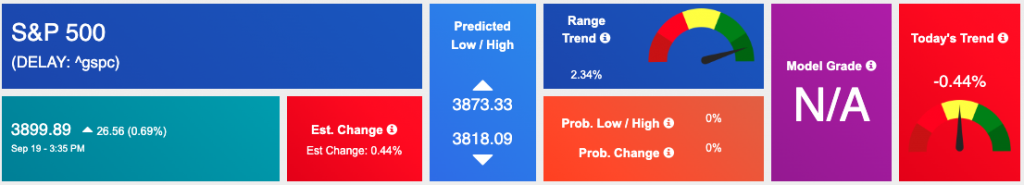

All three major U.S. indicies closed in the green today, ahead of tomorrow’s Federal Open Market Committee policy meeting. Monday’s action was particularly volatile as prices fluctuated throughout the day. However, stocks surged in the final hour of trading as investors prepared for what will likely be another interest rate hike. The Federal Reserve meeting is expected to result in another large interest rate hike and provide more insight into the Fed’s plans for combatting inflation. Economic reporting will remain light this week as all eyes will be on the FOMC meeting, apart from policy update we will see housing start, building permits, and leading economic indicator reports. Look out for $COST and $LEN earnings which will also potentially influence the next move in the market.

Gold and oil shares moved marginally higher on Monday as well, with several commodities continuing to build momentum higher. Stocks felt additional pressure as Treasury yields continued their rise, with the policy-sensitive 2-year rate heading closer to 4%, a level that some say could trigger selloffs throughout the market. Globally, Asian markets finished in the red while European markets saw mixed results. In observance of the Queen’s funeral in London, the U.K. stock market shut down for the day.

We are watching the overhead resistance levels in the SPY, which are presently at $390 and then $404. The $SPY support is at $380 and then $370. We expect the market to continue the current pullback for the next 2-8 weeks. We would be a seller into any further rallies and encourages subscribers not to chase the market at these levels. The VIX traded lower, off its highs near the $28 level and closer to $25 level. We encourage all market commentary readers to maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

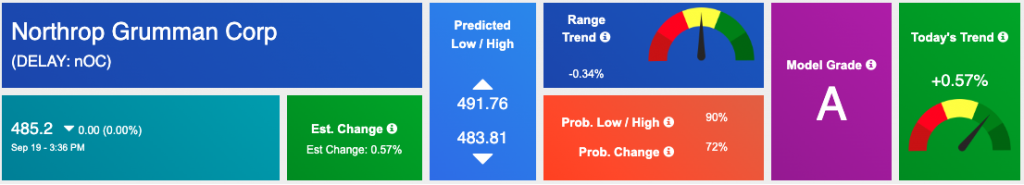

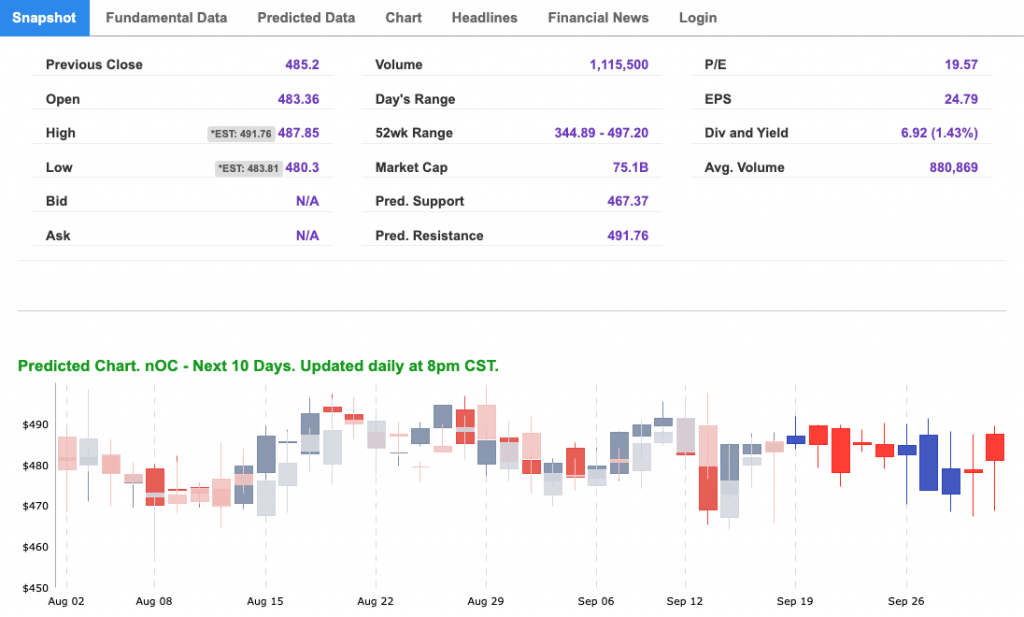

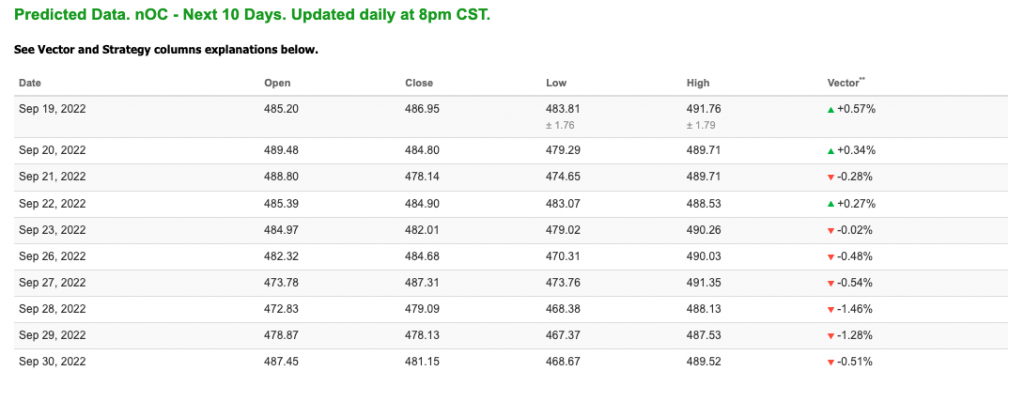

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, noc. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $85.45 per barrel, up 0.40%, at the time of publication.

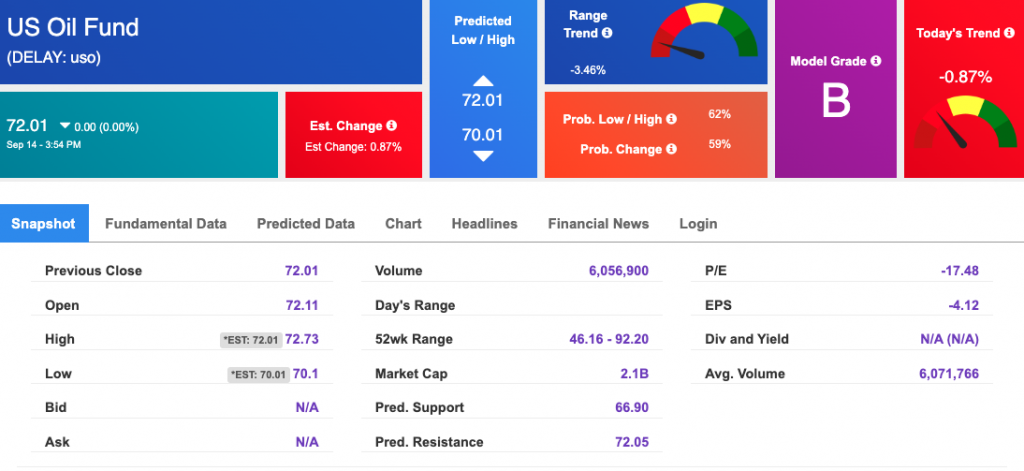

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $72.01 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The price for the Gold Continuous Contract (GC00) is up 0.08% at $1684.80 at the time of publication.

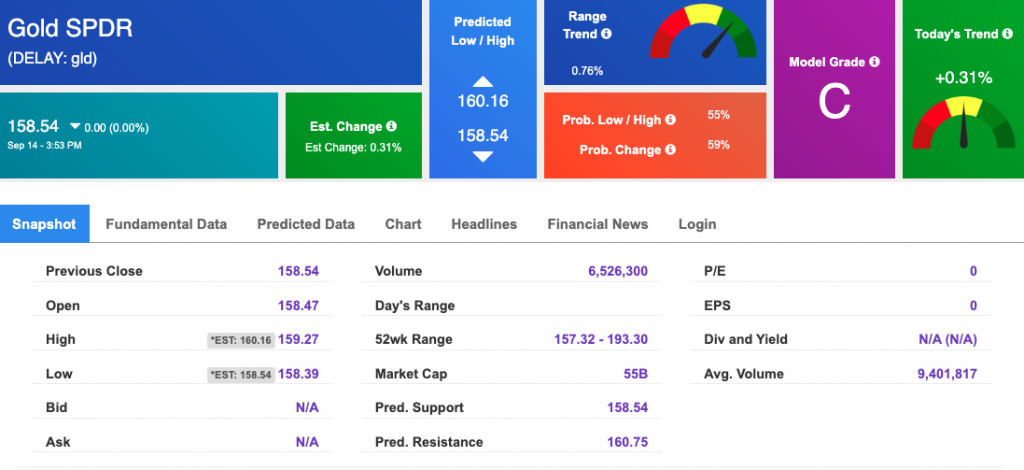

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $158.54 at the time of publication. Vector signals show +0.31% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The yield on the 10-year Treasury note is up, at 3.491% at the time of publication.

The yield on the 30-year Treasury note is down, at 3.515% at the time of publication.

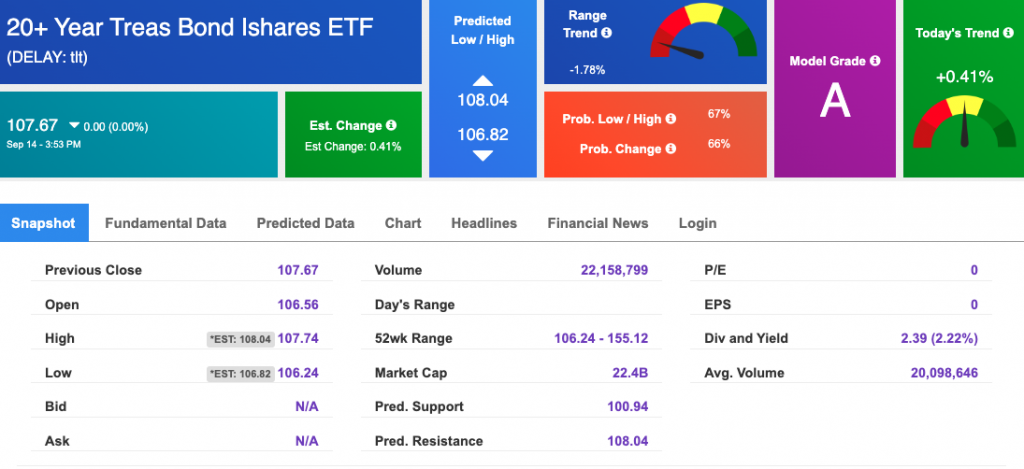

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

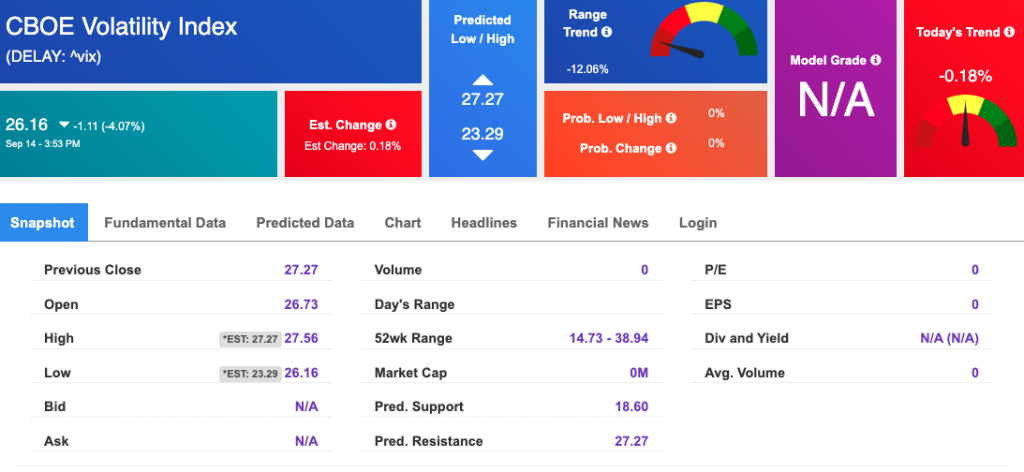

The CBOE Volatility Index (^VIX) is $26.16 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!