RoboStreet – April 24, 2025

The stock market opened the week under a heavy cloud, exacerbated by an escalating clash between President Donald Trump and Federal Reserve Chairman Jerome Powell. President Trump’s renewed public attacks on Powell, including calls for his removal, injected further uncertainty into an already fragile market landscape. These criticisms sparked concerns that political interference could undermine the Federal Reserve’s independence, further intensifying investor anxiety. Trump’s assertions that Powell had been slow to respond to economic challenges weighed heavily on investor sentiment, contributing to a broad sell-off in equities, bonds, and the U.S. dollar.

The previous week had already been marked by turbulence, driven by a combination of trade tensions, mixed economic data, and a surge in volatility. The ongoing conflict between the U.S. and China regarding trade policies continued to disrupt market stability. Initially, the market saw a brief rebound following tariff exemptions for select tech products, including smartphones and PCs. However, fears over the re-escalation of semiconductor tariffs quickly took center stage, dampening optimism.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Jerome Powell’s midweek warnings about the potential long-term inflationary impact of tariffs added fuel to the fire. Powell highlighted that the tariffs could stifle job growth and escalate inflation, complicating the Federal Reserve’s delicate task of managing economic stability. Inflation data was mixed: while the March Consumer Price Index (CPI) showed a modest year-over-year increase of 2.4%, the core CPI, which excludes volatile food and energy prices, rose by 2.8%, signaling persistent price pressures.

Amid the chaos, investors flocked to gold as a safe-haven asset, pushing gold futures up by more than 3%, topping $3,400 per ounce. This surge in gold prices reflected growing concerns over the U.S. monetary policy, especially following the sharp decline in the dollar, which fell below the $99 mark.

Corporate earnings also painted a mixed picture, further contributing to the uncertainty. While Netflix exceeded earnings expectations, providing some optimism, other sectors, particularly healthcare and financials, delivered more cautious outlooks. UnitedHealth Group’s major guidance revision sent shockwaves through the healthcare sector, while JPMorgan Chase and Bank of America offered a glimmer of hope, reporting solid earnings despite the challenging environment.

Looking ahead, the major U.S. indices remained under pressure, with heightened volatility marking the start of the week. The S&P 500, Nasdaq, and Dow were all trading lower as investors grappled with the dual threats of trade uncertainty and a potentially compromised Fed. The Cboe Volatility Index (VIX), a gauge of market fear, surged above 32, signaling that volatility was likely to persist throughout the week.

By midweek, market volatility showed no signs of slowing down. The VIX held steady at 28, and major averages dropped below their 200-day moving averages, marking a 20% pullback from recent highs. On April 21, the S&P 500 plunged 14% year-to-date, marking the worst start to a presidential term in over a century, driven primarily by tariff-related concerns.

The escalating trade war between the U.S. and China intensified as China raised its tariffs on U.S. goods to 125%, while U.S. tariffs on Chinese imports also hit 125%. The back-and-forth tariff increases sent shockwaves through the markets, causing sharp declines in major indices. However, hope for de-escalation briefly lifted markets on April 22, when rumors surfaced that U.S.-China trade talks could resume. This optimism helped the S&P 500 and Nasdaq recover from the previous day’s losses.

Meanwhile, Trump’s attacks on Fed Chairman Jerome Powell had further compounded market uncertainty. On April 21, stocks tumbled as concerns over the Fed’s independence reached a boiling point. Gold prices surged to new heights, topping $3,500 per ounce, reflecting a growing demand for safe-haven assets amidst fears that the political drama could erode confidence in U.S. markets.

Economic data continued to fuel market jitters. The Atlanta Fed’s GDPNow forecast for Q1 2025 improved slightly to -2.2%, up from -2.4%, but recession fears remained elevated. A Bank of America survey on April 17 revealed widespread concerns about an impending recession. Treasury yields fluctuated as the 10-year note traded between 4.33% and 4.8%, adding to the pressure on equities.

The Beige Book provided additional insights into the U.S. economy, revealing that international tourism was slowing and that businesses were preparing for potential layoffs due to tariff-related uncertainties. Despite low unemployment and easing inflation, the report underscored a sentiment of growing economic caution, particularly in industries most affected by the trade war. Auto sales remained solid, but non-auto consumer spending showed signs of weakness, and several Fed districts reported declines in economic activity.

With the VIX hovering near 28, the market remained in a state of uncertainty. While short-term fears dominated, the underlying economic data showed resilience, setting up a precarious balancing act for the Federal Reserve ahead of its May meeting.

Thursday saw the market experience a slight recovery, with all three major U.S. indices trading higher. The tech sector led the charge, with the Nasdaq up 0.7%, while the S&P 500 gained 0.4%. However, despite the positive movement, the market continued to digest a series of mixed earnings reports and a lack of clarity on the trade situation.

Tesla’s disappointing first-quarter results weighed heavily on investor sentiment, as weak sales, operating income, and profit margins triggered concerns about the company’s ability to maintain its growth trajectory. Tesla stock saw a nearly 6% decline on Monday, partially fueled by reports of a delayed launch for its lower-priced vehicle model. However, the company stuck to its production timeline, with a projected launch in the first half of 2025 for the affordable model.

In contrast, other companies posted stronger-than-expected earnings. 3M rose nearly 4% pre-market after exceeding earnings and revenue estimates, despite warning about tariff impacts. Verizon experienced a 4.6% drop following a significant loss of postpaid phone subscribers. Investors remained on edge, watching the earnings results closely to gauge the strength of corporate America amid rising economic and geopolitical risks.

Despite the positive earnings surprises, concerns about the U.S.-China trade war remained top of mind. Both U.S. and Chinese officials denied that trade talks were underway, contributing to uncertainty about the future of tariff negotiations. This added fuel to the VIX, which climbed by 2.5% to over 29 in early trading, signaling continued fears of market instability.

With the latest market news and movements in mind, I am currently in the market neutral camp as we continue to trade on the downside, particularly with recession odds increasing. The ongoing risk in the market is the likelihood that interest rates remain higher for longer, putting additional pressure on economic growth, while unemployment is also ticking upward. Although there may be potential for a SPY rally to reach the $500–580 levels, the near-term support for shorts is likely to be between $500–530 over the next few months. Given these factors, I expect the market to continue trading downward in the short term, with the long-term trend remaining under pressure. For reference, the SPY Seasonal Chart is shown below:

Looking ahead, market participants remain on edge as they brace for more economic data and earnings reports. The risk of a prolonged trade war, combined with rising recession odds and political uncertainty surrounding the Fed, suggests that the market will continue to trade cautiously in the short term. The long-term outlook, however, remains under pressure, with investors keeping a close eye on key support levels for the S&P 500 and other major indices.

As we move toward the close of the week, the market remains in a fragile state, shaped by a complex mix of trade tensions, political uncertainty, and mixed corporate earnings. The VIX continues to signal heightened fear, and volatility is expected to persist as investors digest further economic data and earnings results. While the market may experience short-term rallies, the long-term trend remains under pressure, with risks tied to ongoing tariff concerns, Federal Reserve policy, and a potential recession weighing heavily on investor sentiment. As always, caution remains the watchword as market participants navigate these turbulent waters.

In this complex environment, a well-balanced and diversified strategy is essential. Agility is your advantage—capitalize on emerging opportunities while protecting against potential risks. Staying informed during earnings season and as macroeconomic conditions unfold will help you make timely, well-informed decisions.

While market challenges persist, ample opportunities for growth and strategic positioning remain. By focusing on key indicators and maintaining discipline, you can confidently navigate the market and position yourself for success.

Step into the future of investing with RoboInvestor—your AI-powered advisory service designed to pinpoint high-profit opportunities in today’s dynamic market. Our advanced technology cuts through the noise, providing clear, data-driven insights and strategies. Say goodbye to emotional bias and hello to precision in every trade.

Every other weekend, you’ll receive our exclusive newsletter featuring my latest market analysis, technical outlooks, updates on existing positions, and fresh trade recommendations to act on when the market opens on Monday.

Whether it’s blue-chip stocks, ETFs, commodities, or even inverse ETFs, RoboInvestor offers a flexible approach tailored to current market conditions. With a model portfolio holding 12 to 25 positions, we’ve recently adopted a more selective strategy, focusing on the best opportunities for growth while remaining cautious.

Join us and take advantage of advanced AI technology to guide your investments with precision and confidence.

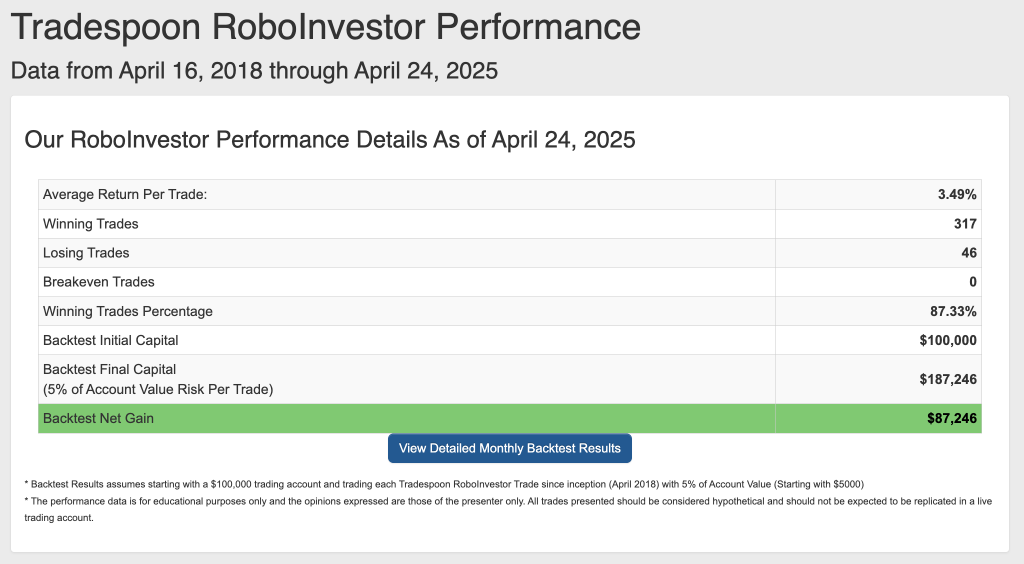

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.33% going back to April 2018.

As we enter Q2 of 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!