U.S. markets traded higher today despite an underwhelming retail sales report, signaling continued investor resilience in the face of economic uncertainty. This comes after a turbulent week that saw heightened volatility, shifting sentiment, and key technical levels being tested. The S&P 500 briefly dipped into correction territory before mounting a late-week recovery, with the Nasdaq Composite and Russell 2000 following a similar trajectory. These movements underscore the fragile yet dynamic nature of the current trading landscape.

Retail Sales and Manufacturing Data Raise Concerns

The latest economic data paints a mixed picture for the U.S. economy. February retail sales came in weaker than anticipated, adding to concerns that consumer spending—the backbone of economic growth—may be starting to falter. The Census Bureau reported a modest 0.2% increase in retail sales from January, significantly below the 0.7% gain expected by economists. Adding to the concern, January’s retail sales were revised downward to a 1.2% monthly decline from the previously reported 0.9% decrease, suggesting a sharper pullback in spending earlier in the year than initially believed.

While retail sales rose 3.1% on an annual basis, the gains were concentrated in essential goods rather than discretionary spending. Of the 13 categories tracked by the Census Bureau, only five saw increases: e-commerce, general merchandise, health and personal care, food and beverages, and building materials. Meanwhile, spending at restaurants and bars—a key gauge of consumer confidence—fell 1.5% from January, indicating increased caution among consumers.

Manufacturing data also provided little reassurance. The New York Federal Reserve’s Empire State Manufacturing Survey revealed a sharp decline in business activity in March, with the general business conditions index plunging 26 points to negative 20, compared to a reading of 5.7 in February. This stark drop suggests that economic momentum in the manufacturing sector is waning, further fueling concerns about a potential slowdown.

The Magnificent Seven Struggle as Microsoft Bucks the Trend

Tech giants, often referred to as the “Magnificent Seven,” faced another rough session on Monday. Microsoft was the sole gainer, edging up 0.2%, while Apple, Alphabet, and Amazon.com each declined around 0.4%. Meta Platforms slid 1%, Nvidia lost 1.4%, and Tesla extended its downward trajectory with a sharp 4.1% drop. The continued struggles of these market leaders reflect broader market jitters and shifting investor sentiment as economic uncertainty lingers.

All Eyes on the Fed: Rate Decision and Powell’s Comments in Focus

This week’s main event will be the Federal Reserve’s interest-rate decision on Wednesday, followed by Fed Chair Jerome Powell’s first public remarks since the S&P 500 entered correction territory last week. Markets widely expect the Fed to hold rates steady, but investors will scrutinize Powell’s tone for any hints about future policy moves. With consumer sentiment dropping for the third consecutive month and economic data showing signs of strain, Powell’s commentary could set the stage for the market’s next major move.

Beyond the Fed, investors are also watching a series of key earnings reports. Notable companies reporting this week include General Mills, Super Micro Computer, Five Below, FedEx, Lennar, Micron, Nike, and Carnival. Additionally, upcoming economic reports will provide fresh insights into the state of the economy, with housing data, the import price index, and U.S. leading economic indicators all on tap.

Technical Outlook: Support and Resistance Levels to Watch

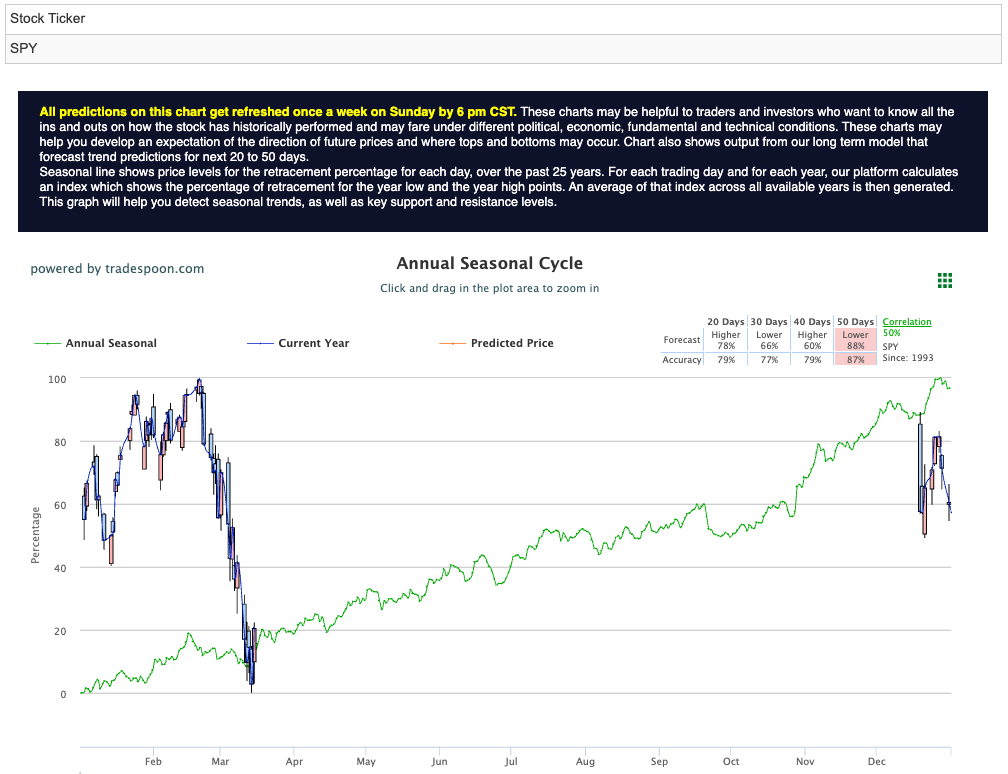

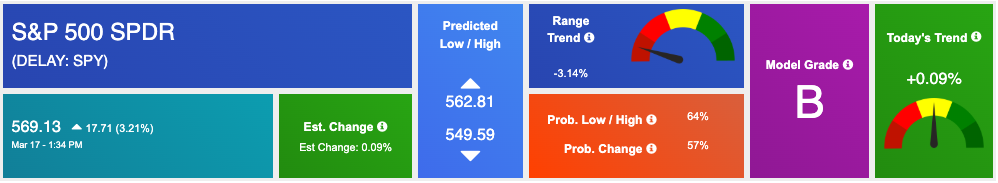

From a technical standpoint, SPY’s short-term support lies between $530 and $550. A sustained rally could push prices toward the $580–$600 range in the coming months, provided market conditions stabilize. For reference, the SPY Seasonal Chart is shown below:

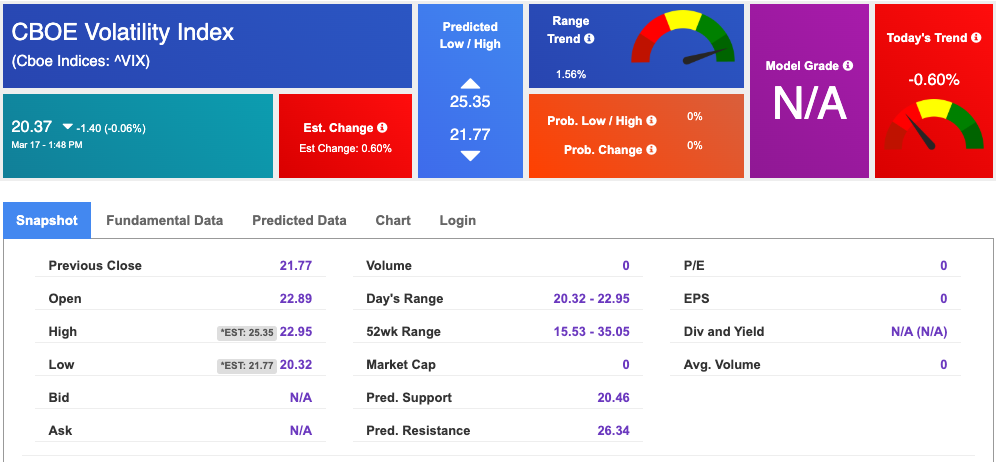

However, volatility remains elevated, with the VIX holding at 24, signaling persistent investor caution. Following a 10% pullback, markets are consolidating near the 200-day moving average, suggesting a period of sideways trading in the near term. Despite short-term headwinds, the broader trend remains intact, leaving room for potential upside if economic data and Fed policy expectations align favorably.

As the week unfolds, investors will be closely monitoring both macroeconomic indicators and corporate earnings for signals on the market’s next direction. While uncertainty remains high, opportunities continue to emerge for those who can navigate the shifting landscape with discipline and strategic insight.

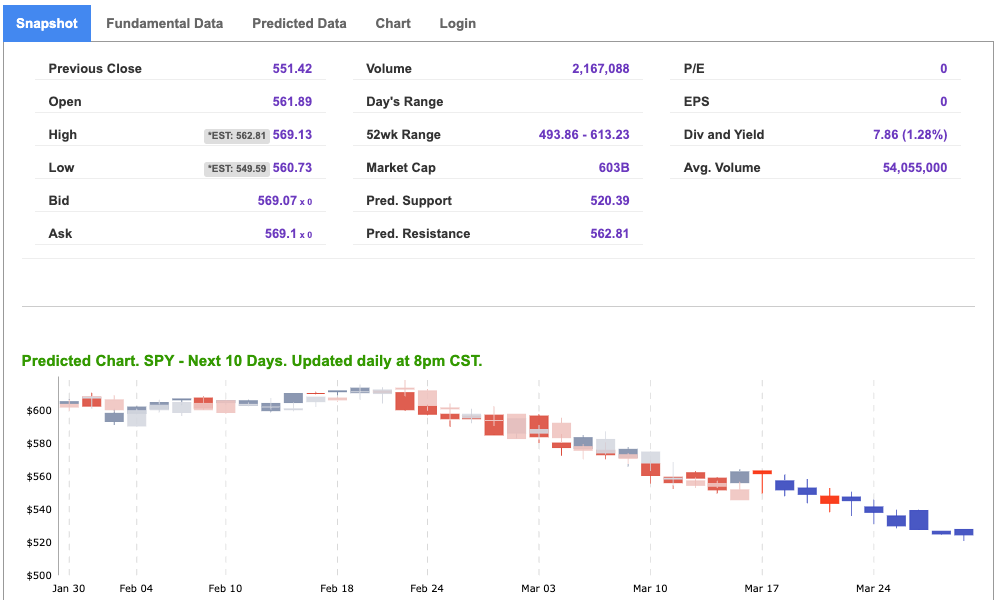

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

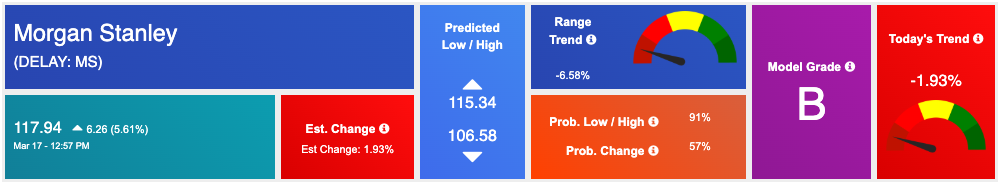

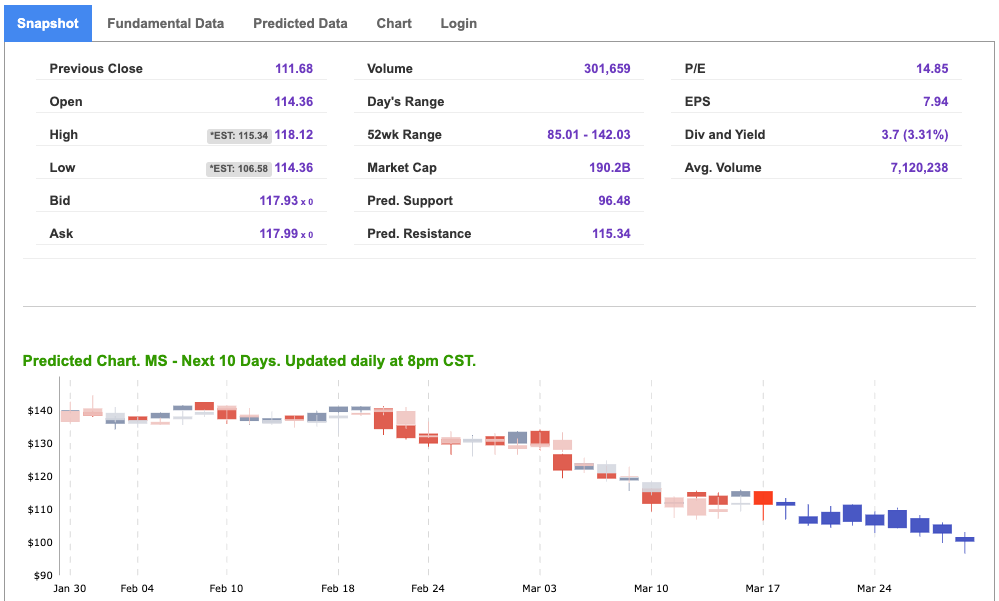

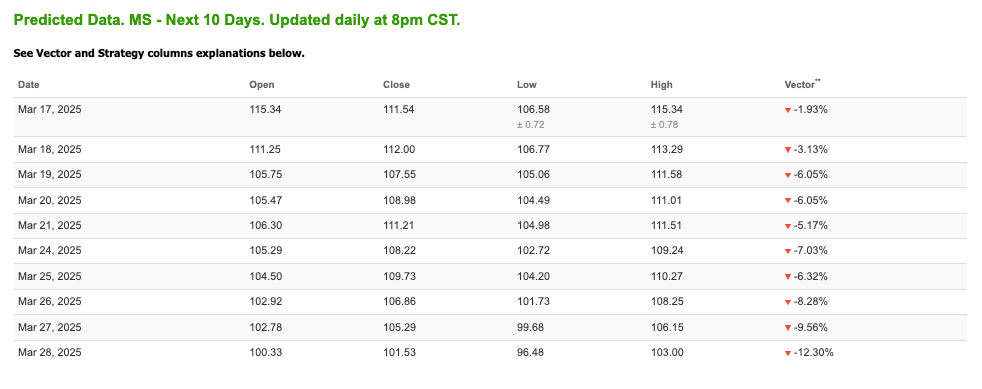

Our featured symbol for Tuesday is MS. Morgan Stanley – MS is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $117.94 with a vector of -1.93% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, MS. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

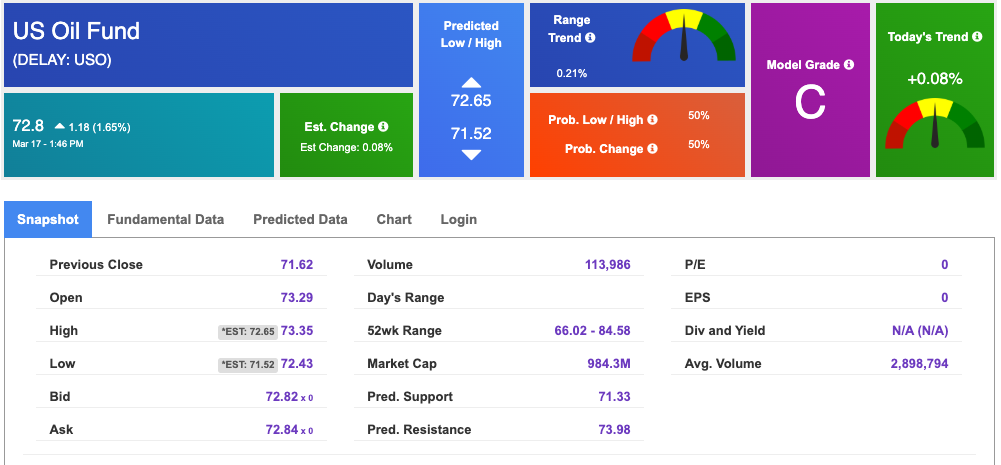

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $67.53 per barrel, up 0.52%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $72.8 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

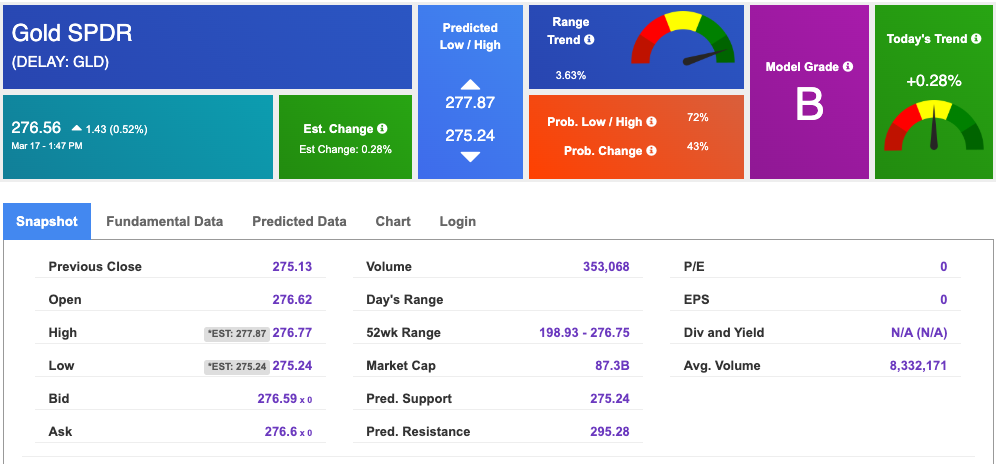

The price for the Gold Continuous Contract (GC00) is up 0.24% at $3,008.40 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $276.56 at the time of publication. Vector signals show +0.28% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

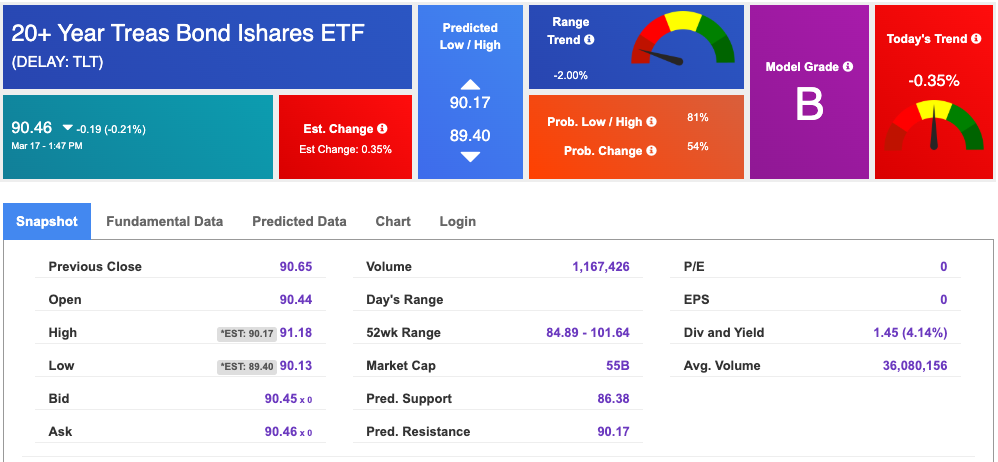

The yield on the 10-year Treasury note is down at 4.216% at the time of publication.

The yield on the 30-year Treasury note is down at 4.544% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $20.37 up -0.60% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!