RoboStreet – December 5, 2024

As 2024 enters its final month, U.S. financial markets are navigating a complex landscape of record highs, pivotal economic data, and shifting Federal Reserve policies. The S&P 500 and Nasdaq Composite extended their remarkable runs, propelled by surging technology stocks, while the Dow Jones Industrial Average faltered, highlighting divergent sector sentiment. Meanwhile, Bitcoin shattered records by surpassing the $100,000 mark, reflecting growing confidence in cryptocurrency markets.

The economic data released this week painted a nuanced picture, with signs of cooling growth tempered by continued strength in certain sectors. Major reports, including the latest readings on the services sector, employment, and inflation, have contributed to the ongoing market volatility, as investors digest the evolving economic environment and brace for the Federal Reserve’s next policy moves.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The Institute for Supply Management’s (ISM) Services PMI dropped to 52.1 in November, down significantly from October’s 56.0 and well below economists’ expectations of 55.6. While the reading remains above the critical 50-point mark, indicating ongoing expansion, the slowdown points to challenges in the services sector. Businesses have cited waning demand and growing uncertainties over incoming tariff policies under the new administration. This report highlights a slowdown after more than four years of relatively strong growth in the sector. Despite this, the services sector has remained resilient, expanding in 51 of the last 54 months, although the latest data hints at some cracks in that trend.

As market participants awaited the November jobs report, due on Friday, employment data provided a mixed picture. Initial jobless claims for the week rose to 224,000, above the consensus estimate of 214,000. Meanwhile, continuing claims decreased to 1.87 million, falling below expectations of 1.91 million, indicating some steadiness in the labor market. Despite these relatively modest numbers, the report arrives just ahead of the jobs data, which is expected to show a sharp rebound in job creation after disruptions from hurricanes and the recent Boeing strike distorted October’s figures. The broader labor market still faces challenges, however, as employers remain cautious in their hiring, as reflected in the Federal Reserve’s Beige Book report. The report, which surveys economic conditions across the Fed’s 12 districts, noted that while job turnover remained low and layoffs were minimal, hiring demand had slowed. At the same time, consumer spending remained stable, with businesses reporting increased price sensitivity among consumers, which may be limiting demand for certain goods and services.

The most recent inflation report, the Personal Consumption Expenditures (PCE) index, revealed that core inflation rose 2.8% year-over-year in October, surpassing the Fed’s 2% target. While this modest inflation growth suggests some stabilization, persistent inflationary pressures continue to cloud the economic outlook. In addition to the concerns about inflation, rising unemployment, and tightening credit conditions, these factors have increased market expectations of a Federal Reserve rate cut in December. Investors are watching closely to see how the Fed balances these concerns against its ongoing efforts to manage inflation and stimulate growth.

Federal Reserve Chairman Jerome Powell, in a speech this week, acknowledged the economy is in “very good shape” but cautioned against over-optimism. He tempered expectations of aggressive interest rate cuts, despite the labor market data suggesting some cooling. Powell’s comments were in line with the latest Beige Book findings, which reported moderate growth in the economy and positive outlooks in many regions, although some sectors, particularly manufacturing, showed signs of weakness. The Fed’s decision on interest rates, which is now widely expected to include a quarter-point cut later this month, will depend heavily on the upcoming inflation data and the continued pace of job creation. Powell’s cautious stance suggests the central bank remains committed to ensuring economic stability while avoiding any rapid shifts in policy that could disrupt growth.

The market has continued its bullish momentum, with major indices hitting record highs despite the uncertainties surrounding inflation and employment. The VIX, or Volatility Index, remained at a calm 13, signaling a period of low volatility despite the numerous risks in play. The S&P 500, in particular, has demonstrated strong growth, driven by strong earnings in the technology sector. With inflation coming within expectations and earnings season exceeding forecasts, the bull market remains intact, though risks still loom. These risks include rising unemployment, potential small bank failures due to commercial and residential real estate exposures, and the possibility of a broader recession in 2025 as the economy cools.

As we approach the end of the year, I remain in the bullish camp as the market continues to make new highs. The positive momentum is being driven by inflation data coming in within expectations, as well as an earnings season that has largely exceeded forecasts. These factors suggest that the economy is still showing strength, despite broader concerns. However, there are risks on the horizon, including the potential for a recession as the economy begins to cool. Unemployment is slowly ticking up, and small banks face heightened risks from their exposure to commercial and residential real estate markets. These factors could weigh on growth in the coming months.

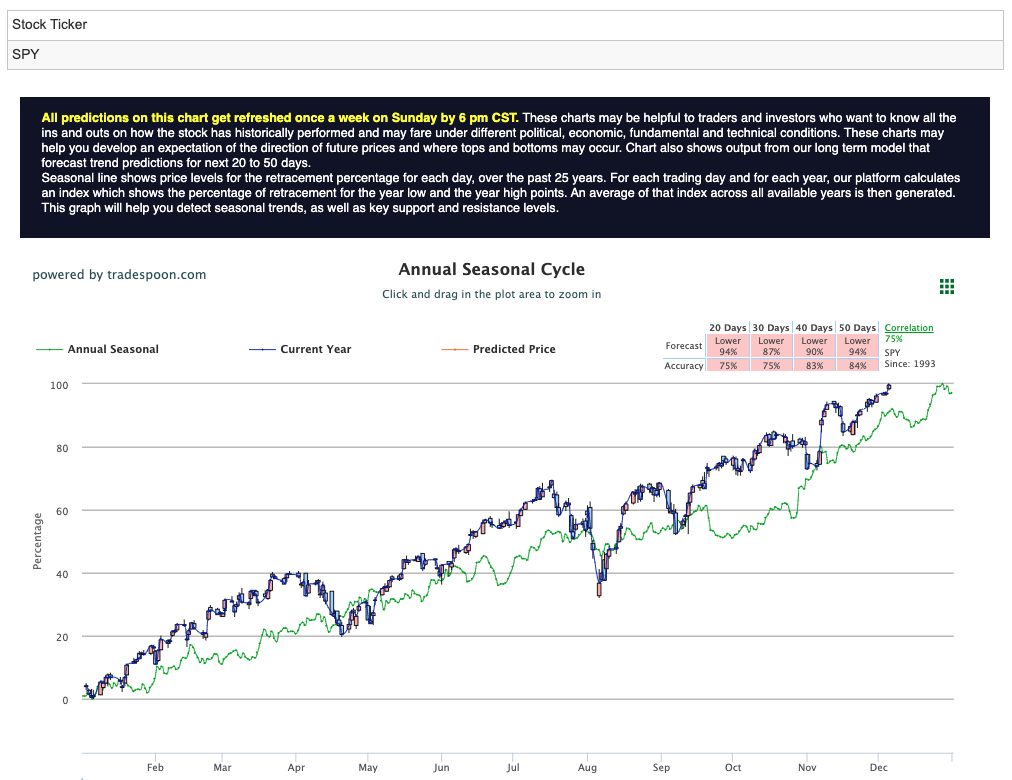

That said, I continue to believe the market will extend its bullish run. In terms of SPY levels, the rally could reach as high as the $620–640 range, with short-term support in the $560–580 zone over the next few months. The broader trend remains intact, and barring unforeseen economic disruptions, I expect the market to continue making new highs. The long-term trajectory remains positive, though vigilance is necessary as we navigate the potential risks of economic cooling and sector-specific vulnerabilities. For reference, the SPY Seasonal Chart is shown below:

In the corporate earnings sphere, technology stocks have continued to shine. Companies like Salesforce ($CRM) have experienced significant stock price increases, up 9% after reporting strong revenue growth, largely attributed to its AI-driven products and services. Similarly, Marvell Technology ($MRVL) and Nvidia have capitalized on the surging demand for AI technology, with their products seeing substantial market adoption. These companies have become pivotal players in the rapidly evolving technology landscape, and their earnings reports continue to fuel optimism in the market. However, not all sectors are seeing such growth. Intel, grappling with operational challenges and leadership turnover, has seen its stock plummet by more than 50% this year. Similarly, CVS, despite its efforts to expand in-store clinics, is struggling against competition from other healthcare providers and online services.

The tech-driven rally has also had an impact on the broader market sentiment, with Bitcoin reaching a significant milestone by breaking through the $100,000 barrier for the first time. The cryptocurrency’s rise is fueled by growing institutional adoption and its increasing appeal as a hedge against inflation. Bitcoin’s surge is indicative of the broader interest in digital assets and the growing confidence in cryptocurrencies, despite volatility in traditional markets.

Overseas, European stocks have also seen mixed performance, shrugging off geopolitical concerns such as the collapse of the French government and disappointing retail sales data. European indices managed to gain on Thursday, suggesting that the broader optimism surrounding global growth has persisted, despite the political instability in France. In Asia, South Korea’s KOSPI index fell by 1.4% due to fears of martial law, while Chinese data showed a slowdown in the services sector, adding to broader concerns about global economic growth.

Oil markets remained subdued, with prices edging lower in response to OPEC+’s decision to delay planned production increases until April. The extended timeline for unwinding voluntary cuts and the ongoing volatility in energy markets point to a cautious outlook for the global economy’s energy needs.

Looking ahead, December will be a crucial month for markets as investors continue to evaluate the potential impacts of Federal Reserve policy, upcoming inflation data, and the health of the global economy. While bullish momentum remains in play, the risks associated with unemployment, small bank stability, and geopolitical tensions cannot be ignored. For now, optimism persists, with many investors anticipating further growth, particularly in technology, while keeping a watchful eye on potential signs of an economic slowdown.

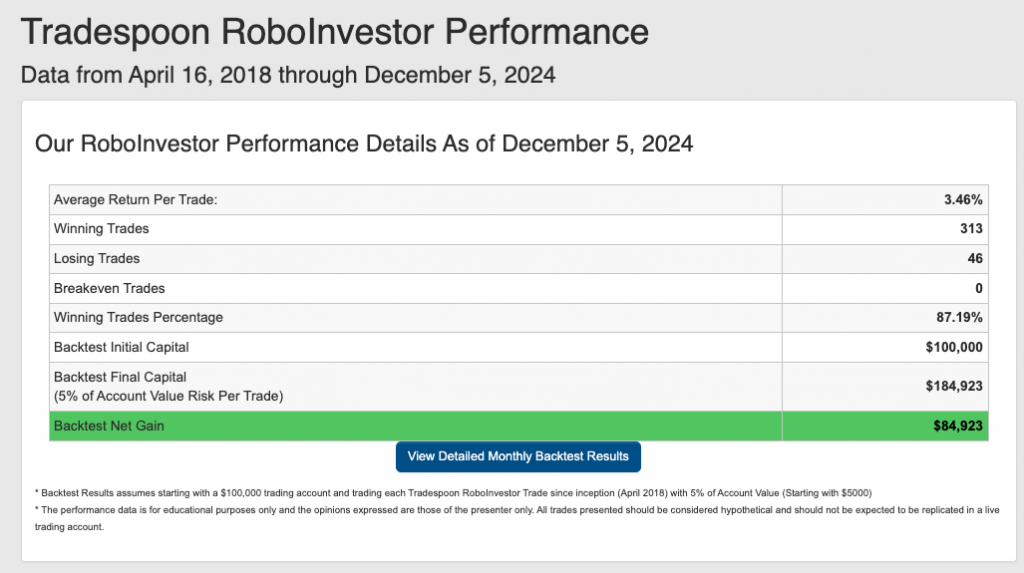

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.19% going back to April 2018.

As we near 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!