RoboStreet – February 20, 2025

U.S. stock futures faced pressure early Thursday following the record highs of the previous session. The big question for traders now is how much negative news the market can handle while keeping the bull run—now in its third year—intact.

On Tuesday, the S&P 500 hit a new record high, continuing its positive momentum, with the Nasdaq and Dow also seeing modest gains. Treasury yields rose during this period as well. However, Thursday saw some profit-taking after the strong rally, causing all major indices to pull back. Sectors such as financials, defense stocks, and high-growth technology names were notably under pressure.

The Federal Reserve helped ease concerns on Wednesday by releasing minutes from its latest meeting, which highlighted that inflation is moderating. The Fed also left the door open for future rate cuts if economic conditions worsen. While no immediate cuts were suggested, the market interpreted the Fed’s stance as a sign that a prolonged pause in rate changes is manageable. At the same time, volatility is starting to creep up, with the VIX at 15, while major indexes consolidate near their all-time highs.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Trade Tensions Rise: 25% Tariffs Spark Fears of Trade War

President Trump’s announcement of new 25% tariffs on computer and car imports has sparked concerns about potential trade wars. Investors are worried that these measures could disrupt supply chains, add inflationary pressures, and hinder economic growth.

Fed Minutes Signal a Long Pause on Rate Cuts

The Federal Reserve’s minutes indicated that policymakers are cautious about cutting rates too soon, noting the need for “further progress on inflation.” Officials debated whether the current rates are near the so-called neutral level, where borrowing costs neither accelerate nor slow down growth. The Fed’s preferred PCE inflation index remains at 2.6% year-over-year, still above the 2% target. The 10-year Treasury yield has been volatile, fluctuating between 3.6% and 4.8%, but softened after the latest inflation data. Market participants are growing concerned that the Fed may hold rates higher for longer if price pressures persist.

U.S.-Russia Talks and Geopolitical Developments

Oil futures rose following a drone attack on a Russian pumping station, disrupting Kazakh crude flows to the Black Sea. Simultaneously, preliminary talks between the U.S. and Russia have begun regarding the Ukraine war, with both sides agreeing to appoint high-level teams to explore peace negotiations.

Housing Market Shows Mixed Signals

Recent U.S. housing data showed a 0.67% drop in building permits month-over-month, with total permits at 1.483 million in December 2024—a 3.07% decline from the previous year. Single-family permits remained steady at 996,000 units, while multi-family permits fell 1.4% to 427,000 units. Higher mortgage rates, increased construction costs due to tariffs, and severe weather conditions have led to weaker demand. Despite these challenges, housing supply remains tight in major cities.

Earnings Season in Focus: $ADI, $BIDU, and $OXY Report

As earnings season unfolds, several key companies, including Analog Devices (ADI), Baidu (BIDU), and Occidental Petroleum (OXY), are set to report this week. Strong earnings have supported markets, but weaker guidance, such as Walmart’s recent report, has raised concerns about slowing consumer demand.

With the market consolidating near record highs and inflation data aligning with expectations, I remain in the MARKET NEUTRAL camp in the short term. The biggest risks remain persistent inflation, prolonged high interest rates, and rising unemployment.

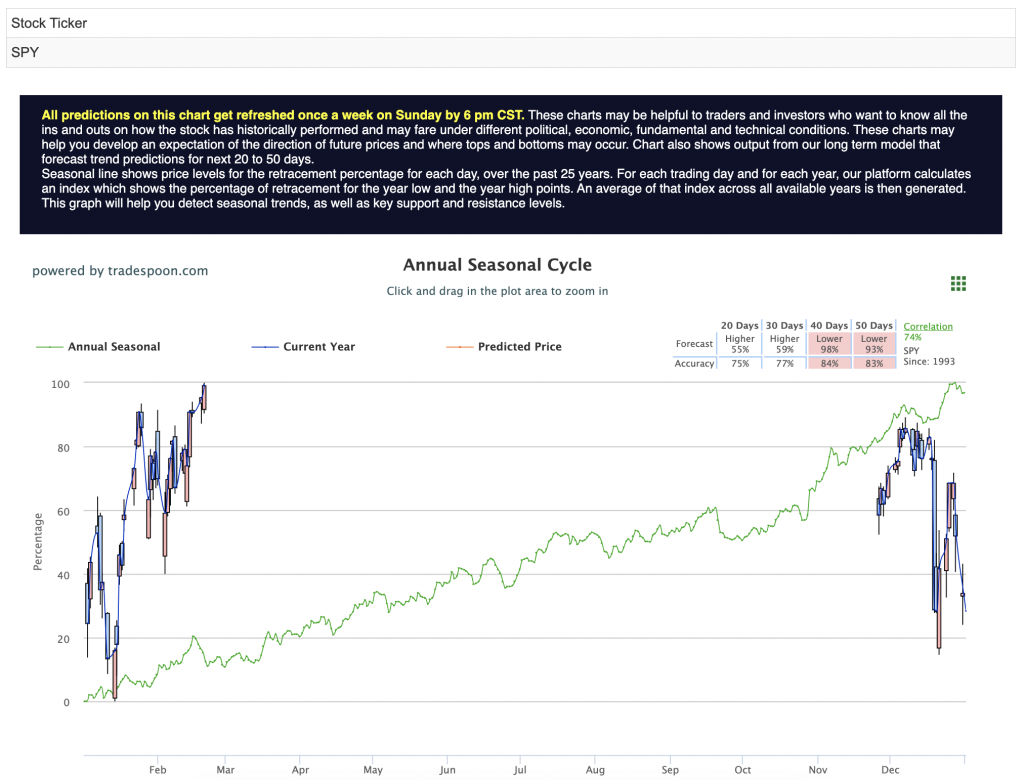

Volatility is rising, with the VIX increasing by 6.7% to 16.29 amid tariff concerns and Fed uncertainty, though it remains below the key 20 level that typically signals heightened risk. Financials and consumer discretionary stocks are showing signs of weakness, while energy stocks are benefiting from geopolitical concerns. In the coming months, SPY could rally to $620–640, with short-term support in the $560–580 range. For reference, the SPY Seasonal Chart is shown below:

While earnings season has been better than expected, market momentum depends on whether investors can look past policy uncertainties and geopolitical risks. The path forward remains choppy, and I expect sideways movement in the short term with the long-term uptrend intact.

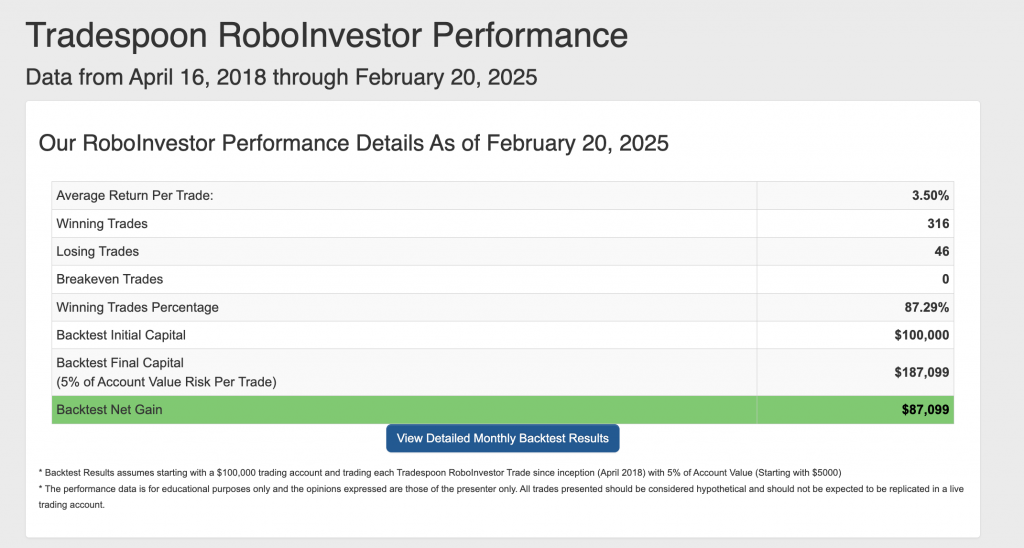

Unlock smarter investment decisions with our RoboInvestor stock and ETF advisory service, powered by advanced AI. This cutting-edge technology identifies trades with high-profit potential, cutting through market noise and eliminating emotional bias. With clear, data-driven insights and strategies, RoboInvestor helps you navigate today’s ever-changing market with confidence and precision.

Every other weekend, subscribers receive an exclusive newsletter packed with my market analysis, technical outlook, updates on existing positions, and one or two fresh trade recommendations to act on when the market opens on Monday.

RoboInvestor is a flexible, unrestricted service. I may recommend blue-chip stocks or ETFs representing major indexes, market sectors, commodities, currencies, interest rates, and even shorting opportunities using inverse ETFs. Our model portfolio typically holds between 12 to 25 positions, adjusting based on market conditions. Recently, we’ve adopted a more cautious approach, focusing on a smaller, more selective set of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.29% going back to April 2018.

As we enter 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!