RoboStreet – November 14, 2024

The U.S. stock market saw strong movement over the past week, driven by the decisive U.S. election results, inflation updates, and anticipated Federal Reserve policy adjustments. With the political uncertainty resolved, investors rallied behind the market, pushing the S&P 500 up by 2.5% for the week. Confidence was further buoyed by potential pro-business policies, the prospect of a “soft landing” for the economy, and clear signals from the Federal Reserve, which held the possibility of additional rate cuts on the horizon.

Tax Cuts and Deregulation: Investors’ confidence in domestic sectors grew as the new administration promised tax cuts and deregulation, creating optimism for pro-business policies expected to enhance corporate profitability. Financial services, industrials, and small-cap stocks rallied on the potential for policies aimed at bolstering growth in domestic industries. Cyclical sectors, especially those sensitive to regulatory changes, experienced notable gains, with the financial sector showing strong upward momentum.

Debt and Inflation Concerns: While the tax cut promises were well-received, concerns emerged regarding their impact on the federal deficit. Prolonged tax relief could drive national debt higher, creating inflationary pressure. This sentiment was reflected in the bond market, where the 10-year Treasury yield spiked to a four-month high, fluctuating between 3.6% and 4.4%. Higher government debt and inflation risk could lead to rising interest rates, introducing an additional layer of volatility.

Federal Reserve Rate Adjustments: In a response to cooling inflation and stable growth indicators, the Federal Reserve cut interest rates for the second time this year, bringing the policy rate down to the 4.5%-4.75% range. Investors are now anticipating a measured rate-cutting cycle, with projections for three additional cuts by the end of next year. This dovish approach could support continued economic growth, particularly if inflation remains within manageable levels. While a full market correction seems unlikely, shallow pullbacks are expected, offering potential entry points for investors.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Inflation data took center stage this week, with the Consumer Price Index (CPI) and Producer Price Index (PPI) providing key insights into price trends and signaling the Federal Reserve’s likely course of action.

Consumer Price Index (CPI) Report: Released on Wednesday, the October CPI report showed headline inflation rising by 2.6% year-over-year, up slightly from September’s 2.4%. This figure, while slightly higher, fell within expected levels and signaled controlled but persistent inflationary pressure. Monthly data revealed a 0.2% rise in headline CPI, mirroring September’s monthly increase.

The core CPI, which excludes volatile food and energy prices, held steady at 3.3% year-over-year—a sign that inflation, while still above target, has stabilized in recent months. This metric is closely watched by the Fed as a gauge for underlying price trends. On a monthly basis, core CPI rose 0.3%, meeting economist forecasts. October marked the third consecutive month with core inflation steady at 0.3% month-over-month, indicating that while inflation has cooled from its peaks, it remains above the lower levels seen during the summer.

Producer Price Index (PPI) Report: On Thursday, the Bureau of Labor Statistics released the October PPI report, which further reinforced expectations of steady inflation. Headline PPI rose 0.2% from the previous month, a slight increase from September’s 0.1% but aligning with consensus expectations. Year-over-year, wholesale prices rose by 2.4%, an increase from September’s 1.9% rise, indicating some price pressures in the production pipeline.

Core PPI, which excludes food and energy, rose by 0.3% month-over-month, suggesting a stickier inflationary trend in the wholesale market. Food and energy prices in the PPI showed mixed signals, with food costs down by 0.2% in October, while energy costs fell by 0.3%. Year-over-year, food prices still rose by 2.7%, and energy costs declined 8.6%. The persistence of higher core PPI aligns with the broader trend of sustained price pressure in the economy, and while these inflationary indicators are cooling, the Fed’s target of 2% remains a distance away.

Broad Market Participation and Small-Caps Lead Gains: Small-cap stocks and financials led the charge this week, signaling renewed investor interest in sectors expected to benefit from the administration’s business-friendly policies. Small-cap companies rallied sharply, while other cyclical sectors, including industrials and energy, followed suit. This shift suggests that investors are favoring U.S.-based, smaller companies as the domestic economy shows resilience.

Tech Struggles Amid “Magnificent Seven” Underperformance:

While most sectors posted gains, some of the market’s largest technology companies—referred to as the “Magnificent Seven”—faced setbacks. Tesla and Alphabet were the only stocks in this group that saw gains, while Apple, Nvidia, Microsoft, Meta Platforms, and Amazon suffered losses of over 1% each. The iShares Semiconductor ETF also fell by 3.6%, reflecting a broader cooling in sentiment for chipmakers and other tech-based stocks.

Energy Sector Finds Stability Despite Oil Price Pressures:

Energy stocks demonstrated resilience despite oil prices trending downward. Brent crude prices fell 1.4% to $72.86 per barrel, while WTI crude dropped 1.6% to $69.26 per barrel. The stronger dollar, which rose 0.4% against a basket of currencies, was a contributing factor, as it made oil more expensive for foreign buyers. Sluggish demand growth in China added to the pressure on global oil prices. Despite these challenges, the sector remained stable as investors remained optimistic about oil companies’ profitability.

Bond Yields and Labor Market Stability:

The market’s positive momentum was tempered by high bond yields and a strong dollar, which weighed on commodities and raised the cost of imports for international buyers. Additionally, initial jobless claims came in lower than expected, at 217,000, indicating continued resilience in the labor market—a factor that could reinforce consumer spending strength moving into the final stretch of the year.

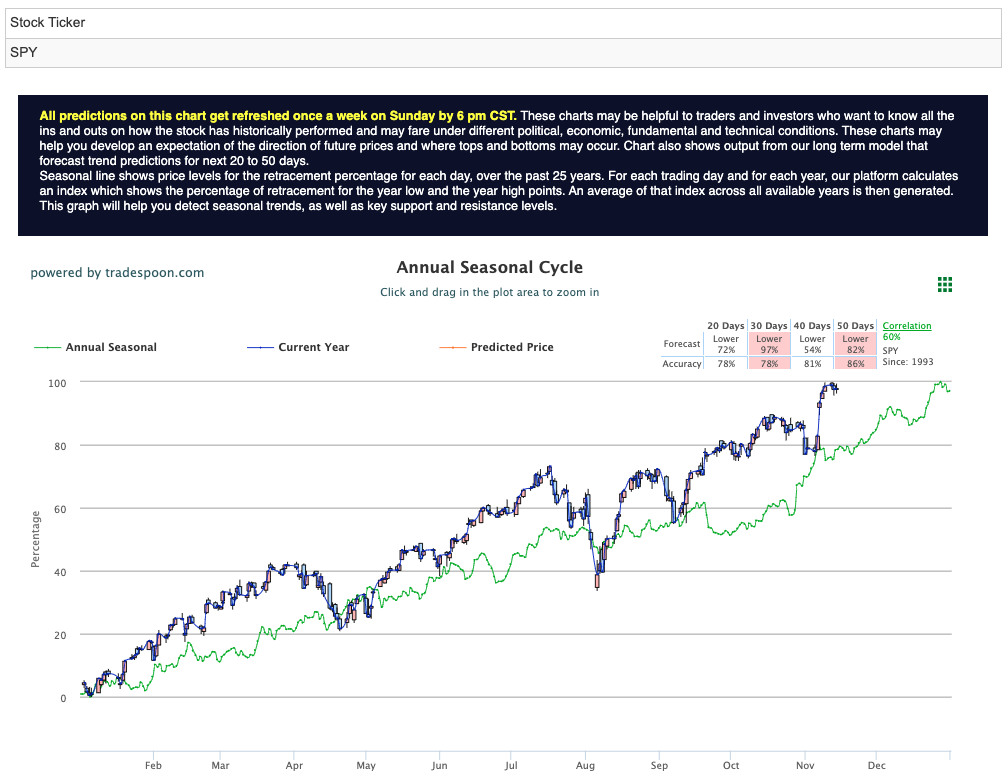

Outlook on S&P 500 and SPY Levels:

Analysts are optimistic that the S&P 500 could reach new highs, with a potential rally range of $600-$610 on the SPY. Short-term support levels are identified around $540-$550, offering attractive buying opportunities for investors looking to capitalize on shallow pullbacks. For reference, the SPY Seasonal Chart is shown below:

While recession risks persist, particularly for small banks with exposure to real estate, the overall market trajectory remains upward, underpinned by robust earnings and moderating inflation.

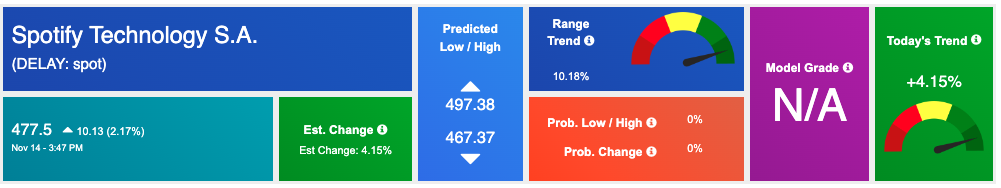

Thursday’s market saw tech and consumer earnings steal the spotlight, with mixed investor reactions to key updates. Spotify (SPOT) had a solid week, with shares climbing after it posted upbeat subscriber and user growth projections. While earnings and revenue were slightly lower than expected, the company’s strong fourth-quarter outlook impressed investors. Spotify’s subscriber base continues to expand significantly, with monthly active users and premium subscribers surging past previous forecasts.

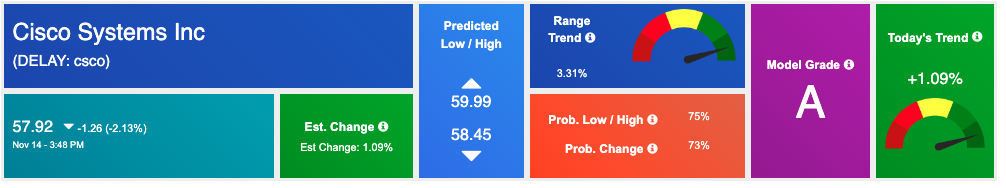

Cisco Systems (CSCO) also exceeded expectations on profit, though revenue dipped from the prior year. The company pointed to ongoing investments in infrastructure to support AI as a promising driver of future growth. However, despite the positive outlook and a raised revenue forecast, Cisco’s stock saw a slight drop, reflecting lingering concerns about the tech giant’s slowing growth rate in core segments.

Chinese e-commerce leader JD.com reported robust profit growth but missed on revenue, sending shares down. Though revenue increased from last year, it fell short of forecasts, highlighting the challenges facing e-commerce in China’s evolving economic landscape.

The market now shifts its attention to upcoming data releases, with October retail sales data due on Friday. This release will shed light on consumer spending, a key driver of economic health. The Federal Reserve’s next interest rate decision is also anticipated, with markets expecting the central bank to consider another rate cut at its December meeting. Before this, the Fed will have additional data on inflation and employment, which will shape its policy stance for 2024.

As the market digests the impacts of inflation data and political developments, investors are positioned to benefit from sector-driven growth and cautious entry into pullbacks. With inflation stabilizing and Fed policy leaning dovish, the market appears primed for further gains, albeit with caution surrounding bond yields and dollar strength. The coming weeks will be critical in gauging the economy’s direction and the Fed’s resolve to balance growth with its inflation target.

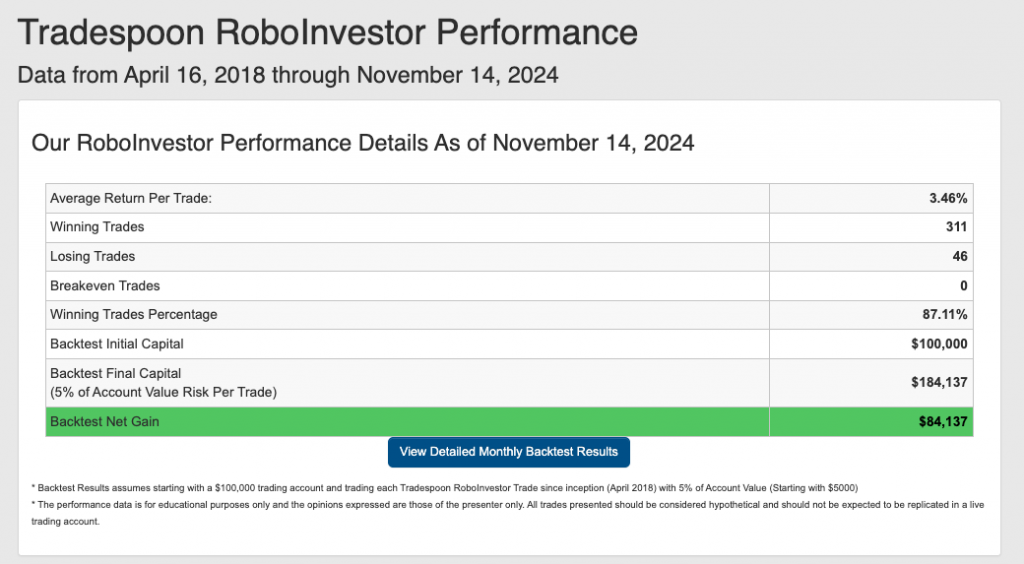

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.11% going back to April 2018.

As we advance further in Q4, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!