the July Federal Open Market Committee (FOMC) meeting minutes on Wednesday will offer valuable insights, Powell’s address is expected to be the week’s defining moment. The stakes are high, as investors look for clear signals regarding the Fed’s next moves, especially in light of recent inflation data that has shown signs of cooling.

Market sentiment currently leans towards a potential 25 basis point interest rate cut in September, reflecting the hope that the Fed might ease monetary policy to support continued economic growth. However, there is also speculation that Powell could hint at a more aggressive 50 basis point cut, particularly if he interprets the data as indicating a more significant slowdown in the economy. This has led to a cautious optimism in the market, as traders position themselves ahead of what could be a pivotal moment in the Fed’s policy trajectory.

The anticipation surrounding Jackson Hole comes after a strong performance last week, where all three major indexes posted their best results of 2024. This rally was driven by robust economic data, including better-than-expected inflation figures, solid retail sales, and lower-than-anticipated jobless claims. These indicators have bolstered the case for a soft landing—a scenario where the economy slows enough to curb inflation without tipping into a recession—which many now see as a more plausible outcome.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Nvidia: A Key Player in the Tech Sector’s Resilience

Amid this broader market optimism, Nvidia has emerged as a critical player, particularly in the tech sector. Nvidia’s stock has been on a tear, reflecting the company’s strong performance and the high expectations surrounding its upcoming earnings report on August 28. Over the past six days, Nvidia shares have surged by 23%, with today’s 3% gain underscoring the stock’s momentum. This rally has made Nvidia one of the most actively traded stocks in both the S&P 500 and Nasdaq 100, highlighting its importance as a barometer for the tech sector’s health.

However, the volatility that characterizes the current market environment was evident in Nvidia’s midday trading. Despite a wave of positive commentary ahead of its earnings report, Nvidia’s stock fell 2.5% to $125.24 after an initial rise. This drop came even as the broader market continued its rally, reflecting the high stakes surrounding Nvidia’s earnings announcement. The stock eventually closed 1% higher on Wednesday, but the day’s swings underscore the uncertainty that continues to loom over the tech sector and the broader market.

Treasury Yields, Market Volatility, and the Impact on Tech Stocks

As Nvidia’s performance drives tech sentiment, the broader market is also being influenced by movements in Treasury yields. The 10-year Treasury yield rose to 3.876% on Thursday, a level that has significant implications for market volatility. The iShares Semiconductor ETF, which includes Nvidia, fell 1.7%, while Nvidia itself declined 1.9% ahead of its earnings report. These moves reflect the ongoing tension in the market as investors weigh the impact of rising yields on tech stocks, which are often sensitive to changes in interest rates.

The VIX, a key measure of implied volatility, also rose to 16.79, signaling increased caution among investors as they await Powell’s speech at Jackson Hole. The rise in volatility is a reminder that, despite the recent rally, the market remains on edge, with significant risks still in play. Thursday’s broader market pullback, led by a decline in technology stocks, further illustrates the market’s nervousness ahead of Powell’s address, where he is expected to provide crucial guidance on the Fed’s future policy path.

Interest Rate Debate and Economic Signals

Powell’s upcoming speech is anticipated to offer clarity on the Fed’s plans, particularly regarding the potential for interest rate cuts. With the Fed considering cutting borrowing costs to support the U.S. labor market, investors are keenly focused on any hints about the timing, magnitude, and pace of these cuts. This comes at a time when crude oil futures have risen for the first time in five sessions, and gold, which had been breaking out to all-time highs midweek, saw a 1.1% decline on Thursday as investors took profits. The dollar remains weak, and the 10-year Treasury yield is approaching year-to-date lows, adding to the bond market’s signs of recession and distress.

Treasury markets have been extremely volatile as market participants continue to reprice the odds of rate cuts. The 10-year yield has been trading within a wide range, fluctuating between 3.6% and 4.4%. The recent break below the key 3.8% level and the subsequent retest of long-term support at 4.0% have added to the market’s uncertainty, as investors try to gauge the Fed’s next move. The debate over the timing and magnitude of interest rate cuts remains intense, with the Fed’s data-driven approach leaving room for multiple interpretations and outcomes.

Volatility, Gold, and Market Sentiment

The VIX, which had surged to 60 during periods of extreme fear earlier this year, has now retreated to around 15, indicating that market anxiety has significantly subsided following a string of better-than-expected economic data. Meanwhile, GLD (SPDR Gold Shares) reached all-time highs earlier in the week before pulling back as investors took profits. This retreat in gold prices, alongside the ongoing volatility in Treasury markets, underscores the complex interplay of factors currently driving market sentiment.

As Treasury market participants continue to reprice the odds of rate cuts, the uncertainty surrounding the start, magnitude, and number of these cuts remains a key driver of market volatility. Despite the ongoing rally, I maintain a market-neutral stance, as the risks are far from over. While inflation is aligning with expectations and the earnings season has been better than anticipated, the economy is showing signs of cooling. Unemployment is ticking up, and there is a looming threat of small banks failing due to their exposure to commercial and residential real estate, which could have broader implications for the financial sector.

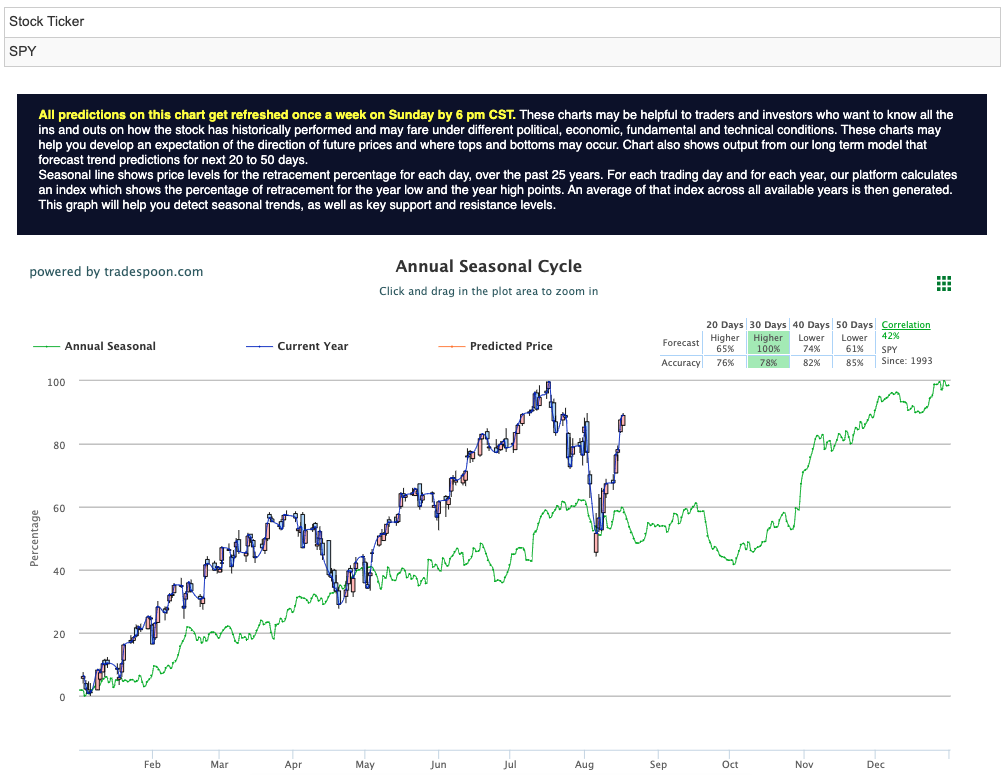

SPY Outlook: Navigating a Complex Market

Looking ahead, the SPY (SPDR S&P 500 ETF) appears to have a rally cap at the $560–$575 levels, with short-term support in the $480–$510 range for the next few months. While the long-term uptrend remains intact, I anticipate that the market will trade sideways in the short to medium term, as the current risks and potential for continued volatility suggest a cautious approach. Given these dynamics, I would advise against chasing this rally with additional capital, as the correction may not be fully behind us. For reference, the SPY Seasonal Chart is shown below:

As we approach the pivotal Jackson Hole meeting and Nvidia’s highly anticipated earnings report, the market’s next moves hinge on the insights and outcomes of these critical events. Investors should remain vigilant, ready to navigate a range of scenarios, as the interplay between economic data, Federal Reserve policy, and corporate earnings will shape the market’s direction in the weeks and months ahead.

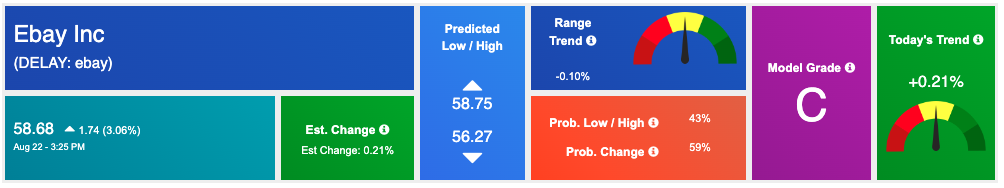

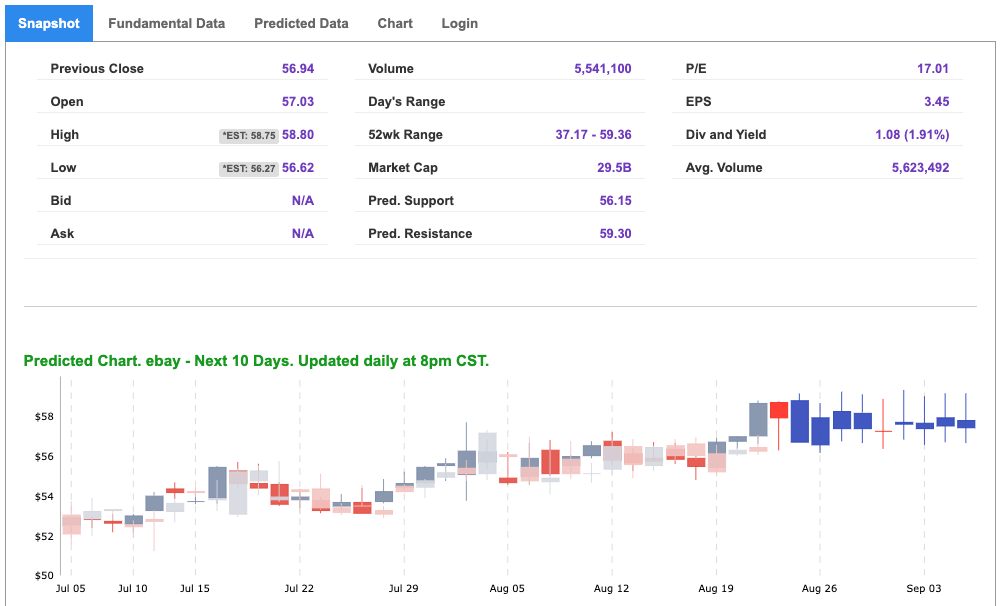

Amid these uncertainties, certain stocks stand out as potential opportunities. One such stock is eBay Inc. ($EBAY), which presents a compelling case for consideration in the upcoming week. eBay’s resilience in the current market environment, coupled with its unique positioning within the e-commerce sector, makes it a strong contender. As the broader market experiences volatility, particularly within the tech sector, eBay offers a more stable alternative, benefiting from its robust business model that is less sensitive to the fluctuations in consumer electronics and semiconductor demand.

This week’s discussions around interest rates, inflation data, and consumer sentiment all point to an environment where eBay could thrive. The recent stabilization in inflation and the potential for a dovish turn from the Federal Reserve could bode well for consumer spending, particularly in the online marketplace segment. eBay’s platform, which thrives on consumer-to-consumer sales, could see increased activity as consumers look for value-driven purchases during economic uncertainty.

Moreover, eBay’s recent earnings report highlighted strong growth in key areas, including a significant increase in gross merchandise volume (GMV) and active buyer engagement. This growth reflects the company’s successful adaptation to shifting consumer behaviors, with a focus on high-value items such as collectibles and luxury goods, which have shown resilience even as broader retail sales have fluctuated.

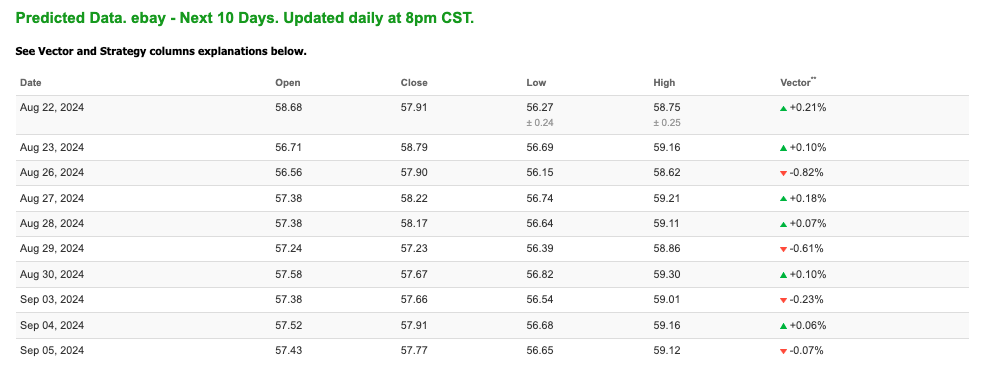

Adding to eBay’s appeal is the positive outlook from AI-driven market analysis models, which have consistently identified eBay as a strong performer. These models, which analyze a wide range of market indicators and historical data, suggest that eBay is well-positioned to capitalize on the current economic conditions. The models have indicated that eBay’s stock is likely to outperform in the near term, driven by its stable revenue streams, strong user engagement, and strategic focus on profitable segments.

Furthermore, eBay’s consistent performance amidst broader market volatility aligns with the current trend of investors seeking refuge in companies with solid fundamentals and less exposure to the tech sector’s cyclical downturns. With the market expected to remain volatile in the short term, eBay’s steady growth trajectory and focus on niche markets make it a strong pick for investors looking to navigate the upcoming week’s challenges.

In summary, eBay’s strategic positioning, coupled with supportive macroeconomic trends and positive AI model predictions, makes it a stock worth considering as we head into a week full of potential market-moving events. As always, staying informed and making data-driven decisions will be crucial for successfully navigating the complexities of the current market landscape.

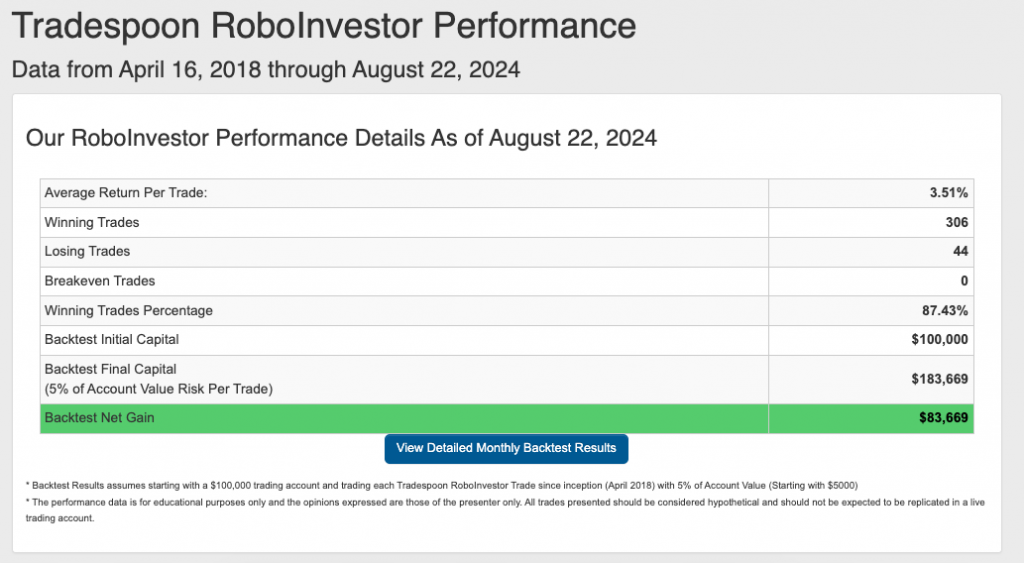

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.43% going back to April 2018.

As we advance toward the back end of 2024, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and navigating the fluctuating market conditions effectively.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!