The financial markets are heading into another pivotal week as investors brace for key inflation reports and speeches from Federal Reserve officials. After last week’s turbulence, all eyes are on economic indicators that could set the tone for monetary policy and broader market sentiment.

Stocks Rebound Amid Volatility

Wall Street opened the week on shaky ground but managed to regain footing despite lingering economic concerns. The S&P 500 and Dow Jones Industrial Average both climbed after an initial dip, with the Dow up 204 points (0.5%) and the S&P gaining 0.2%. The Nasdaq Composite, which dropped over 1% earlier, pared losses to end just 0.2% lower.

Market jitters stemmed from a combination of last week’s economic data and a cautious outlook from Walmart, which hinted at potential cracks in consumer strength. The S&P 500 recorded its worst session of 2025 last Friday as concerns about economic resilience intensified.

Monday’s early selling was led by AI stocks, with a report from TD Cowen citing two canceled Microsoft data center leases fueling speculation about shifts in AI infrastructure spending. However, Microsoft executives swiftly refuted any strategic changes, according to a Jefferies note.

Sector Performance and Market Breadth

Utilities were the biggest laggard in the S&P 500, down 0.4%, followed by the technology sector, which slipped 0.1%. The widely watched Invesco S&P 500 Equal Weight ETF (RSP), a proxy for market breadth, rose 0.4%, signaling broad participation in the rebound despite struggles among mega-cap tech names. Within the Magnificent Seven, only Apple, Alphabet, and Nvidia posted gains, while Amazon, Microsoft, and Meta declined over 1%.

Economic Data and Earnings in Focus

While Monday’s calendar was relatively quiet, the market’s attention is shifting toward Nvidia’s highly anticipated earnings release on Wednesday and key economic data in the days ahead. Investors remain on edge, anticipating signals from the Federal Reserve’s preferred inflation metric, due Friday.

Last week’s weak economic data heightened concerns, with the University of Michigan’s consumer sentiment index dropping sharply to 64.7 from December’s 74. Additionally, S&P Global surveys pointed to softness in both manufacturing and services activity. These reports, coupled with Walmart’s cautious outlook, raised fresh doubts about the strength of the U.S. consumer.

Key Earnings and Economic Reports Ahead

Berkshire Hathaway gained traction following strong earnings, driven by strength in its insurance and investment businesses. Apple edged higher after announcing significant long-term investment plans in artificial intelligence and U.S. operations.

Alibaba faced sharp declines as investors reacted to its aggressive spending plans in AI and cloud infrastructure, raising concerns about near-term profitability. Super Micro Computer slipped amid uncertainty surrounding its regulatory filing status.

Domino’s Pizza saw slight declines after posting earnings that fell short of expectations, while Nike moved higher on an analyst upgrade, boosting investor sentiment. Rivian and Lucid both struggled, weighed down by bearish analyst ratings and concerns over future growth potential.

Investors are gearing up for a crucial week packed with earnings from industry leaders including Nvidia, Home Depot, Lowe’s, Dell Technologies, Salesforce, and Intuit. Nvidia’s report, in particular, will be closely scrutinized, as the AI chip leader remains a bellwether for the broader tech sector. Analyst Dan Ives of Wedbush called Nvidia “the most important company for the tech sector and AI revolution” and expects another strong quarter.

Beyond earnings, market participants will closely monitor the Federal Reserve’s preferred inflation gauge, set for release Friday, alongside speeches from Fed officials that could offer further clarity on the rate outlook. Despite recent volatility, the broader market uptrend remains intact, though investors remain wary of potential headwinds, including persistent inflation and labor market uncertainty.

Market Outlook: Navigating Volatility

With markets at a crossroads, investors face a battle between bullish momentum and persistent economic concerns. The Federal Reserve’s next move remains a focal point, with inflation data and consumer trends likely to dictate near-term direction.

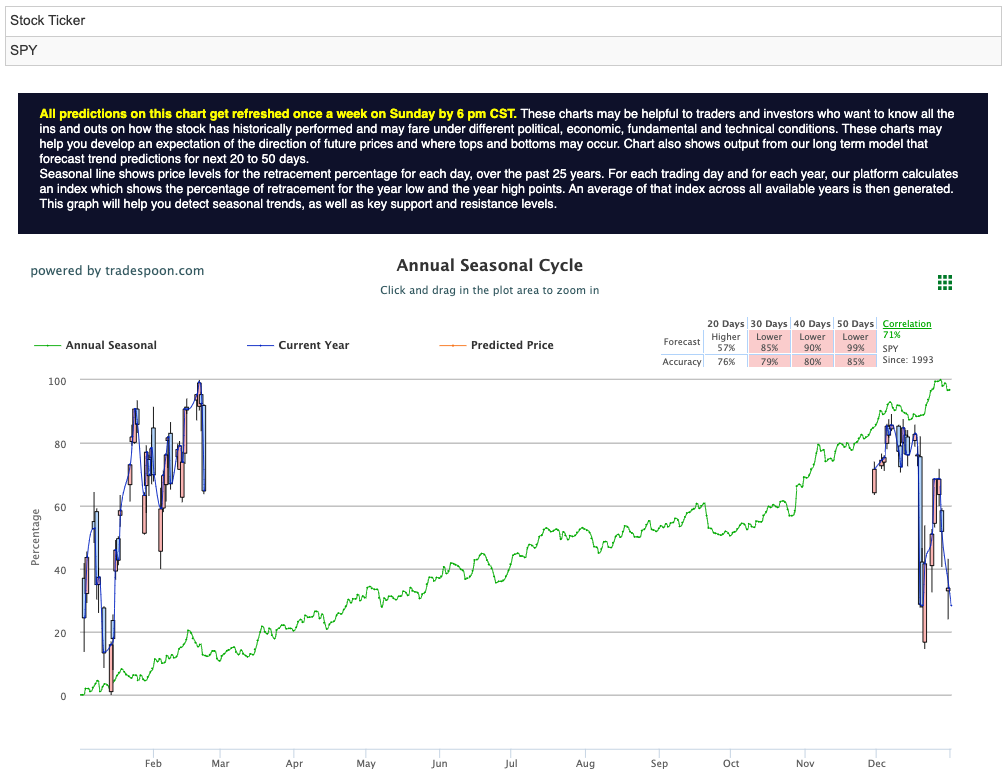

For the S&P 500 (SPY), current projections suggest a potential rally toward the $620–$640 range, while short-term support lies between $560–$580 over the coming months. A sideways trading pattern remains the most likely scenario in the near term, though long-term trends continue to favor upside potential. For reference, the SPY Seasonal Chart is shown below:

As the week unfolds, traders and investors alike should prepare for potential market swings, with Nvidia’s earnings and economic data serving as key catalysts that could determine the market’s next major move.

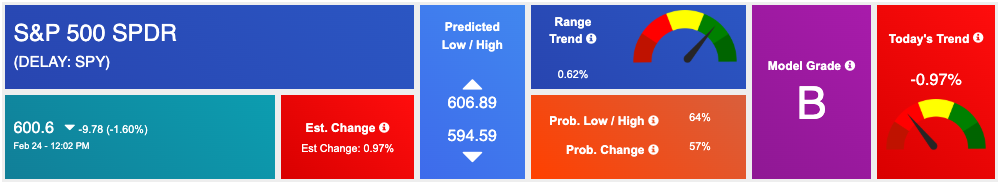

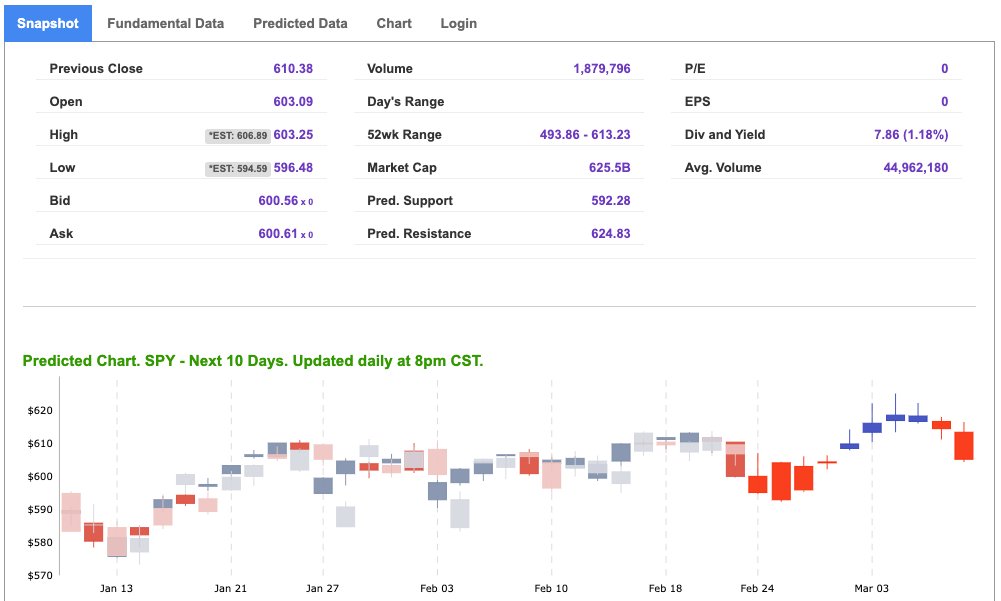

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

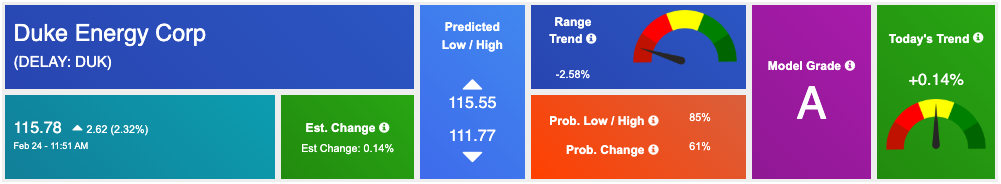

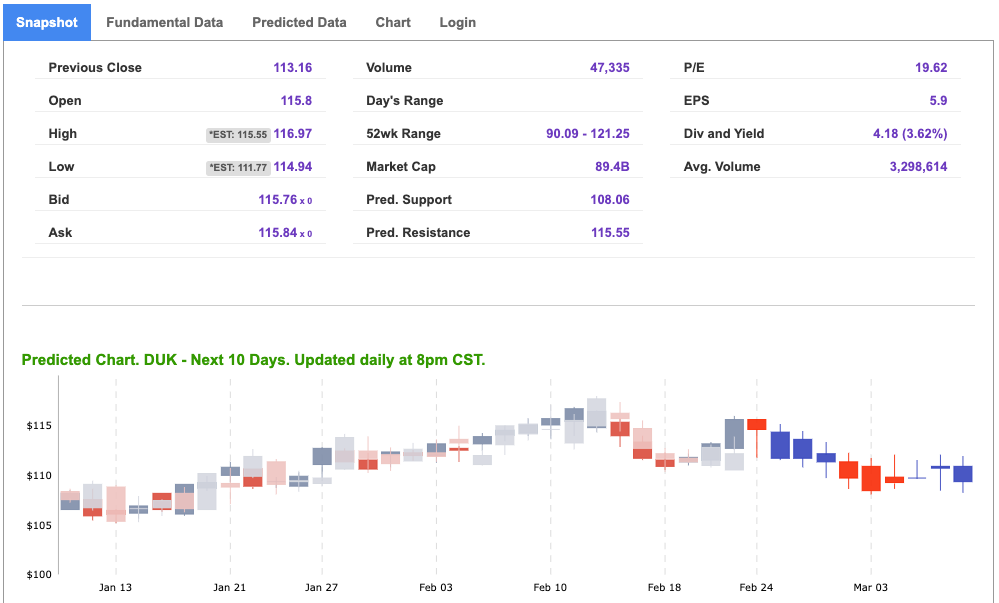

Our featured symbol for Tuesday is DUK. Duke Energy Corp – DUK is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $115.75 with a vector of +0.14% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, DUK. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

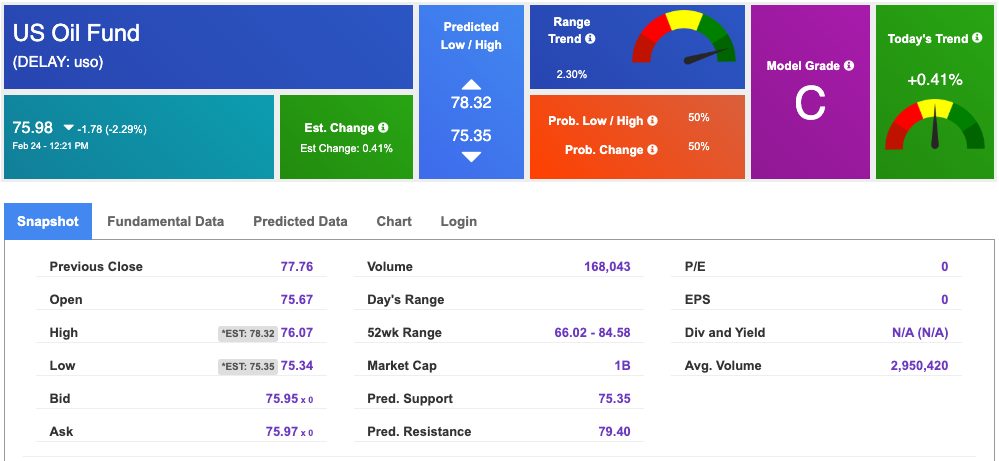

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $70.75 per barrel, up 0.51%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $75.98 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

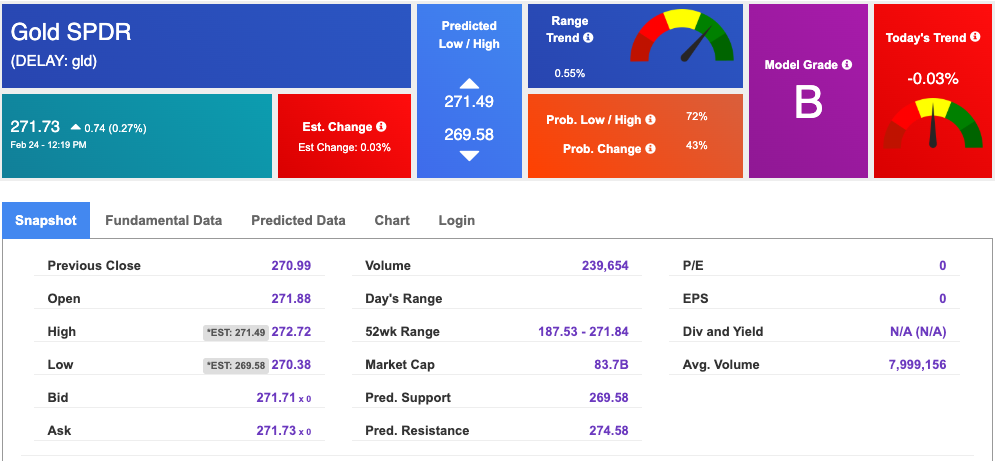

The price for the Gold Continuous Contract (GC00) is up 0.27% at $2,961.00 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $271.73 at the time of publication. Vector signals show -0.03% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

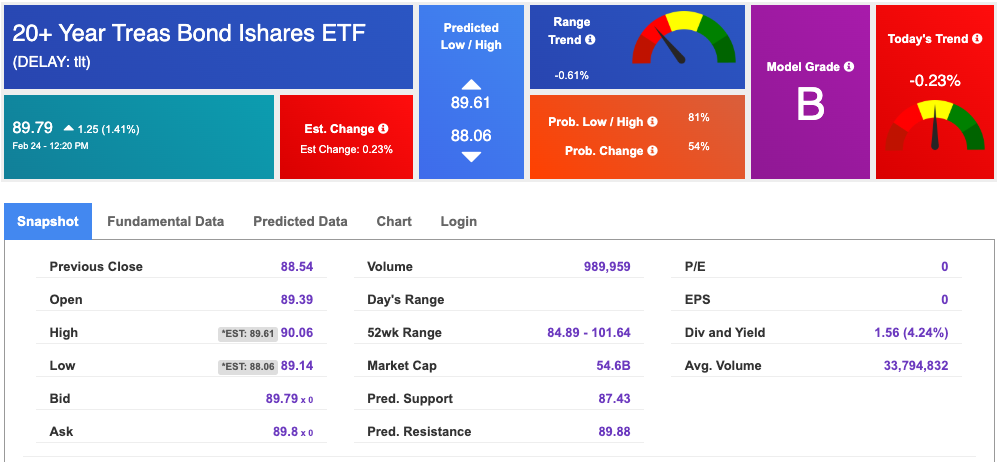

The yield on the 10-year Treasury note is down at 4.396% at the time of publication.

The yield on the 30-year Treasury note is down at 4.657% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

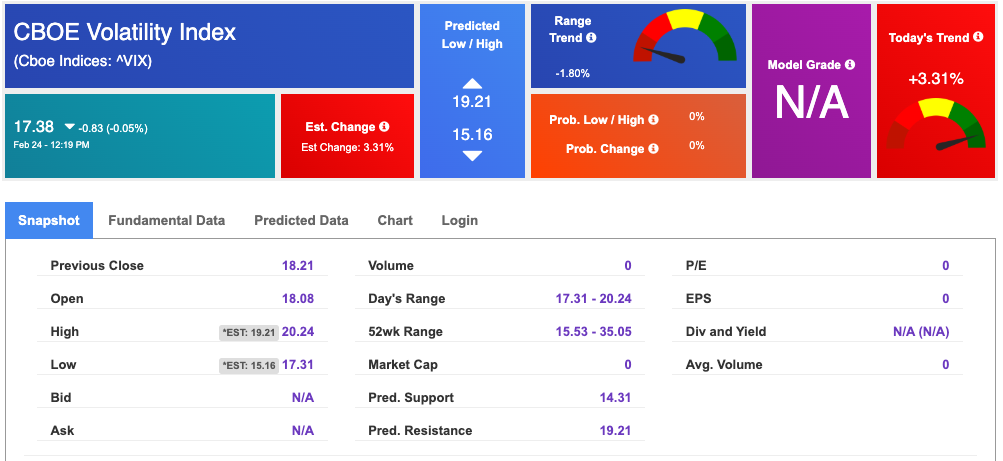

The CBOE Volatility Index (^VIX) is priced at $17.38 down 0.04% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!