As the third-quarter earnings season draws to a close, all eyes are on Nvidia, poised to deliver its much-anticipated report on Wednesday. The AI chipmaker has become a key barometer for the tech and semiconductor sectors, with its performance likely to ripple across broader market sentiment. Meanwhile, the week opened with modest gains, as Wall Street absorbed a blend of economic signals and political developments tied to President-elect Donald Trump’s transition into office.

Last week’s market activity painted a tale of two halves. The S&P 500 began on a high note, hitting new records on enthusiasm for pro-business policies, including tax cuts and deregulation. Domestic sectors such as financials, industrials, and small caps benefited most, as investors leaned into cyclical stocks expected to thrive in a growth-focused policy environment. However, the optimism waned midweek as Federal Reserve Chair Jerome Powell tempered expectations for imminent interest rate cuts. His comments, combined with inflation data showing an uptick, shifted market dynamics, leading to a sell-off by Friday. The Nasdaq Composite bore the brunt, plunging 2.2%, while rising Treasury yields added to the unease, with the 10-year yield climbing to a four-month high of 4.4%.

The market now reflects a precarious balance between optimism and caution, a theme expected to persist. Inflation data offered further insight into the Federal Reserve’s stance. The Consumer Price Index (CPI) revealed a 2.6% annual increase, slightly above September’s figure, while core inflation—excluding food and energy—remained steady at 3.3% for the third consecutive month. These figures suggest that while inflation has moderated, it remains above the Fed’s 2% target. Similarly, the Producer Price Index (PPI) highlighted persistent but controlled inflation, with headline PPI rising 2.4% year-over-year. Core PPI ticked upward monthly, reinforcing the sticky nature of price pressures despite modest declines in food and energy costs.

Together, the data underscores a complex inflationary environment, one that supports the Federal Reserve’s cautious approach. While runaway inflation appears contained, elevated prices keep aggressive rate cuts off the table for now.

This week’s corporate earnings are set to provide a critical gauge of economic health. Nvidia’s results on Wednesday could be a defining moment for the tech sector, particularly for AI and semiconductor stocks. As growth stocks remain highly sensitive to macroeconomic shifts, Nvidia’s performance could steer sentiment for months to come.

Retailers are also stepping into the spotlight, with Walmart, Lowe’s, and Target scheduled to report. Their earnings will offer insights into consumer behavior, supply chain adaptability, and the broader economic landscape as the pivotal holiday shopping season approaches.

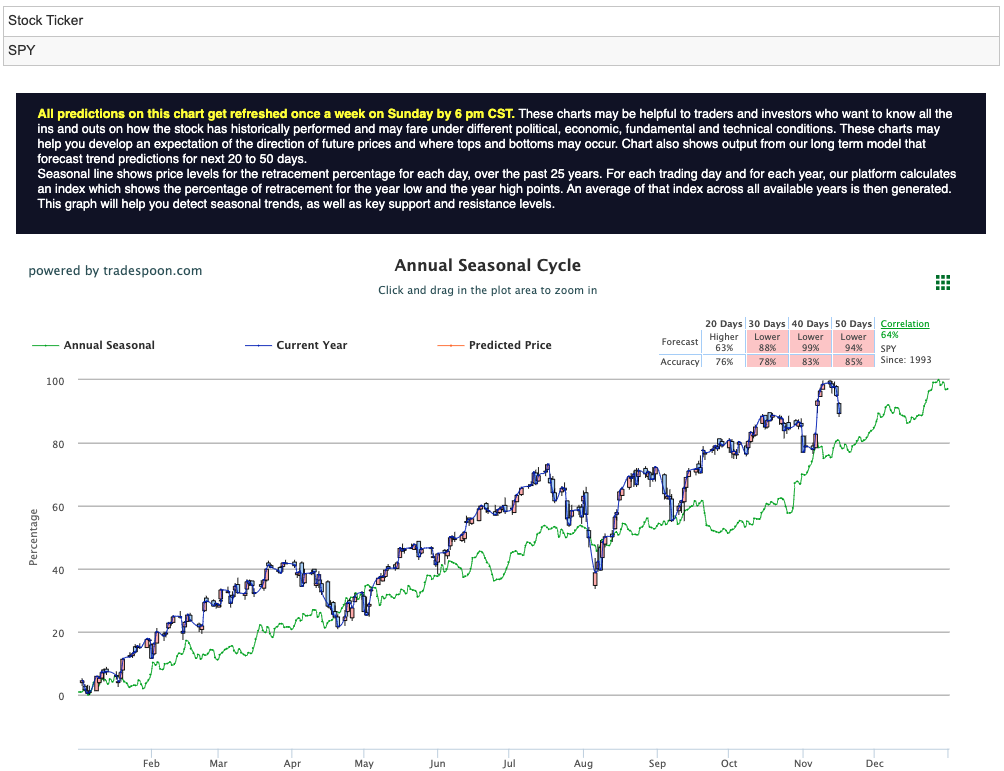

Technically, the SPY appears positioned for further upside, with targets in the $600–$610 range. Short-term support at $540–$550 provides a buffer for any near-term volatility as markets juggle optimism and caution. For reference, the SPY Seasonal Chart is shown below:

The intersection of earnings, inflation, and Federal Reserve policy will shape the market’s trajectory in the weeks ahead. Nvidia’s performance, coupled with retail earnings, could provide clarity on sector resilience. While bullish momentum persists, sustaining this rally will require a careful balance between hopes for growth and persistent economic risks.

As the year winds down, investors face a pivotal moment. Nvidia’s report and retail earnings could either bolster the current rally or allow inflation concerns to cast a longer shadow. The coming days will reveal whether markets can maintain their upward momentum or pivot toward caution in the face of lingering challenges.

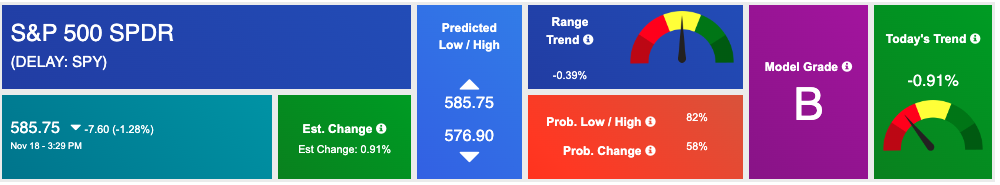

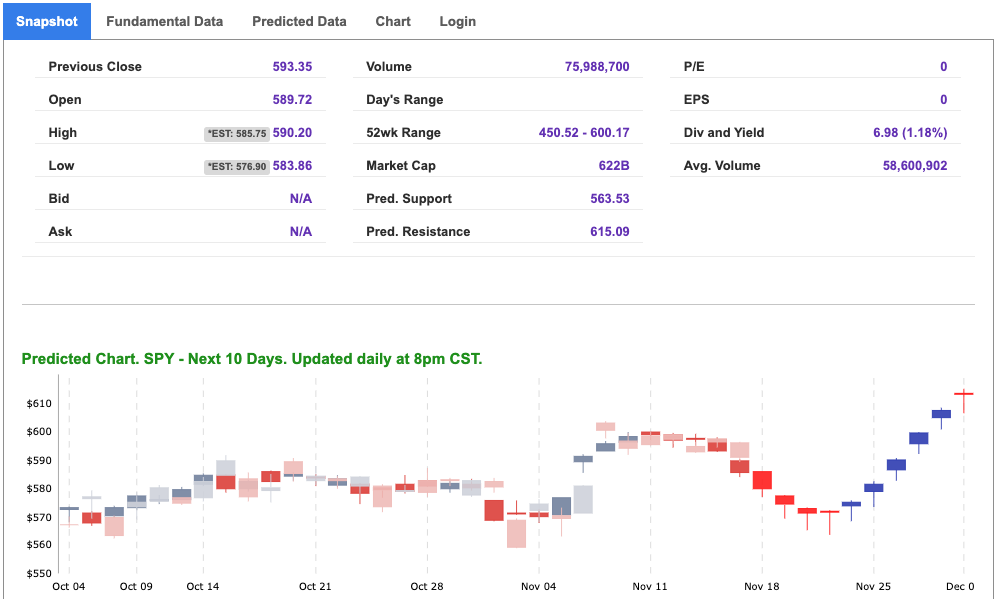

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

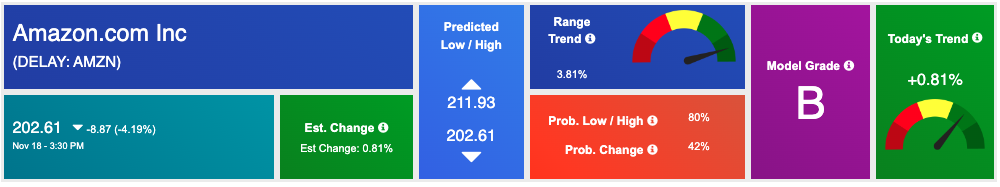

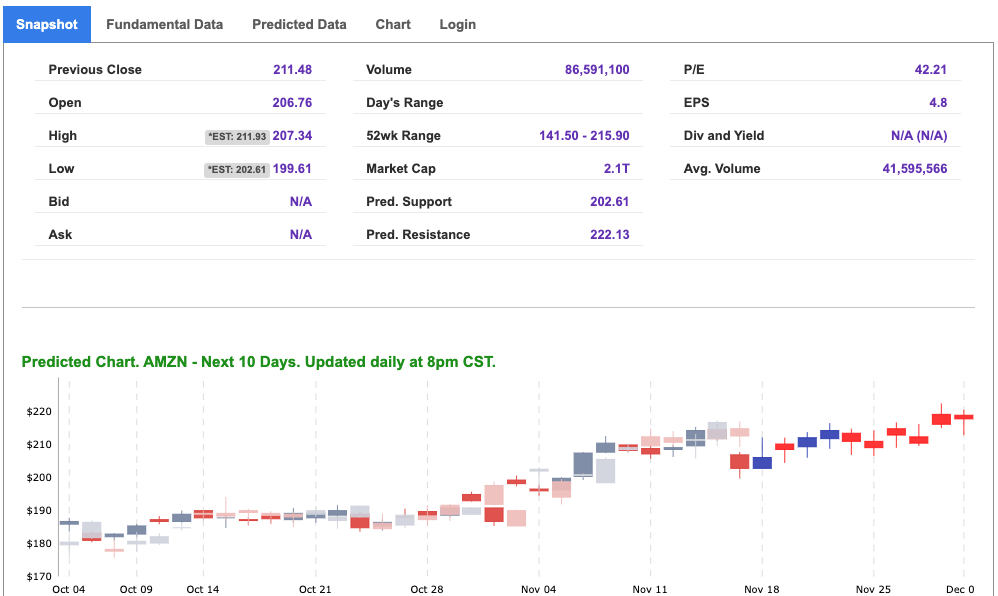

Our featured symbol for Tuesday is Amazon.com Inc. – AMZN is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $202.61 with a vector of +0.81% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, AMZN. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

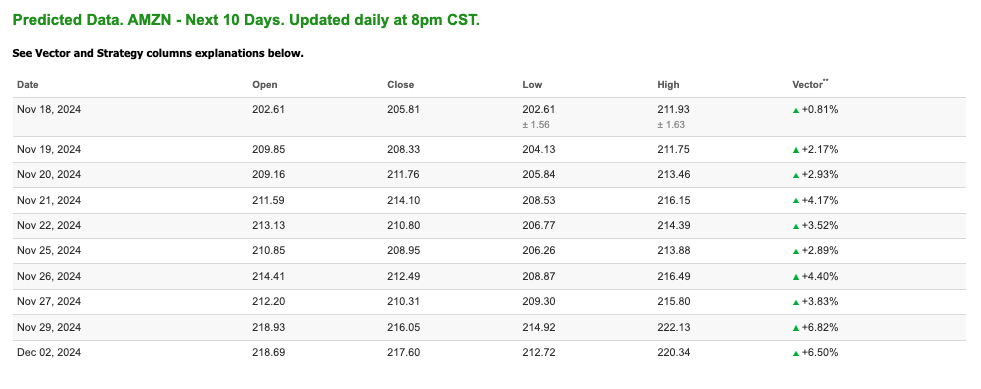

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $69.20 per barrel, up 3.25%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $69.75 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

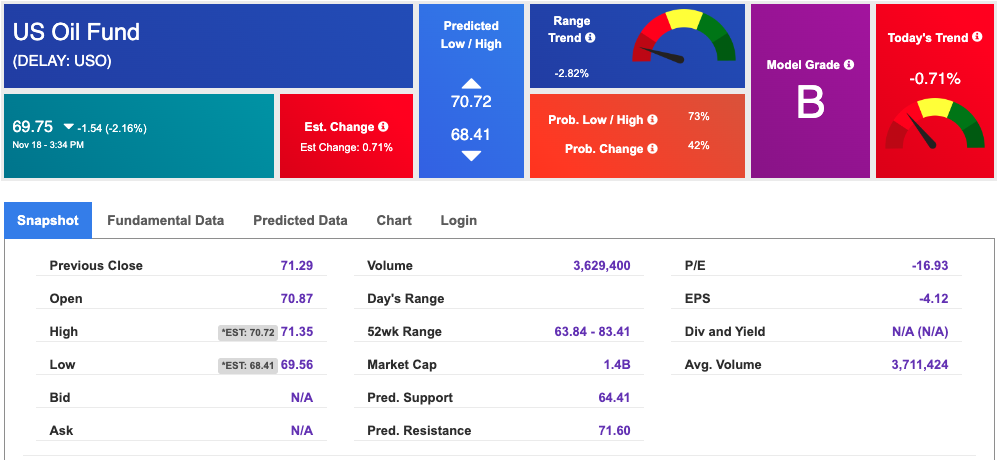

The price for the Gold Continuous Contract (GC00) is up 1.79% at $2,616.00 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $236.59 at the time of publication. Vector signals show -0.86% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

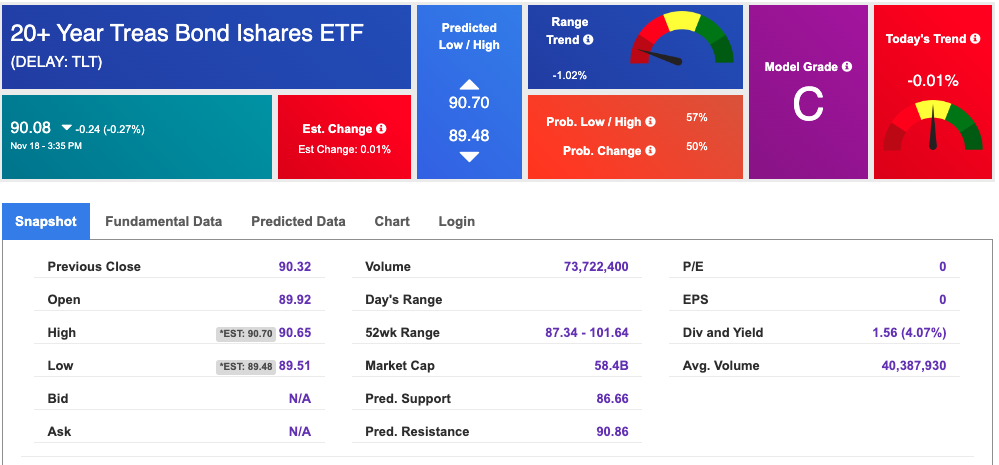

The yield on the 10-year Treasury note is down at 4.417% at the time of publication.

The yield on the 30-year Treasury note is down at 4.611% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

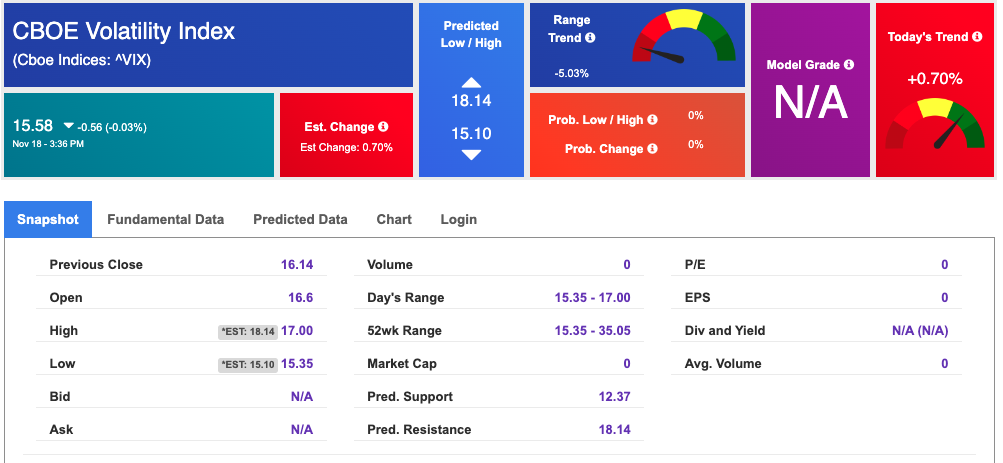

The CBOE Volatility Index (^VIX) is priced at $15.58 down 0.70% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!