RoboStreet – December 26, 2024

The U.S. stock market demonstrated remarkable resilience this week, with major indexes rallying to all-time highs. The S&P 500 (SPY) and Nasdaq 100 (QQQ) led the charge, propelled by gains in technology and semiconductor sectors. This rally unfolded despite a challenging macroeconomic backdrop, underscoring the adaptability of market participants.

The Federal Reserve captured attention early in the week with its unexpectedly hawkish outlook. Markets were taken by surprise as the Fed signaled only two rate cuts in 2025, a stark contrast to the previously anticipated four. Initially, this shift in monetary policy weighed on sentiment, driving bond yields higher and dragging equities lower. However, the underlying strength of the economy ultimately helped stocks recover and resume their upward trajectory.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

In addition to its projections, the Fed announced a 0.25% rate cut last week, reducing the federal funds rate to a range of 4.25% to 4.5%. While the immediate impact of this decision was mixed, the accompanying economic outlook provided some reassurance. Updated forecasts pointed to stronger-than-expected U.S. GDP growth of 2.1% in 2025 and a lower unemployment rate, fostering cautious optimism among investors.

Inflation remained a focal point throughout the week. Although inflation levels have eased, they continue to exceed the Fed’s 2% target. Policymakers also highlighted uncertainties surrounding tariff policies as an additional layer of complexity influencing inflation projections. Despite these lingering challenges, market participants appeared to draw confidence from the broader economic resilience and strong fundamentals.

Treasury yields added another dimension of volatility, fluctuating within a range of 3.6% to 4.7%. Yields moved higher following the Fed’s announcement, reflecting ongoing recalibrations in fixed-income markets. This volatility served as a reminder of the market’s sensitivity to monetary policy shifts.

Adding to the week’s developments, consumer confidence unexpectedly declined in December. The Conference Board’s index dropped to 104.7 from November’s 112.8, falling well below expectations of 113.8. This decline signaled growing concerns about the economic outlook for 2025. Initially, the report exerted pressure on equities, but the market quickly rebounded as investors took advantage of the dip. The start of the historically bullish “Santa Claus rally” period further bolstered sentiment, encouraging renewed buying activity.

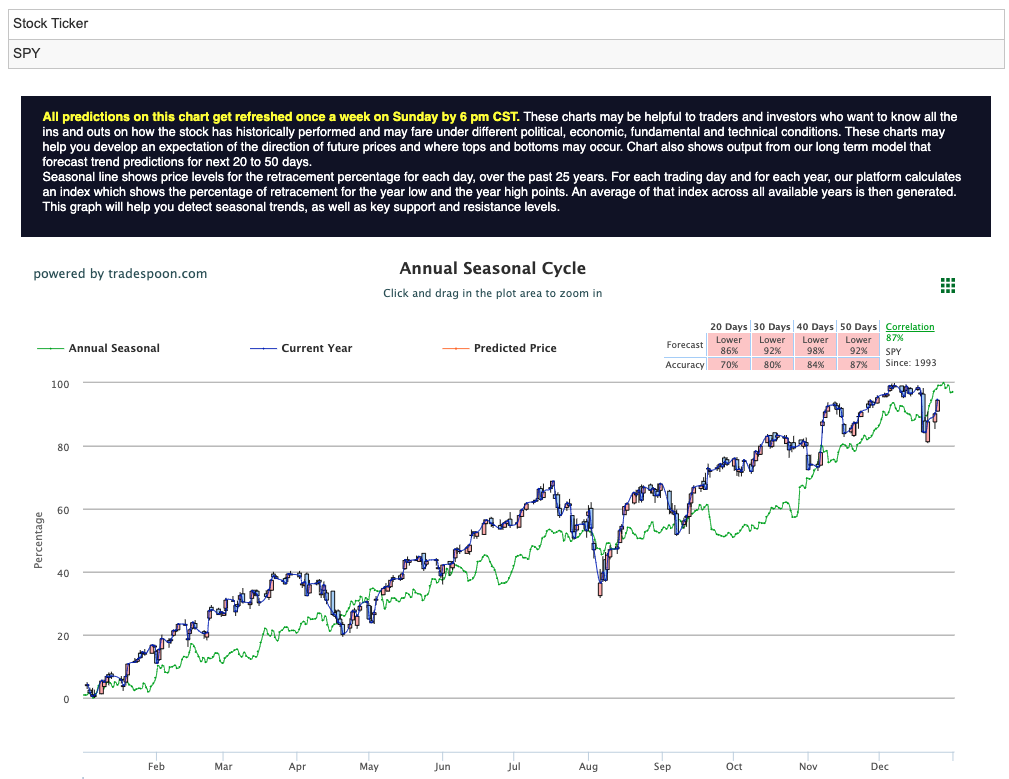

Amid these developments, the SPY continued its strong rally, with potential upside targets of $620 to $640 over the next few months. Short-term support levels are positioned in the $560 to $580 range, reflecting the market’s underlying strength. The Nasdaq, buoyed by gains in Big Tech, maintained its leadership role, while the Dow lagged due to its lower exposure to technology stocks. Nvidia’s 3% climb significantly contributed to the Nasdaq’s performance, while price-weighted components like UnitedHealth Group provided more modest support for the Dow. For reference, the SPY Seasonal Chart is shown below:

Despite recent positive momentum, risks remain on the horizon. The economy is showing signs of cooling, with unemployment ticking higher and vulnerabilities emerging among small banks exposed to commercial and residential real estate. However, the long-term bullish trend remains intact, buoyed by easing inflation, better-than-expected corporate earnings, and resilient consumer spending. This dynamic environment underscores the importance of a selective, stock-picking approach.

As the year draws to a close, risk management should take center stage in every investor’s strategy. While the likelihood of a recession appears to be decreasing, surprises cannot be ruled out. Staying invested, leveraging expert insights, and utilizing advanced tools for risk assessment can provide a critical edge. Tradespoon’s suite of models and analysis offers investors the ability to validate trade ideas against both macroeconomic trends and micro-level conditions, delivering a sense of security in an ever-evolving market landscape. By remaining disciplined and informed, investors can capitalize on opportunities while safeguarding their portfolios against potential downside risks.

While risks persist, I remain firmly in the bullish camp, as new market highs appear to be within reach. Inflation has stayed within expectations, and corporate earnings continue to exceed forecasts, supporting the long-term upward trend. Nonetheless, caution is warranted as we approach the new year, given the ongoing economic cooling and potential stress in the banking sector.

As markets digest this week’s developments, investors should focus on maintaining a balanced strategy, seizing opportunities during pullbacks, and preparing for what could be a pivotal year ahead.

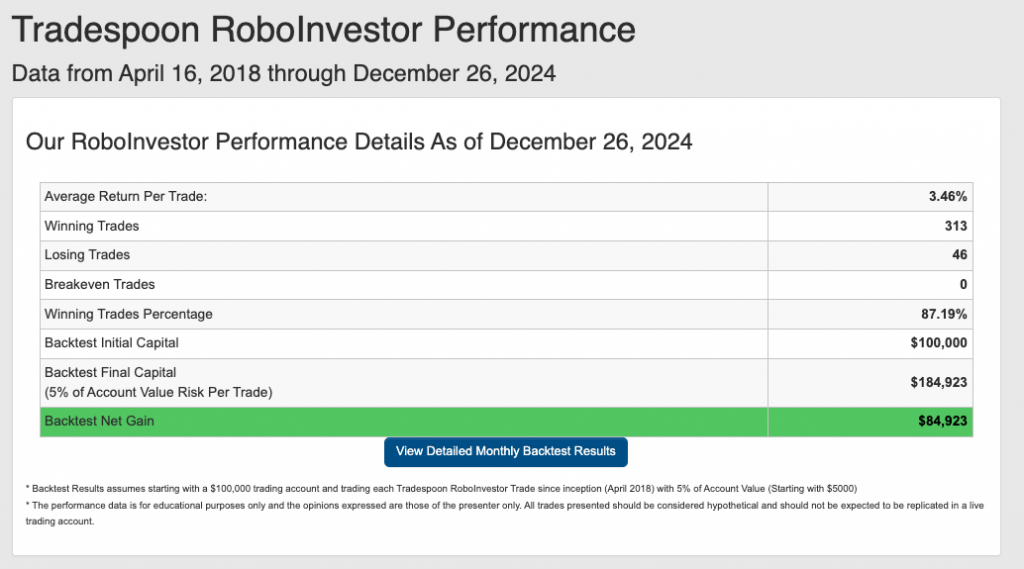

Unlock smarter investment decisions with our RoboInvestor stock and ETF advisory service, powered by advanced AI. This cutting-edge technology identifies trades with high-profit potential, cutting through market noise and eliminating emotional bias. With clear, data-driven insights and strategies, RoboInvestor helps you navigate today’s ever-changing market with confidence and precision.

Every other weekend, subscribers receive an exclusive newsletter packed with my market analysis, technical outlook, updates on existing positions, and one or two fresh trade recommendations to act on when the market opens on Monday.

RoboInvestor is a flexible, unrestricted service. I may recommend blue-chip stocks or ETFs representing major indexes, market sectors, commodities, currencies, interest rates, and even shorting opportunities using inverse ETFs. Our model portfolio typically holds between 12 to 25 positions, adjusting based on market conditions. Recently, we’ve adopted a more cautious approach, focusing on a smaller, more selective set of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.19% going back to April 2018.

As we near 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!