RoboStreet – March 6, 2025

Over the past week, the U.S. stock market experienced heightened volatility as investors navigated escalating trade tensions, conflicting economic data, and a pivotal earnings season. The announcement of new tariffs on Canadian and Mexican imports sent shockwaves through the markets, fueling fears of retaliatory measures and disrupting investor sentiment. Meanwhile, economic reports painted a mixed picture—private-sector job growth sharply slowed, inflation pressures mounted, and manufacturing data signaled contraction—raising concerns about the Federal Reserve’s next policy move.

Amidst this backdrop, corporate earnings delivered a blend of optimism and caution, with key companies reporting strong performances in AI and technology, while retailers faced headwinds from rising costs. As a result, the major indices saw sharp fluctuations, with the S&P 500 briefly dipping below key technical levels before rebounding on a temporary delay in auto tariffs.

One of the most consequential events this week was the Trump administration’s decision to impose a 25% tariff on imports from Canada and Mexico, effective immediately. Additional threats of higher duties on Chinese goods further rattled markets, reviving fears of a prolonged trade war. The impact was swift and severe, with the S&P 500 experiencing its sharpest daily drop since mid-December on March 3. Investors rushed to reposition their portfolios, wiping out recent post-election gains.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

By March 5, however, market sentiment shifted after President Trump announced a temporary one-month delay on auto tariffs. This move provided some relief to North American manufacturers, leading to a modest rebound in equities. The Dow Jones Industrial Average and the S&P 500 climbed over 1% in response, though the tech-heavy Nasdaq remained fragile, hovering near correction territory.

Trade-related uncertainty also impacted currency markets, with the euro surging to a four-month high against the U.S. dollar, which declined by 0.2% against the Chinese yuan. Meanwhile, Japan’s yen strengthened as investors flocked to safe-haven assets, putting additional pressure on U.S. exporters.

Economic data released this week added to the market’s turbulence. On March 5, the ADP employment report showed that private-sector payrolls increased by just 77,000 in February—far below expectations and marking the weakest job growth since July 2024. A slowdown in the services sector and adverse weather conditions across parts of the U.S. were cited as primary factors.

Manufacturing data released earlier in the week painted a similarly cautious picture. The ISM Manufacturing PMI signaled a contraction in factory activity, fueling concerns about broader economic deceleration. Inflation, however, remained a persistent worry. CPI and PPI data from late February indicated higher-than-expected price pressures, pushing long-term inflation expectations to decade highs.

In response to these developments, the Federal Reserve hinted at maintaining a cautious stance, with recent meeting minutes suggesting that rate cuts may be delayed. This shifted market expectations away from a dovish pivot, leading to a rise in Treasury yields. The 10-year yield remained volatile, oscillating between 3.6% and 4.8% before trending lower following the tariff announcements.

Despite these headwinds, weekly jobless claims fell by 21,000 to 221,000, indicating that the labor market remains relatively stable. However, planned layoffs surged to 172,017 in February, the highest since the onset of the pandemic, with federal government job cuts contributing significantly. The Commerce Department also reported that the U.S. trade deficit widened by 34% to a record $131.4 billion in January as businesses rushed to import goods ahead of tariff hikes.

Corporate earnings played a significant role in shaping market sentiment this week. While some companies posted strong results, others issued cautious guidance, highlighting the uneven impact of trade policies and inflationary pressures.

Among the notable reports:

The S&P 500 briefly fell below its 200-day moving average for the first time since November 2023, triggering broader concerns about technical support levels. Meanwhile, the Nasdaq Composite entered correction territory, dropping more than 10% from its recent highs. The Dow also posted steep losses earlier in the week before stabilizing following the tariff delay announcement.

Oil futures saw minor gains, fluctuating in response to trade policy developments and reports that the U.S. would tighten enforcement of sanctions on Iranian oil exports.

From a broader market perspective, volatility remains elevated, with the VIX at 24, signaling persistent investor caution. However, the S&P 500 has shown resilience, staging a late-session recovery on March 5.

Looking ahead, I remain in a market-neutral stance, given the sideways trading action in recent weeks. Inflation data is coming in largely as expected, and corporate earnings have been better than feared. However, risks remain elevated due to prolonged high interest rates and rising unemployment trends.

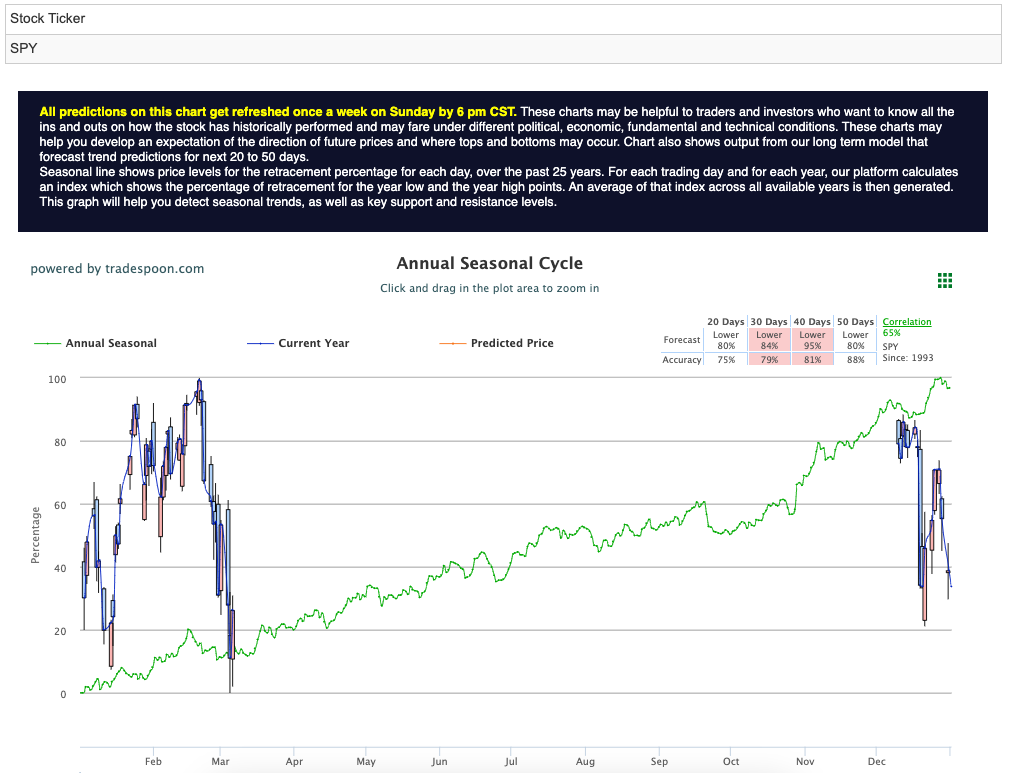

From a technical standpoint, the S&P 500 rally could extend to the $620–640 range, with short-term support at $560–580 over the next few months. While long-term trends remain intact, short-term market movement is likely to be choppy as investors weigh ongoing trade developments, Federal Reserve policy shifts, and the strength of the U.S. consumer. For reference, the SPY Seasonal Chart is shown below:

The past week has been a rollercoaster for investors, marked by trade policy uncertainty, slowing economic indicators, and an uneven earnings season. While markets showed resilience following the tariff delay announcement, sentiment remains fragile. Investors should brace for continued volatility as geopolitical risks, Federal Reserve decisions, and corporate earnings guidance dictate market direction in the coming weeks.

Unlock smarter investment decisions with our RoboInvestor stock and ETF advisory service, powered by advanced AI. This cutting-edge technology identifies trades with high-profit potential, cutting through market noise and eliminating emotional bias. With clear, data-driven insights and strategies, RoboInvestor helps you navigate today’s ever-changing market with confidence and precision.

Every other weekend, subscribers receive an exclusive newsletter packed with my market analysis, technical outlook, updates on existing positions, and one or two fresh trade recommendations to act on when the market opens on Monday.

RoboInvestor is a flexible, unrestricted service. I may recommend blue-chip stocks or ETFs representing major indexes, market sectors, commodities, currencies, interest rates, and even shorting opportunities using inverse ETFs. Our model portfolio typically holds between 12 to 25 positions, adjusting based on market conditions. Recently, we’ve adopted a more cautious approach, focusing on a smaller, more selective set of stocks and ETFs.

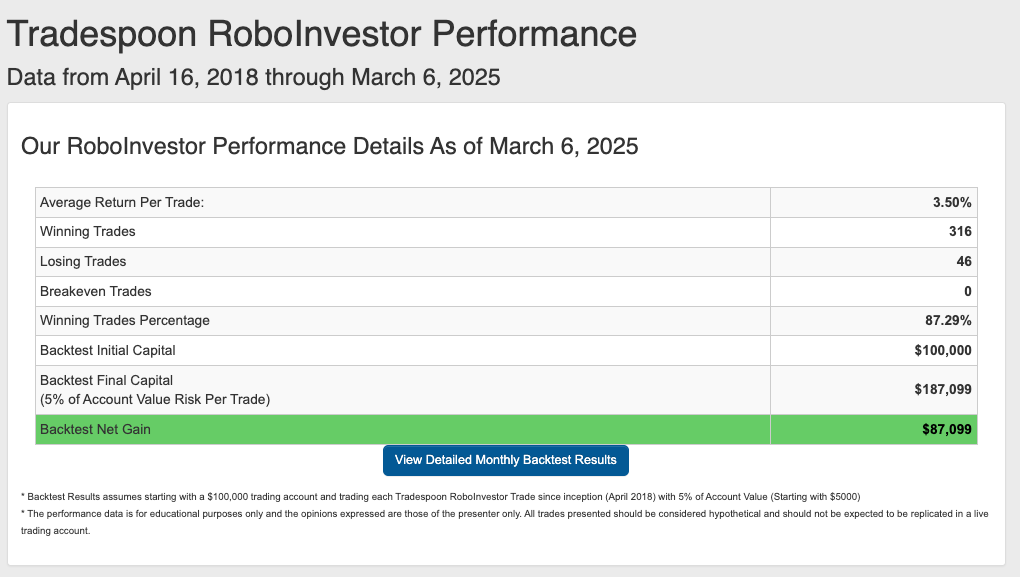

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.29% going back to April 2018.

As we enter 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!