The stock market is seeing modest gains to start the week, but investors remain cautious as they await clarity on tariffs and brace for a series of critical economic reports. Despite the lingering uncertainty, equities are inching upward, with market participants weighing potential policy shifts, inflation data, and Federal Reserve commentary that could influence monetary policy in the coming months.

Trade concerns remain at the forefront, as President Donald Trump signals fresh tariff hikes, particularly targeting steel and aluminum imports. The proposed 25% tariff on these key materials has already sent shockwaves through global markets. While domestic steel producers are benefiting in the short term, European steelmakers are under pressure, with stocks in the sector declining. Meanwhile, gold prices surged to new highs on Monday, as investors sought safety amid escalating trade war fears. Oil prices also edged higher, reflecting broader market reactions to tariff-related uncertainty.

This week’s economic calendar is packed with key reports that could shape market sentiment. Investors will closely monitor Tuesday’s testimony from Federal Reserve Chair Jerome Powell before the Senate Banking Committee, as his remarks could provide crucial insights into the central bank’s policy outlook.

Additionally, January’s inflation report is set for release on Wednesday, offering fresh data on price trends. This will be followed by the Treasury’s 10-year refunding auction in the afternoon, another important event that could impact bond yields and broader financial conditions.

Recent consumer surveys show that inflation expectations remain steady, with the median projection at 3% over both one- and three-year horizons—unchanged from prior readings. However, concerns about job security persist. While expectations of rising unemployment have declined slightly to 34%, the perceived probability of losing one’s job in the next year has increased to 14.2%, signaling a more cautious outlook on employment.

The previous week saw heightened uncertainty as investors reacted to mixed economic data, earnings reports, and evolving inflation expectations. A sharp decline on Friday followed a disappointing University of Michigan consumer sentiment report, which pointed to renewed inflation concerns. The survey revealed a jump in one-year inflation expectations, rising to 4.3% from 3.3% in January—the highest level since November 2023. This unexpected increase rattled markets, reinforcing fears that inflation could remain persistent despite the Federal Reserve’s tightening efforts.

Treasury yields moved higher in response, with the 10-year yield ticking upward as bond traders reassessed the likelihood of future rate cuts. The University of Michigan’s consumer sentiment index also fell for the second consecutive month, dropping to 67.8 from 71.1 in January and missing economist forecasts of 72. This marks the lowest reading since July 2024, reflecting broad-based declines across all demographics.

Corporate earnings continue to shape market direction, with major technology and consumer-focused companies delivering mixed results. While some firms exceeded expectations, others issued cautious guidance, contributing to market volatility.

This week, investors will turn their attention to earnings reports from major corporations, including:

As the trading week unfolds, the market remains at a crossroads, balancing bullish momentum against persistent economic uncertainties. The Federal Reserve’s next policy move remains a focal point, with investors closely watching inflation data and retail sales figures for signals on interest rates.

Despite ongoing volatility, the broader uptrend remains intact, though risks persist, particularly regarding prolonged higher interest rates and rising unemployment concerns.

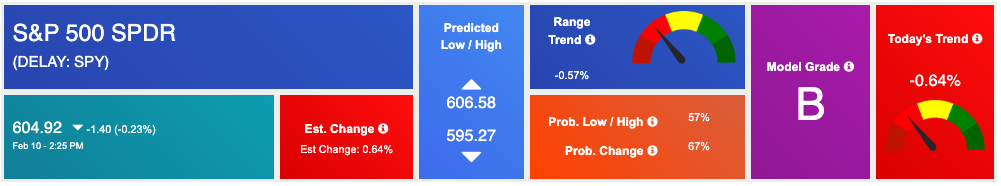

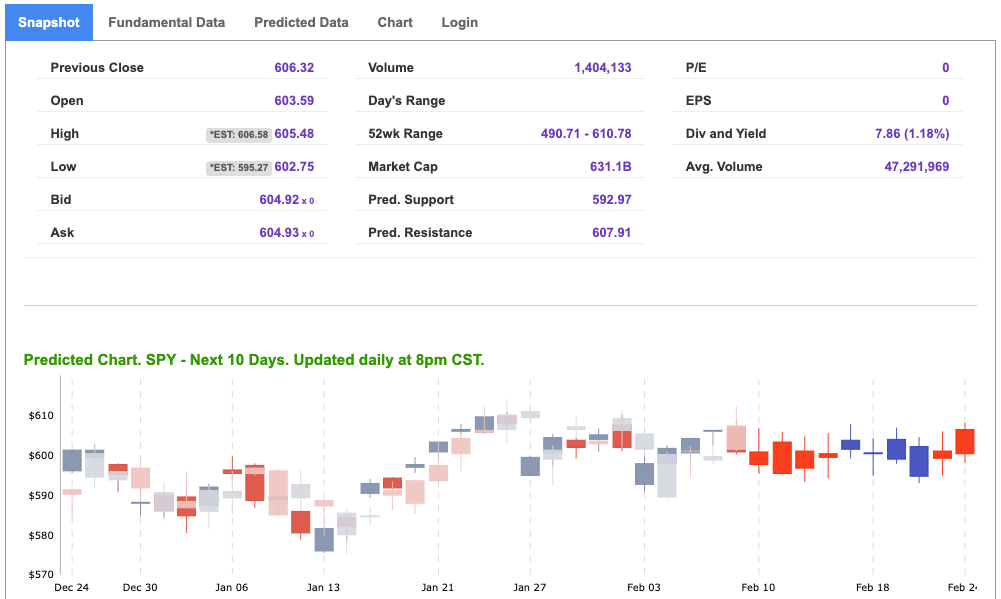

For the S&P 500 (SPY), the current rally could extend toward the $620–$640 range, while short-term support lies between $560–$580 over the next few months. Given current market conditions, a sideways trading pattern is likely in the near term, though the long-term trend remains favorable. For reference, the SPY Seasonal Chart is shown below:

With volatility remaining elevated and markets on edge, investors should prepare for continued price swings as sentiment continues to shift in response to new developments. Staying informed and agile in this environment will be crucial for navigating the evolving market landscape. While inflation is coming in within expectations and earnings season has been better than feared, the risk remains that interest rates could stay elevated for longer, and unemployment trends could shift unexpectedly.

The market remains in a neutral stance, trading sideways as investors digest economic data, policy updates, and corporate earnings. As we move forward, all eyes will be on key economic indicators and Federal Reserve commentary to determine the next major move in equities and financial markets.

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

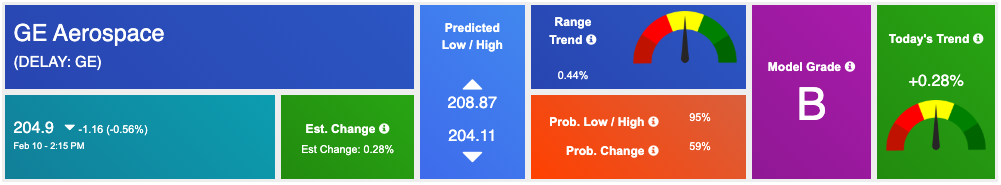

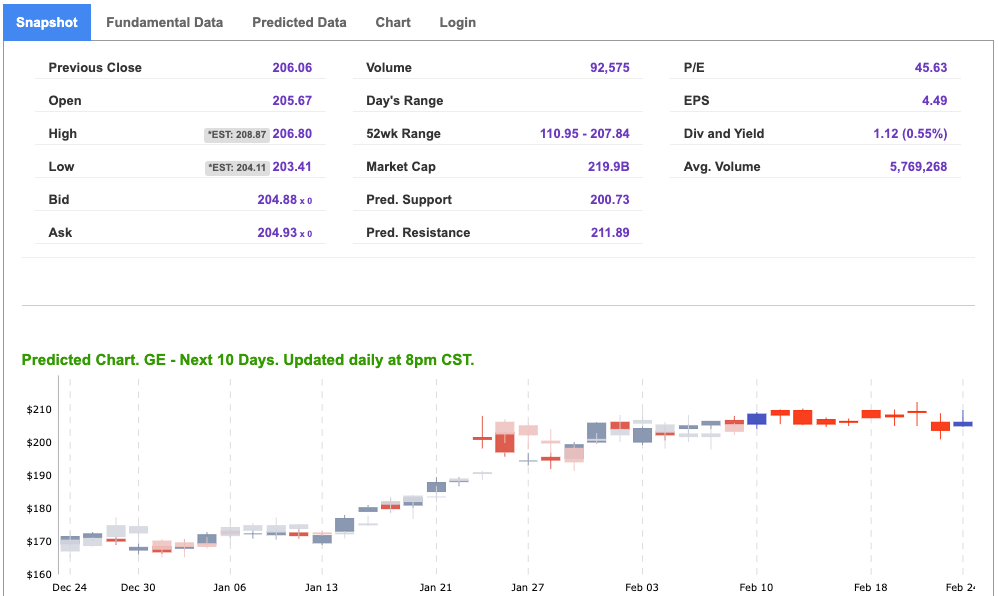

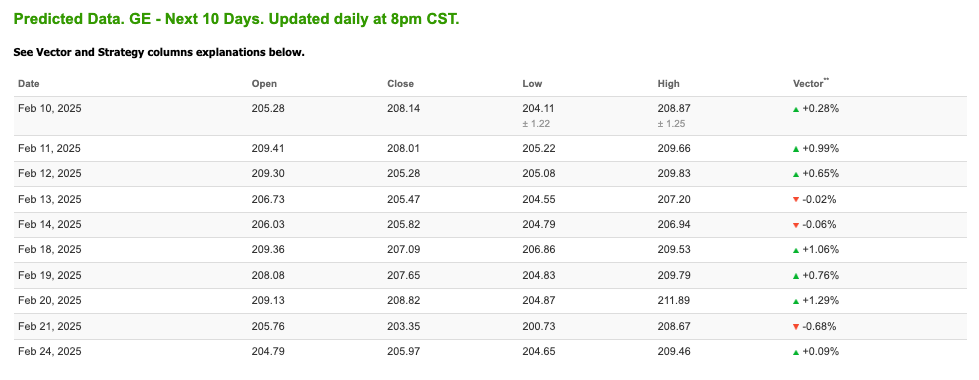

Our featured symbol for Tuesday is GE Aerospace -GE which is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $204.9 with a vector of +0.28% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, GE. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

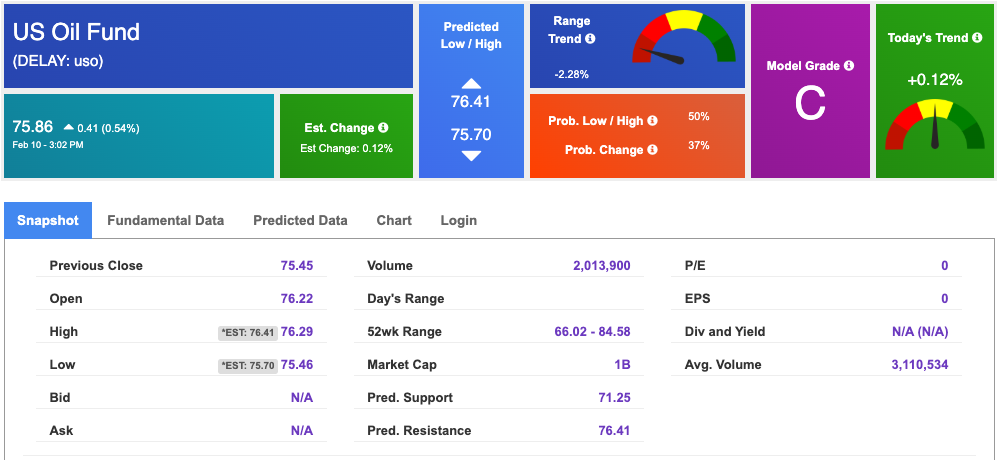

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $72.45 per barrel, up 2.04%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $75.86 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

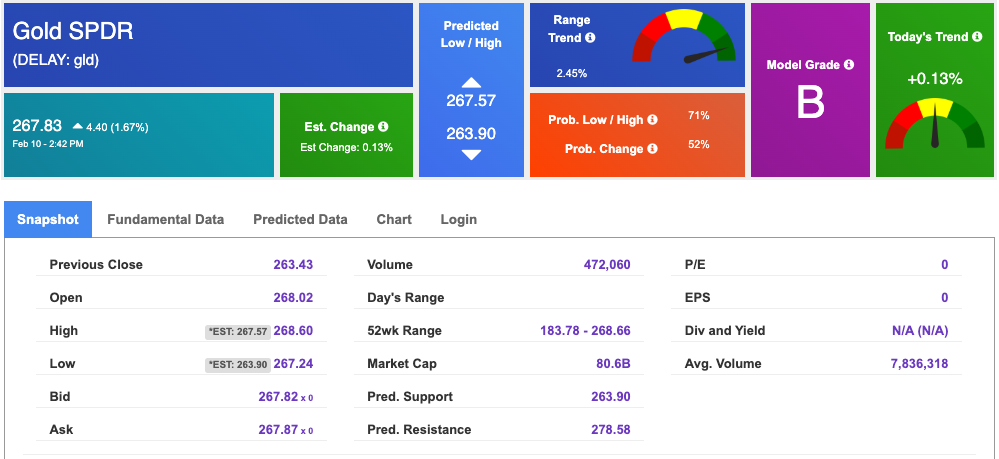

The price for the Gold Continuous Contract (GC00) is up 1.62% at $2,934.60 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $267.83 at the time of publication. Vector signals show +0.13% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

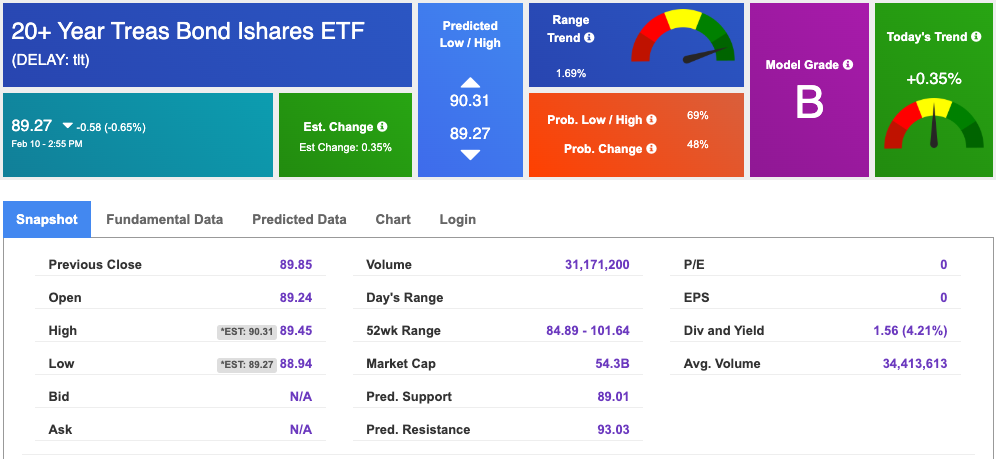

The yield on the 10-year Treasury note is up at 4.504% at the time of publication.

The yield on the 30-year Treasury note is up at 4.715% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

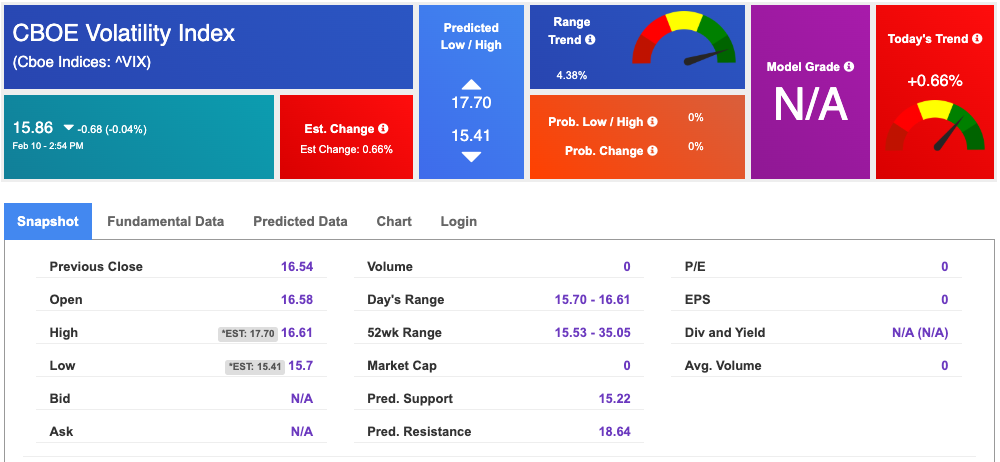

The CBOE Volatility Index (^VIX) is priced at $15.86 down 0.04% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!