Good news, everyone! On Wednesday, the Federal Reserve made a big move by announcing a 25 basis point increase in interest rates. And what do you know, the stock market loved it! U.S. indices rose to their highest levels in months, showing positive reactions from investors who are hopeful for further rate cuts to come.

As expected, the Fed’s decision was made with a focus on regulating inflation, which currently sits at a high of 6% – well above their target of 2%. The central bank made sure to emphasize that changes to rates can take time to impact the economy, so we may see a decrease in inflation in the future.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The Federal Reserve’s latest announcement has left some investors wondering if multiple interest rate hikes are necessary for the near future. The central bank stated that they will closely monitor the latest economic data to determine the extent of their intervention. As a result, the two-year Treasury yield, which gives an indication of potential fluctuations in the Fed funds rate, has declined to just under 4.10%.

On another note, the ISM manufacturing index for January showed a surprising drop to 47.4, contrasting economists’ predictions of a slight increase to 48.1. This drop in demand in the manufacturing sector further strengthens the case for a pause in interest rate hikes. As the Federal Reserve carefully considers the current economic conditions, it will be interesting to see their next move.

With earnings season still in full swing, we’re seeing some exciting results from major companies and there are still a few key reports to come. Last night’s batch of earnings brought a mixed bag of results, with reports from tech giants Amazon, Alphabet, and Apple making headlines.

Despite driving the market rally earlier in the day, tech stocks saw a dip in after-hours trading. Apple’s iPhone sales fell short of expectations; Amazon gave a weak forecast and saw misses in its AWS segment, while Alphabet felt the impact of a slowdown in ad spending. On the other hand, Bitcoin continued to surge after the Federal Reserve’s announcement, with many investors eyeing a potential $24,000 price point. These developments are worth keeping an eye on as they have the potential to shape the market in the days ahead.

The equity markets are expected to face increased volatility in the coming months. Despite the possibility of reaching a market bottom in the first half of the year, the main factor driving market instability is the likelihood of downward revisions to the S&P 500 revenue numbers, which are not currently reflected in market levels. Additionally, the dollar is considered oversold and could see a rally during February and March. Unfortunately, the bear market is expected to persist this year. Investors should be cautious and stay informed of the latest market developments.

With this in mind, there is one symbol, I will be looking to invest in this week.

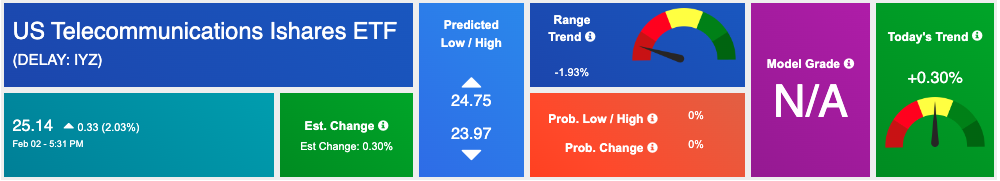

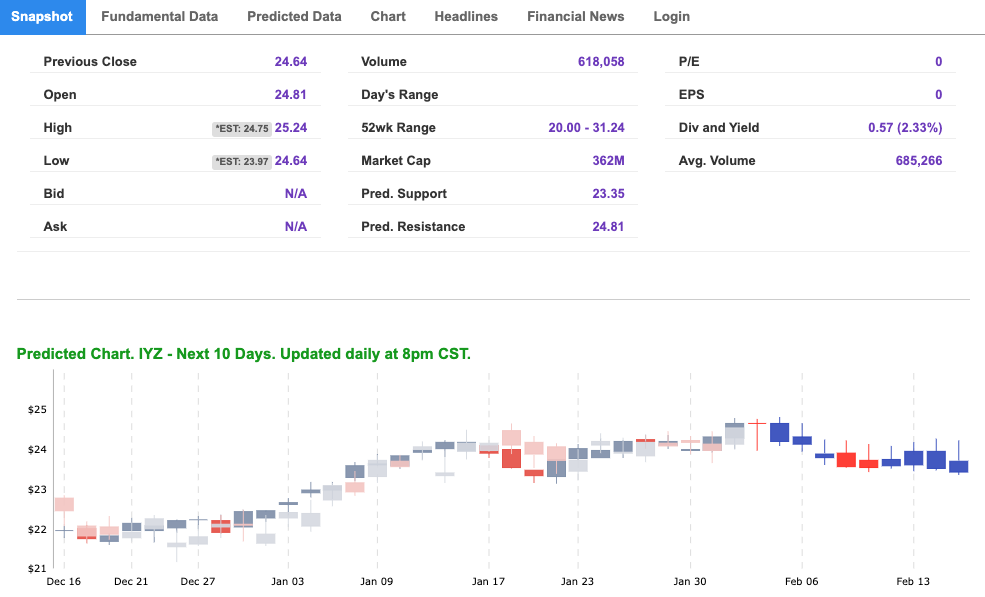

IYZ is the ticker symbol for iShares U.S. Telecommunications ETF, a fund that provides investors with exposure to stocks associated with the US telecommunications sector such as wireless carriers, telecom equipment makers, and internet service providers. The ETF is designed to follow the performance of the Dow Jones U.S. Select Telecommunications Index closely so you can keep your finger on America’s pulse in this critical industry!

With IYZ, investors can acquire exposure to the telecom sector and profit from its array of companies. With a diversified selection of stocks in this industry, it lessens the risk associated with investing in one company alone. The telecommunications sector is considered an essential component of technology and has a low correlation with other markets – making it an ideal source for portfolio stability.

Our A.I. platform, using the Seasonal Charts tool for long-term data, is now giving you a strong ‘buy’ signal, and the chart pattern shows clear potential for success. Of the three time frames we’ve studied– 20 days, 30 days, and 50 days – Seasonal Chart readings paint an especially promising picture in three of them. See IYZ seasonal chart below:

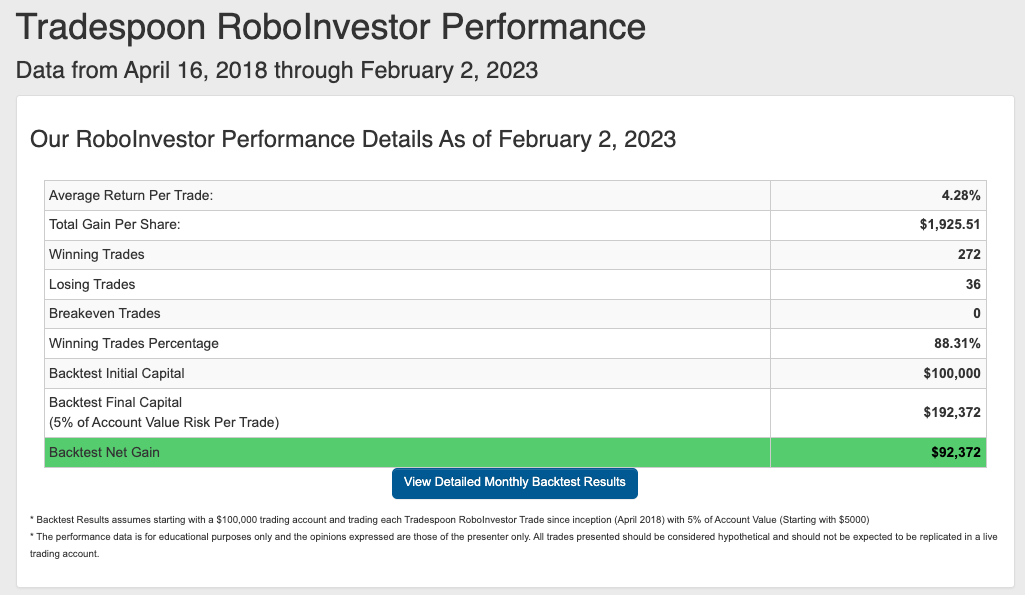

This is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.31% going back to April 2018.

Inflation, Fed decisions, geopolitical tension, and the Ukraine war – all factor into how money is being made and lost. 2023 is set up to be an eventful market year. Don’t go at it alone in this investing landscape, but instead, put RoboInvestor to work today and add a big layer of confidence to your portfolio going into tomorrow. We’ll be with you every step of the way!

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!