RoboStreet – March 13, 2025

The past week has seen significant volatility in U.S. equity markets, with all major indexes posting steep losses. The Dow Jones Industrial Average fell over 2%, the S&P 500 retreated sharply, and the Nasdaq Composite plunged more than 3%, briefly entering correction territory before a minor recovery. The S&P 500’s dip below its 200-day moving average underscored market fragility, with investors grappling with inflation concerns, trade policy uncertainty, and shifting Federal Reserve expectations.

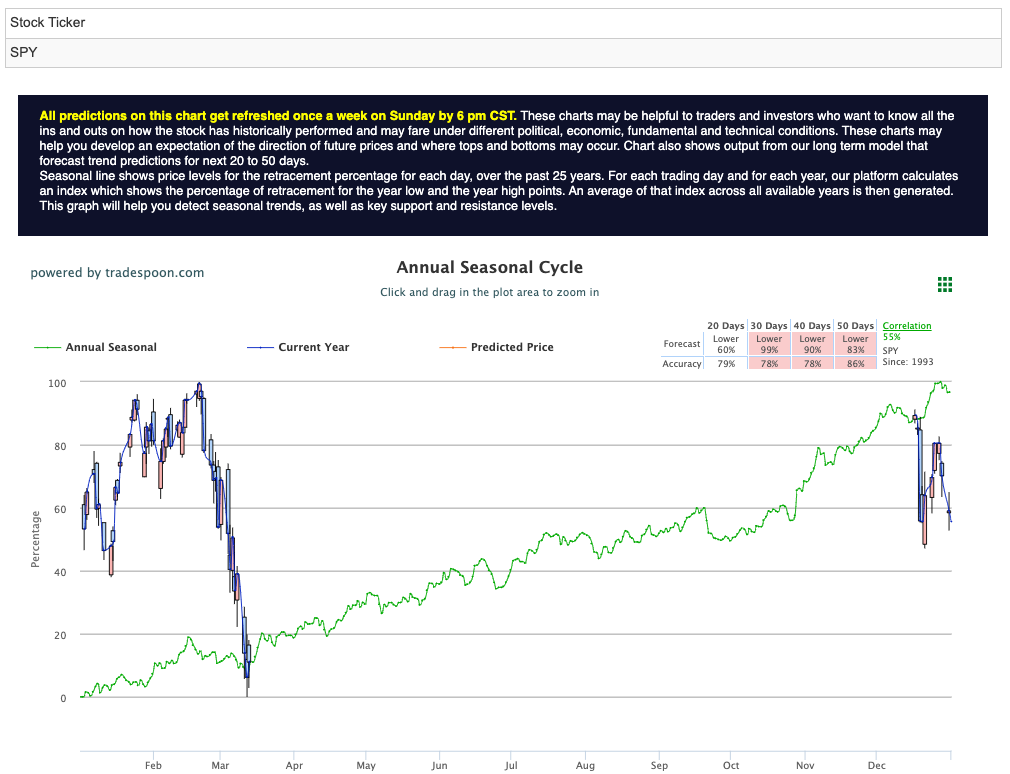

The SPY (S&P 500 ETF) has been a focal point as markets navigate volatility. The rally has the potential to reach the $580–600 range, with short-term support in the $530–550 range over the next few months. For reference, the SPY Seasonal Chart is shown below:

Although short-term fluctuations are expected, the long-term trend remains intact, with the market consolidating near key technical levels and the VIX hovering around 24, signaling that volatility will persist.

Tariffs Take Center Stage

Trade policy uncertainty remains a significant catalyst for market turbulence. Investors are particularly uneasy about President Donald Trump’s aggressive trade policies, which have introduced a 25% levy on imports from Canada and Mexico and a 10% duty on Chinese goods. While these tariffs have been delayed multiple times, the unpredictability surrounding them has added to market concerns.

Tariffs have a dual impact: higher import costs squeeze business profit margins and pressure earnings, while companies passing costs onto consumers could exacerbate inflation. This creates a challenging environment for the Federal Reserve, complicating its ability to ease monetary policy amidst persistent inflationary pressures.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Economic Data Raises Growth Concerns

Recent economic data has painted a mixed picture. The March ADP employment report revealed private-sector job growth slowing to just 77,000 jobs—the weakest reading since July 2024. This slowdown has heightened concerns of a potential economic deceleration. Additionally, the latest Federal Reserve meeting minutes indicated that policymakers are reluctant to cut interest rates in the near term, dampening investor hopes for immediate relief.

Treasury yields fluctuated amid uncertainty. The 10-year yield moved between 3.6% and 4.8%, ultimately settling lower on softer inflation data, while the 2-year yield dipped to 3.95%, signaling increased demand for safe-haven assets.

Earnings reports have played a significant role in shaping market sentiment. Nvidia continued to outperform, benefiting from strong demand for AI-driven computing and data center sales. Meanwhile, retail and consumer-facing companies faced challenges. Best Buy warned that rising import costs were squeezing margins, and Ross Stores’ solid earnings failed to lift shares due to concerns over cautious consumer spending. Box saw a sharp decline after issuing disappointing guidance, further contributing to market jitters.

Inflation Data Offers Temporary Relief

Markets received brief relief midweek after February’s Consumer Price Index (CPI) report showed inflation rising at a slower-than-expected pace. CPI increased by just 0.2% month-over-month, which was below the anticipated 0.3% increase, signaling a potential easing in inflationary pressures. On an annual basis, CPI rose by 2.8%, in line with expectations, but still a slight improvement compared to previous months. This moderation in inflation was particularly encouraging as the core CPI, which excludes the more volatile food and energy prices, rose by 3.1%, coming in just below consensus expectations of 3.2%.

This cooling of inflation offered a glimmer of hope that price pressures might be moderating, potentially giving the Federal Reserve some breathing room. As a result, markets briefly entertained the possibility that the Fed might consider rate cuts later in the year, especially as inflation appeared to be coming in line with their long-term target. This sense of relief was particularly welcomed after a period of high volatility and persistent inflation concerns.

In addition to the CPI data, the February Producer Price Index (PPI) also presented some positive news, as it showed no change from January levels, defying expectations of a 0.3% increase. The PPI measures the average change in prices received by domestic producers for their goods and services and is often seen as a leading indicator of consumer inflation. The flat PPI reading helped reinforce the idea that inflationary pressures might be cooling at both the consumer and producer levels, contributing to a more optimistic short-term outlook.

However, this optimism was short-lived as new tariff headlines reignited investor concerns. President Trump announced additional duties on Canadian steel and aluminum imports, as well as the potential for 200% tariffs on European wine in response to the European Union’s retaliatory tariff on American whiskey. These tariff threats injected fresh uncertainty into the market, once again overshadowing the positive inflation data and leading to renewed fears of a prolonged trade war. The market’s reaction was swift, and the enthusiasm around the inflation data quickly waned as attention shifted back to the unpredictable landscape of international trade and its potential economic impacts.

Volatility Persists as Markets Weigh Future Risks

The week’s market swings underscored the ongoing tension between economic data and policy uncertainty. The S&P 500 officially entered correction territory on Thursday after falling more than 10% from its February peak, while the Nasdaq Composite extended its losses. The Dow dropped 537 points (-1.3%), reflecting broad investor unease.

Oil and gold prices reacted to trade developments: crude oil futures fell sharply on renewed tariff threats, while gold surged to a record high of $2,984.30 per ounce as investors sought safe-haven assets.

Looking ahead, investors remain in a wait-and-see mode as the Federal Reserve balances inflation concerns with the risk of economic slowdown. The upcoming earnings season and further clarity on trade policy will likely dictate near-term market direction. As major indexes consolidate near key levels, volatility is expected to persist.

Despite signs of cooling inflation, the key question remains whether interest rates will stay higher for longer, particularly as labor market weakness emerges. While earnings season has delivered some encouraging results, the risks tied to persistent inflation, trade disruptions, and potential economic deceleration continue to weigh heavily on investor sentiment.

Given the balancing act between resilient corporate performance and the risk of prolonged higher interest rates, I maintain a neutral market stance. The market is trading sideways, reflecting both resilient earnings and ongoing rate risks. Additionally, rising unemployment could add complexity to the economic landscape.

The Federal Reserve’s policy decisions will remain crucial in determining the market’s trajectory. Inflation data, employment figures, and consumer spending trends will offer further clues on the central bank’s next steps. With some economic softening, particularly in labor data, there may be room for rate cuts later this year. However, policymakers are likely to remain cautious as inflationary pressures persist.

Key Takeaway: Adaptability is Crucial

As market conditions evolve, adaptability remains essential for investors. The market is currently in a neutral stance, but fluctuating risks and opportunities call for flexibility. With yields in the bond market shifting and commodities like gold attracting attention as safe-haven assets, investors must stay alert to changing dynamics.

The Federal Reserve’s policy decisions will remain a central factor, as inflation data, employment figures, and consumer trends offer insights into future actions. With signs of economic softening—especially in labor market data—rate cuts are a possibility, but inflation’s persistence warrants caution. This uncertainty is likely to fuel continued market volatility, underscoring the importance of strategic portfolio management.

Sector-wise, growth-sensitive areas like industrials and consumer discretionary show resilience, while defensive sectors remain stable amid rate uncertainty. Commodities, especially gold, continue to shine as safe-haven assets. Meanwhile, bond yields reflect ongoing investor uncertainty about the Fed’s next steps.

A well-balanced, diversified strategy is crucial to navigate this complexity. Investors should remain agile—capitalizing on opportunities as they arise, while protecting against potential risks. Staying informed throughout earnings season and as macroeconomic conditions unfold will be vital for making sound decisions.

Despite challenges, the market presents opportunities for growth and strategic positioning. By monitoring key indicators and maintaining a disciplined approach, investors can confidently chart a course forward.

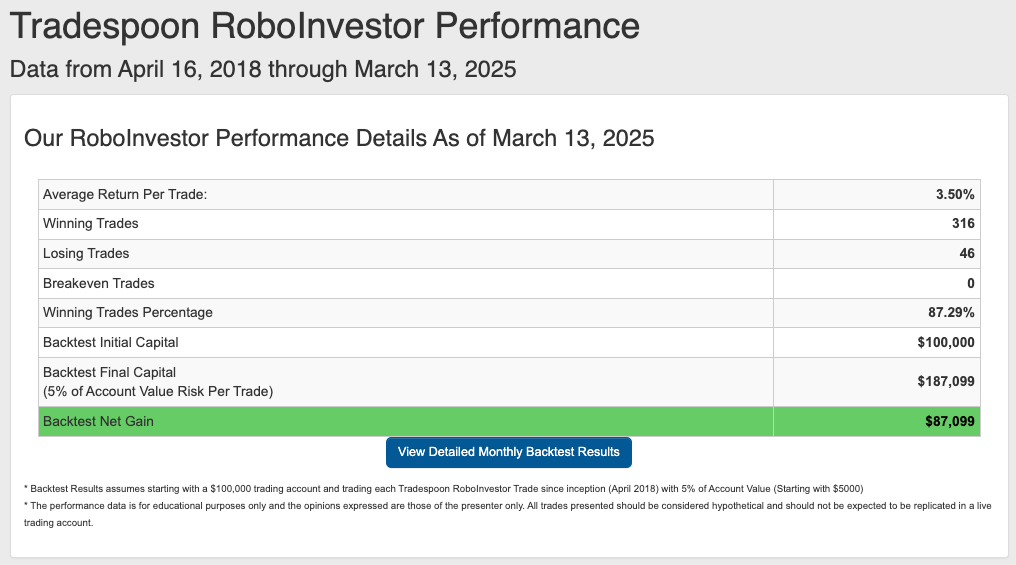

Unlock smarter investment decisions with our RoboInvestor stock and ETF advisory service, powered by advanced AI. This cutting-edge technology identifies trades with high-profit potential, cutting through market noise and eliminating emotional bias. With clear, data-driven insights and strategies, RoboInvestor helps you navigate today’s ever-changing market with confidence and precision.

Every other weekend, subscribers receive an exclusive newsletter packed with my market analysis, technical outlook, updates on existing positions, and one or two fresh trade recommendations to act on when the market opens on Monday.

RoboInvestor is a flexible, unrestricted service. I may recommend blue-chip stocks or ETFs representing major indexes, market sectors, commodities, currencies, interest rates, and even shorting opportunities using inverse ETFs. Our model portfolio typically holds between 12 to 25 positions, adjusting based on market conditions. Recently, we’ve adopted a more cautious approach, focusing on a smaller, more selective set of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.29% going back to April 2018.

As we enter 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!