The stock market kicked off the final full trading week of 2024 with mixed results across major indexes. The Nasdaq Composite hit a record high, while the Dow Jones Industrial Average pulled back, weighed down by weakness in healthcare and energy sectors. The S&P 500 posted modest gains as investors focused on a crucial week of central bank decisions, especially the Federal Reserve’s Open Market Committee (FOMC) meeting on Wednesday.

This week, all eyes are on the central banks in the U.S., Japan, and the U.K., as their monetary policy decisions could shape markets for the rest of the year and beyond.

On Wednesday, the Federal Reserve is expected to announce a 25-basis-point rate cut. However, persistent inflation concerns have led to uncertainty around the pace of future rate cuts in 2025. Investors will closely scrutinize Fed Chair Jerome Powell’s comments for any signals of a pause or a shift toward a more hawkish stance, which could strengthen the U.S. dollar.

On Thursday, the Bank of Japan (BoJ) and the Bank of England (BoE) will make policy announcements. Analysts expect the BoJ to maintain its ultra-loose monetary policy, while the BoE is likely to hold rates steady amid mixed inflation trends. These decisions will be pivotal in shaping market sentiment as the year comes to a close.

Recent economic reports have painted a mixed picture of inflation, which remains a key focal point for investors heading into the Fed’s decision. The November Consumer Price Index (CPI) rose 0.3% month-over-month and 2.7% year-over-year, slightly exceeding expectations. Housing-related inflation, a major CPI component, showed signs of slowing, offering cautious optimism. Similarly, the Producer Price Index (PPI) rose 0.4% month-over-month and 3% year-over-year, marking its fastest annual pace since February 2023. However, service inflation within the PPI continued to decline for the third consecutive month, rising by just 0.2%.

In the labor market, initial jobless claims edged up to 242,000, surpassing estimates. While still historically low, this increase suggests the labor market may be cooling. Together, these trends support a narrative of gradual inflation moderation, providing the Fed with more flexibility in its approach to future rate adjustments.

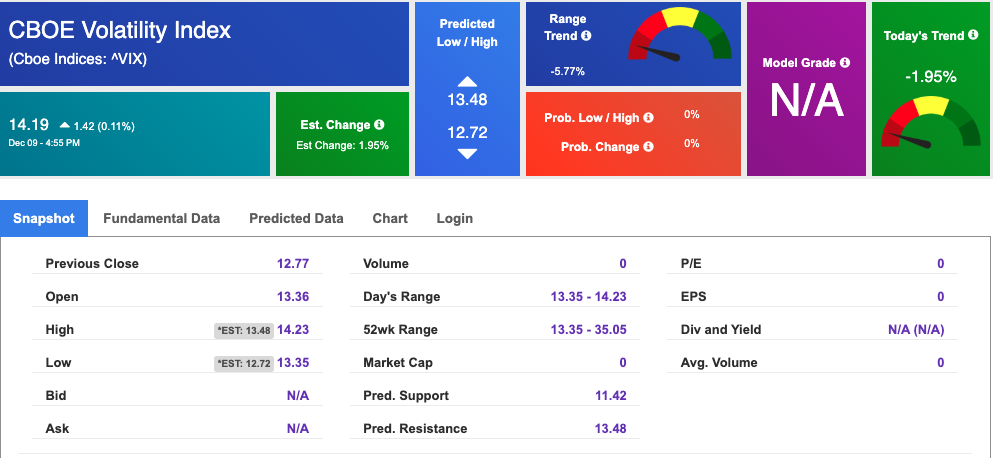

Equities remain resilient heading into 2025, buoyed by strong corporate earnings and broader economic stability. The U.S. economy is on a path toward a soft landing, supported by lower Treasury yields, which have remained between 3.6% and 4.4% on the 10-year note. These lower yields have eased borrowing costs and supported equity valuations. Additionally, subdued volatility, as reflected in the VIX index at 14, signals investor confidence in the near term.

However, caution is warranted. Risks such as rising unemployment, strains in the banking sector related to commercial real estate, and ongoing geopolitical uncertainties could disrupt this positive momentum.

The Nasdaq Composite’s record-breaking performance underscores the ongoing strength of the technology sector, driven by the rapid evolution of artificial intelligence, robust earnings momentum, and sustained consumer demand for tech products. With tech leading the charge, the S&P 500 is also edging closer to its all-time highs. Meanwhile, the Dow Jones continues to experience greater volatility, weighed down by sector-specific struggles in healthcare and energy.

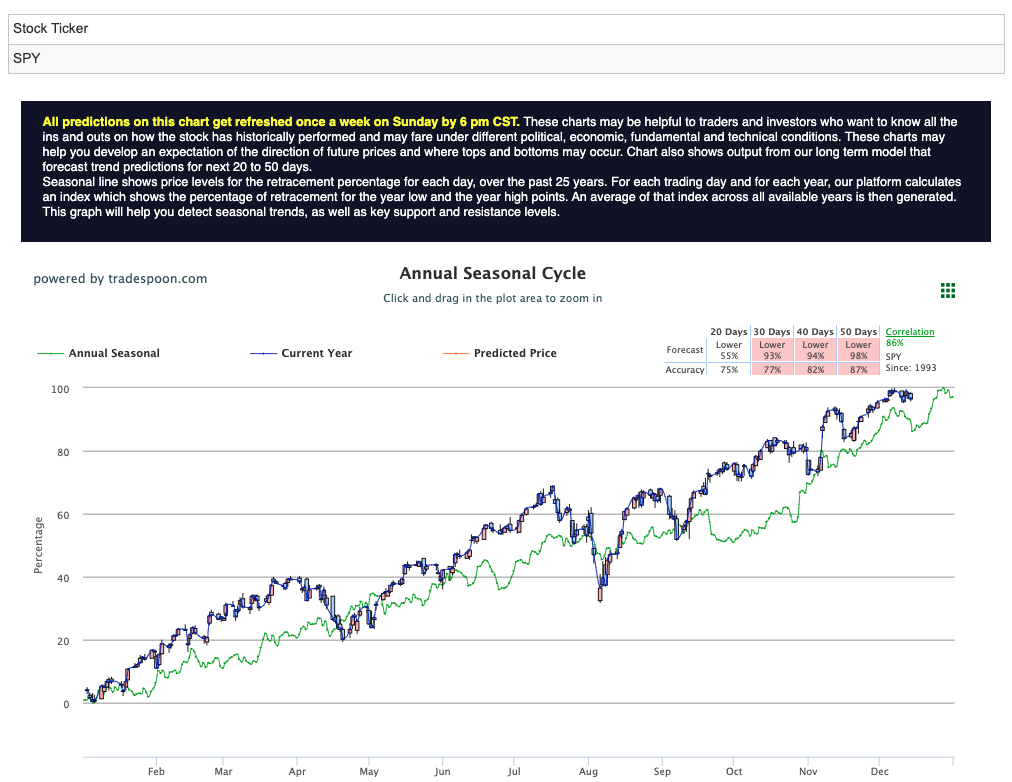

I remain firmly in the bullish camp, as we are hitting new highs, supported by inflation coming in within expectations and a stronger-than-anticipated earnings season. The market’s upward momentum appears solid, with the S&P 500 rally potentially reaching the $620–640 range in the coming months. Short-term support levels for SPY are in the $560–580 range. For reference, the SPY Seasonal Chart is shown below:

However, risks still loom. The economy is cooling, with unemployment on the rise, and concerns about small bank failures linked to exposure to commercial and residential real estate persist. Despite these risks, the long-term trend remains intact, and I expect the market to continue making new highs.

As volatility persists, it’s crucial to maintain disciplined investing and strategic risk management. Tech and growth sectors continue to offer attractive long-term opportunities, while defensive sectors such as utilities and healthcare may provide balance amid lingering uncertainties. Staying focused on macroeconomic trends, earnings strength, and risk management will be essential as we head into 2025.

The final days of 2024 will be critical, with central bank decisions, inflation data, and market performance all under close scrutiny. While risks remain, there are ample opportunities for investors who approach the market with caution and strategy.

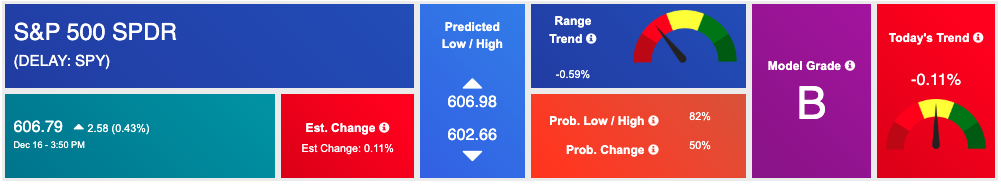

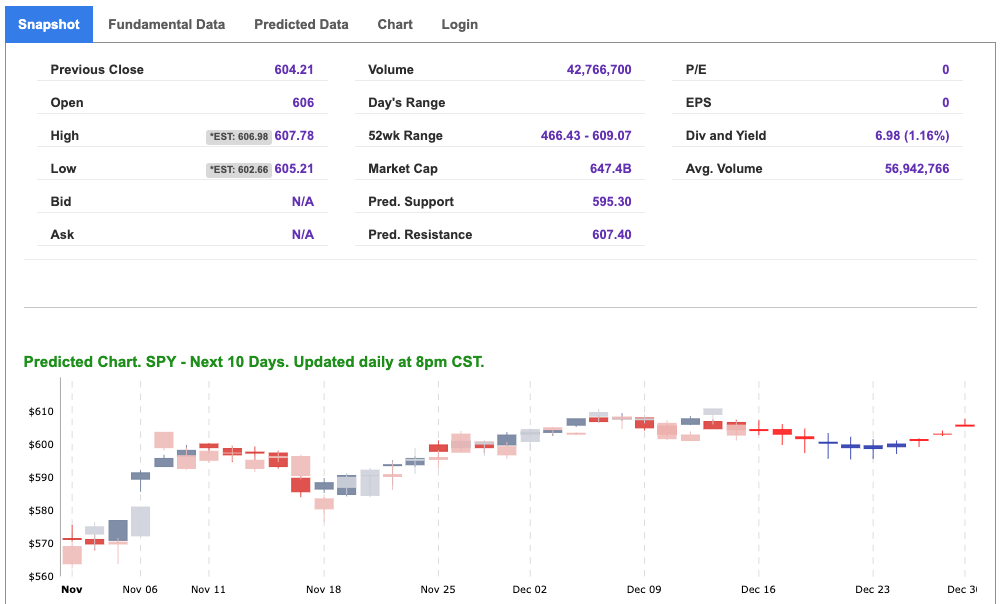

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

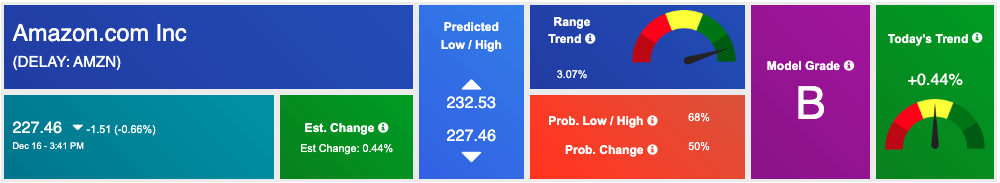

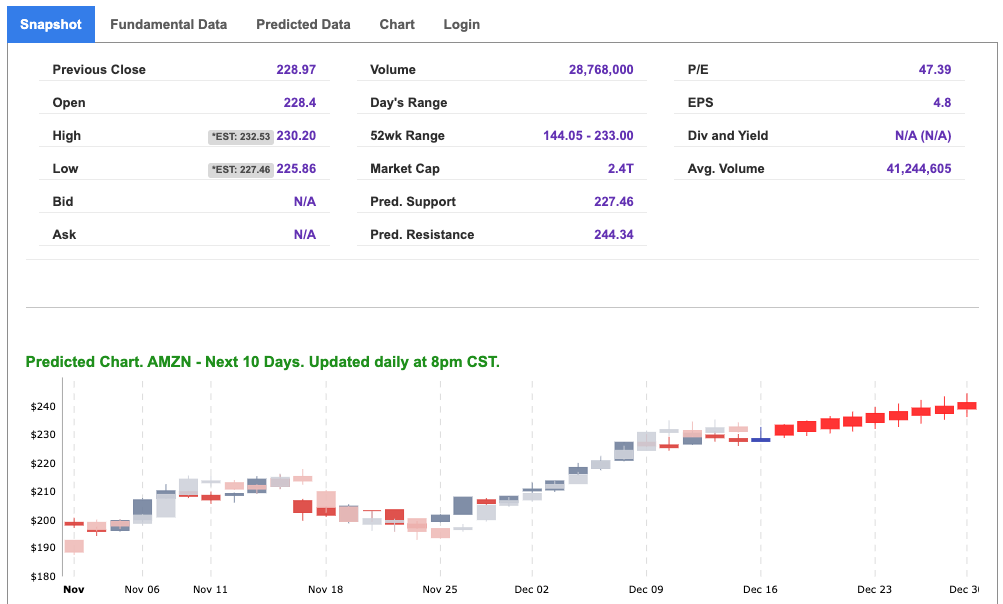

Our featured symbol for Tuesday is Amazon.com Inc. – AMZN is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $227.46 with a vector of +0.44% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, AMZN. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

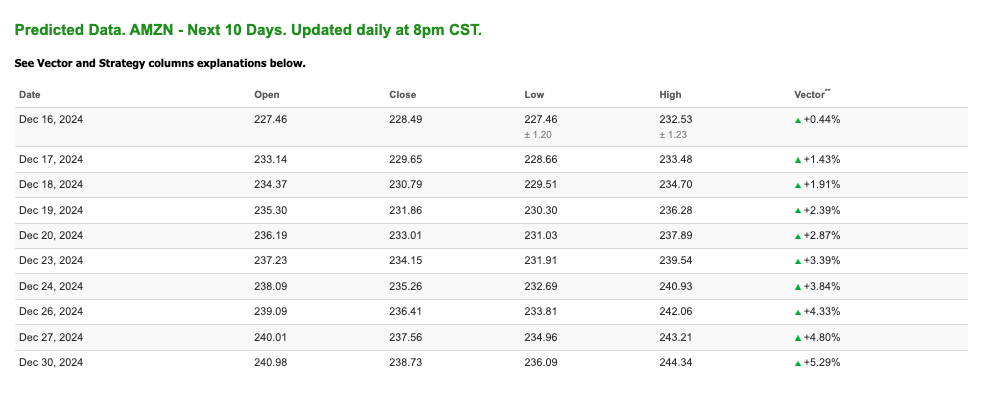

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $70.64 per barrel, down 0.91%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $71.17 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

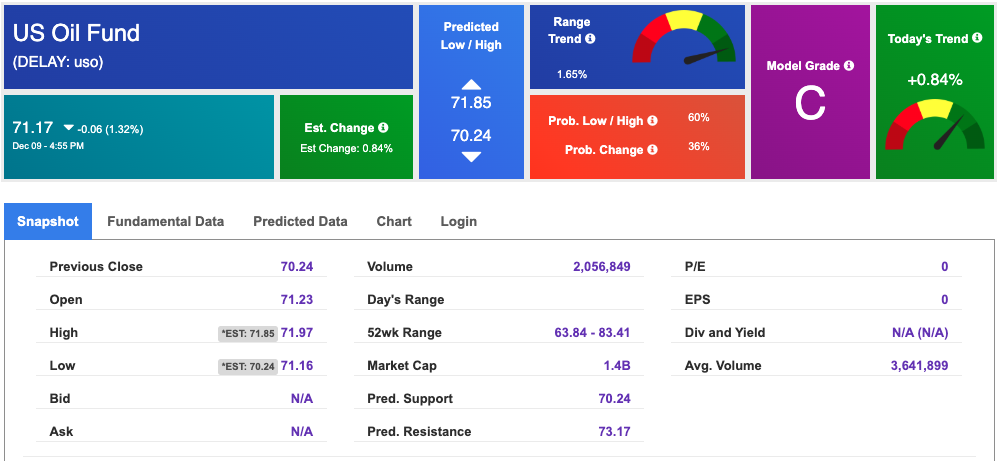

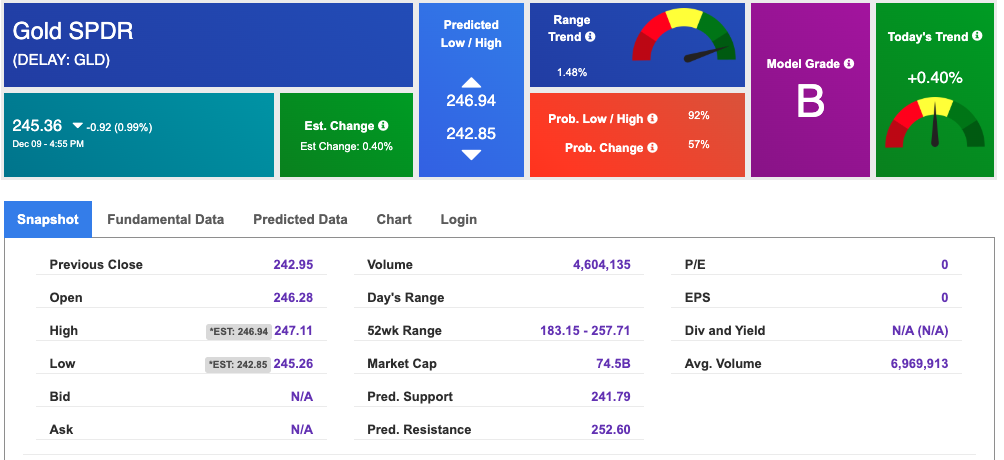

The price for the Gold Continuous Contract (GC00) is down 0.21% at $2670.20 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $245.36 at the time of publication. Vector signals show +0.40% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

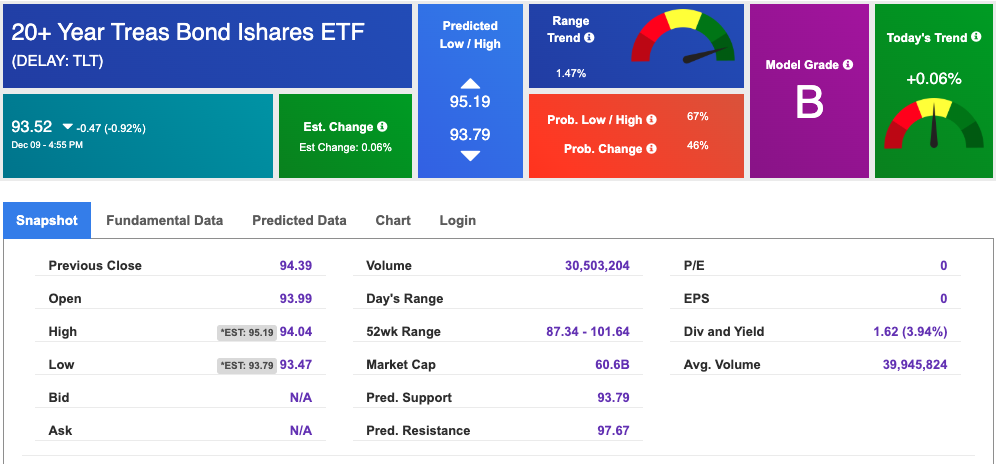

The yield on the 10-year Treasury note is up at 4.405% at the time of publication.

The yield on the 30-year Treasury note is up at 4.600% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $14.19 up 0.11% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!