In a strong recovery from previous losses, the stock market opened the week on a positive note, driven by the impressive performance of technology stocks. Additionally, investors are closely monitoring the ongoing debt-ceiling talks and eagerly awaiting the outcome. The final round of key earnings releases is also underway, providing valuable insights into the market’s direction.

Lawmakers are actively working towards increasing the nation’s borrowing limit, which currently stands at an astonishing $31.4 trillion. The progress of these debt-ceiling negotiations holds significant importance for investors, who are carefully observing any developments that could influence market sentiment and overall stability. President Joe Biden expressed optimism about reaching a consensus with Republicans, adding to the market’s positive sentiment.

Additionally, Federal Reserve speakers addressed concerns over rising inflation, emphasizing the need for further actions to curb it. The Dow Jones Industrial Average managed to erase earlier losses, propelled by the prospects of progress on the debt-ceiling negotiations.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Amidst the prevailing positive market sentiment, a recently released Federal Reserve survey highlights concerning trends in the U.S. banking sector. The survey reveals a decline in loan demand among banks, accompanied by a notable tightening of loan terms. This tightening is the most significant observed in six years, raising concerns of a potential credit crunch and the associated risk of a recession.

The Dallas Federal Reserve Banking Conditions Survey provided insights into the state of the banking industry. In May, the loan demand index recorded a decline from April, registering at -31.8 compared to -45.6 previously. This negative trend in loan demand has continued. Notably, nearly 48% of CEOs and senior loan officers from various financial institutions reported tightening credit standards and terms, marking the highest percentage observed since the survey began in 2017. Respondents expressed concerns about further contractions in loan demand and anticipated a rise in nonperforming loans over the next six months.

Stocks advanced on Wednesday as investors gained confidence that an agreement would be reached regarding the debt ceiling. President Biden and top congressional leaders acknowledged progress in the negotiations, emphasizing their commitment to avoiding default, which could occur as soon as June 1.

During Wednesday’s trading session, shares of Meta jumped 1.7%, while Nvidia stock climbed 3%. Regional bank stocks experienced gains following Western Alliance Bancorp’s announcement of deposit growth in the current quarter.

Thursday witnessed a significant focus on earnings, with Walmart reporting robust results amid a challenging retail environment. Walmart’s stock made notable gains after the retail giant surpassed Wall Street expectations with its first-quarter adjusted earnings and revenue. Moreover, Walmart raised its outlook for the fiscal year, showcasing strong performance amidst adversity. Bath & Body Works also saw its stock rise sharply after delivering impressive earnings for the first quarter and raising guidance.

However, Target stock experienced a decline of 4.7% on Thursday, becoming the worst performer in the S&P 500. This drop followed the CEO’s warning to investors about the negative implications of retail theft. Gold prices also dipped slightly in Thursday’s afternoon trading.

Primarily impacting markets, Thursday saw a positive shift in the stock market as investors responded to Speaker Kevin McCarthy’s announcement that the House of Representatives could vote on a debt-ceiling deal as early as next week. This news sparked optimism among market participants, leading to an upward trajectory in stock prices.

Less so impacting markets were the cooler-than-expected jobs data: the Labor Department reported a decline in initial jobless claims to 242,000 for the week ended May 13, surpassing economists’ expectations. The U.S. leading economic index fell by 0.6% in April for the 13th consecutive month, pointing to a potential recession later in the year. However, the measure of current economic conditions rose by 0.3% in April, indicating some resilience in the economy.

Investors continue to monitor these economic indicators and look for signs of a potential recession amidst higher interest rates, although the leading index has been signaling a recession for months with little evidence of one.

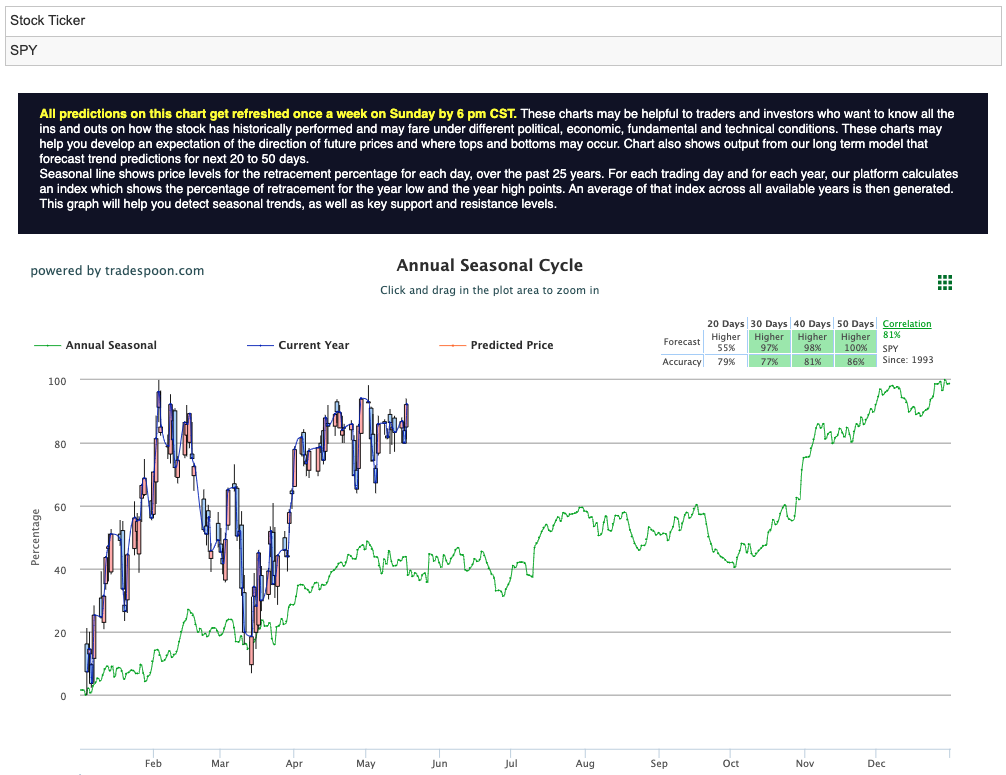

The $VIX is trading near $18, and the current round of key earnings reports from $BIDU, $HD, and $WMT, along with retail data, continue to influence market direction. The focus remains on the SPY’s overhead resistance levels at $414 and $418, with support at $408 and $404. SPY forecasted data predicts sideways trading for the next 2-8 weeks and readers should look to hedge positions during the bearish market. See $SPY Seasonal Chart:

With this in mind, I will be keeping an eye on tech stocks. There is a sugar rush on A.I. right now and companies like Microsoft and Meta continue looking for ways to expand this new market landscape. As tech weathers the current volatility, I believe the continued addition of A.I. will allow symbols in these sectors to remain recession-proof. When checking with my A.I. toolset, I am seeing similar positive forecasts!

If tech is to remain steady, there is one symbol, in particular, my A.I. system likes and I agree!

Alphabet Inc. (GOOGL), is a multinational technology company that specializes in Internet-related services and products and is the parent company of Google. GOOGL offerings include various products and services, such as online advertising technologies, cloud computing, software applications, and hardware devices.

Google remains one of the world’s most influential and valuable companies. Its search engine is widely regarded as the most popular and dominant in the industry. The company’s mission is to organize the world’s information and make it universally accessible and useful.

Google’s stock is traded on the NASDAQ stock exchange under the ticker symbol “GOOGL” and has a market capitalization exceeding billions of dollars, making it one of the most valuable companies globally. The company continues to innovate and expand its product offerings, investing in emerging technologies such as artificial intelligence, machine learning, and autonomous vehicles.

With its significant influence and market presence, Google plays a vital role in shaping the digital landscape and driving technological advancements. A.I. is at the forefront of Google’s next venture and should offer market-giant stability.

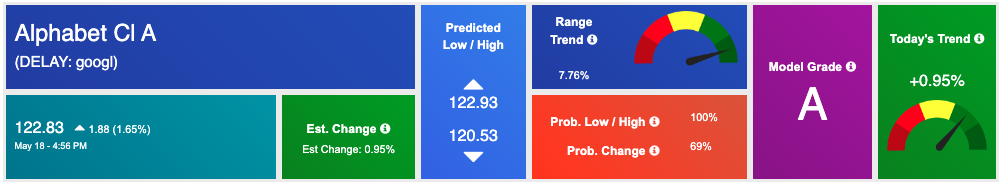

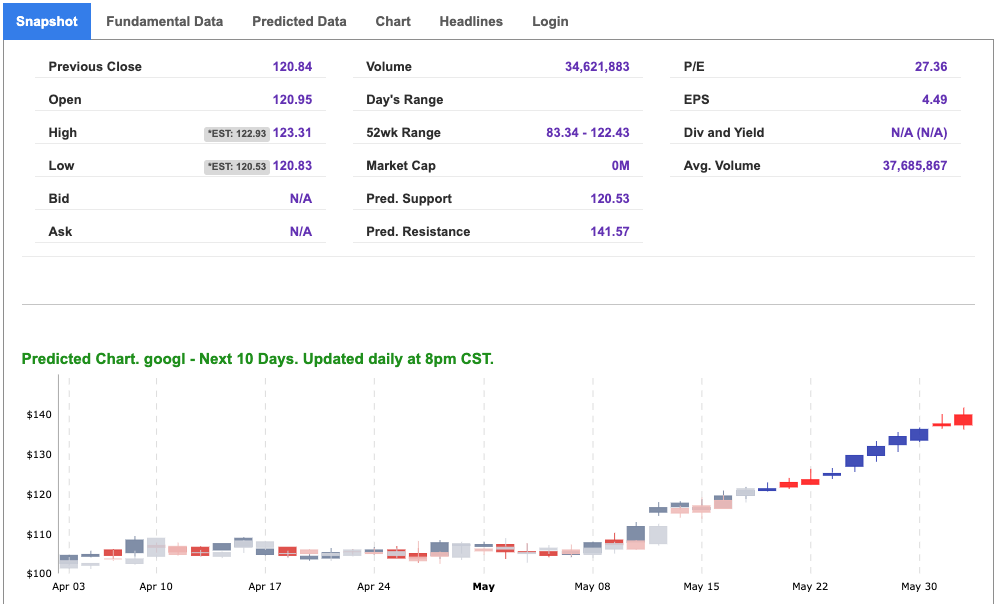

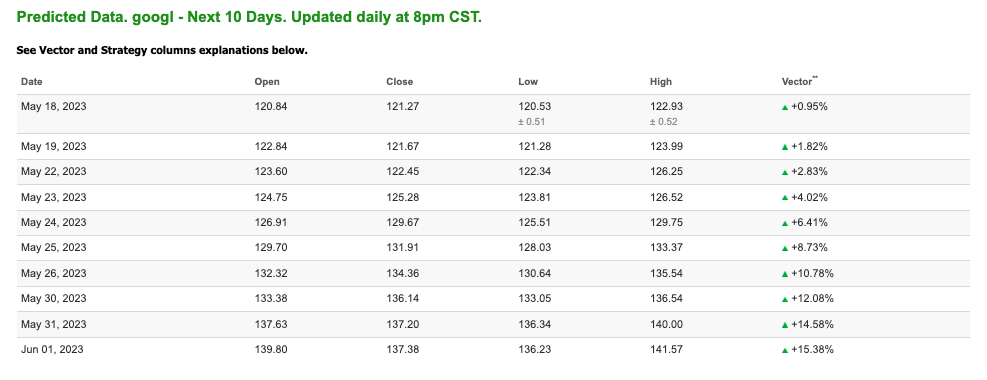

Looking at the 10-day forecasted data from the Stock Forecast Toolbox we see a positive and one-directional vector trend. This trend traditionally indicates a strong likelihood the symbol should trend higher. With its strong vector trend and high accuracy score, I have confidence in Google in the coming weeks. See 10-day Predicted Data:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

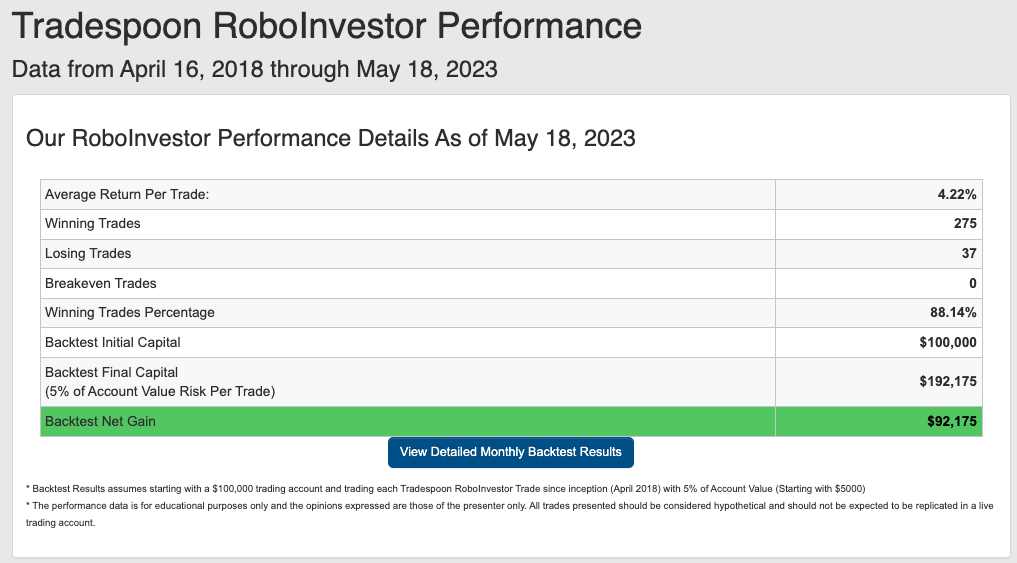

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.14% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!