RoboStreet – November 21, 2024

This week marked a pivotal moment for markets, with major averages breaking through all-time highs and the VIX retreating to 18, signaling reduced volatility. The week’s headlines centered on earnings from corporate giants like Nvidia, Snowflake, and CrowdStrike, along with retail sector standouts Walmart and Target. These results, combined with broader economic data and political developments, created a dynamic backdrop for investors to navigate.

As the post-election rally continued to evolve, markets experienced both surges and pullbacks. Investors have begun reassessing the policy implications of President-elect Donald Trump’s administration, focusing on potential changes to tax rates, trade tariffs, and regulatory measures. The initial optimism has given way to measured adjustments as the market looks for clarity on future economic policies.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

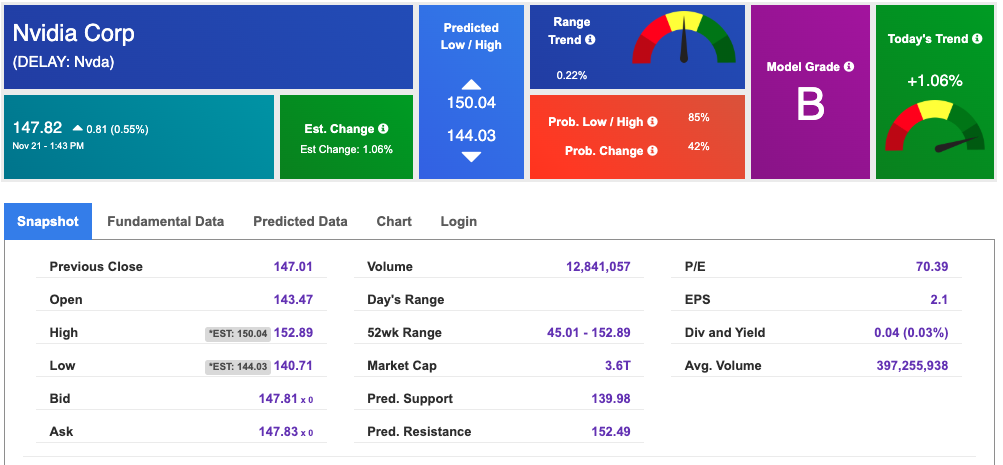

Nvidia ($NVDA) once again captured Wall Street’s attention with stellar earnings, reinforcing its position as a bellwether for the tech sector and artificial intelligence. The company reported adjusted earnings of $0.81 per share, outpacing estimates of $0.75. Revenue reached $35.1 billion, surpassing the forecasted $33.2 billion. Nvidia also provided a strong revenue outlook for the current quarter, projecting $37.5 billion, slightly above consensus expectations.

Despite these robust results, Nvidia’s stock edged lower as analysts questioned whether its growth trajectory could sustain such high valuations. The company’s flagship Blackwell chips remain in high demand, with supply still falling short—a testament to Nvidia’s dominance in the AI space. Investors, however, are cautiously optimistic, watching closely to see if the company can maintain its leadership position amid heightened expectations.

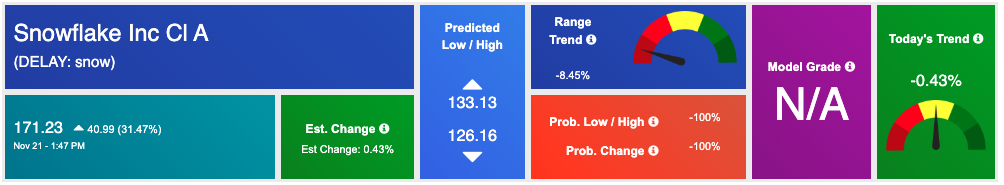

Snowflake ($SNOW) emerged as a major highlight in the software sector. The company posted earnings that beat expectations and raised its product revenue guidance for the year, sending its stock soaring to its best trading day ever. Snowflake’s performance underscores the growing demand for data-driven cloud solutions, which continue to outshine even the most anticipated semiconductor earnings.

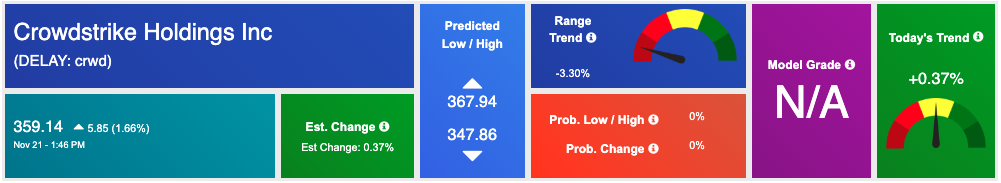

CrowdStrike ($CRWD) also delivered a notable performance, reflecting strength in cybersecurity. Its solid results contributed to the tech sector’s resilience, even as other areas showed signs of rotation.

Retail earnings painted a mixed picture. Walmart ($WMT) impressed investors with a rally fueled by better-than-expected results, bolstered by robust grocery sales and improved operational efficiency. In contrast, Target ($TGT) suffered a sharp decline following a significant earnings miss. These divergent performances highlight the challenges facing retailers as they navigate shifting consumer spending habits amid economic uncertainty.

The week’s economic indicators provided a mixed but generally supportive backdrop for equities. The U.S. PMI data signaled continued expansion in manufacturing and services, though at a slower pace than previous months, reflecting the economy’s gradual cooling. Meanwhile, Federal Reserve Chair Jerome Powell reiterated that the Fed remains cautious about further rate cuts, maintaining a stance of patience that contributed to some market volatility.

The 10-year Treasury yield, trading within a volatile range of 3.6% to 4.4%, highlighted ongoing uncertainty in the bond market. A strong dollar added to short-term headwinds, but these were offset by optimism surrounding a potential soft landing, yield curve normalization, and broader market participation.

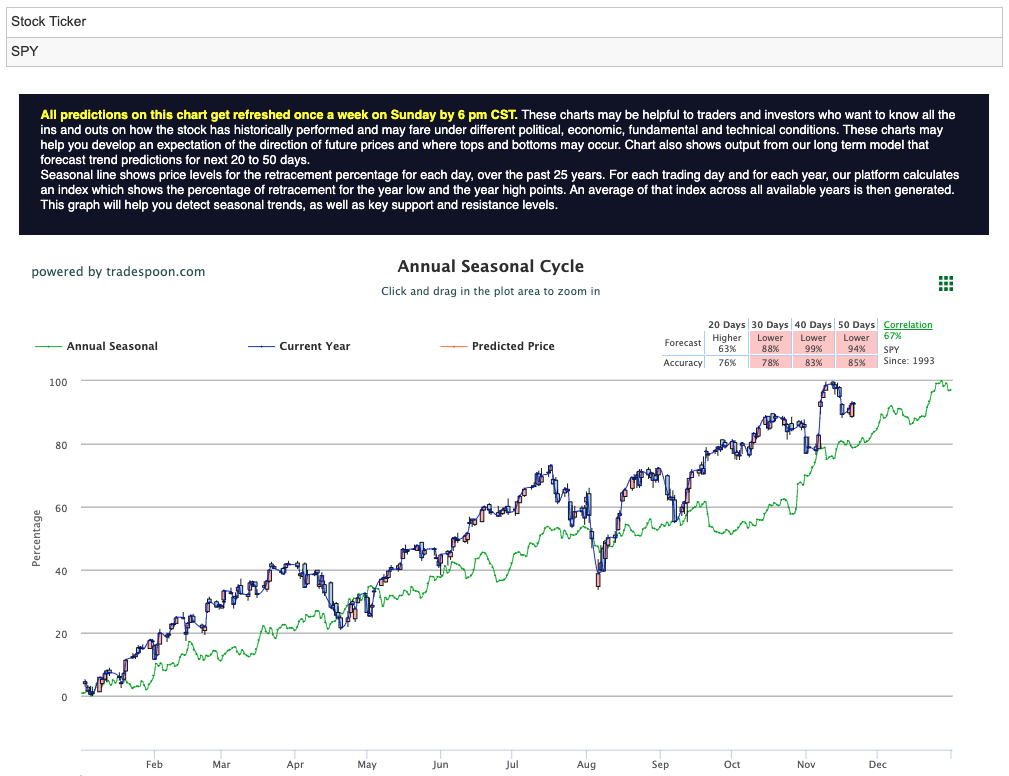

Despite recession concerns, inflation is largely within expectations, and the earnings season has exceeded forecasts, supporting a bullish narrative. Analysts project the S&P 500 could rally to the 600-610 range in the coming months, with short-term support around 540-550. While risks remain, including the potential failure of small banks with exposure to commercial and residential real estate, the long-term trend appears intact. For reference, the SPY Seasonal Chart is shown below:

The VIX, now at 18, underscores the market’s confidence as volatility subsides. Broadening participation beyond tech—the hallmark of the recent rally—suggests a healthier market environment. Sectors like software, industrials, and even undervalued retail names have begun to attract investor attention, signaling a diversification of leadership.

As the earnings season concludes, investors will continue to monitor economic signals, corporate guidance, and geopolitical developments. Nvidia’s results reaffirm its dominance, but the rotation into sectors like software and retail underscores the market’s search for balance amid lofty valuations. With major averages hitting record highs, optimism remains the prevailing sentiment, even as caution is warranted in a landscape marked by both opportunity and risk.

Markets seem poised for further gains, but the path forward will likely involve navigating shallow pullbacks and sector rotations. The post-election rally, robust corporate earnings, and a softening inflation narrative provide strong tailwinds, but vigilance will be key as economic data and policy uncertainties unfold.

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

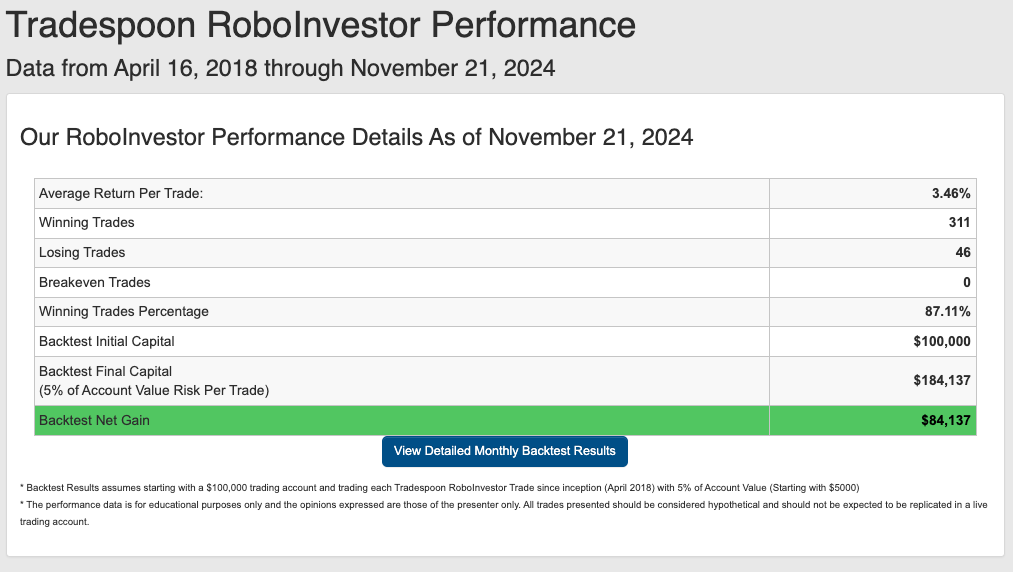

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.11% going back to April 2018.

As we near 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!