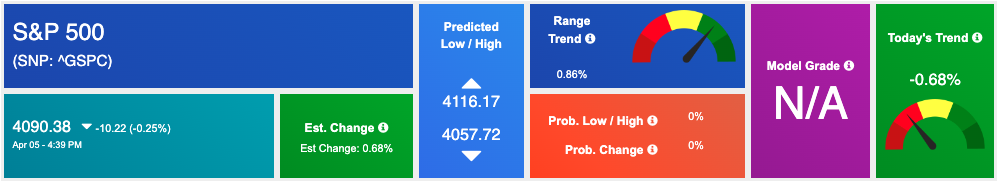

U.S. stocks experienced a sell-off on Wednesday, with the Dow Jones Industrial Average dropping 38 points, while the S&P 500 and Nasdaq Composite fell by 0.4% and 0.9%, respectively. These indexes had all started the day in positive territory, but the news of rising consumer prices put a dampener on investor confidence. Earnings season kicks off on Friday with major banks releasing data.

However, there was some good news to be found in the Consumer Price Index (CPI) report, as the 5% year-over-year gain in March came in slightly below estimates of 5.2%. This was also a slowdown from the 6% result in February. The core CPI, which excludes volatile food and energy prices, rose by 5.6%. The cooling of inflation has led to increased confidence that the Federal Reserve may soon pause its rate-hiking campaign. Still, the flip side of falling inflation and interest rates is a weakening of economic demand, which the Fed highlighted in its meeting minutes released later in the day. The possibility of a recession this year has caused concern among investors and has contributed to the stock market’s struggles.

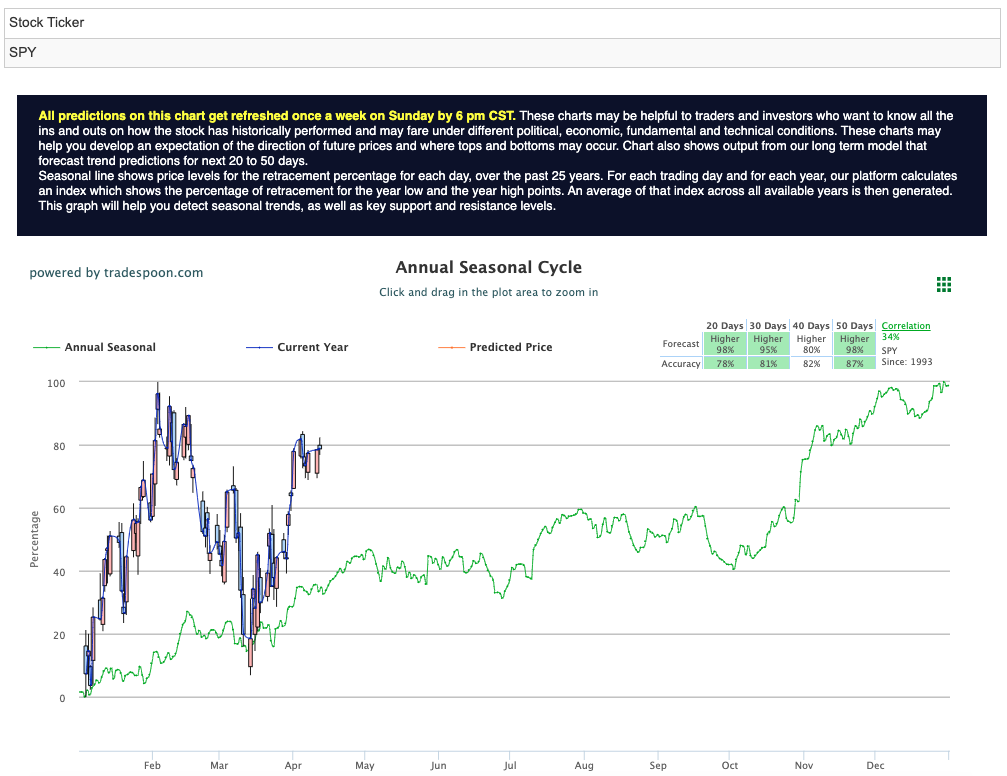

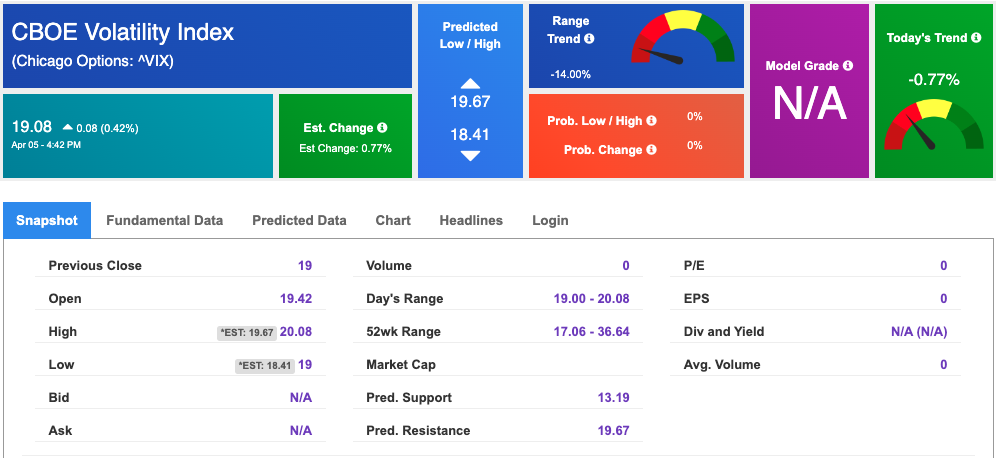

The VIX is trading near the $19 level, and upcoming earnings reports from companies such as JPMorgan, Delta Air Lines, and UnitedHealth Group, as well as retail and PPI data, could influence the market’s next move. Currently, the overhead resistance levels in the SPY are at $412 and then $418, with support at $406 and then $402. It is expected that the market will trade sideways for the next two to eight weeks, leading many to adopt a market-neutral stance and hedge their positions. Market commentary readers should maintain clearly defined stop levels for all positions. For reference, the SPY Seasonal Chart is shown below:

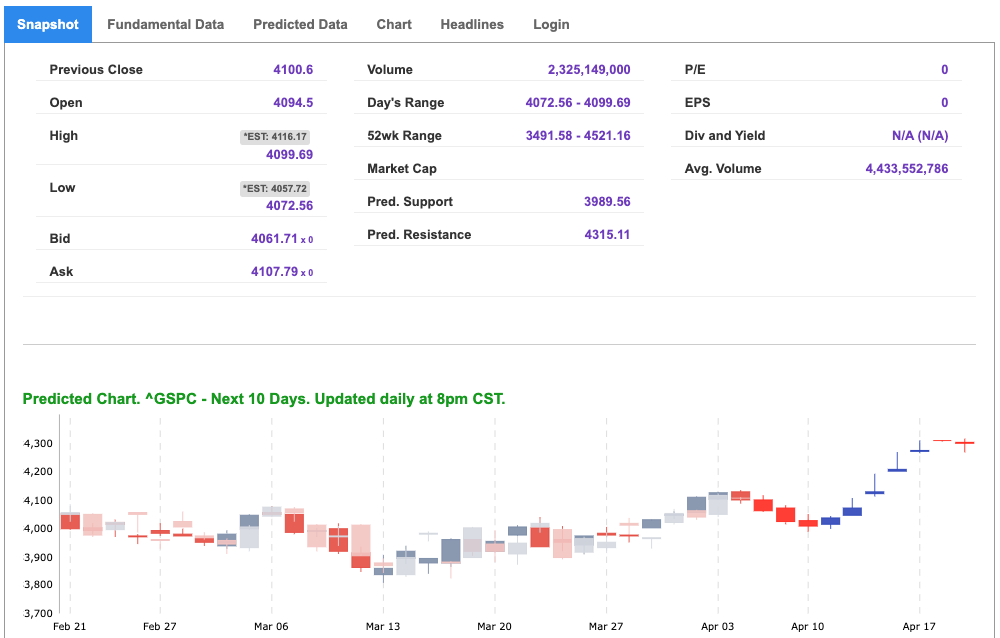

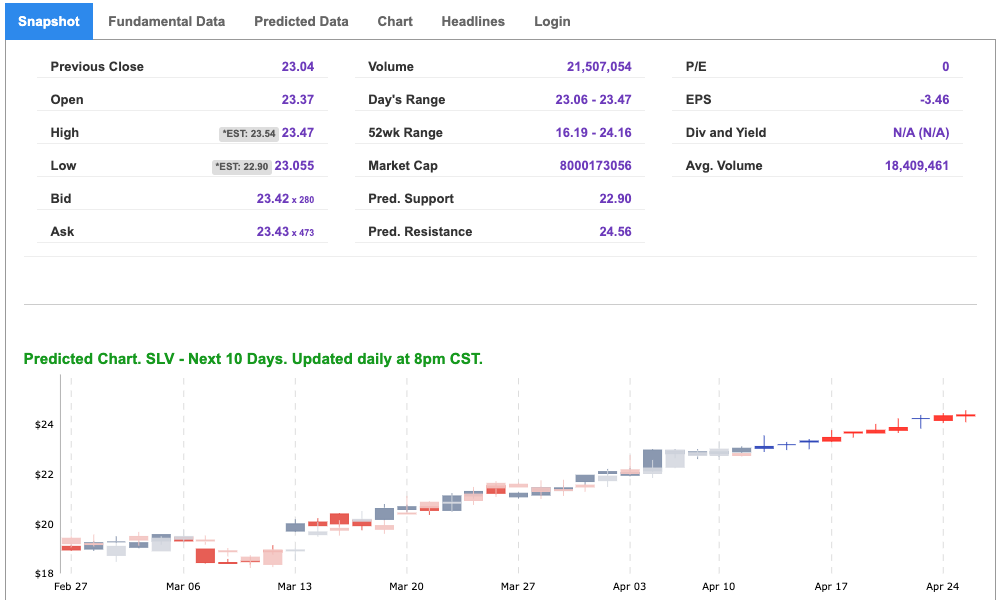

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

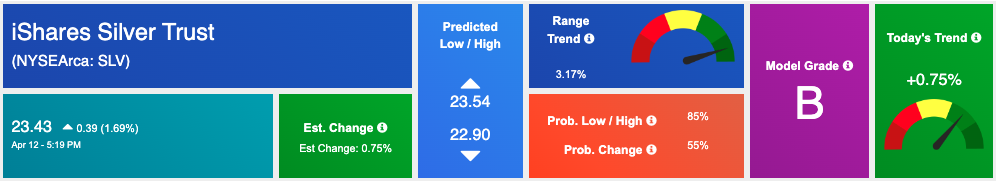

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, SLV. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

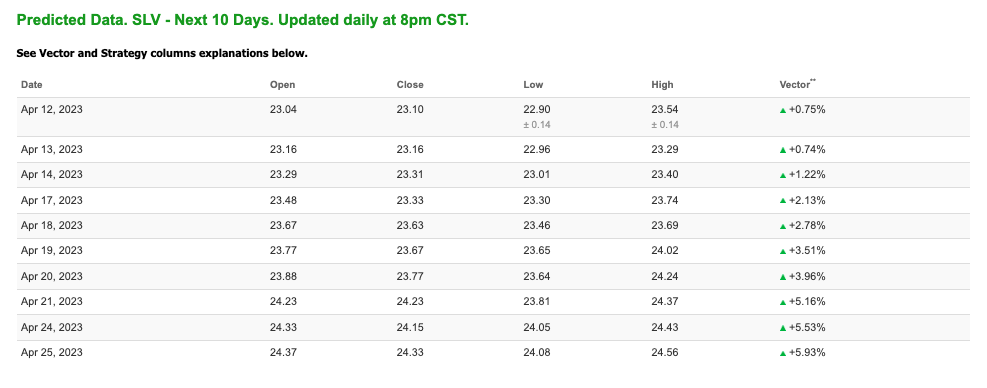

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $83.08 per barrel, down 0.22%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $70.24 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

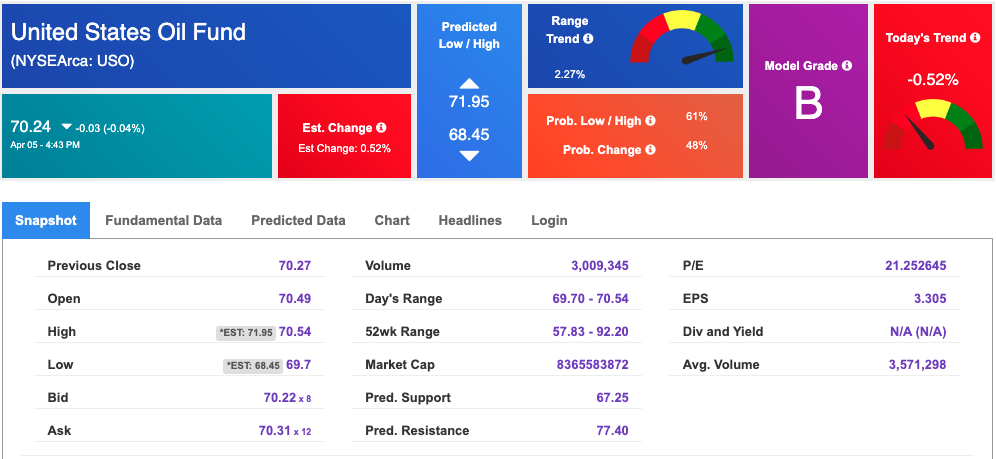

The price for the Gold Continuous Contract (GC00) is up 0.19% at $2028.70 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $187.83 at the time of publication. Vector signals show -0.14% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

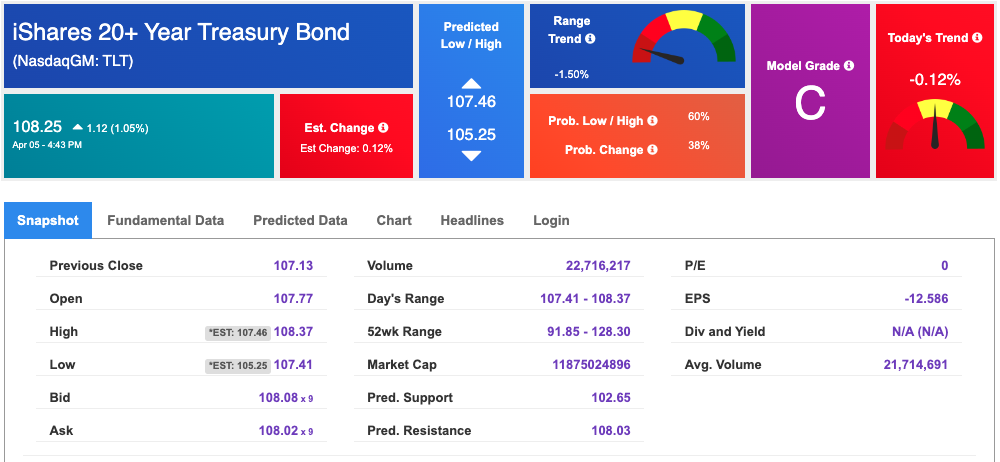

The yield on the 10-year Treasury note is down at 3.401% at the time of publication.

The yield on the 30-year Treasury note is up at 3.629% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is $19.08 at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!