Market Rally Sets Tone as Investors Brace for FOMC Meeting and Earnings Surge

In anticipation of this week’s Federal Open Market Committee (FOMC) meeting, where Federal Reserve Chair Jerome Powell is set to provide crucial updates on November 1st, the U.S. stock market witnessed a robust resurgence on Monday. All three major indices, the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite, posted significant gains, effectively snapping a recent losing streak.

The Dow led the charge, surging by over 500 points, as investor optimism swelled. This renewed confidence saw a widespread rally in the tech sector, with notable giants like Alphabet (Google), Meta Platforms (Facebook and Instagram’s parent company), and Amazon bouncing back after a challenging week in which they struggled to keep pace with the broader market.

Alphabet’s shares were up by 1.7% during afternoon trading, while Meta Platforms and Amazon.com saw gains of 1.9% and 2.8%, respectively. Microsoft joined the upward trend with a 1.6% gain, and even Apple, which is scheduled to announce its quarterly results after the market closes on Thursday, experienced a 0.6% uptick.

A decline in oil prices, with WTI crude oil futures down 4% to $82.02 per barrel on Monday, further contributed to the market’s rebound. The ongoing conflict in the Middle East, particularly Israel’s measured approach in response to Gaza, did not trigger an immediate spike in oil prices, providing some relief to investors.

SoFi Technologies, a fintech company, stole the spotlight with a 1% gain after initially jumping as much as 14% during the session. The company reported third-quarter adjusted revenue of $531 million, surpassing analyst expectations, and, notably, raised its revenue outlook for 2023.

McDonald’s, the fast-food giant, reported third-quarter earnings and revenue exceeding Wall Street’s predictions. Their impressive performance was underscored by a robust 8.1% rise in same-store sales in the U.S., beating expectations. Consequently, their stock witnessed a 1.7% increase.

Meanwhile, ON Semiconductor reported third-quarter earnings and revenue that exceeded Wall Street estimates. However, the company’s fourth-quarter guidance fell short of expectations, causing its stock to decline by 22%.

On a brighter note, biopharmaceutical company AbbVie saw its shares rise by 2.2% to $141.92 after analysts at Barclays upgraded the stock to “Overweight” from “Equal Weight” and raised their price target from $160 to $170. This positive development came after AbbVie reported earnings that exceeded analyst estimates last Friday.

Investors can expect a flurry of earnings reports later this week from industry heavyweights including Apple, Eli Lilly, Pfizer, Advanced Micro Devices, Amgen, Caterpillar, Qualcomm, CVS Health, Moderna, Airbnb, PayPal, ConocoPhillips, Starbucks, Anheuser-Busch InBev, and Electronic Arts. These reports will provide a deeper insight into the health and performance of various sectors within the economy.

In the background, the U.S. Treasury Department made a noteworthy adjustment to its estimate for fourth-quarter borrowing, attributing it to higher tax receipts. This shift has triggered curiosity among bond investors who are now waiting for further details on the composition of the debt that will be offered. The increased borrowing has cast a shadow on the U.S. government’s fiscal discipline, as it has historically aimed for regular and predictable borrowing patterns. This unexpected change in the third-quarter report earlier in the year led to higher yields on the 10-year bonds, creating more volatility for the S&P 500 and Dow Jones Industrial Average.

To date, yields on 10-year bonds, a vital economic indicator, have risen by 0.83 percentage points through Monday’s close. As a result, Americans may experience increased costs for mortgages, credit card balances, and bank loans.

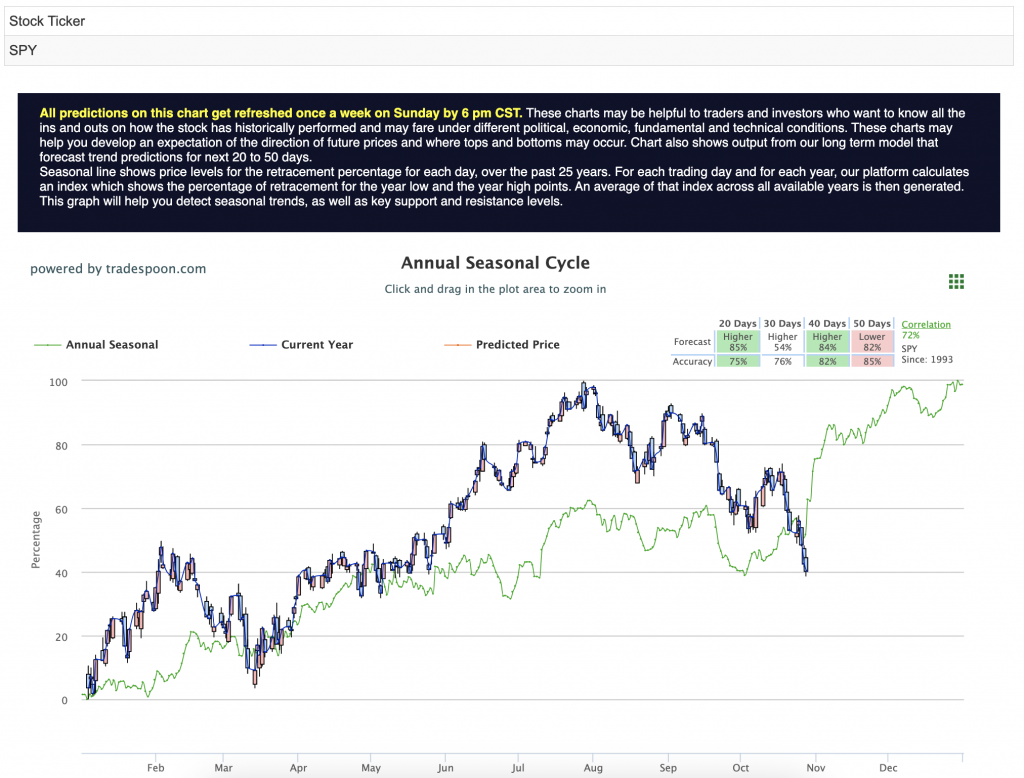

I am maintaining a cautious outlook, with expectations that the SPY rally may remain constrained within the $450-470 range, while short-term support could dip to the 400-430 level in the coming months. Currently, there appears to be more room for a downward trend, with the breaking of August lows already in progress. For reference, the SPY Seasonal Chart is shown below:

November might bring some volatility, but the anticipation of better-than-expected earnings and the seasonal year-end rally could establish a stable market floor around the 200-day moving average. All eyes are now focused on Powell’s upcoming speech and the pivotal FOMC meeting this week.

As the markets prepare for the FOMC meeting and earnings onslaught, investors remain vigilant, seeking to discern the broader economic trends and implications of these developments. The coming days promise to be an exciting period for both seasoned and novice investors alike.

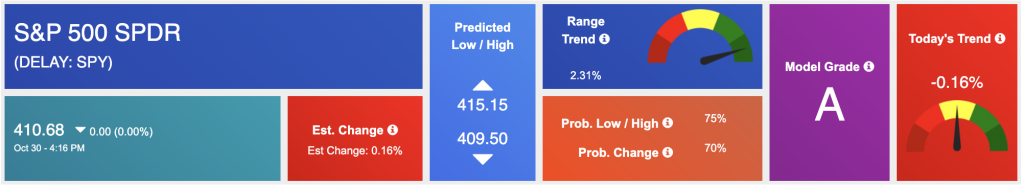

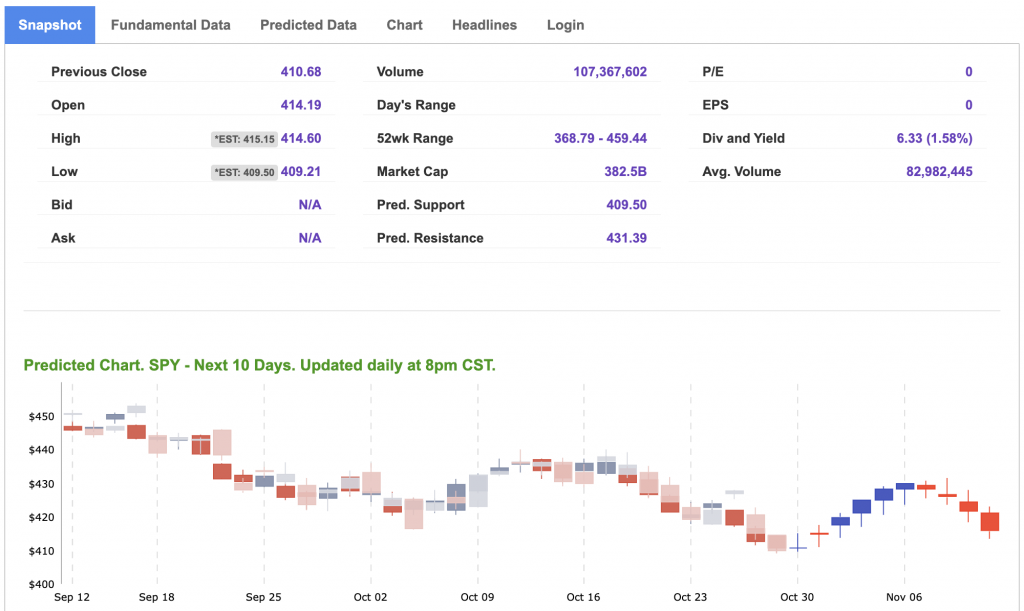

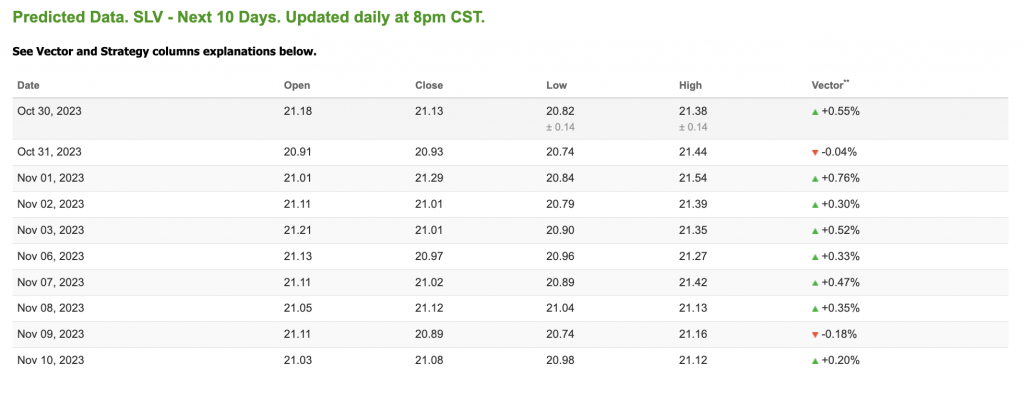

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

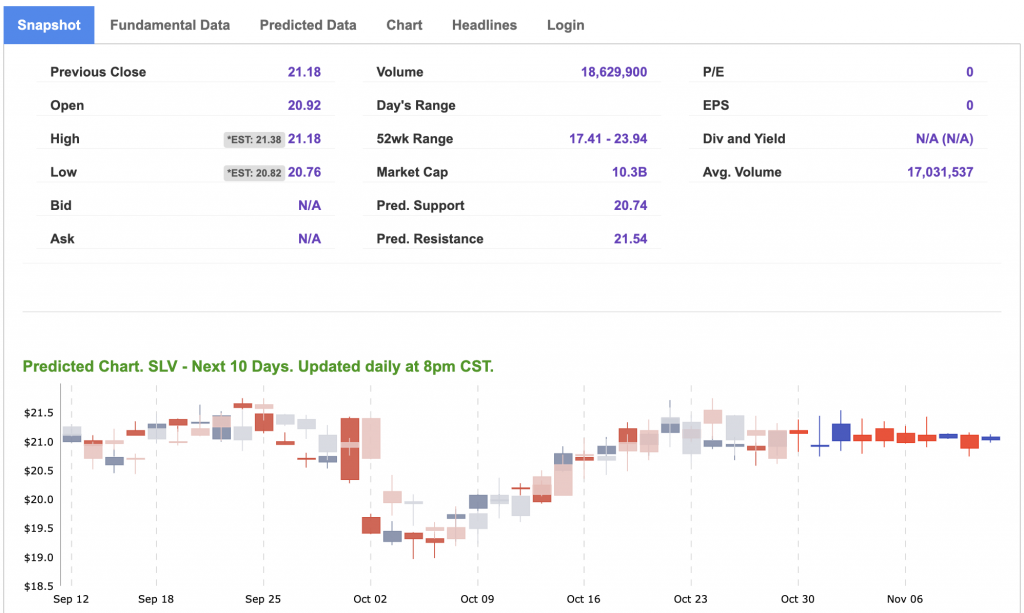

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, SLV. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

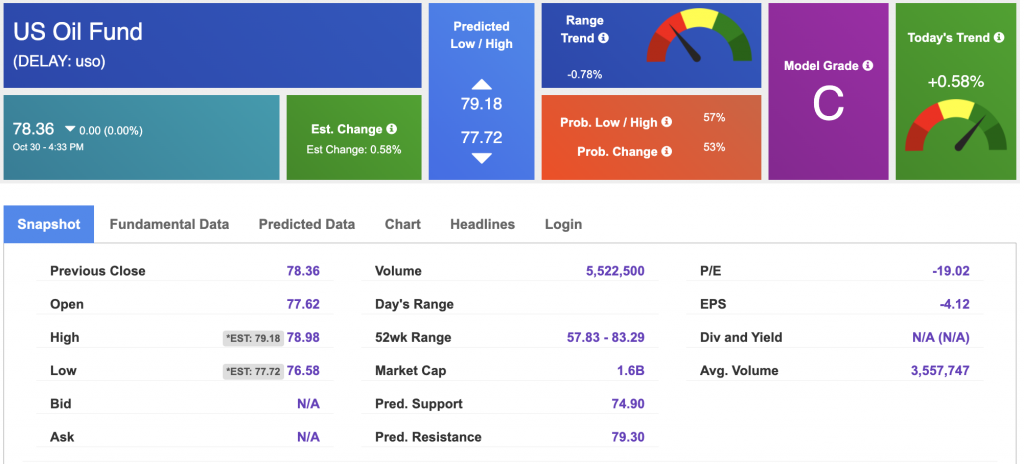

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $82.59 per barrel, down 3.45%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $78.36 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

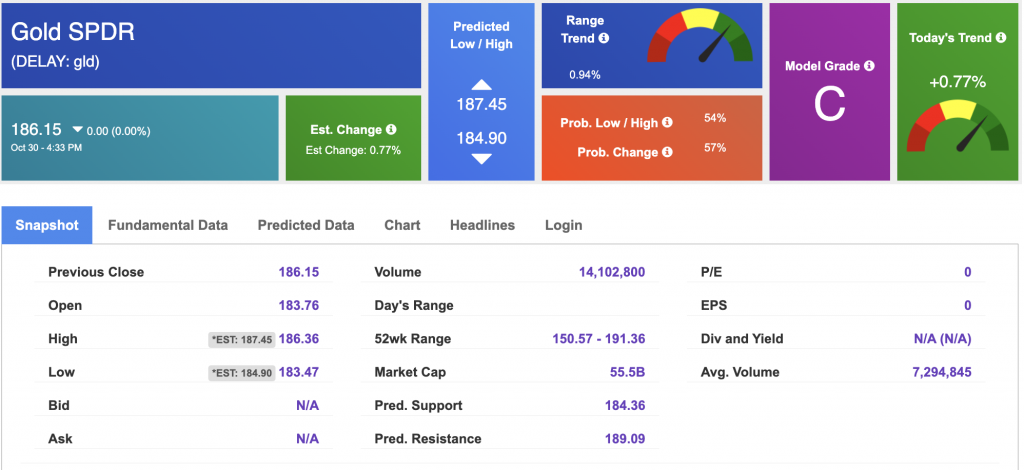

The price for the Gold Continuous Contract (GC00) is down 0.36% at $2005.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $186.15 at the time of publication. Vector signals show +0.77% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

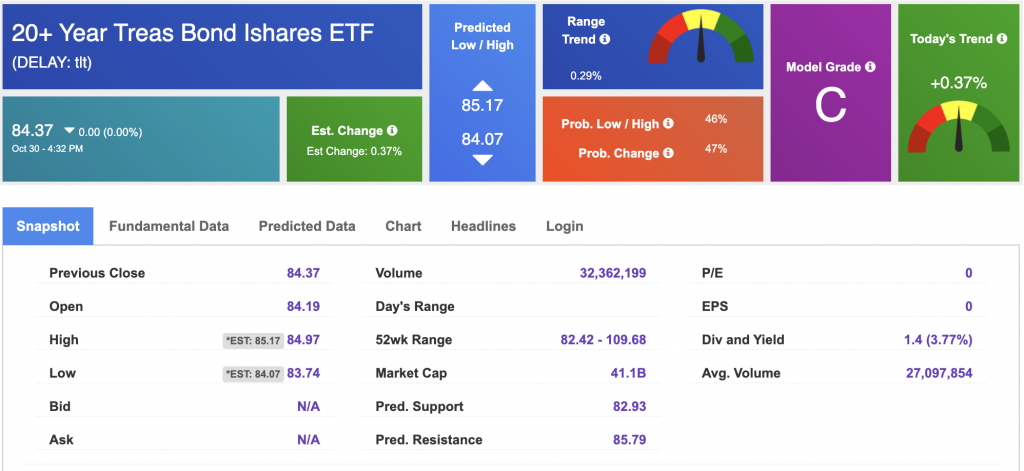

The yield on the 10-year Treasury note is up at 4.895% at the time of publication.

The yield on the 30-year Treasury note is up at 5.051% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $19.75 down 7.15% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!