Financial markets experienced a tumultuous week as investors grappled with mixed economic signals and earnings reports. Stocks fell sharply on Thursday after new data reignited fears that the Federal Reserve’s expected rate cut in September might be insufficient to prevent an impending recession. This decline followed a brief rally on Wednesday, spurred by the Federal Open Market Committee’s (FOMC) decision to maintain the federal funds rate, with hints at a possible future reduction.

The Federal Reserve opted to keep interest rates steady at 5.25%-5.50%, marking the eighth consecutive meeting without a change. Despite recent indicators of slowing inflation and a cooling labor market, Fed Chair Jerome Powell suggested that a rate cut might be considered at the next meeting in September, though no commitments have been made. The Fed’s preferred inflation measure, the personal consumption expenditures (PCE) price index, showed a 2.5% annual increase as of June, with core PCE inflation at 2.6%. Concurrently, the unemployment rate rose to 4.1%, ending a prolonged period of lower rates and indicating potential shifts in labor market dynamics.

In the FOMC’s statement, they highlighted, “Job gains have moderated, and the unemployment rate has moved up but remains low. Inflation has eased over the past year but remains somewhat elevated.” This reflects a balanced perspective, weighing inflation concerns against labor market changes. The statement also noted that recent months have shown progress toward the Fed’s 2% inflation target, despite persistent challenges.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Amidst these developments, the tech sector was a focal point as major companies released their quarterly earnings. The semiconductor industry, a critical driver of the S&P 500’s performance, posted strong second-quarter results, indicating robust demand.

Meta Platforms reported a significant revenue increase of 22% and a 73% rise in earnings for the June quarter, bucking the trend of fluctuating tech stock performances. Amazon and Apple reported modest gains, but their outlooks remained cautious in light of broader economic uncertainties. Microsoft, despite strong earnings, saw a dip in its shares as investors scrutinized its substantial investments in AI technology. Advanced Micro Devices (AMD) led a rally in chip stocks after raising its full-year AI GPU revenue expectations. Nvidia, however, faced a decline as investors awaited its earnings report later this month, underscoring the sector’s sensitivity to earnings outcomes and AI demand.

Economic indicators painted a mixed picture, with the U.S. manufacturing sector continuing to exhibit signs of weakness. The Institute for Supply Management’s Purchasing Managers Index (PMI) dropped to 46.8 in July from June’s 48.5, marking the fourth consecutive month of contraction. This figure fell short of expectations, signaling persistent challenges in manufacturing growth and casting a shadow over economic recovery prospects. The PMI’s new orders index, which gauges future demand, also declined, indicating ongoing difficulties in the sector.

Geopolitical tensions contributed to market volatility, as crude oil futures recorded their largest one-day gain since October. This was driven by concerns over potential conflict between Israel and Iran following the killings of a Hezbollah military leader in Beirut and a top Hamas political leader in Tehran. However, these gains were tempered by concerns about weak demand from China, which continues to weigh on the market.

The bond market displayed significant volatility, with the 10-year U.S. Treasury yield fluctuating between 4.2% and 4.7%. Notably, the 2-year yield fell below the 30-year yield for the first time in two years, suggesting shifting economic expectations and potential future monetary policy adjustments. This yield inversion, often seen as a precursor to recession, added to the market’s uncertainty.

Investor sentiment, as reflected in the CBOE Volatility Index (VIX), rose to 17.09, indicating increased anxiety amid mixed signals. Over the past year, the VIX has ranged from 10.62 to 23.08, capturing the market’s fluctuating sentiment and risk appetite. Market dynamics showed a shift from momentum stocks to value stocks, with interest-sensitive stocks demonstrating a strong rebound. The Nasdaq (QQQ) and S&P 500 (SPY) showed neutral short-term momentum as investors reassessed their positions.

Despite recent optimism driven by positive inflation data and tech sector resilience, market participants remain divided on the timing and magnitude of potential rate cuts. The bond market’s volatility, exemplified by the 10-year yield’s break below 4.3% and its retest of long-term support at 4.0%, underscores ongoing uncertainty.

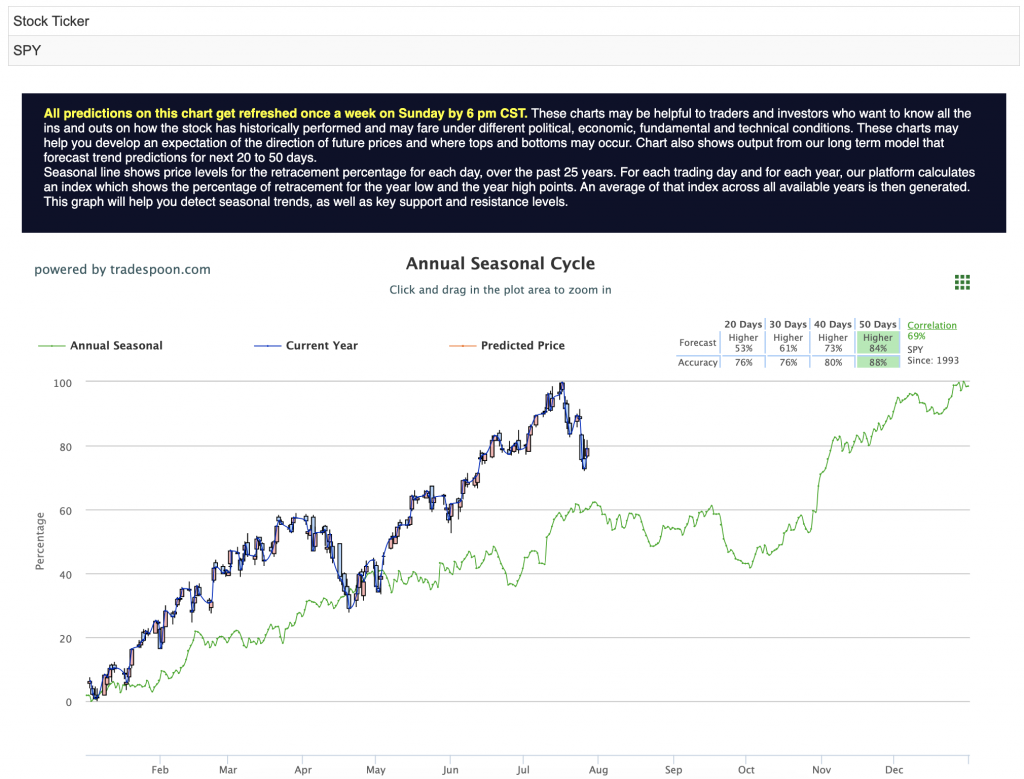

Given these developments, I am transitioning to a market-neutral stance. While inflation is aligning with expectations and earnings season is exceeding forecasts, risks persist as the economy cools, unemployment ticks up, and small banks face potential failures due to real estate exposure. The SPY rally appears capped at $560-$575, with short-term support at $520-$530. I anticipate sideways trading in the short to medium-term, while the long-term trend remains intact. For reference, the SPY Seasonal Chart is shown below:

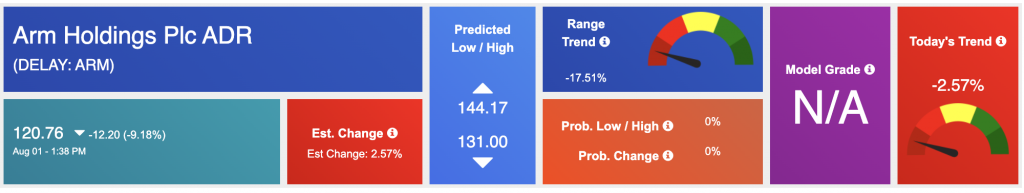

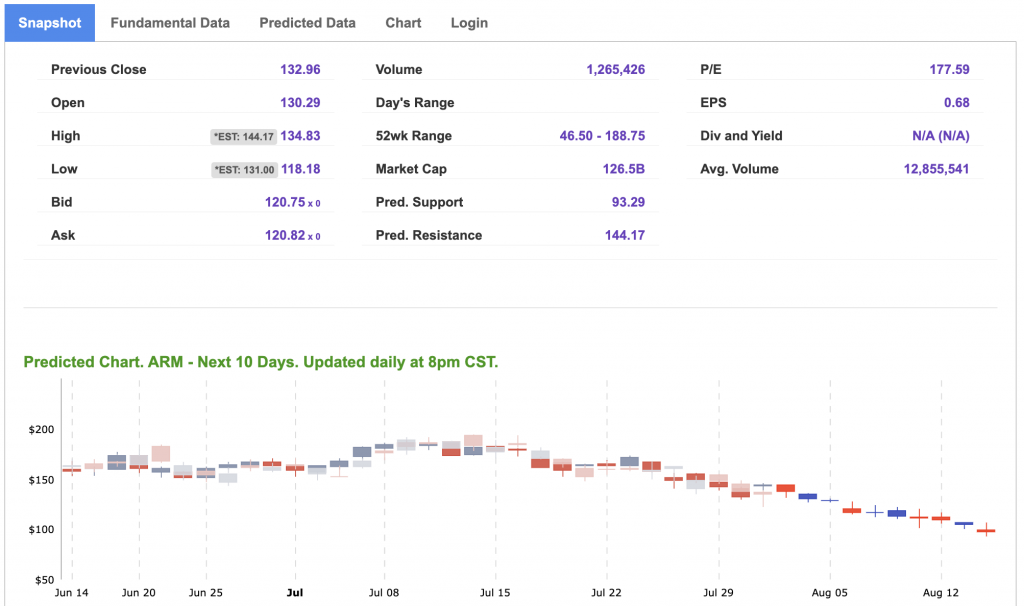

As markets navigate a whirlwind of economic signals and geopolitical developments, future rate decisions and investment strategies remain in the spotlight. Amid this climate of uncertainty, opportunities for savvy investors are emerging. One standout option for the upcoming week is ARM Holdings, which presents a compelling case for investment.

ARM Holdings, a UK-based company renowned for its semiconductor and software design, plays a pivotal role in powering the technology that drives our digital age. Founded in 1990, ARM’s designs are at the heart of many of the world’s most popular smartphones, tablets, and other connected devices. The company’s innovative architecture is a cornerstone for processors in a variety of industries, from mobile technology to automotive applications. ARM’s business model primarily revolves around licensing its technology to manufacturers, which means it earns revenue from licensing fees and royalties on every chip produced using its designs.

Given the current market conditions, ARM Holdings (ARM) presents an intriguing buying opportunity. The recent turbulence in the markets has underscored the importance of companies with strong fundamentals and resilient business models. ARM’s focus on licensing and intellectual property positions it uniquely to capitalize on growing trends such as the Internet of Things (IoT), artificial intelligence (AI), and 5G connectivity. The increasing demand for more efficient and powerful processors plays directly into ARM’s strengths, particularly as tech giants continue to seek advanced solutions to power their next-generation devices.

Additionally, ARM has benefited from the heightened attention on the semiconductor industry, a sector that has shown remarkable resilience and growth potential despite recent market volatility. The company’s recent strategic moves, such as expanding its presence in data center technologies and enhancing its AI capabilities, further strengthen its long-term growth trajectory.

ARM’s financial performance has been robust, with steady revenue growth and a strong balance sheet, making it well-positioned to weather market fluctuations. The company’s recent earnings reports have demonstrated its ability to adapt and thrive, with consistent demand for its cutting-edge designs across multiple sectors. Moreover, ARM’s potential IPO, which has generated significant investor interest, could further enhance its visibility and access to capital, bolstering its market position.

As investors reassess their portfolios in light of economic uncertainties and potential Fed rate cuts, ARM’s unique position in the semiconductor industry makes it a compelling choice. Its blend of innovation, strategic partnerships, and adaptability provides a solid foundation for growth, making ARM a promising buy for the upcoming week.

Despite the broader market’s ongoing challenges, ARM Holdings emerges as a standout opportunity. With its advanced technology and strategic focus on high-growth sectors, ARM is well-positioned to offer substantial value to investors seeking stability and growth amid an uncertain economic climate.

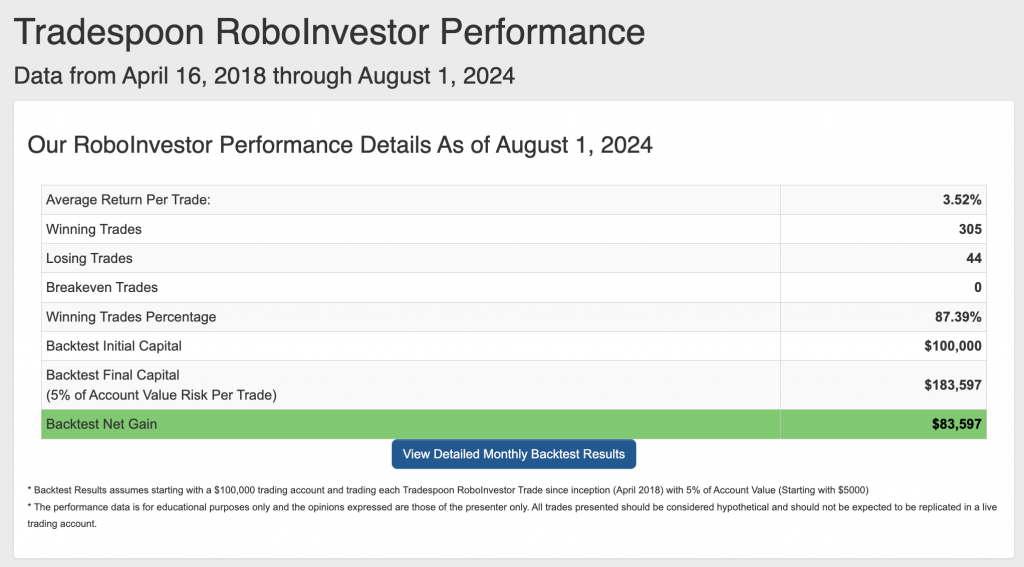

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.39% going back to April 2018.

As we advance through the summer of 2024, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and navigating the fluctuating market conditions effectively.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!