RoboStreet – January 16, 2025

This week brought a combination of critical economic data and the much-anticipated kickoff of earnings season, both of which shaped the market’s direction. As investors absorbed the latest inflation reports and corporate results, the major indices rebounded strongly, indicating that sentiment remains cautiously optimistic. However, the path ahead may still hold challenges.

The S&P 500 managed to rally from earlier declines, showing resilience despite geopolitical concerns and mixed retail data. While the Nasdaq Composite struggled under the weight of tech sector headwinds, the Dow Jones Industrial Average outperformed, supported by strength in financial and energy stocks. These movements underscore a market attempting to find equilibrium amid competing forces.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The most significant drivers of market sentiment this week were the latest inflation figures, which provided further evidence of moderating price pressures. Both the Consumer Price Index (CPI) and the Producer Price Index (PPI) for December delivered readings that reinforced expectations of a softer stance from the Federal Reserve in the coming months.

The Consumer Price Index, released midweek, revealed a modest monthly increase of 0.2%, bringing the year-over-year inflation rate to 3.2%. This marked a notable slowdown from the 3.7% annual rate reported in October. The report was particularly encouraging because it showed progress in curbing inflation despite a rebound in energy costs. Core CPI, which excludes the volatile food and energy categories, also increased by 0.2% for the month, with an annual rate of 3.2%. This was in line with expectations, suggesting that the inflationary pressures that defined much of 2022 and 2023 are finally abating.

The Producer Price Index, released earlier in the week, reinforced the cooling trend. PPI rose by 0.2% in December, matching forecasts and signaling a year-over-year increase of 3.3%. As a measure of wholesale inflation, the PPI often serves as a leading indicator for future consumer prices. The fact that producer prices continue to moderate bodes well for the broader economy and suggests that supply chain pressures have largely normalized.

Treasury yields responded immediately to the inflation data, with the 10-year yield retreating to 4.65% and the 30-year yield dipping below 4.88%. Lower yields are particularly supportive for growth-oriented sectors, including technology and discretionary stocks, while also signaling that the bond market is beginning to price in the possibility of no further rate hikes from the Fed.

This moderation in inflation has strengthened the case for the Federal Reserve to hold rates steady at its next meeting, though policymakers remain cautious. Fed officials have repeatedly emphasized the need for inflation to move closer to their 2% target, but this week’s data has eased concerns about additional tightening.

The December retail sales report provided a mixed picture of consumer activity during the critical holiday shopping season. Headline retail sales rose by 0.4%, slightly missing expectations of a 0.5% increase. However, core retail sales, which exclude autos, were more robust, rising by 0.4% and outpacing the prior month’s 0.2% growth.

These figures suggest that while consumers remain somewhat cautious in their spending, underlying demand is holding up better than anticipated. Strength in discretionary categories and e-commerce sales highlighted resilience among U.S. households, even as higher borrowing costs and economic uncertainty persist.

Labor market data, meanwhile, showed modest signs of cooling. Initial jobless claims rose to 217,000, an increase from the prior week and slightly above forecasts. While the labor market remains historically tight, any signs of softening could influence Fed policy, as officials closely monitor employment trends alongside inflation data.

The start of earnings season added another layer of complexity to market sentiment this week, as some of the largest U.S. financial institutions reported their results. The focus was on how corporations have navigated higher interest rates, slowing economic growth, and ongoing geopolitical challenges.

JPMorgan Chase delivered an impressive performance, underscoring the resilience of the banking sector. The company reported strong revenue growth in both its investment banking and consumer lending divisions, driven by robust demand for loans and a solid pipeline of corporate transactions. CEO Jamie Dimon struck an optimistic tone, emphasizing the bank’s ability to adapt to shifting market conditions while maintaining healthy profitability.

Goldman Sachs also surprised investors with better-than-expected results. The firm reported earnings of $11.95 per share, far exceeding analyst expectations of $8.21. Trading and investment banking were standout contributors, with the bank benefiting from heightened market volatility and a rebound in M&A activity. Goldman’s performance provided reassurance that even in a challenging macroeconomic environment, Wall Street’s largest players remain well-positioned to deliver solid returns.

Taiwan Semiconductor Manufacturing Company (TSMC) offered another bright spot with a 57% increase in quarterly profits. Despite facing geopolitical tensions and new export restrictions on advanced AI chips, TSMC continues to benefit from strong global demand for semiconductors. The company’s results highlighted its pivotal role in the tech supply chain and reassured investors about the sector’s long-term growth prospects.

Elsewhere, Wells Fargo, Citigroup, and Bank of America also reported earnings this week, with results that largely exceeded expectations. These banks highlighted strong consumer activity, stable credit quality, and disciplined expense management as key drivers of their performance.

As earnings season progresses, attention will shift to other sectors, including technology, healthcare, and consumer goods. Investors will be watching closely for signs of resilience or weakness as companies navigate an increasingly complex macroeconomic environment.

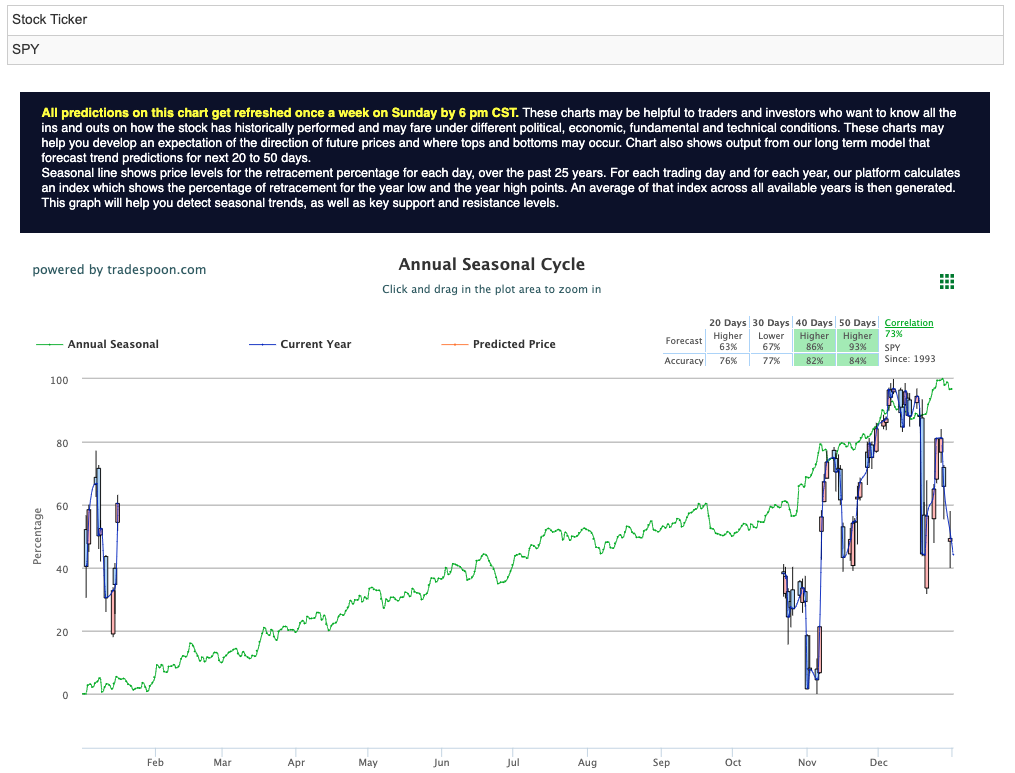

Despite the encouraging data and earnings results, the market remains in a consolidation phase, with short-term movements likely to be influenced by economic data, corporate earnings, and geopolitical developments. The S&P 500 (tracked by SPY) is expected to rally toward $620–$640 over the coming months, with strong near-term support levels at $560–$580. For reference, the SPY Seasonal Chart is shown below:

Volatility, as measured by the VIX, has eased significantly, falling to 16 this week. This decline suggests that investors are growing more confident in the market’s ability to navigate current challenges. However, risks remain, including the potential for weaker-than-expected corporate earnings, ongoing geopolitical tensions, and uncertainty about the Federal Reserve’s long-term policy direction.

Looking ahead, the market is likely to trade sideways in the short term, reflecting a period of consolidation following its recent rally. However, the long-term trend remains intact, supported by easing inflation, resilient corporate earnings, and improving financial conditions.

For investors, this environment presents opportunities to focus on high-quality assets and sectors that stand to benefit from the evolving macroeconomic landscape. By staying disciplined and maintaining a balanced approach, traders can position themselves to navigate the complexities of the market while capitalizing on its opportunities.

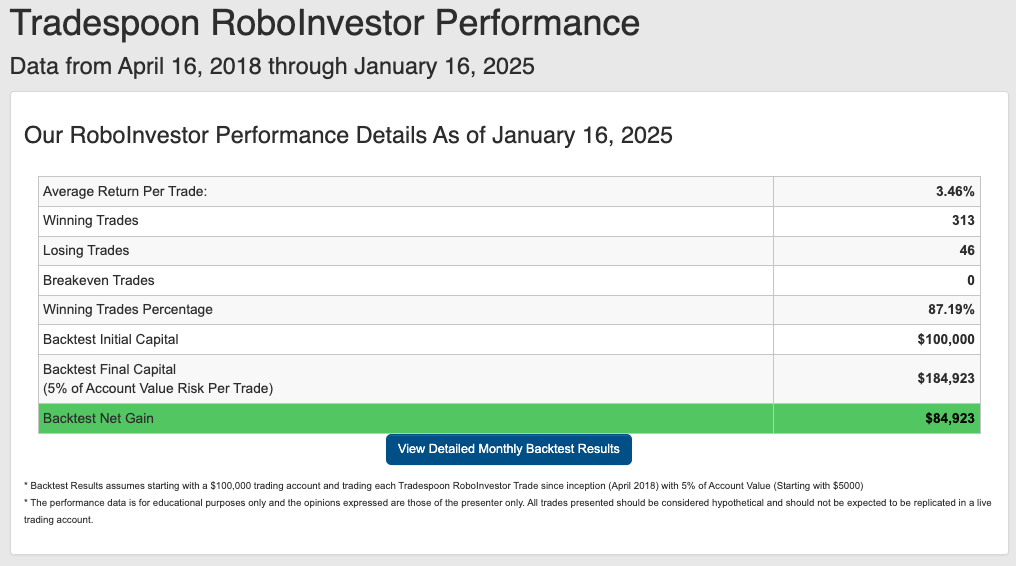

Unlock smarter investment decisions with our RoboInvestor stock and ETF advisory service, powered by advanced AI. This cutting-edge technology identifies trades with high-profit potential, cutting through market noise and eliminating emotional bias. With clear, data-driven insights and strategies, RoboInvestor helps you navigate today’s ever-changing market with confidence and precision.

Every other weekend, subscribers receive an exclusive newsletter packed with my market analysis, technical outlook, updates on existing positions, and one or two fresh trade recommendations to act on when the market opens on Monday.

RoboInvestor is a flexible, unrestricted service. I may recommend blue-chip stocks or ETFs representing major indexes, market sectors, commodities, currencies, interest rates, and even shorting opportunities using inverse ETFs. Our model portfolio typically holds between 12 to 25 positions, adjusting based on market conditions. Recently, we’ve adopted a more cautious approach, focusing on a smaller, more selective set of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.19% going back to April 2018.

As we enter 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!