Thursday’s stock market performance showcased a positive trend, particularly driven by the tech sector propelling gains in the Nasdaq Composite. This followed a previous downturn in both the S&P 500 and Nasdaq Composite, attributed to robust retail sales data. Simultaneously, Treasury yields witnessed an increase, continuing a pattern from Tuesday’s market where both indices had fallen, accompanied by higher Treasury yields and relatively stable oil futures.

The decline on Tuesday was prompted by remarks from Federal Reserve Gov. Christopher Waller concerning potential rate cuts. Waller noted the Fed’s progress in controlling inflation, opening the possibility for rate cuts this year. However, he expressed uncertainty about the sustained decline in inflation, leaving investors anticipating the timing of the rate cuts, speculated to be as early as March. Waller emphasized the potential for Fed policymakers to lower the target range for the federal funds rate in 2024.

Spirit Airlines faced a setback as a federal judge blocked its proposed merger with JetBlue Airways, resulting in a substantial drop in Spirit’s shares. Boeing stock also experienced its first downgrade since a Jan. 5 incident involving a 737 MAX 9. Oil futures remained stable despite geopolitical tensions, with OPEC maintaining its 2024 oil demand growth outlook at 2.2 million barrels per day.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Wednesday saw a slip in stocks following hotter-than-expected retail sales, raising concerns about a potential delay in Federal Reserve interest rate cuts. Weaker-than-expected gross domestic product figures from China further impacted market sentiment. The Beige Book release had minimal impact on Treasury yields, which rose following stronger-than-expected economic data.

In a report released on Wednesday, government data unveiled a stronger-than-expected surge in US retail sales for December, concluding a year marked by robust consumer activity. The Commerce Department noted a 0.6 percent increase in sales, reaching $709.9 billion, compared to a 0.3 percent rise in November. Surpassing projections, the full-year 2023 total sales exhibited a growth of 3.2 percent from the previous year.

This resilient performance defied expectations of weakened consumer demand due to elevated interest rates, attributing part of its success to a steadfast job market that supported spending throughout the year. Despite the Federal Reserve’s proactive approach in raising the benchmark lending rate since early 2022, the central bank’s recent efforts to maintain rates at a high-level aim to sustainably curb inflation. The juxtaposition of increased interest rates and sustained consumer spending highlights the intricate dynamics shaping the trajectory of the US economy.

Thursday’s trading session witnessed positive movement in the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite, driven by a rally in chip stocks. The Nasdaq Composite briefly turned positive for the year, propelled by positive news on semiconductor stocks and Apple, according to Dow Jones Market Data.

Atlanta Federal Reserve President Raphael Bostic indicated a potential implementation of rate cuts in the third quarter of the year, contingent on current economic conditions remaining stable. Market volatility ensued with fluctuations in AAPL and NVDA, triggered by hotter-than-expected CPI from Britain and unexpected sales data from the US. The reset in market expectations led to a continuation of downward momentum in small caps and a reversal in growth for tech stocks.

Various indicators, including the 10-year yield and $DXY, rebounded from oversold conditions, potentially influencing market trends. Oil experienced a rebound due to geopolitical risks in the Red Sea, although overall demand decrease kept prices down. Bitcoin underwent a significant reversal, signaling a potential peak in the risk-on trade. Gold reversed its trend due to a dollar rebound during the week.

In the realm of earnings and market levels, Thursday witnessed significant movements and notable developments. Humana faced a substantial decline of 12% after the health insurer revised its fiscal 2023 adjusted earnings outlook to approximately $26.09 per share, citing increased medical costs. The forecasted GAAP earnings for the year were set at $20 per share. UnitedHealth also experienced a downturn, declining by 3.1%, while CVS Health slumped by 5.4%, further contributing to the overall negative sentiment in the health sector.

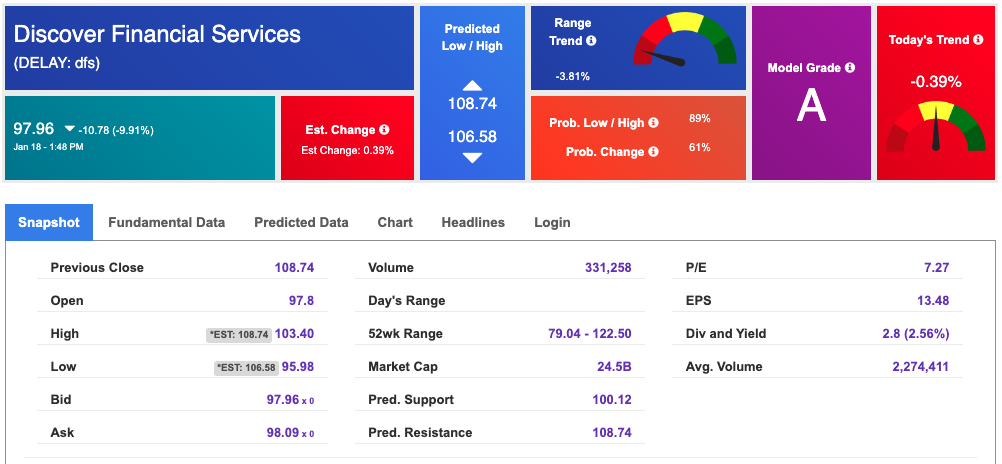

Discover Financial Services encountered challenges, falling by 11% after reporting an elevated charge-off rate of 4.11% in the fourth quarter, up from 2.13% a year earlier. The provision for credit losses at the end of the quarter reached $1.9 billion, a significant increase of $1 billion from the previous year, driven by higher net charge-offs and an augmented reserve build. Additionally, fourth-quarter earnings at Discover missed analysts’ estimates, adding to the downward pressure on the company’s stock.

Spirit Airlines faced a tumultuous period, plummeting by 32% to $4.15. Following a blocked merger with JetBlue Airways, Spirit reportedly planned to explore restructuring options with advisors, given the impending near-term debt maturities. The situation worsened as Citi analysts downgraded the stock to Sell on Thursday after a federal judge blocked the proposed merger with JetBlue on antitrust grounds. This series of events led to a 47% drop on Tuesday and an additional 22% decline on Wednesday, intensifying the challenges for Spirit Airlines.

On a positive note, U.S.-listed shares of Taiwan-based chip maker Taiwan Semiconductor Manufacturing saw a notable increase of 7.4%. The company expressed optimism about revenue growth in the coming year, expecting it to exceed 20%, more than double the rate of the wider chip market. Despite a 19% decline in fourth-quarter profit from a year earlier, the company’s performance surpassed analysts’ expectations. Revenue in U.S. dollars fell by 1.5% in the quarter to $19.62 billion but rose by 13.6% from the third quarter. Additionally, chip maker Nvidia witnessed a 1.6% increase, contributing to the positive momentum in the semiconductor sector.

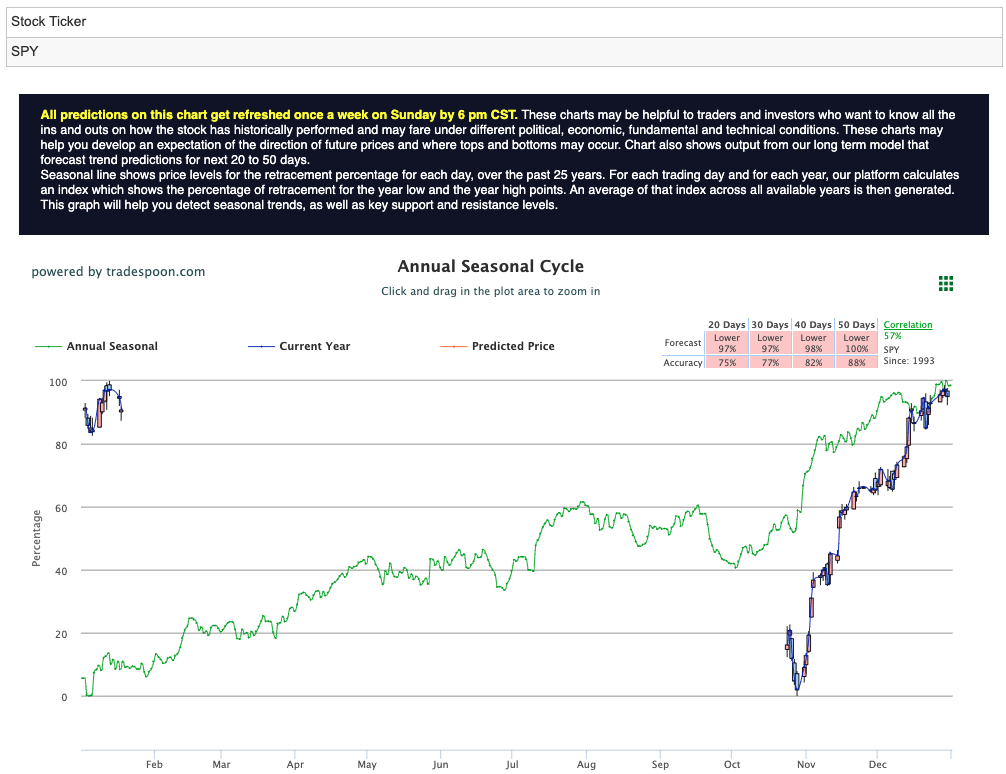

Amidst these stock movements, the overall outlook for the SPY (SPDR S&P 500 ETF) remained a topic of discussion. Some analysts expressed the belief that the SPY rally might be capped at the $470-490 levels, with short-term support predicted to be in the range of $430-450 for the next few months. For reference, the SPY Seasonal Chart is shown below:

While patterns of higher highs and higher lows were anticipated in the coming weeks, there was a consensus that the most favorable phase of the rally might have already occurred. The market seemed to require a catalyst to propel it higher, and despite expectations of short-term pullbacks, the prevailing pattern of upward momentum was expected to continue into the next year, contingent on the majority’s belief in the absence of recessionary signs.

As we approach the upcoming trading week, market participants are closely attuned to the nuanced landscape of interest rates, particularly in the wake of Federal Reserve Governor Christopher Waller’s remarks on potential rate cuts. The uncertainty surrounding the timing of these cuts adds a layer of anticipation and volatility to the market environment. Traders are keenly watching for any signals or guidance from the Federal Reserve regarding the trajectory of interest rates, as these insights can significantly impact market sentiment and investment strategies.

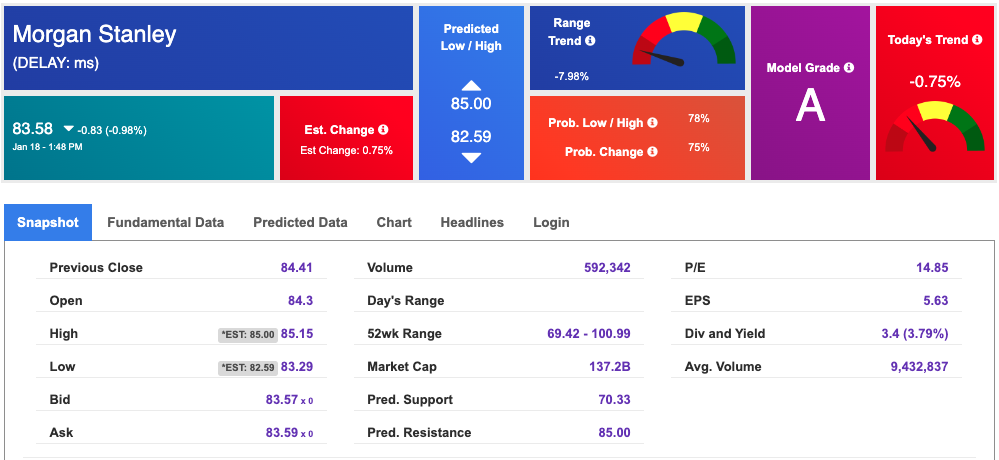

In this context, the earnings reports of major financial institutions hold heightened significance. Morgan Stanley ($MS), a stalwart in the financial sector, is poised to release its earnings data, and market observers are eagerly awaiting insights into the bank’s performance and strategy. The report will provide a comprehensive view of Morgan Stanley’s stance on interest rates, offering valuable guidance for traders navigating the dynamic financial landscape. The bank’s outlook and response to potential rate cuts will likely have ripple effects across the broader financial industry.

Discover Financial Services ($DFS) is another key player under the spotlight as traders scrutinize its recent earnings and sales data. Facing a challenging period marked by an 11% decline in its stock, Discover’s performance will be pivotal in assessing its resilience and strategic adjustments. The interplay between interest rates and Discover’s credit-related metrics, including its charge-off rate, provisions for credit losses, and overall financial health, will shape trading decisions. As traders evaluate these dynamics, the coming week is poised to be a pivotal juncture for gauging the financial sector’s response to evolving interest rate expectations.

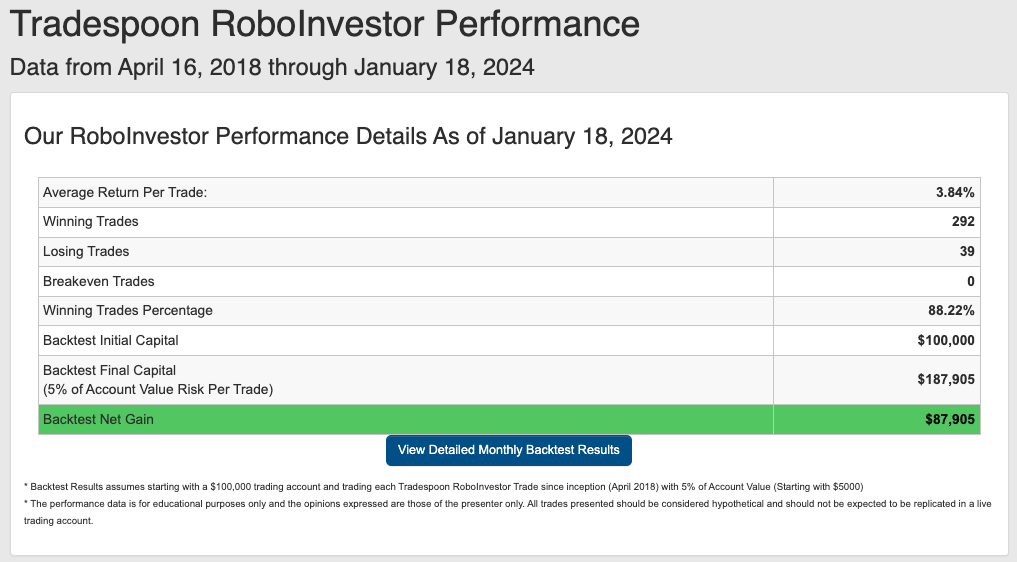

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.22% going back to April 2018.

As we step into 2024, investors are confronted with a complex market scenario shaped by elements like inflationary forces, evolving Federal policies, and persistent geopolitical tensions, such as the ongoing conflict in Ukraine. Successfully maneuvering through this intricate landscape demands a dependable and well-informed investment platform. This is where RoboInvestor proves its worth, acting as a reliable ally by providing a spectrum of invaluable resources and expert guidance. With RoboInvestor at your service, you can adeptly oversee your portfolio and capitalize on lucrative opportunities within the dynamic and fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!