RoboStreet – February 27, 2025

The week opened on a subdued note as investors remained cautious due to rising Treasury yields. The 10-year yield climbed past 4.8%, its highest level in weeks, increasing concerns about tightening financial conditions. This led to downward pressure on equities, particularly in the technology sector, where high-growth stocks are more sensitive to interest rate fluctuations. The S&P 500 and Nasdaq opened lower, while the Dow Jones experienced mixed trading, oscillating between minor gains and losses. Defensive sectors such as utilities and healthcare showed relative strength as investors sought safety. The broader market remained in a wait-and-see mode ahead of key economic reports and Federal Reserve commentary scheduled for later in the week.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The Job Openings and Labor Turnover Survey (JOLTS) revealed a decline in job openings to 8.7 million, down from 9.1 million in the previous month. This data suggested a cooling labor market, potentially easing inflationary pressures and reducing the need for further Federal Reserve rate hikes. Initially, the report was received positively by equity markets, but bond yields remained elevated, keeping gains in check. Defensive sectors like utilities and consumer staples extended their outperformance as investors weighed the implications of a gradually softening labor market. Technology stocks attempted a modest rebound following Monday’s losses but struggled to maintain traction as rate concerns persisted.

Market sentiment took a hit as the ISM Services PMI exceeded expectations, coming in at 53.4, reinforcing the strength of the services sector. While this indicated continued economic expansion, it also fueled concerns that inflationary pressures might persist longer than anticipated, potentially delaying any Federal Reserve rate cuts. Several Fed officials delivered hawkish remarks, emphasizing their commitment to a data-driven approach and signaling that rate cuts were not imminent. The market reacted with volatility as investors tried to balance optimism about economic resilience with fears of prolonged higher interest rates. Financial stocks performed well, benefitting from rising yields, while technology stocks remained under pressure due to interest rate sensitivity.

The weekly jobless claims report showed 218,000 new claims, slightly higher than the prior week but still within historically low levels, indicating continued labor market strength. However, the 10-year Treasury yield surged toward 4.9%, reigniting fears that elevated interest rates would continue to weigh on economic growth. As a result, equity markets experienced another wave of selling pressure, particularly in growth-oriented stocks like technology. The Nasdaq bore the brunt of the selloff, while energy stocks staged a strong rally, fueled by a sharp rebound in crude oil prices. WTI crude climbed above $80 per barrel, supported by reports of tightening supply conditions and ongoing geopolitical uncertainties.

The highly anticipated Non-Farm Payrolls (NFP) report showed a robust gain of 275,000 new jobs, significantly surpassing expectations of 200,000. The unemployment rate held steady at 3.9%, while average hourly earnings increased 0.2% month-over-month, signaling controlled wage inflation. The report was seen as a sign of economic stability, easing recession fears and sparking a broad-based market rally. Financials and energy stocks led the charge, with banks benefiting from the higher interest rate outlook and energy companies gaining from rising oil prices. The strong finish helped erase earlier losses, with all three major indices—the S&P 500, Dow Jones, and Nasdaq—closing the week on a positive note.

The technology sector faced heightened volatility throughout the week, reacting to fluctuations in bond yields. While AI-related stocks demonstrated resilience, semiconductor and software companies struggled under the pressure of rising interest rates, leading to notable declines. Energy stocks, on the other hand, experienced a strong rebound as crude oil prices surged above $80 per barrel, driven by supply constraints and escalating geopolitical tensions. This rally benefited oil majors and exploration companies, which posted significant gains. The financial sector also performed well, with rising bond yields providing support for banks and insurance companies, both of which typically benefit from a higher interest rate environment. Meanwhile, consumer staples emerged as a defensive play early in the week as investors sought safety amid economic uncertainty. However, as optimism returned on Friday following the strong jobs report, gains in the sector moderated.

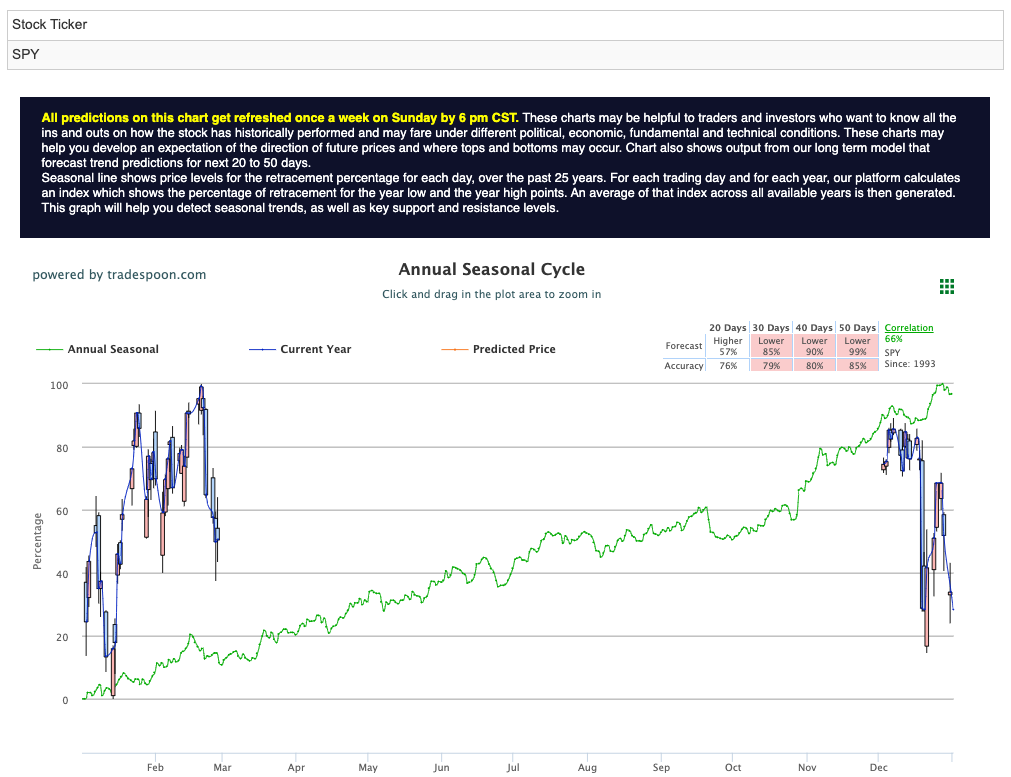

Overall, the market remains in a neutral stance, trading sideways as inflation data continues to align with expectations and corporate earnings come in stronger than anticipated. However, risks persist, particularly with interest rates remaining elevated for a prolonged period and signs of rising unemployment beginning to emerge. The S&P 500 (SPY) could see a rally toward the $620–$640 range, with short-term support levels between $560 and $580 over the coming months. While the market is likely to continue its sideways movement in the near term, the long-term bullish trend remains intact. For reference, the SPY Seasonal Chart is shown below:

Several critical data points and events will shape market sentiment in the coming week. The Consumer Price Index (CPI) and Producer Price Index (PPI) reports will provide key insights into inflation trends, influencing expectations regarding Federal Reserve policy decisions. Additionally, the earnings season kicks off with major financial institutions reporting, offering valuable insights into corporate health, lending conditions, and broader economic resilience. Fed Chair Jerome Powell is also scheduled to speak, and his remarks will be closely scrutinized for signals on the central bank’s rate outlook. Lastly, retail sales data will shed light on consumer spending trends, an essential gauge of economic momentum as we move into the next quarter.

Despite persistent concerns over inflation and the Federal Reserve’s policy trajectory, the market demonstrated resilience, rallying into the weekend following the strong jobs report. With key inflation data and corporate earnings on the horizon, next week’s developments will play a crucial role in shaping investor sentiment and determining the market’s near-term direction.

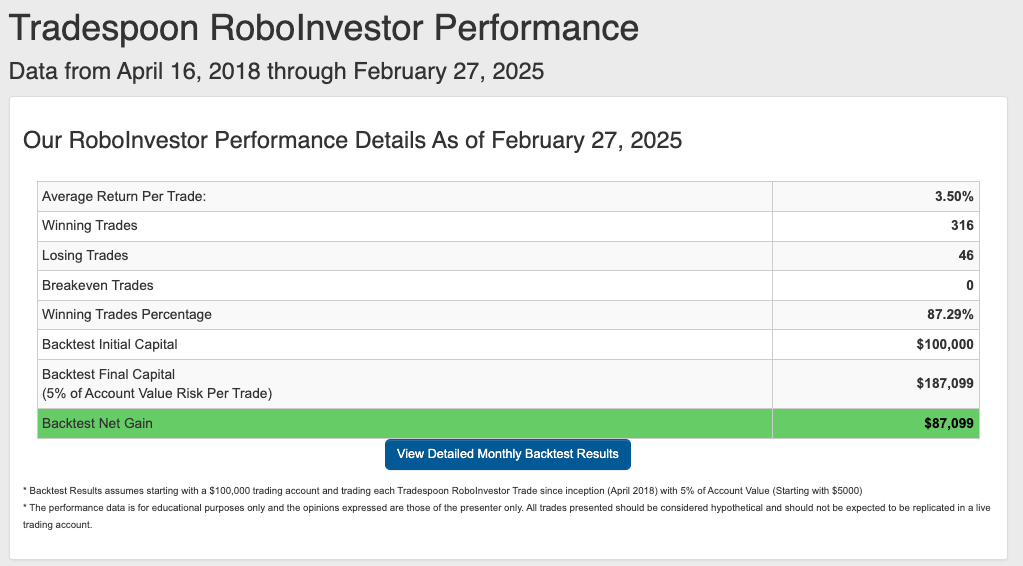

Unlock smarter investment decisions with our RoboInvestor stock and ETF advisory service, powered by advanced AI. This cutting-edge technology identifies trades with high-profit potential, cutting through market noise and eliminating emotional bias. With clear, data-driven insights and strategies, RoboInvestor helps you navigate today’s ever-changing market with confidence and precision.

Every other weekend, subscribers receive an exclusive newsletter packed with my market analysis, technical outlook, updates on existing positions, and one or two fresh trade recommendations to act on when the market opens on Monday.

RoboInvestor is a flexible, unrestricted service. I may recommend blue-chip stocks or ETFs representing major indexes, market sectors, commodities, currencies, interest rates, and even shorting opportunities using inverse ETFs. Our model portfolio typically holds between 12 to 25 positions, adjusting based on market conditions. Recently, we’ve adopted a more cautious approach, focusing on a smaller, more selective set of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.29% going back to April 2018.

As we enter 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!