This week, all eyes in the financial world were fixed on the latest inflation data, particularly the release of the Consumer Price Index (CPI) report on Wednesday. The eagerly anticipated report provided a breath of relief for investors as it indicated a slight cooling of price gains in April. This news ignited a midweek rally in the markets, sending all three major indexes to new closing highs, setting the stage for a robust performance through the latter part of the week.

The Dow Jones Industrial Average soared past the historic 40,000 mark for the first time, while both the S&P 500 and Nasdaq Composite surged to record highs. This rally reflects growing investor confidence amidst a moderately growing economy, tempered enough to alleviate concerns of runaway inflation. The Federal Reserve, while keeping a close watch on economic indicators, seems inclined to maintain interest rates at their current levels, indicating a stable monetary policy for the time being.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The April CPI data, released by the U.S. Bureau of Labor Statistics, revealed a year-over-year gain of 3.4%, slightly lower than March’s 3.5% increase. Economists had forecasted a mild slowdown in price growth, which was indeed confirmed by the report. This favorable inflation report, the first in four months, indicated a decline in the annual rate of inflation, aligning with market expectations. Notably, the pace of headline inflation in April, at 0.3% on a monthly basis, was softer than anticipated, further signaling a potential easing of inflationary pressures.

Digging deeper into the data, the CPI’s index of services, excluding energy, showed a slight deceleration in April compared to the previous month. Key sectors such as medical care, hospital services, and transportation experienced marked slowdowns in price increases, alongside a more subdued pace of growth in auto insurance costs.

Despite the encouraging signs in the inflation report, Federal Reserve officials remain cautious about adjusting interest rates. While acknowledging the positive trajectory of inflation, Chair Jerome Powell emphasized the need for patience, indicating that the central bank is likely to maintain its current stance on monetary policy for the foreseeable future.

Amidst the backdrop of inflationary concerns, the market witnessed a resurgence in meme stocks, captivating investor attention. Stocks like GameStop and AMC Entertainment experienced extreme volatility, triggered by social media activity and short squeezes. Additionally, speculative assets like cryptocurrencies saw positive momentum amid rising inflation expectations and cautious market sentiment.

Looking ahead, market volatility is expected to persist, with factors such as VIX expiration week and May expiration contributing to uncertainty. Eyes are particularly on Nvidia (NVDA) as it gears up to report earnings in two weeks, amidst ongoing debates surrounding interest rate cuts and their potential impact on market dynamics.

In summary, while the latest inflation data provided some relief to investors, uncertainties linger regarding the future trajectory of interest rates and market sentiment. As the market continues to navigate through economic data releases and unexpected movements, vigilance remains paramount in ensuring informed investment decisions amidst evolving market conditions.

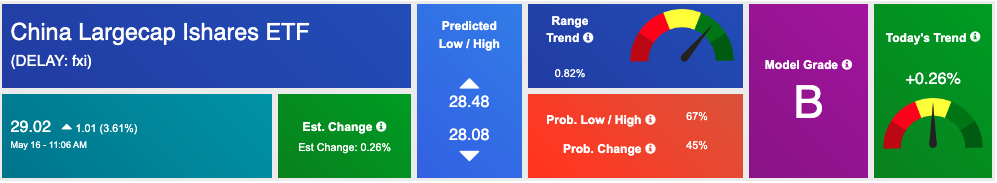

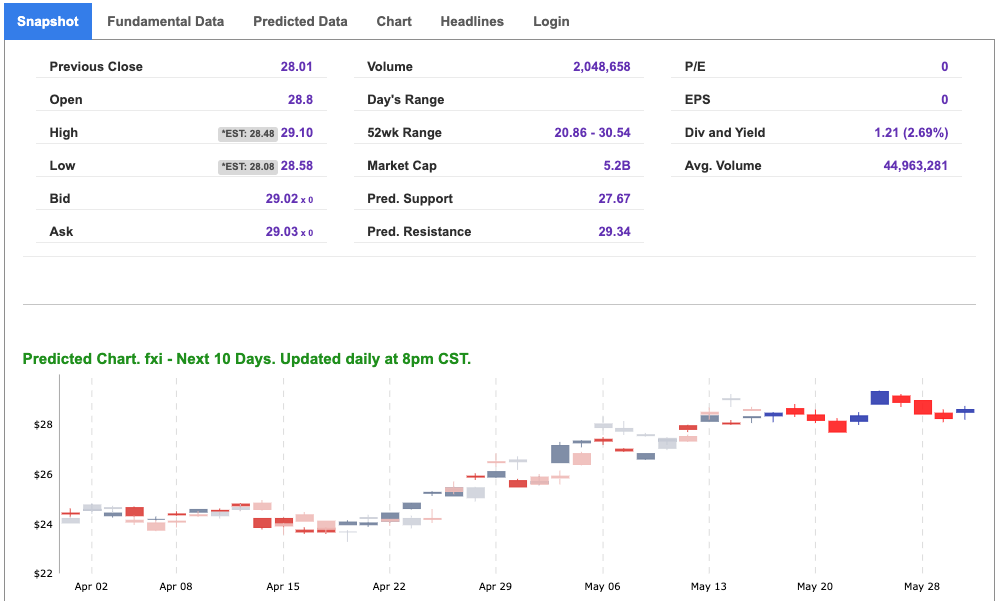

The iShares China Large-Cap ETF (FXI) is an exchange-traded fund that seeks to track the investment results of an index composed of large-capitalization Chinese equities that trade on the Hong Kong Stock Exchange or other major foreign exchanges. Amidst the current market dynamics characterized by a rallying environment buoyed by favorable inflation data and growing investor confidence, the landscape presents a compelling opportunity to consider a long position in FXI.

In China, despite global economic uncertainties, the economy has showcased remarkable resilience, bolstered by robust domestic consumption, government stimulus measures, and ongoing structural reforms. Recent positive earnings reports from JD.com, a leading Chinese e-commerce giant, underscore the strength of the country’s corporate sector amidst challenging conditions.

While market volatility remains a concern, particularly amidst factors like VIX expiration week and May expiration, FXI offers diversified exposure to large-cap Chinese equities, potentially mitigating risks associated with individual stock volatility. Moreover, with uncertainties surrounding interest rate cuts and their implications for global markets, FXI provides a hedge against such uncertainties by tapping into the resilience of the Chinese economy.

As the global economy gradually recovers from the pandemic-induced slowdown, emerging markets like China are poised to drive global growth. FXI offers investors a strategic entry point into this growth narrative, with its portfolio consisting of key players in sectors such as technology, consumer discretionary, and financials, which stand to benefit from China’s continued economic expansion.

With inflationary pressures showing signs of moderation and the Federal Reserve maintaining a cautious stance on interest rates, investor sentiment remains positive, providing a conducive environment for equity investments. Against this backdrop, FXI stands out as an attractive option for investors looking to capitalize on emerging market potential while navigating through market uncertainties.

Considering the current market conditions characterized by optimism fueled by favorable inflation data and resilient economic growth in China, going long on FXI presents a compelling opportunity for investors seeking exposure to the dynamic Chinese market, poised for further upside potential amidst improving economic fundamentals.

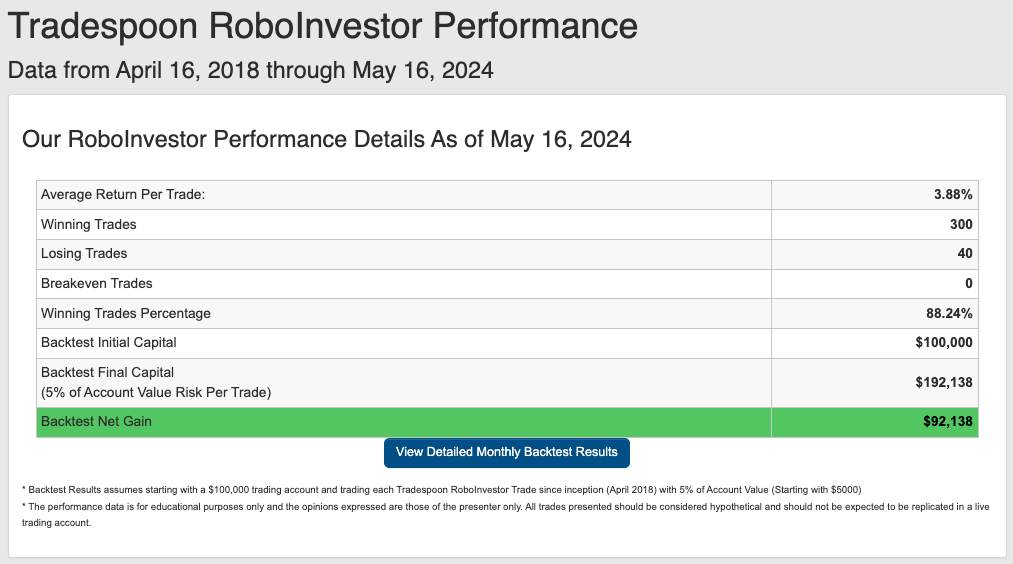

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.24% going back to April 2018.

As we navigate deeper into 2024, investors face a labyrinth of market challenges, from surging inflation to shifting Federal policies and geopolitical uncertainties like the ongoing conflict in Ukraine. In such turbulent times, having a trusted and informed investment partner becomes paramount. Enter RoboInvestor – your steadfast ally in the ever-evolving financial landscape. Offering a comprehensive array of resources and expert insights, RoboInvestor empowers you to navigate your portfolio with confidence and seize promising opportunities amidst the rapid pace of market dynamics.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!