The Nasdaq Composite and S&P 500 tumbled on Monday as the rise of a Chinese artificial intelligence start-up, DeepSeek, sent ripples through Wall Street, shaking confidence in the sustainability of the recent AI-driven stock rally. Meanwhile, the Dow Jones Industrial Average managed to weather the storm, closing up 0.7%, buoyed by its relatively low exposure to the AI sector.

The tech-heavy Nasdaq fell 3.1%, its steepest drop in weeks, while the S&P 500 declined 1.5%. Despite the S&P’s overall dip, a majority of its components managed to gain ground, leaving its tech and utilities sectors as the primary drags. The Dow, often regarded as a bastion of stability, briefly turned positive during Monday’s session before retreating slightly. Its final 290-point gain highlighted its insulation from the tech-heavy AI trade.

A significant factor in the downturn was Nvidia, a linchpin in the AI rally, which dropped 13%, wiping out 112 points from the Dow. Microsoft, down 2.8%, and Caterpillar, which fell sharply on broader industrial weakness, also weighed on the index.

DeepSeek, a Chinese AI company, stunned the tech world after its open-source large language model climbed to the top of the Apple App Store. The model, which rivals Microsoft-backed OpenAI’s ChatGPT, boasts efficiency in both energy and cost, forcing investors to reevaluate the growth potential of U.S.-dominated AI markets. Chipmakers like Nvidia and software firms tied to AI infrastructure saw sharp selloffs as traders began questioning the overblown expectations for growth in the sector.

Chip stocks bore the brunt of the selloff, with Nvidia’s decline mirrored across the sector. Dutch chipmaker ASML fell 7.4%, while Broadcom and Marvell Technology posted declines of 19% and 18%, respectively. Analysts noted that Wall Street is reassessing the global AI race, particularly as DeepSeek’s emergence challenges the presumed dominance of U.S. companies like Nvidia and Microsoft.

The ripple effects extended beyond technology. Semiconductor-dependent energy companies and utilities also fell, with Wall Street recalibrating assumptions about the compute power and energy demands of AI applications.

Earnings season continued to dominate the narrative, with corporate results delivering mixed outcomes. AT&T posted better-than-expected fourth-quarter earnings, rising 6.8% as the company added profitable 5G and fiber subscribers. SoFi Technologies, however, fell 12% despite beating revenue and adjusted earnings estimates, as its guidance disappointed investors.

United States Steel edged 1.2% lower after reports suggested activist investor Ancora Holdings is preparing a proxy battle to prevent a merger with Japan’s Nippon Steel and push for CEO David Burritt’s ouster.

Tesla, a bellwether for innovation, fell 2.8% ahead of its highly anticipated earnings release on Wednesday. Investors are eyeing margin trends closely, with expectations for operating profit margins of 10.5%, up from 8% a year earlier.

This week’s earnings calendar features tech heavyweights Microsoft, Meta Platforms, Apple, and Tesla, whose combined market capitalization represents a significant portion of broader indices. Their results are expected to play a pivotal role in determining the market’s trajectory.

Key economic data, including U.S. GDP growth and inflation metrics from Japan and the Eurozone, will provide additional clarity on global macroeconomic trends. The Federal Reserve’s upcoming rate decision looms large, with its implications for the market’s long-term trajectory and ongoing volatility in the 10-year Treasury yield, which remains range-bound between 3.6% and 4.8%.

Last week, earnings season injected fresh momentum into equities. Netflix’s record subscriber growth and Oracle’s strong revenue tied to generative AI adoption were key highlights. However, DeepSeek’s rise has cast a shadow over the AI trade, with Wall Street questioning whether sky-high valuations for U.S. tech firms are sustainable.

While some investors see DeepSeek’s ascent as a wake-up call, others view it as an opportunity for global collaboration in AI development. Nevertheless, the selloff in AI-linked stocks underscores the market’s fragility amid changing narratives.

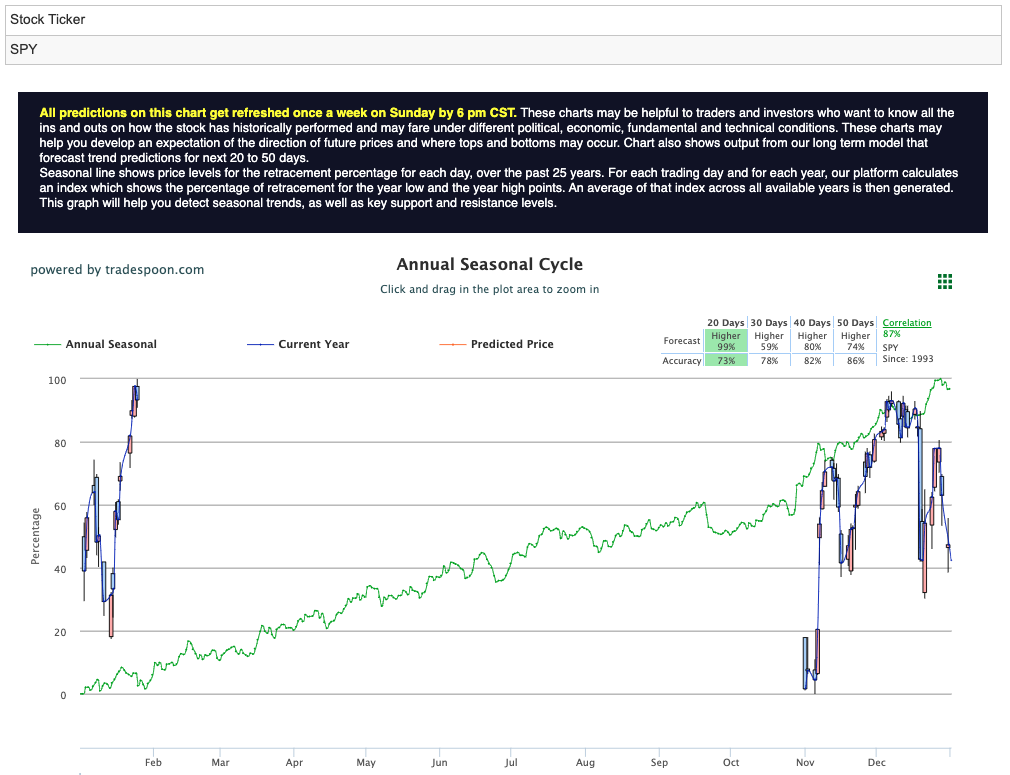

Amid the turbulence, a market-neutral sentiment prevails. The S&P 500’s rally remains intact, with potential upside targets of $620–$640 in the coming months, though short-term support at $560–$580 will be closely watched. For reference, the SPY Seasonal Chart is shown below:

The risk of higher-for-longer interest rates and a ticking-up unemployment rate remain significant headwinds. However, with inflation moderating and earnings season delivering better-than-expected results, the market appears poised to trade sideways in the near term while maintaining its long-term bullish trend.

As the market recalibrates to shifting economic dynamics and evolving AI narratives, investors are advised to remain cautious, focusing on diversified portfolios and staying attuned to upcoming data releases and earnings reports.

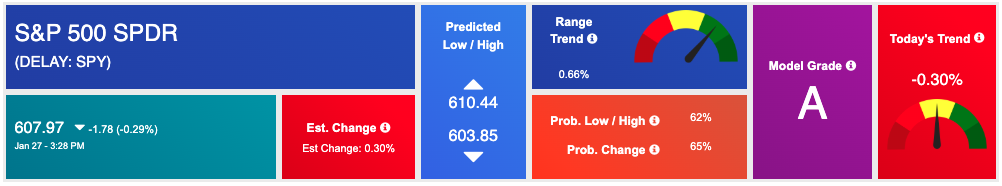

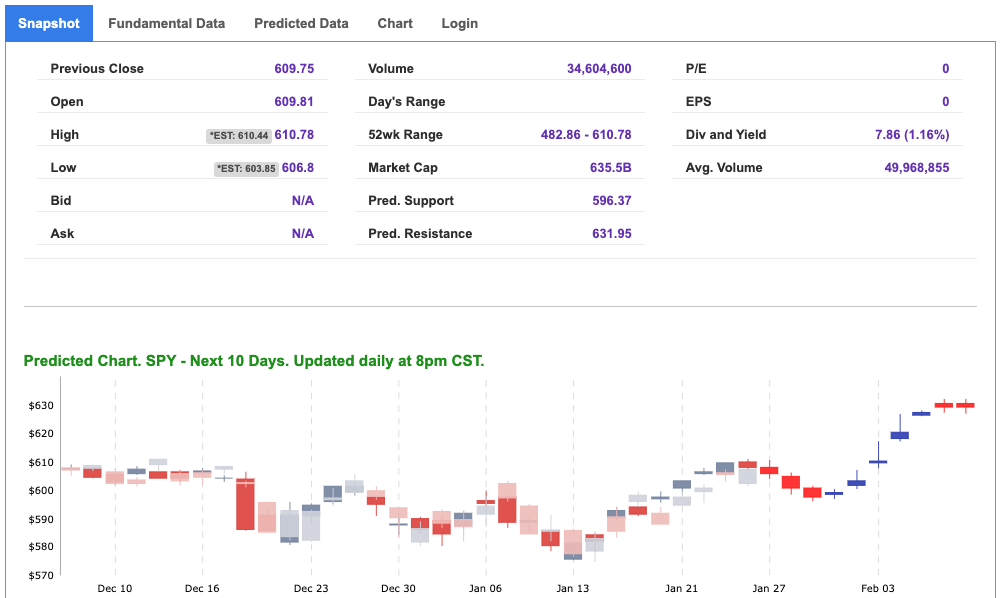

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

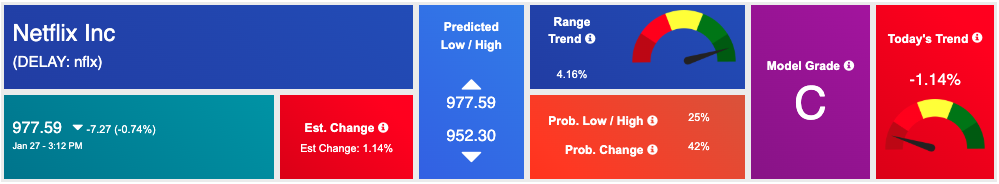

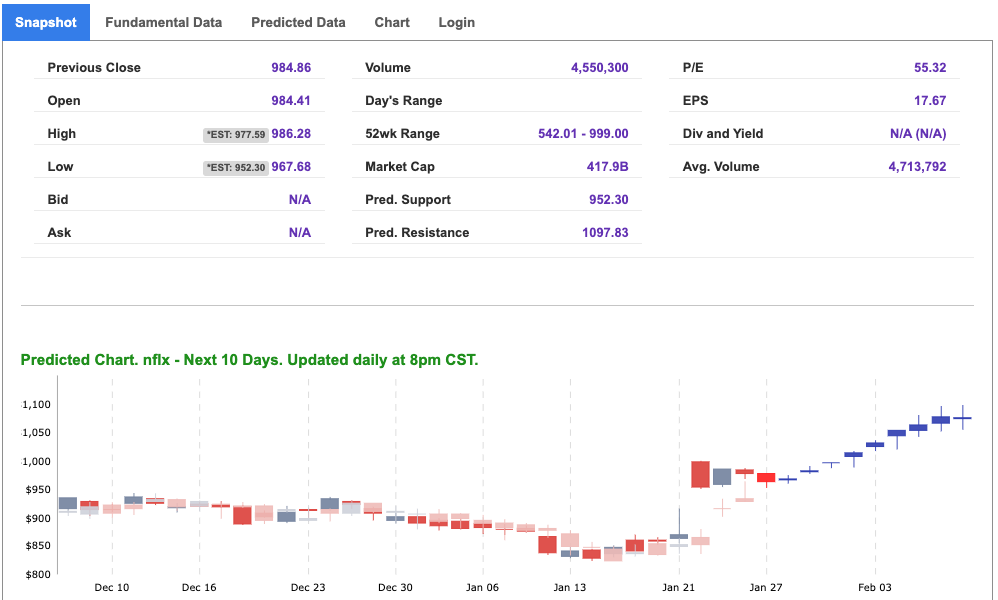

Our featured symbol for Tuesday is Netflix Inc. – NFLX is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $977.59 with a vector of -1.14% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, NFLX. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

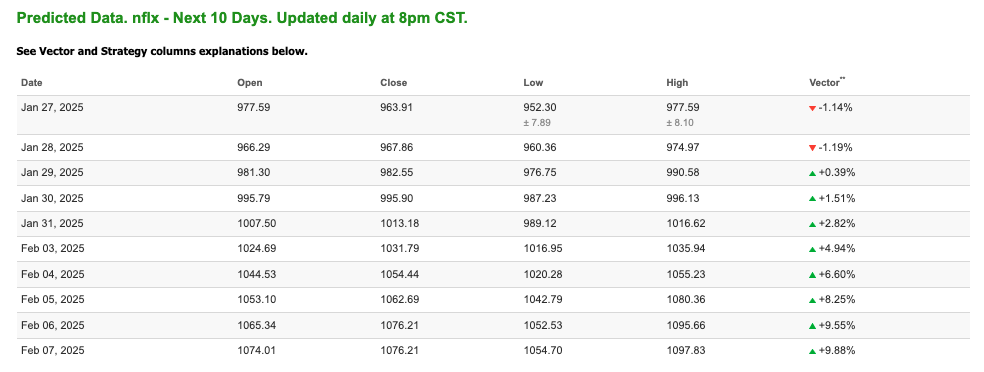

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $73.09 per barrel, down 2.10%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $79.6 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

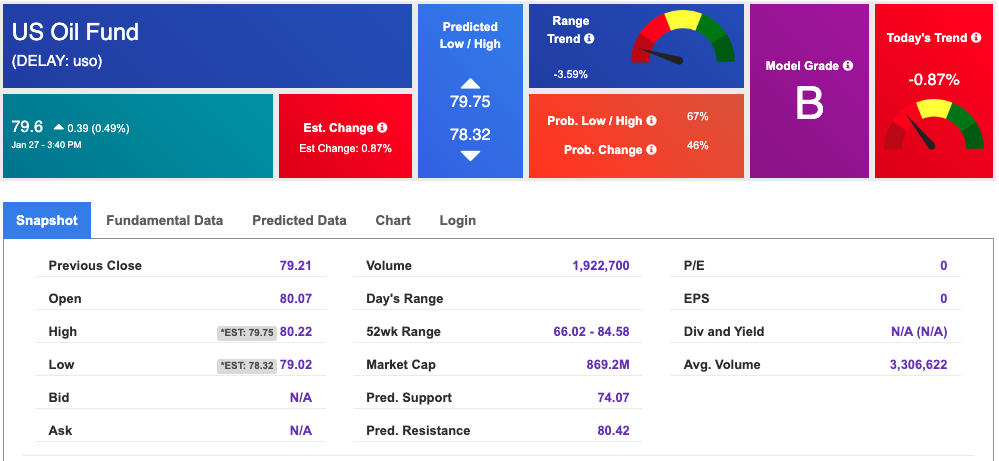

The price for the Gold Continuous Contract (GC00) is down 1.23% at $2,744.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $255.65 at the time of publication. Vector signals show +0.13% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

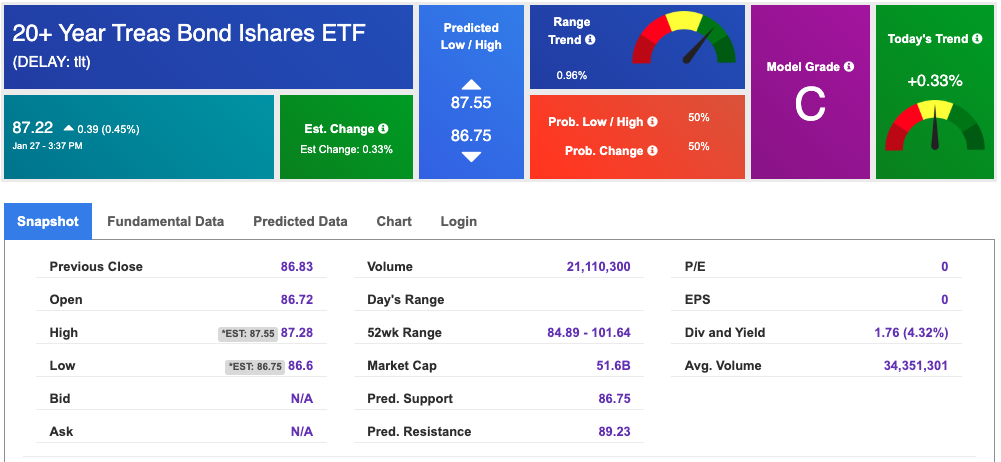

The yield on the 10-year Treasury note is down at 4.539% at the time of publication.

The yield on the 30-year Treasury note is down at 4.774% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

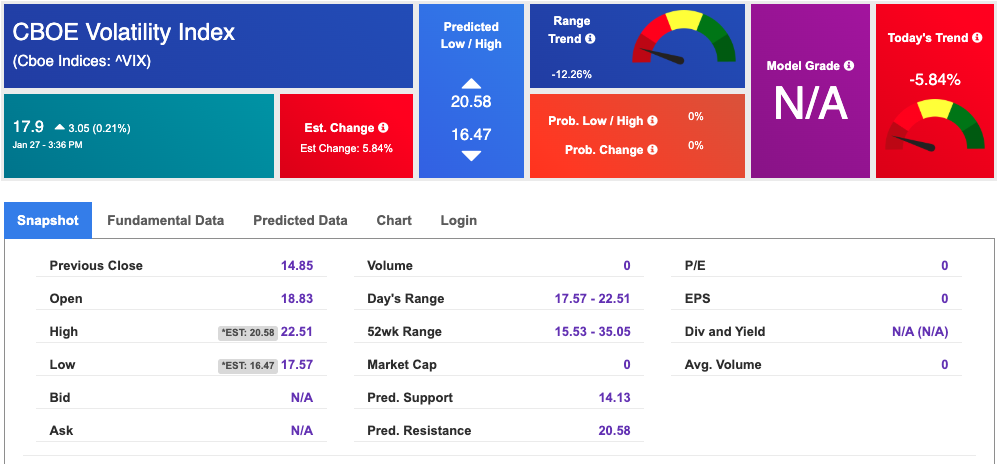

The CBOE Volatility Index (^VIX) is priced at $17.9 up 0.21% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!