RoboStreet – January 2, 2025

U.S. stocks stumbled into the new year, with all three major equity benchmarks finishing lower after a volatile trading session on Thursday. The S&P 500 and Nasdaq Composite each recorded their fifth consecutive day of declines, signaling a rocky start to 2025. Market analysts pointed to profit-taking and a surge in the U.S. dollar as key culprits behind the downturn. Despite early gains on the first trading day of the year, momentum proved fragile, underscoring investor unease about the road ahead.

The Federal Reserve’s latest policy update sent ripples through financial markets. In a bid to support economic growth, the Fed cut interest rates by 0.25%, bringing the federal funds rate to a range of 4.25%-4.5%. Despite the rate cut, the central bank’s updated dot plot showed only two projected rate cuts for 2025, a sharp departure from the four cuts anticipated in September’s projections. This cautious approach surprised markets, triggering initial selloffs in equities.

While the move signaled some flexibility, the Fed reiterated its vigilance against inflation, which remains above its 2% target. Projections suggest core personal consumption expenditures (PCE) inflation will only reach the target by 2027. This balancing act between fostering growth and ensuring price stability left investors grappling with mixed signals about the economic outlook.

The Federal Reserve adjusted its economic forecasts for 2025, projecting U.S. GDP growth at 2.1%, a slight improvement from earlier estimates. Unemployment is expected to average 4.3%, marginally better than previous predictions. However, concerns linger about a cooling economy. Rising unemployment and potential vulnerabilities in small banks tied to commercial and residential real estate exposure add layers of uncertainty to the broader economic picture.

Adding to this, the Labor Department reported a significant drop in initial jobless claims, which fell unexpectedly to 211,000 in the last week of December—the lowest level since April. This decline, which offset previous summer volatility, underscores the resilience of the labor market. Consistently low layoffs suggest that economic expansion remains on track, providing a degree of confidence ahead of the December jobs report, set for release on January 10. Economists predict the unemployment rate to hold steady at 4.2%, further reinforcing labor market stability. However, the data also supports the Federal Reserve’s case for fewer interest rate cuts in the near term, reflecting cautious optimism about growth.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The stock market opened the year on a hopeful note, with futures pointing to gains across major indexes. By mid-morning Thursday, the Nasdaq Composite climbed 1%, the S&P 500 rose 0.8%, and the Dow advanced 300 points, reflecting broad-based optimism. Roughly 441 components of the S&P 500 registered gains, highlighting exceptional market breadth.

However, this optimism quickly waned. Weakness in Tesla Inc., which saw a 4.7% decline on disappointing delivery figures, led broader struggles in tech stocks. Tesla’s drop weighed on the Magnificent Seven group of megacap technology companies, though others like Meta Platforms, Amazon, and Nvidia managed gains exceeding 1.5%. Apple, down 1.9%, and the Roundhill Magnificent Seven ETF, falling 1.4%, exemplified the uneven performance.

The S&P 500, Dow, and Nasdaq all closed the day in negative territory, reflecting the fragile nature of early-year momentum. The CBOE Volatility Index (VIX) spiked to 18.87, underscoring heightened market uncertainty. While most sectors posted gains, real estate lagged, dipping 0.2%. Energy and communication services led the charge, each advancing over 1.4%.

Bond markets also experienced turbulence. Yields on U.S. government debt briefly spiked before stabilizing, with the benchmark 10-year Treasury yield settling at 4.574%. This was near its seven-month high, reflecting investor caution amid a strengthening U.S. dollar. The dollar’s surge added pressure to equities, particularly as global investors recalibrated their expectations.

Energy markets offered a rare bright spot amid broader uncertainty. Crude oil futures climbed to their highest levels since mid-October, buoyed by optimism surrounding Chinese economic recovery and a sixth consecutive weekly decline in U.S. crude inventories. Additionally, forecasts of colder weather across much of the U.S. provided a tailwind for natural gas prices.

Gold saw its largest gain in nearly two weeks, as investors sought safe-haven assets amidst persistent market volatility. This renewed interest in commodities highlighted their enduring appeal in uncertain times.

After a challenging end to 2024, many investors hoped for a more stable start to the new year. Yet, the week’s trading revealed lingering apprehensions about elevated interest rates, stubborn inflation, and mounting U.S. debt. Treasury Secretary Janet Yellen’s warning about a looming borrowing limit added further pressure to already fragile sentiment.

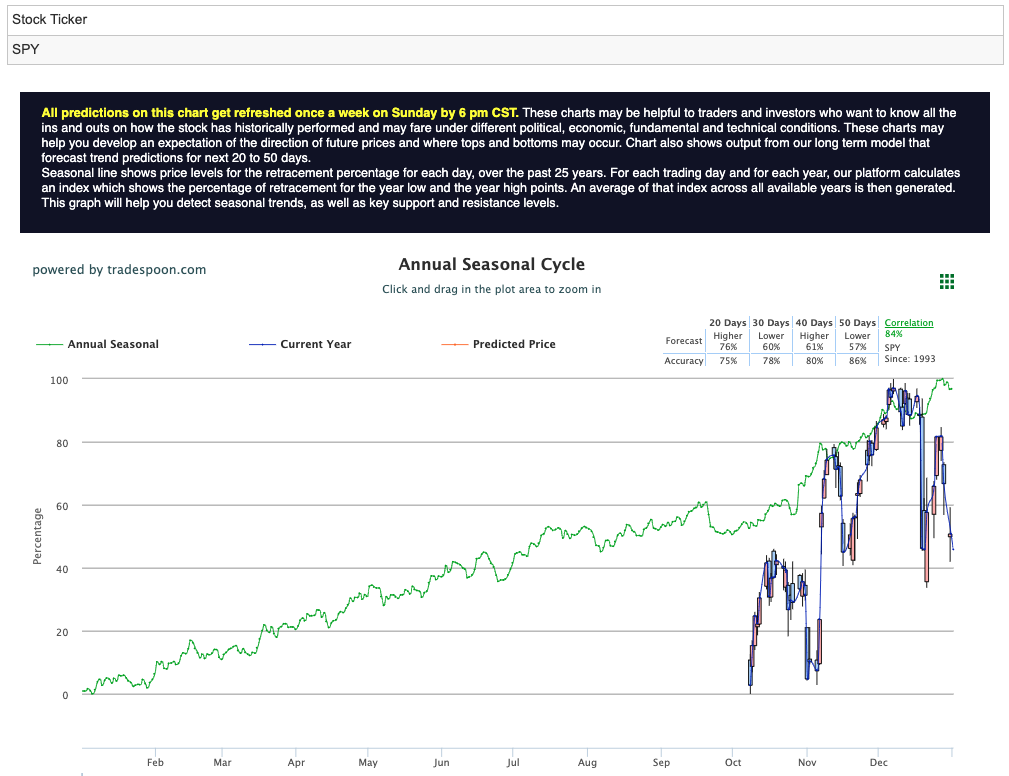

While inflation appears to be moderating and earnings reports have exceeded expectations, the outlook remains clouded. The SPY ETF, often seen as a proxy for the S&P 500, shows potential to rally toward $620-$640 in the coming months, with support levels identified at $560-$580. However, systemic risks tied to a cooling economy and vulnerabilities in the financial sector remain significant headwinds. For reference, the SPY Seasonal Chart is shown below:

The volatile start to 2025 underscores a market still searching for direction. Investors will need to proceed cautiously, balancing short-term uncertainty with long-term opportunities for growth. Whether this fragile optimism can hold will depend largely on macroeconomic developments and the market’s ability to navigate an increasingly complex landscape.

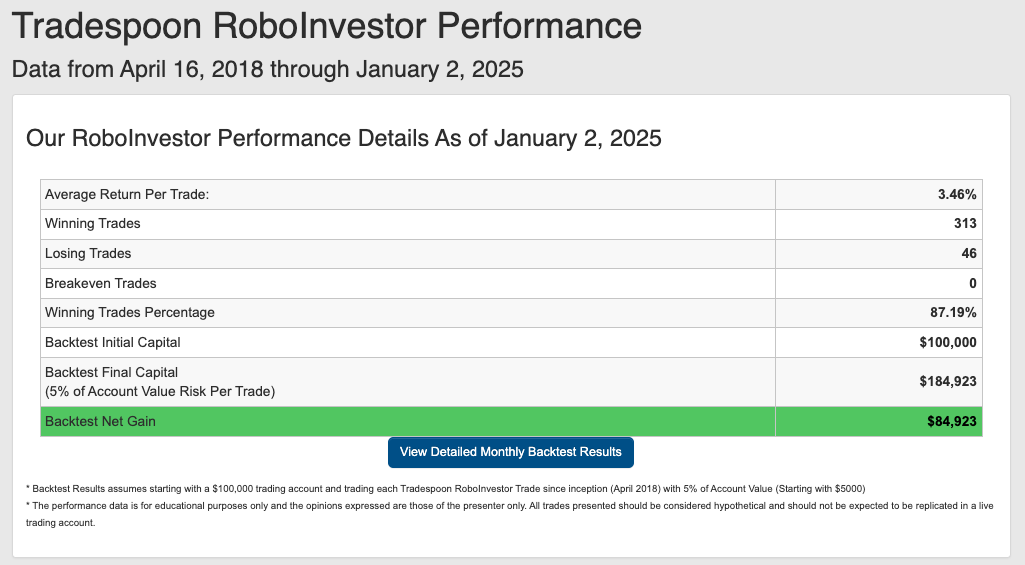

Unlock smarter investment decisions with our RoboInvestor stock and ETF advisory service, powered by advanced AI. This cutting-edge technology identifies trades with high-profit potential, cutting through market noise and eliminating emotional bias. With clear, data-driven insights and strategies, RoboInvestor helps you navigate today’s ever-changing market with confidence and precision.

Every other weekend, subscribers receive an exclusive newsletter packed with my market analysis, technical outlook, updates on existing positions, and one or two fresh trade recommendations to act on when the market opens on Monday.

RoboInvestor is a flexible, unrestricted service. I may recommend blue-chip stocks or ETFs representing major indexes, market sectors, commodities, currencies, interest rates, and even shorting opportunities using inverse ETFs. Our model portfolio typically holds between 12 to 25 positions, adjusting based on market conditions. Recently, we’ve adopted a more cautious approach, focusing on a smaller, more selective set of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.19% going back to April 2018.

As we near 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!