Stocks fell on Thursday as concerns over banking industry woes and the Federal Reserve’s interest rate hike weighed heavily on investors. All three major US stock indices were down for the fourth consecutive session, and the Dow Jones Industrial Average erased all gains for the year.

The market reaction followed Wednesday’s announcement by the Federal Reserve of a quarter-point interest rate hike, its tenth of the current cycle. Fed Chairman Jerome Powell stated that the central bank is “prepared to do more” and committed to reducing inflation to 2%. While the Fed’s statement did not contain the phrase “some additional policy firming may be appropriate,” Powell emphasized during his press conference that the bank is “prepared to do more if greater monetary policy restraint is warranted.”

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The announcement led to Treasury yields rallying across the curve and a dip in the value of the dollar. Investors are now awaiting the release of Friday’s jobs report, which is expected to show a slight increase in the unemployment rate.

Earlier this week, JP Morgan Chase’s acquisition of all the deposits of First Republic Bank caused all three major US stock indices to close lower. Although investors remain concerned about the impact of the Fed’s interest rate hikes on other banks, JP Morgan’s shares rose by 2%, while First Republic Bank’s stock was halted.

However, the ISM manufacturing survey brought some good news, showing a slight improvement in US manufacturing activity in April. The reading of 47.1 was higher than the consensus of 46.7 and up from March’s 46.3, suggesting a slower contraction.

Investors are also closely watching several big companies, including Pfizer, Advanced Micro Devices, Apple, Uber, and MGM, as they release their earnings reports this week. With these reports and the Fed’s decision influencing the market’s next move, investors are anxiously waiting to see how the market will react.

As the $VIX is trading near the $20 level, we are closely monitoring the overhead resistance levels in the SPY, which are currently at $418 and then $430. The $SPY support is at $410 and then $406. We anticipate the market will continue to trade sideways for the next 2-8 weeks, and we would be bearish at this time, encouraging subscribers to hedge their positions. See $SPY Seasonal Chart:

The market’s sideways trading has continued, with expectations of increased volatility in the first half of the year. As the earnings season unfolds, there is a pullback in progress, with small caps, regional banks in China, and semiconductors breaking April lows and initiating their pullback. Eurozone inflation data is also higher than anticipated, and with the takeover of First Republic Bank by JPMorgan, regional banks such as PACW and SION appear to be next in line for scrutiny. Additionally, the KRE is breaking down through major support.

All eyes are on the FED meeting this week, followed by CPI data next week. However, it appears that oil prices have given up all of their gains after OPEC’s decision, and the retesting of 52-week lows is another indication that China’s reopening is not going according to plan, with the odds of a recession increasing.

As the markets cannot drop unless stocks such as AAPL, NVDA, and MSFT start the pullback, many are eagerly watching to see when that will happen. This week, small caps are announcing earnings, and we are currently sitting on 52-week lows.

With this in mind, I have identified my next move in the market with an eye on volatility continuing ahead of the upcoming CPI reports.

ProShares Short S&P 500 ETF (SH) is an exchange-traded fund that allows investors to profit from a decline in the S&P 500 index. $SH accomplishes this by holding a portfolio of derivative instruments such as futures, options, and swaps, which are designed to move in the opposite direction of the S&P 500.

The fund is designed to be a short-term hedge for investors who are concerned about the stock market’s potential downside risk. By shorting the S&P 500, investors can protect their portfolios from significant losses during periods of market volatility. The fund is particularly useful for those who are looking to hedge their long positions in the S&P 500 or those who believe that the market is due for a correction.

Investors should be aware that $SH is not designed to be held for the long term. It is a tactical investment tool meant to be used during periods of market stress. As such, the fund is subject to risks such as high volatility and potential losses if the market goes up instead of down.

Overall, $SH can be a good hedge for your portfolio if you are looking for a way to protect your investments from downside risk during market downturns – and my A.I. toolset agrees!

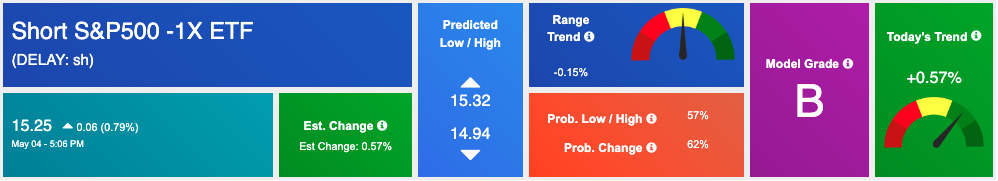

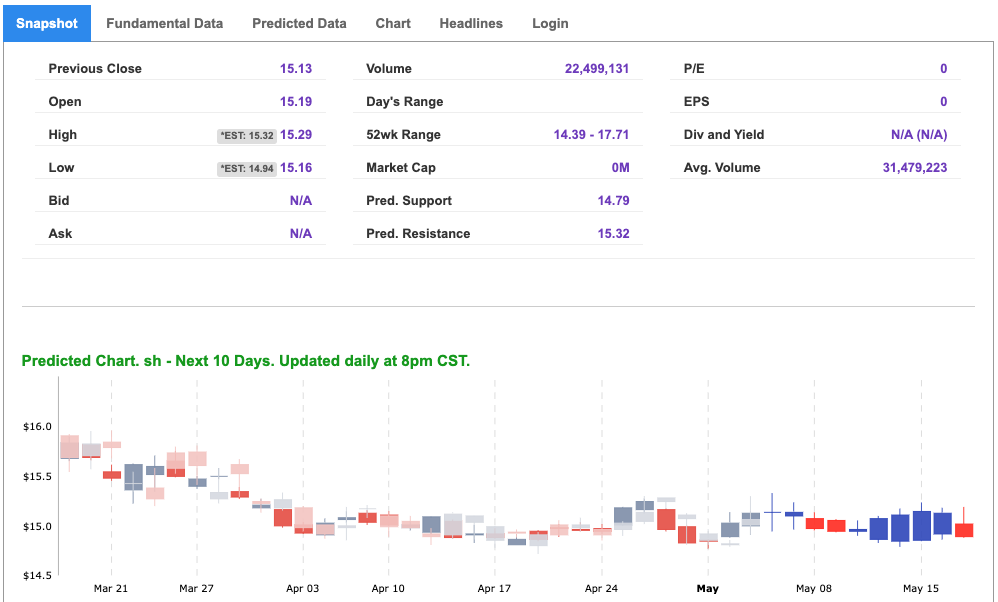

Priced near the $15 range, $SH is trading in the lower half of its 52-week range and has plenty of room for the upside – and plenty of market catalysts to push it higher!

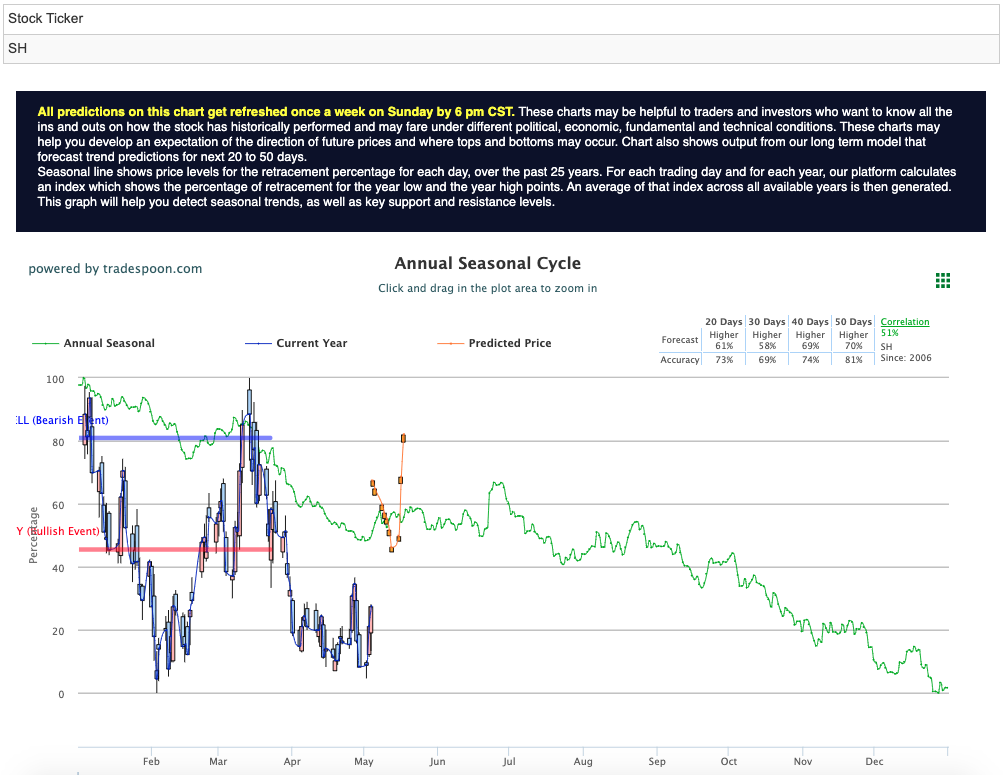

When reviewing $SH in my Seasonal Charts tool I am seeing even more encouraging signals. Flashing “higher” for all four-time ranges – 20, 30, 40, and 50 days- SH’s forecast for the upcoming months seems extremely promising. See $SH Seasonal Chart:

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

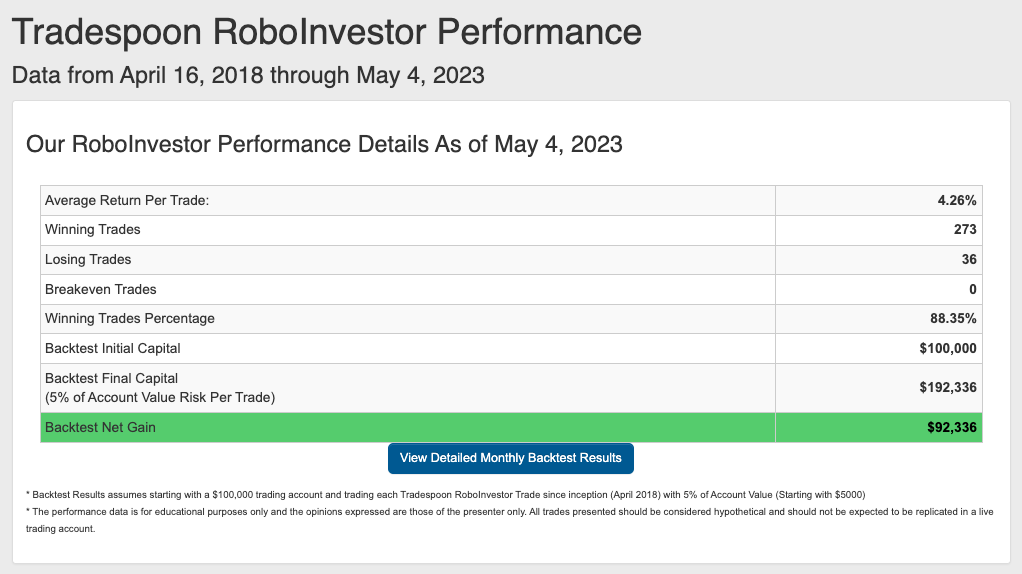

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

In 2023, investors are facing a dynamic market affected by a combination of factors such as inflation, Federal policies, and geopolitical tensions, including the ongoing conflict in Ukraine. To successfully navigate this complex landscape, it is crucial to partner with a trustworthy and knowledgeable investment platform. RoboInvestor provides the necessary expertise and tools to help investors manage their portfolios with confidence and capitalize on opportunities in the fast-paced market.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!