RoboStreet – April 10, 2025

It was another wild week for the stock market, characterized by sharp swings and unpredictable sentiment. After starting the week with a significant sell-off, the market briefly found a sense of optimism mid-week, only to be hit by further volatility later in the week. The overarching theme was the continuing impact of tariffs, with President Trump’s ongoing trade policies at the forefront of investor concerns.

Tariffs and Trade Tensions

The week’s market movements were heavily influenced by the trade war between the U.S. and China, as tariffs continued to dominate economic discussions. In the second quarter, tariffs have emerged as one of the most important drivers of market sentiment, with President Trump’s announcements making waves across global markets.

The market’s early volatility on Monday was largely attributed to the looming uncertainty over the impact of tariffs on both the U.S. and global economies. President Trump had threatened to impose additional tariffs on China if Beijing retaliated with its own set of punitive measures. However, a temporary market rally was sparked mid-day by an erroneous report suggesting Trump might halt tariffs. That optimism quickly dissipated when the White House clarified that the tariffs would not be paused, further unsettling the market.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Mid-Week Market Surge

By Wednesday, a surprising development briefly eased market fears. President Trump announced a 90-day pause on a significant portion of global tariffs, excluding China, allowing countries some time to negotiate. This announcement fueled a remarkable rebound in the market. The S&P 500 surged by 9.5%, its best day since 2008, and the Nasdaq Composite soared by 12%, marking its largest one-day percentage gain since 2001.

However, this rally was not without its complexities. The volatility index (VIX) spiked earlier in the week, reaching nearly 50, only to pull back to 30 after Wednesday’s relief rally. The U.S. Dollar Index also surged following Trump’s announcement, reflecting investor optimism that the tariff pause could alleviate some economic pressures. Additionally, oil prices saw a boost as markets welcomed the temporary halt to tariff escalation on nations outside of China.

Thursday’s Setback and Tariff Clarifications

Despite the mid-week rally, Thursday saw a dramatic reversal. Gold futures surged by 3.5%, and the stock market continued to experience heightened volatility. By Thursday afternoon, the major indices had moved off their lows but were still deeply in the red. This downturn was exacerbated when the White House clarified that the tariffs on China would be higher than initially stated, reaching a total of 145% instead of the previously announced 125%. This clarification reignited concerns about the escalating trade war with China and further dampened market sentiment.

Inflation and Economic Concerns

Amidst the tariff developments, inflation continued to be a critical factor influencing market movements. The Bureau of Labor Statistics released the March consumer price index, revealing a year-over-year increase of 2.4%, which was slightly below the 2.6% expected by economists. The month-over-month inflation was up by just 0.1%, underperforming the anticipated 0.1% increase. The core inflation rate, which excludes volatile food and energy prices, rose 2.8%, slightly lower than the 3% expected. These figures provided some relief, but concerns about rising inflation and its potential impact on future Federal Reserve actions remained.

Earnings and Economic Reports: A Mixed Bag

This week, earnings season gained momentum as several prominent companies reported their results. One of the key earnings releases was from ConAgra Brands ($CAG), which provided further insight into consumer demand and the state of the food sector amidst inflationary pressures. While earnings reports remain critical for understanding corporate health, the broader economic outlook is also shaping up to be challenging.

On Friday, the Producer Price Index (PPI) will be released, providing further insight into inflationary pressures and potential economic slowdowns. The report will help gauge the extent to which inflation is being passed on to producers and may offer clues to the Federal Reserve’s future actions on interest rates. Additionally, several high-profile companies are set to report earnings on Friday, including Delta Air Lines, Constellation Brands, CarMax, and major financial institutions such as JPMorgan Chase, Morgan Stanley, and Wells Fargo. These reports will provide further clarity on corporate performance in the face of rising costs and macroeconomic headwinds.

VIX and Market Sentiment

The market’s sentiment remained fragile throughout the week, with the VIX—the CBOE Volatility Index—hitting alarming levels. At its peak earlier in the week, the VIX reached nearly 50, signaling extreme investor fear and uncertainty. As the week progressed, volatility remained heightened, with the VIX hovering around 40 by Thursday, indicating that market participants were still on edge. This level of volatility is a strong reminder of the underlying risk in the market, particularly given that major indices have dropped below their 200-day moving averages, a key technical level that often signals the potential for further declines.

As of Thursday, the major averages were down by more than 20% from their recent peaks, putting them into bear market territory. This substantial pullback reflects the market’s ongoing struggles amid rising interest rates, global trade tensions, and concerns over economic growth. In this environment, market participants should brace for more volatility in the coming weeks as the full impact of tariff policies, inflation, and corporate earnings take shape.

Outlook: Navigating Uncertainty

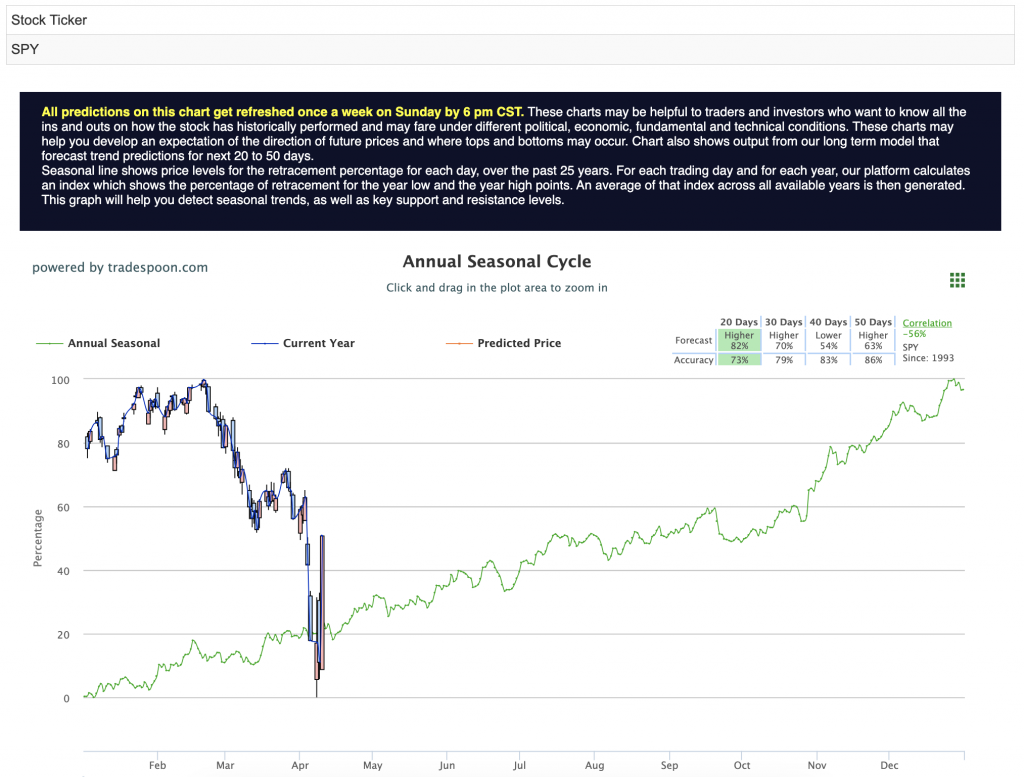

The broader economic outlook is also under increasing pressure. As recession risks grow, the market sentiment remains fragile. With interest rates expected to remain higher for longer and unemployment on the rise, the market faces significant headwinds. The S&P 500 could rally to levels between $500 and $580, with short-term support ranging from $500 to $530. However, the current trend indicates that the market is more likely to continue trading to the downside in the short term. For reference, the SPY Seasonal Chart is shown below:

The long-term trend remains under pressure as the market grapples with the potential for a recession and the continued uncertainty surrounding global trade dynamics. The risks are amplified by the ongoing volatility, making it increasingly difficult to predict where the market will head next.

In Summary: A Bumpy Ride Ahead

This week’s market moves were a stark reminder of how sensitive the markets are to policy changes, especially those related to tariffs. The week started with heightened volatility, surged mid-week on news of a temporary tariff pause, and ended with another sell-off after tariff levels on China were raised again. As the market remains on edge, the outlook continues to be dominated by risks related to trade wars, inflation, and the possibility of a looming recession.

For investors, this environment calls for caution. With heightened volatility and recession odds increasing, I remain in the “Market Neutral” camp, prepared for further downside in the short term. While there may be opportunities for a brief rally, the long-term trend remains under pressure, and the risks of holding long positions in this environment are significant.

In this complex environment, a well-balanced and diversified strategy is essential. Agility is your advantage—capitalize on emerging opportunities while protecting against potential risks. Staying informed during earnings season and as macroeconomic conditions unfold will help you make timely, well-informed decisions.

While market challenges persist, ample opportunities for growth and strategic positioning remain. By focusing on key indicators and maintaining discipline, you can confidently navigate the market and position yourself for success.

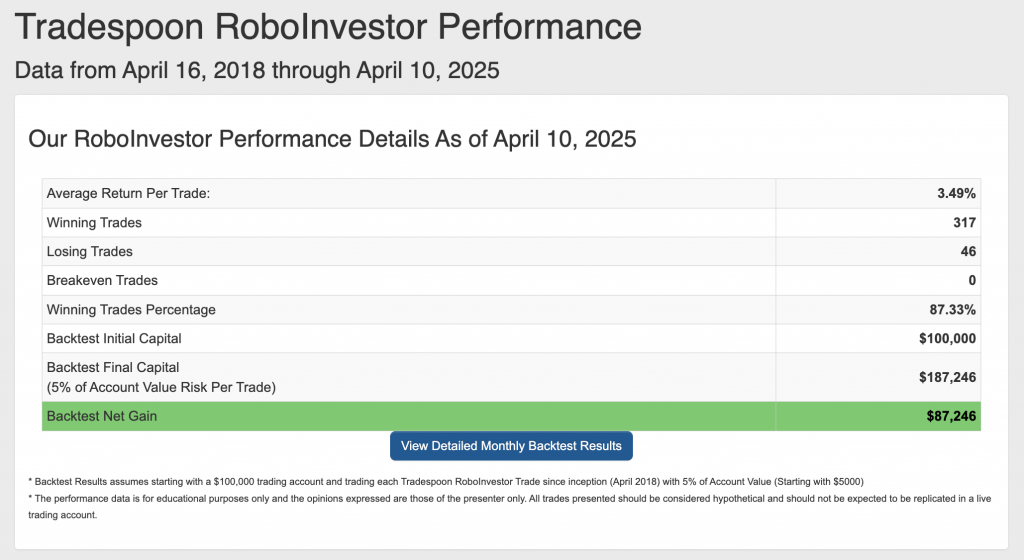

Step into the future of investing with RoboInvestor—your AI-powered advisory service designed to pinpoint high-profit opportunities in today’s dynamic market. Our advanced technology cuts through the noise, providing clear, data-driven insights and strategies. Say goodbye to emotional bias and hello to precision in every trade.

Every other weekend, you’ll receive our exclusive newsletter featuring my latest market analysis, technical outlooks, updates on existing positions, and fresh trade recommendations to act on when the market opens on Monday.

Whether it’s blue-chip stocks, ETFs, commodities, or even inverse ETFs, RoboInvestor offers a flexible approach tailored to current market conditions. With a model portfolio holding 12 to 25 positions, we’ve recently adopted a more selective strategy, focusing on the best opportunities for growth while remaining cautious.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.33% going back to April 2018.

As we enter Q2 of 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!