Markets ended Monday near session lows, as major indexes slightly retraced their impressive gains for 2024. Investors appear cautious ahead of Wednesday’s critical November Consumer Price Index (CPI) report and next week’s Federal Reserve policy decision. Treasury yields ticked higher, reflecting anticipation of the CPI data, which could heavily influence the Fed’s path forward. According to CME data, markets are assigning a 90% probability of another interest rate cut, bolstered by Friday’s relatively soft labor market report.

The CPI report is expected to reveal that inflation rose by 2.7% year-over-year in November, compared to October’s 2.6% increase. Meanwhile, November’s Producer Price Index (PPI), set to be released on Thursday, will provide additional insight into upstream pricing pressures. Together, these data points could reinforce the Federal Reserve’s narrative that inflation remains under control, potentially paving the way for further rate adjustments.

The Dow Jones Industrial Average fell for a second consecutive session, weighed down by UnitedHealth Group shares following the tragic death of executive Brian Thompson in a shooting incident. The S&P 500 and Nasdaq also declined, albeit modestly, as investors shifted their attention to macroeconomic data and geopolitical uncertainties.

Retail earnings are back in focus this week. Macy’s, which postponed its results last month due to an investigation into an employee concealing $154 million in expenses, will finally report earnings. Warehouse retailer Costco is also set to release its quarterly results, offering a closer look at consumer spending trends as the holiday season approaches.

Investors are also monitoring developments outside U.S. borders. Over the weekend, Syrian President Bashar al-Assad reportedly fled the country and resigned, according to Russia’s Foreign Ministry. This dramatic shift has introduced fresh geopolitical uncertainty in the Middle East, driving oil prices higher early Monday. Markets are bracing for further volatility as the region navigates this upheaval.

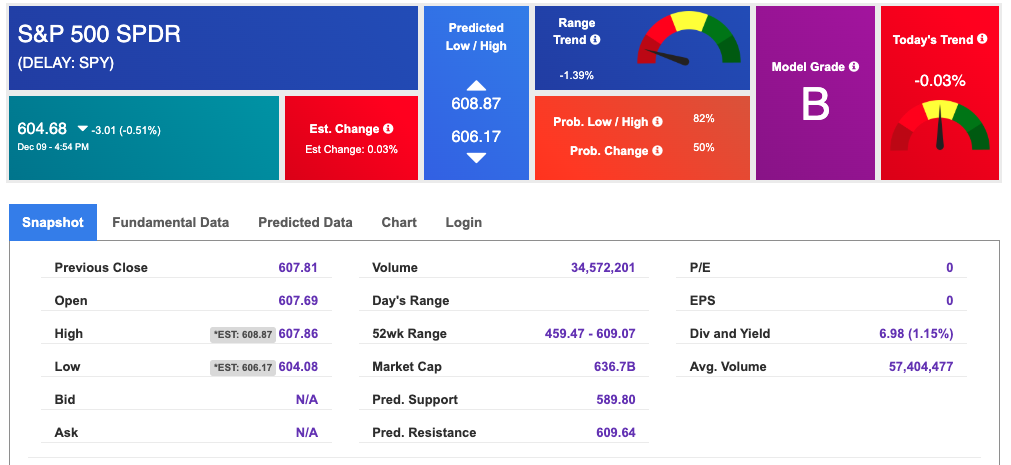

Despite Monday’s decline, the stock market remains in a long-term uptrend. Major indices, including the S&P 500, have hit record highs this year, supported by strong corporate earnings, resilient economic data, and dovish signals from the Federal Reserve. Looking ahead, the S&P 500 ETF (SPY) could test levels between $620 and $640, with near-term support in the $560-$580 range.

However, this optimism is tempered by signs of a cooling economy. Last week’s labor market data revealed continued job growth but a slight uptick in the unemployment rate to 4.2%. While hiring has slowed, the labor market remains tight, suggesting that businesses are still facing challenges filling positions. This dynamic has given the Federal Reserve room to shift toward a more accommodative policy stance, boosting investor confidence.

While the market’s momentum remains strong, risks are becoming increasingly apparent. Geopolitical tensions, evolving inflation trends, and the potential for a recession in 2025 loom large. Rising unemployment, along with challenges facing smaller banks due to exposure to commercial and residential real estate, could introduce volatility into the financial system.

Moreover, as the economy continues to cool, a rise in corporate earnings misses or unexpected inflation spikes could shake investor confidence. Maintaining a balanced portfolio and staying attuned to key economic developments will be critical as we close out the year.

As we enter the final stretch of 2024, the spotlight will remain on three key factors: inflation data, Federal Reserve policy decisions, and geopolitical developments. A favorable alignment of these variables could extend the market’s rally into 2025. However, any significant disruptions could lead to heightened volatility.

For now, the stock market’s resilience and the Fed’s softer stance on rate hikes continue to provide a solid foundation for optimism. That said, vigilance remains the watchword as we prepare for the unknowns of the year ahead.

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

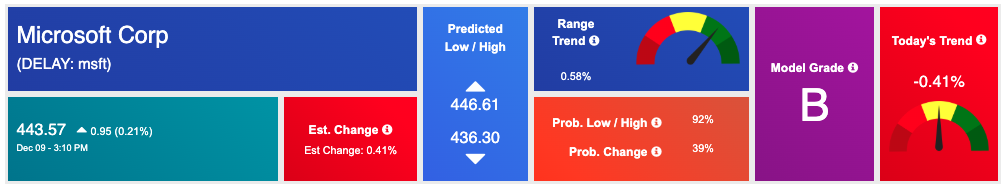

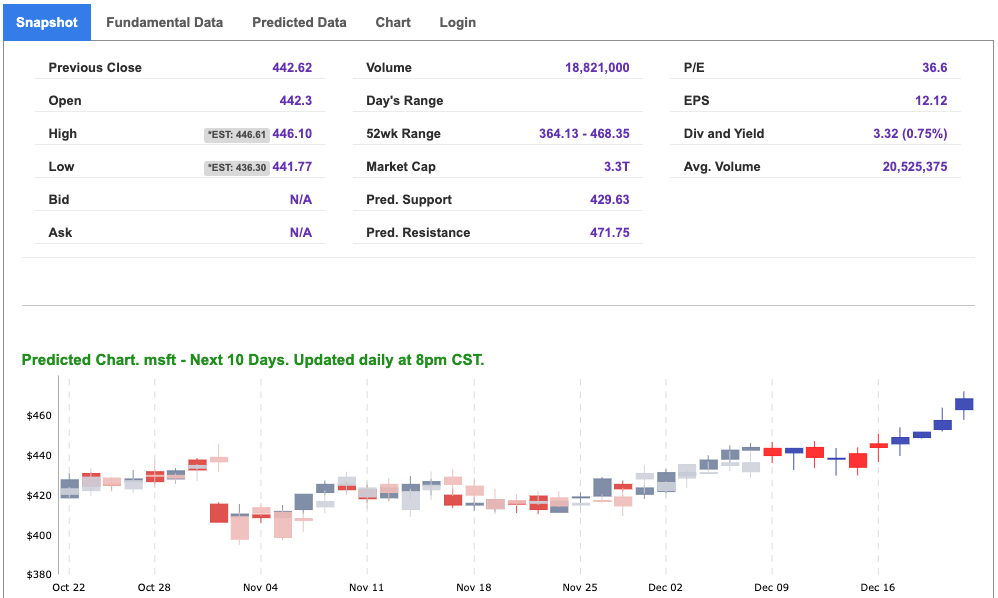

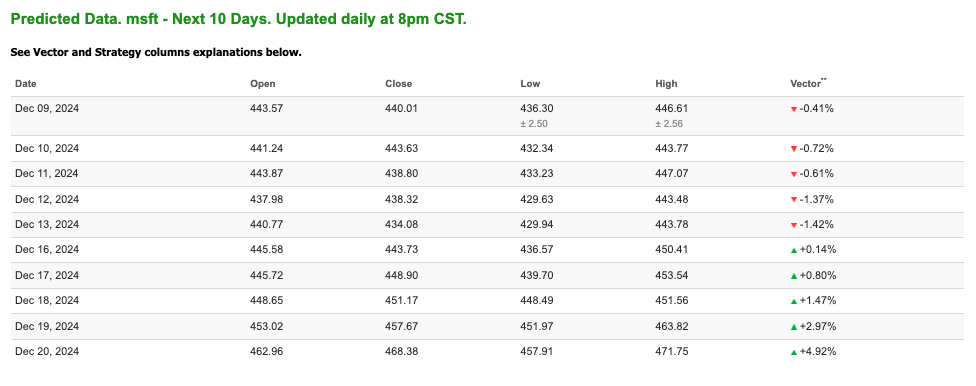

Our featured symbol for Tuesday is Microsoft Corp – MSFT, which is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $443.57 with a vector of -0.41% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, MSFT. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

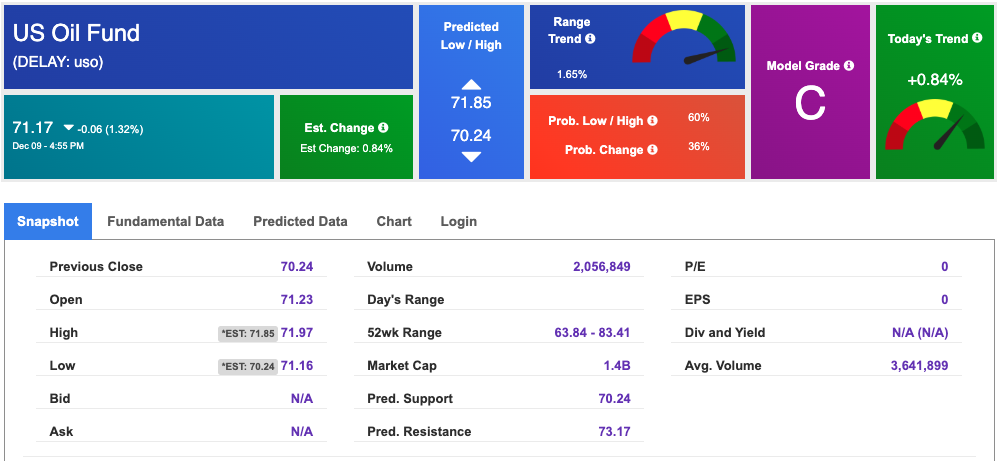

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $68.15 per barrel, up 1.41%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $71.17 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

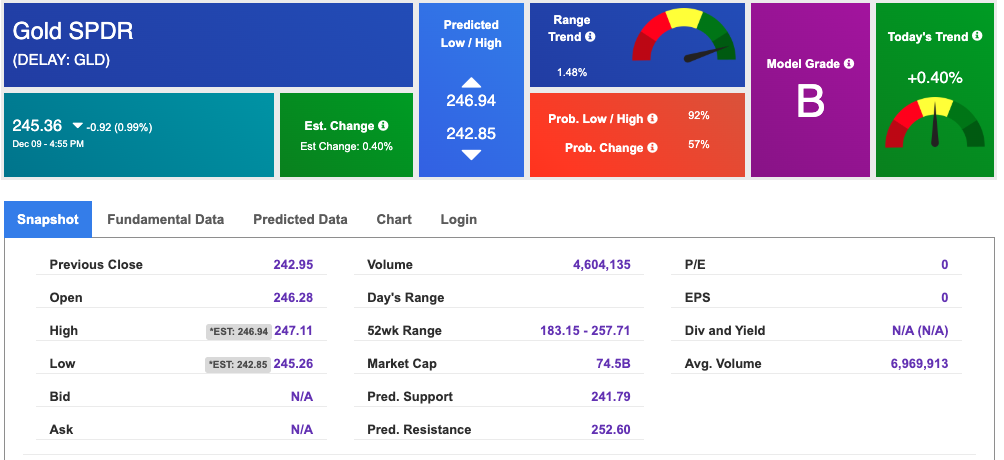

The price for the Gold Continuous Contract (GC00) is up 0.88% at $2683.00 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $245.36 at the time of publication. Vector signals show +0.40% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

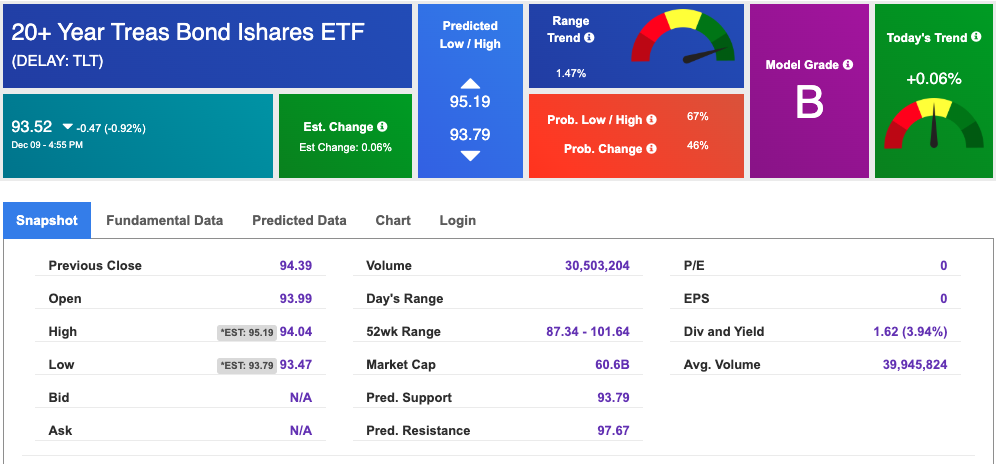

The yield on the 10-year Treasury note is up at 4.203% at the time of publication.

The yield on the 30-year Treasury note is up at 4.389% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

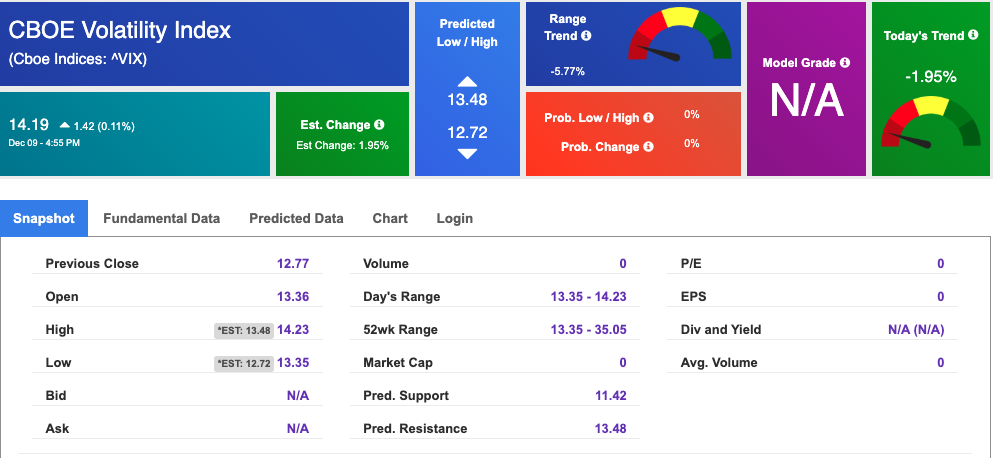

The CBOE Volatility Index (^VIX) is priced at $14.19 up 0.11% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!