On Thursday, the stock market experienced a significant boost after the Labor Department announced that initial jobless claims for the week ending August 3rd had fallen to 233,000, below the anticipated 240,000. This positive surprise came amid widespread recession fears, providing a strong catalyst for market gains. The decrease in jobless claims reinforced investor confidence, driving stocks higher and alleviating some concerns about the economy’s health.

Earlier in the week, global markets were rattled by the Bank of Japan’s (BOJ) unexpected decision to raise interest rates, triggering a substantial unwinding of the carry trade. This decision caused the VIX, often referred to as the market’s “fear gauge,” to spike to 60 on Monday morning, reaching its highest level since March 2020. The VIX measures market expectations of near-term volatility conveyed by S&P 500 stock index option prices. Although it eventually settled back to 20 later in the week, this dramatic surge highlighted heightened market anxiety as the BOJ’s hawkish stance suggested the possibility of further rate hikes.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The technology sector, particularly the “Magnificent Seven” stocks—Nvidia, Apple, Alphabet, Tesla, Amazon, Microsoft, and Meta Platforms—experienced significant losses on Monday. These tech giants, which have been pivotal in driving recent market gains, collectively shed $653 billion in market capitalization in a single day. This marked the largest one-day decline since July 24, when the group lost $744 billion. The selloff was intensified by a 10% plunge in Tokyo’s Nikkei 225, the most substantial one-day drop since the Black Monday crash of 1987. This global market upheaval was fueled by growing concerns that the Federal Reserve might have delayed interest rate cuts for too long, raising fears of an economic downturn.

Amidst the turmoil, investors sought refuge in U.S. government debt, leading to significant fluctuations in bond yields. The 10-year Treasury yield recently settled at 3.782%, having fluctuated between 3.6% and 4.4% in recent weeks. This volatility reflects shifting expectations about the Federal Reserve’s future rate policy and underscores the stress in the market. The inversion of the 2-year yield below the 30-year yield for the first time in two years highlights heightened market anxiety and uncertainty, emphasizing the growing concerns about economic stability.

In the precious metals sector, SLV and GLD experienced a pullback from recent highs, though their long-term upward trends remain strong. Gold futures showed recovery later in the week, supported by improved market sentiment following the jobless claims report. Despite earlier declines related to the stock market selloff, sustained demand for gold suggests that investors are maintaining caution amid economic uncertainties. This ongoing interest in gold reflects its role as a safe haven in times of market volatility.

As the market contends with ongoing turbulence, the debate over interest rate cuts is a central focus, heavily influenced by new economic data. Recently, the 10-year Treasury yield dropped below the key 3.8% threshold and is now testing long-term support at around 4.0%. This shift, along with the VIX’s significant swings, reflects the persistent uncertainty and heightened anxiety prevailing among investors.

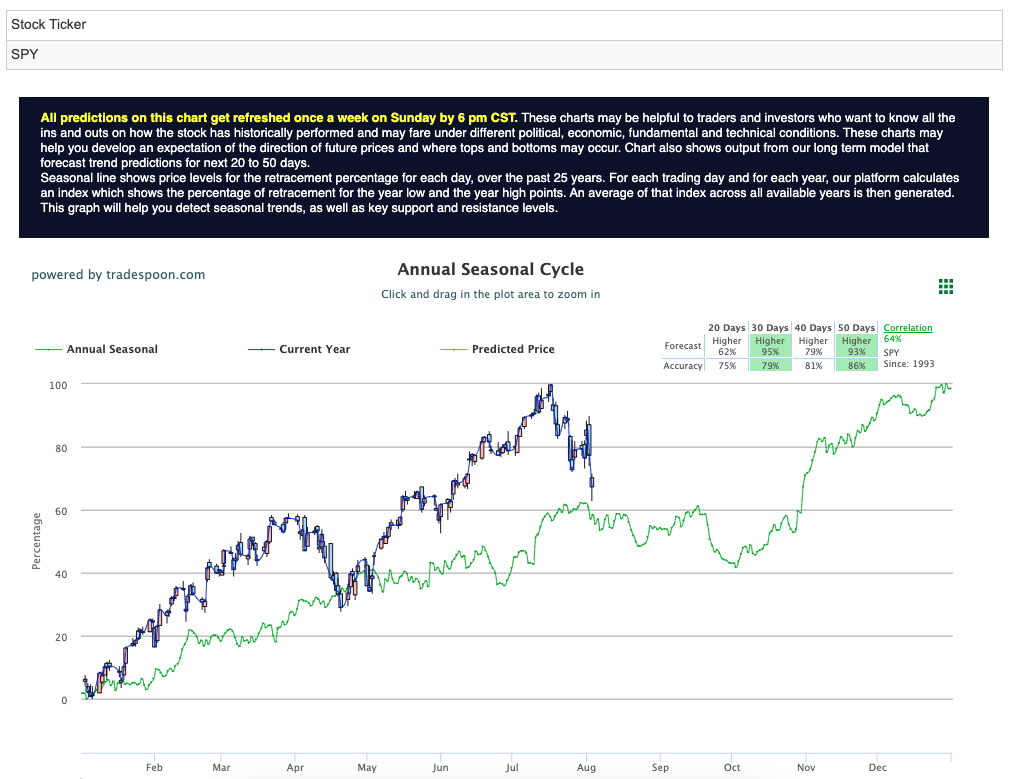

Despite inflation aligning with expectations and earnings season showing positive results, significant risks persist. The economy is cooling, unemployment is ticking up, and there are potential failures of small banks with exposure to commercial and residential real estate. As a result, I’ve shifted to a market-neutral stance, anticipating sideways trading for the SPY in the short to medium term, with resistance at $560-$575 and support at $480-$510. For reference, the SPY Seasonal Chart is shown below:

Focus now turns to next week’s Consumer Price Index (CPI) and Producer Price Index (PPI) data, along with the continuation of earnings season. These indicators will provide crucial insights into the state of the economy and help shape expectations for the Federal Reserve’s future policy moves. As investors navigate this complex landscape, they will closely monitor these developments to balance opportunities and risks.

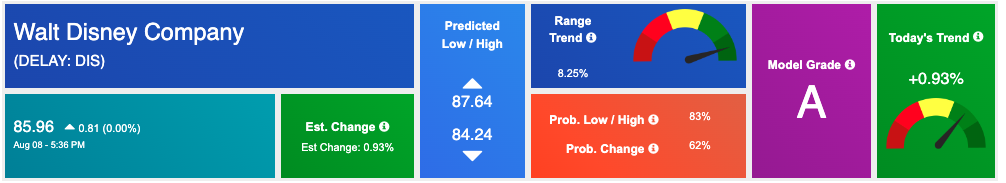

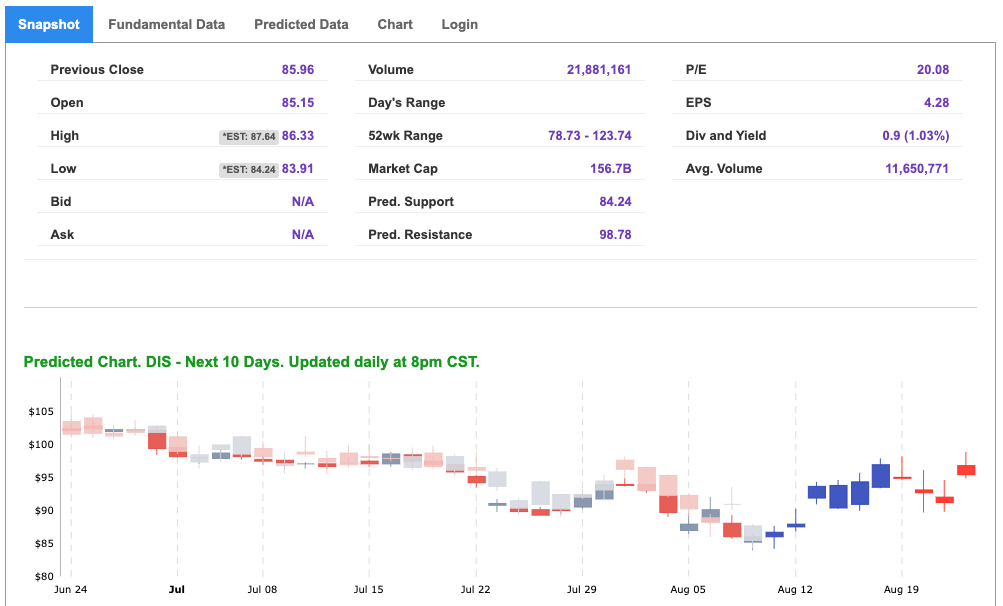

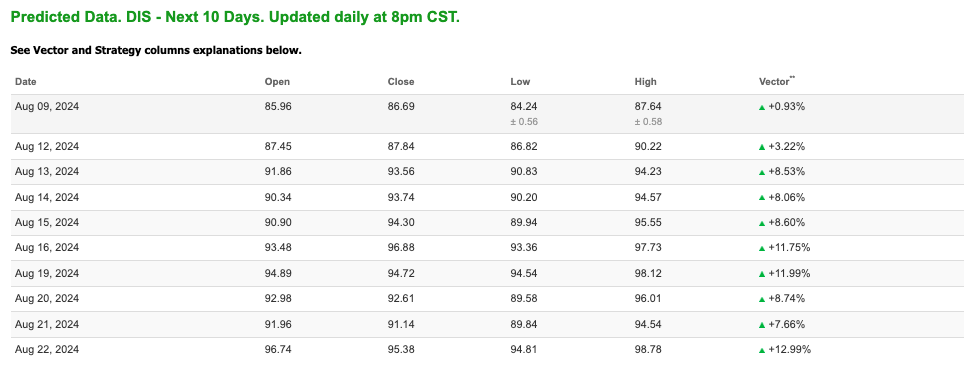

Amidst this market volatility and economic uncertainty, certain opportunities emerge as particularly compelling. Among them, Walt Disney Company (DIS) stands out as a notable buy for the upcoming week, offering potential value amidst the turbulence.

As we assess the market’s recent fluctuations and the prevailing macroeconomic environment, it’s crucial to identify assets with strong fundamentals and growth potential that can weather these uncertainties. With the “Magnificent Seven” technology stocks experiencing substantial selloffs and the broader market exhibiting heightened volatility, investors are increasingly seeking diversification and stability in their portfolios. In this context, Disney presents a unique opportunity.

Disney’s diversified business model, spanning media networks, theme parks, and streaming services, provides a level of resilience that can appeal to investors in today’s volatile market. While the tech sector faces significant headwinds, Disney’s ability to adapt to changing consumer preferences and its robust brand presence position it well for future growth. The company’s Disney+ streaming platform continues to gain traction, with subscriber numbers steadily increasing. As consumers increasingly pivot toward digital entertainment, Disney’s strategic focus on expanding its streaming offerings aligns with current market trends, potentially offsetting other sector weaknesses.

As global travel and tourism gradually recover from pandemic-related disruptions, Disney’s theme parks and resorts are poised to benefit. The easing of travel restrictions and growing consumer confidence in leisure activities could lead to a robust rebound in this segment, providing a further boost to the company’s revenue streams. In light of the recent market selloff, Disney’s stock is trading at an attractive valuation relative to its historical averages. This presents a potential entry point for investors looking to capitalize on its long-term growth trajectory while mitigating short-term risks. Additionally, Disney maintains a strong balance sheet, with sufficient liquidity to navigate economic uncertainties. This financial strength supports its ability to invest in growth initiatives, including content production and theme park expansions, further enhancing its competitive edge.

While the market continues to grapple with volatility and economic challenges, Disney stands out as a promising addition to an investor’s portfolio. Its diversified business model, strategic focus on streaming, and potential recovery in theme parks and travel make it a compelling buy for the upcoming week. As we seek stability and growth amid uncertainty, Disney offers a unique combination of resilience and opportunity in the current market landscape.

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

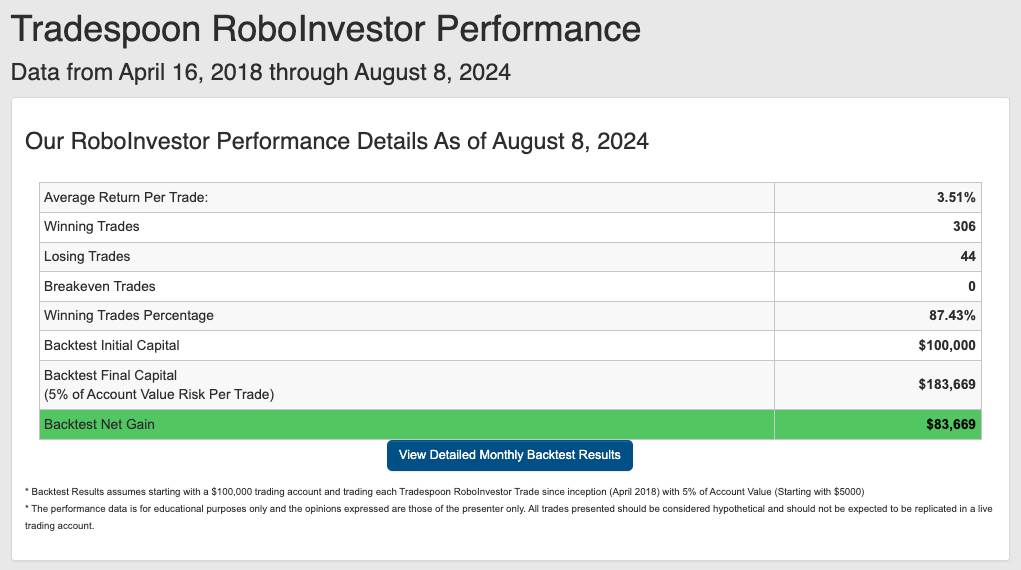

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.43% going back to April 2018.

As we advance through the summer of 2024, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and navigating the fluctuating market conditions effectively.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!