Thursday’s market session saw mixed results, with the S&P 500 and Dow Jones Industrial Average closing in negative territory, while the Nasdaq managed to eke out a small gain. Tech stocks, particularly the “Magnificent 7” mega-cap companies, were the driving force behind the Nasdaq’s resilience. While broader sectors stumbled, these tech giants provided a much-needed boost, reflecting their continued strength in an otherwise shaky market. Tesla led the charge with a 4.7% rise, followed by Amazon’s 2% gain.

Despite this, investors were left to digest a range of conflicting economic data. August’s private payroll numbers fell significantly short of economists’ estimates, raising concerns about a slowdown in the labor market. In contrast, weekly jobless claims showed improvement, which added to the uncertainty. The market’s attention, however, is squarely on the upcoming August jobs report from the Labor Department, set to be released Friday morning. This report is expected to be a pivotal moment for the markets, potentially offering clues on whether the U.S. economy is on track for a soft landing or faces a more severe downturn.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The stock market’s struggles this week began with a steep selloff as September kicked off, fulfilling the month’s notorious reputation for volatility. Historically, September has been the worst month of the year for equities, and the weak data from the U.S. manufacturing sector added to investor anxiety. This sector, a critical driver of economic activity, showed continued weakness in August, which helped to fuel market fears.

The CBOE Volatility Index (VIX), often referred to as Wall Street’s “fear gauge,” jumped by more than 34% during afternoon trading earlier in the week, underscoring the growing concern among market participants. The latest report from the Institute for Supply Management (ISM) also stoked worries, as weak manufacturing data raised questions about the sustainability of economic growth.

Thursday brought a mix of economic data releases that only added to market uncertainty. The ADP private payroll report missed estimates by a significant margin, reflecting weakness in the job market. However, initial jobless claims declined, offering a glimmer of optimism. The ISM’s services industry survey came in higher than expected, signaling continued strength in that sector, further muddying the waters for investors trying to gauge the broader economic outlook.

Despite most sectors experiencing a selloff, tech stocks were a notable exception. Six of the “Magnificent 7” companies were up, led by Tesla’s 4.7% jump and Amazon’s 2% rise. Apple climbed 0.9%, while Nvidia gained 0.6%. Meta Platforms and Alphabet also saw modest gains. The only outlier was Microsoft, which fell by 0.5%.

The anticipation ahead of Friday’s jobs report has left Wall Street in a holding pattern. The July nonfarm payrolls report, which missed expectations, sparked a major selloff on August 5, so investors are particularly anxious to see whether August’s data will point to a continued slowdown or a rebound in job growth.

Volatility has surged, with the VIX back above 22, reflecting renewed fears of an economic downturn. Weaker-than-expected economic data this week has reignited concerns about the pace of the Federal Reserve’s interest rate hikes and their impact on growth. The bond market is flashing warning signs as well, with yields on the 10-year Treasury note fluctuating between 3.6% and 4.4%, contributing to the market’s sense of instability.

Globally, the picture is also troubling. The Japanese yen is approaching multi-year highs, and the Nikkei is continuing to slide. Bitcoin is trading near recent lows, further signaling that investors are moving away from riskier assets as concerns mount.

Gold (GLD) has hit new all-time highs, driven by a weak U.S. dollar and rising concerns about the global economy. As investors flock to safe-haven assets, the bond market is showing increasing signs of distress. The volatility in Treasuries suggests that market participants are nervous about the potential for a recession and are bracing for a turbulent road ahead.

The bond market’s wild swings reflect growing uncertainty about the timing and scope of future interest rate cuts by the Federal Reserve. While there is hope for rate reductions, the market remains deeply uncertain about when they will materialize and how aggressive the Fed will be in easing monetary policy.

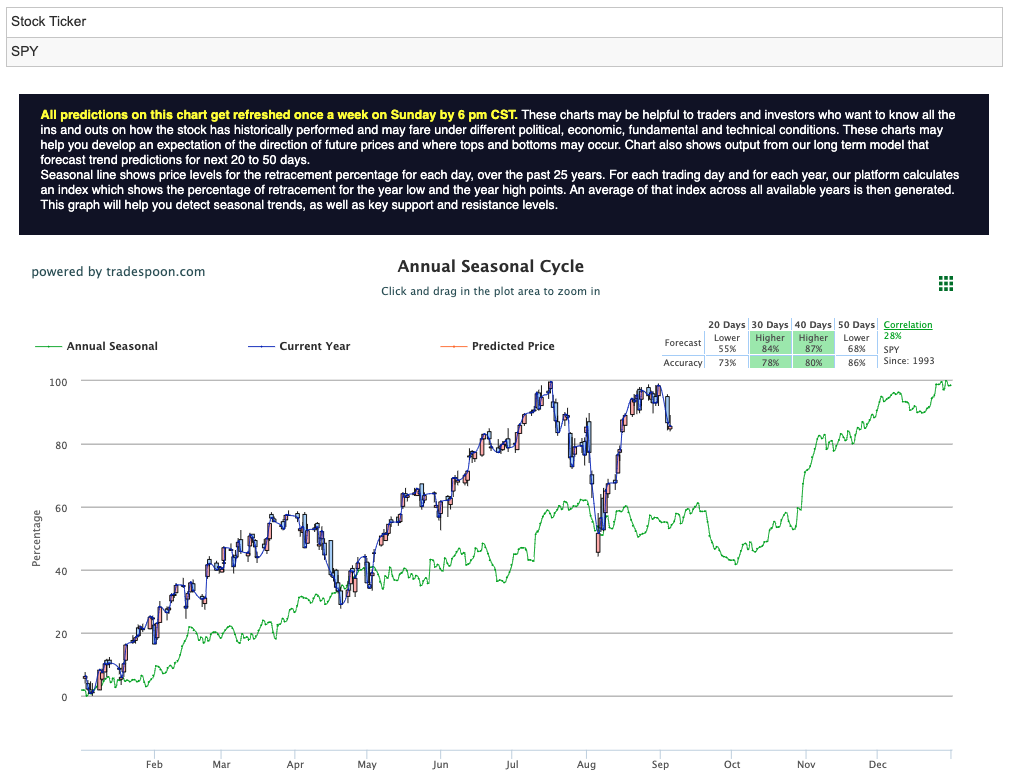

The S&P 500’s rally has been capped at the 560–575 range, with support levels in the 480–510 area expected to hold over the coming months. Although the long-term trend remains intact, the short-term picture is one of caution. The upcoming August jobs report, coupled with ongoing inflation data, will be critical in shaping market sentiment in the weeks ahead. For reference, the SPY Seasonal Chart is shown below:

The risks of a hard landing, driven by inflation concerns and a slowing economy, appear to be mounting. While some market participants are holding out hope for future interest rate cuts, the bears currently have the upper hand as fears of an economic slowdown dominate.

The ongoing market correction is likely not over, and investors would be wise to avoid chasing any short-term rebounds. While tech stocks have shown resilience, the overall market outlook remains uncertain in both the short and medium term. Maintaining a market-neutral stance appears prudent for now, as risks of further downside remain.

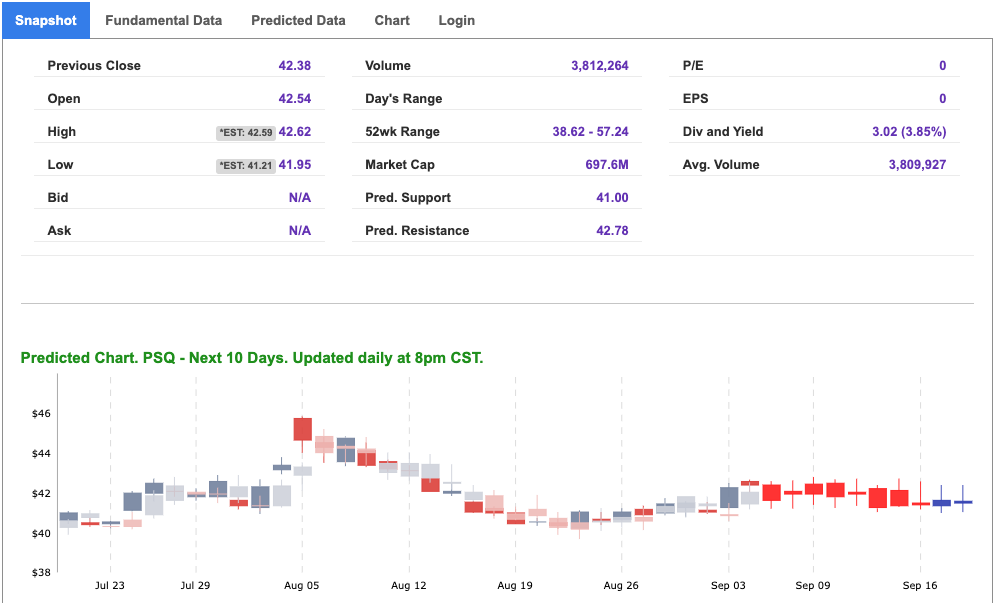

As market uncertainty continues to rise, the ProShares Short QQQ ETF (PSQ) becomes a compelling symbol of interest for the upcoming week. PSQ is an inverse ETF designed to deliver the opposite daily performance of the Nasdaq-100 Index, making it an effective tool for investors seeking to hedge against potential declines in the tech-heavy market.

Given the current market conditions, PSQ appears particularly attractive. The recent spike in the CBOE Volatility Index (VIX) above 22 reflects growing market anxiety, and with many investors turning bearish, PSQ offers a timely opportunity to profit from—or protect against—further downturns in the Nasdaq-100. Despite the recent strength in tech stocks, including the “Magnificent 7,” broader economic concerns, such as weaker private payroll numbers and volatile global markets, suggest that tech may be vulnerable to sharper corrections, especially if the highly anticipated August jobs report signals deeper economic troubles.

Tech stocks, though recently resilient, are also at risk due to uncertainty around future interest rate hikes. Bond market fluctuations, particularly in 10-year Treasury yields, indicate that investors are uncertain about the Federal Reserve’s next steps. Should the market begin to price in higher rates or slow economic growth, tech stocks could face significant headwinds. PSQ provides a strategic hedge in such a scenario, offering a way to benefit from declines in the Nasdaq-100.

As the broader market continues to struggle—driven by weak manufacturing data and broader selloffs—PSQ serves as a defensive option for investors. If the market correction extends further, PSQ could prove to be a strong short-term buy for those looking to protect their portfolios or capitalize on a potential downturn in tech-heavy stocks.

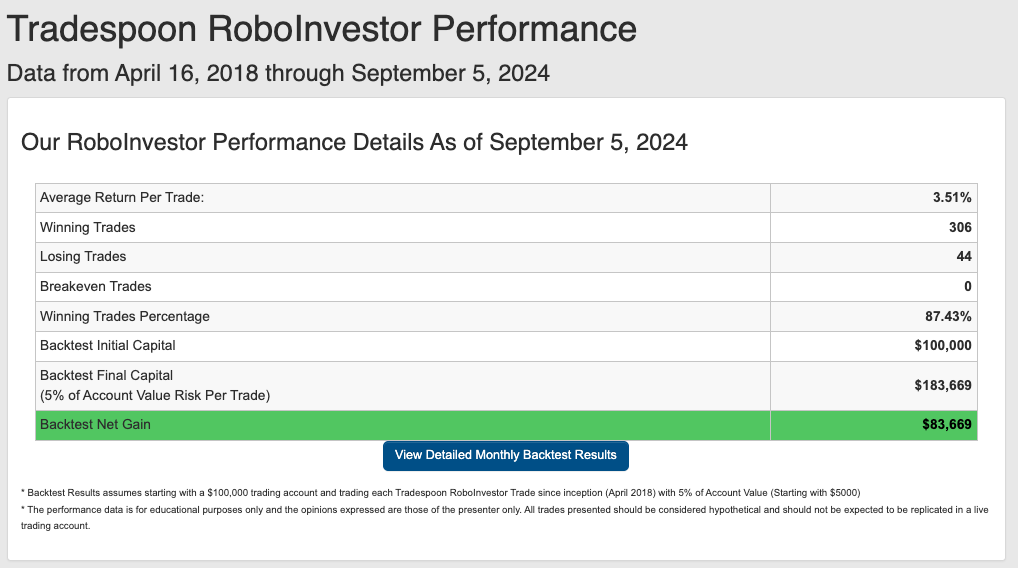

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.43% going back to April 2018.

As we advance toward the back end of 2024, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and navigating the fluctuating market conditions effectively.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!