The stock market kicked off the week with a strong rally, led by consumer discretionary stocks, as major indices climbed sharply on Monday. The S&P 500 and Dow Jones Industrial Average gained over 1%, while the Nasdaq Composite surged nearly 2%, driven by renewed investor optimism.

The consumer discretionary sector emerged as the top-performing group within the S&P 500, on pace for a 3.2% gain. Tesla (TSLA) led the sector’s rebound, soaring 10.1% despite ongoing challenges. The electric vehicle maker has struggled in recent weeks, facing headwinds from tariffs, economic uncertainty, and weakening consumer sentiment. Additionally, Tesla’s brand image has been impacted by consumer protests related to CEO Elon Musk’s perceived political affiliations. Despite Monday’s rally, Tesla remains down 32% year-to-date, while the broader consumer discretionary sector has lost 11.1% in 2025.

Last week, market sentiment remained volatile as investors digested the latest Federal Open Market Committee (FOMC) decision, corporate earnings reports, and geopolitical developments—including discussions of a potential ceasefire between Russia and the U.S. Stocks initially rallied following Federal Reserve Chair Jerome Powell’s press conference, but gains faded as concerns over trade policy, fiscal uncertainty, and economic growth took center stage.

Economic data added to the uncertainty. February retail sales disappointed, rising just 0.2% month-over-month—well below the 0.7% forecast. January’s retail sales figures were also revised downward, reflecting a 1.2% decline instead of the previously reported 0.9% drop. While retail sales saw an annual increase of 3.1%, the gains were largely concentrated in essential goods, with discretionary spending showing signs of weakness.

The Federal Reserve’s decision to maintain interest rates was widely expected, but its updated economic projections suggested a more cautious outlook:

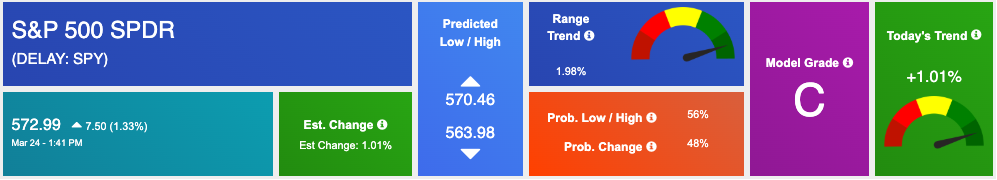

Market conditions remain neutral, with the S&P 500 consolidating within key support and resistance levels. Inflation trends have stayed within expectations, and corporate earnings have largely exceeded forecasts. However, risks persist due to higher-for-longer interest rates and a labor market that is beginning to show signs of softening.

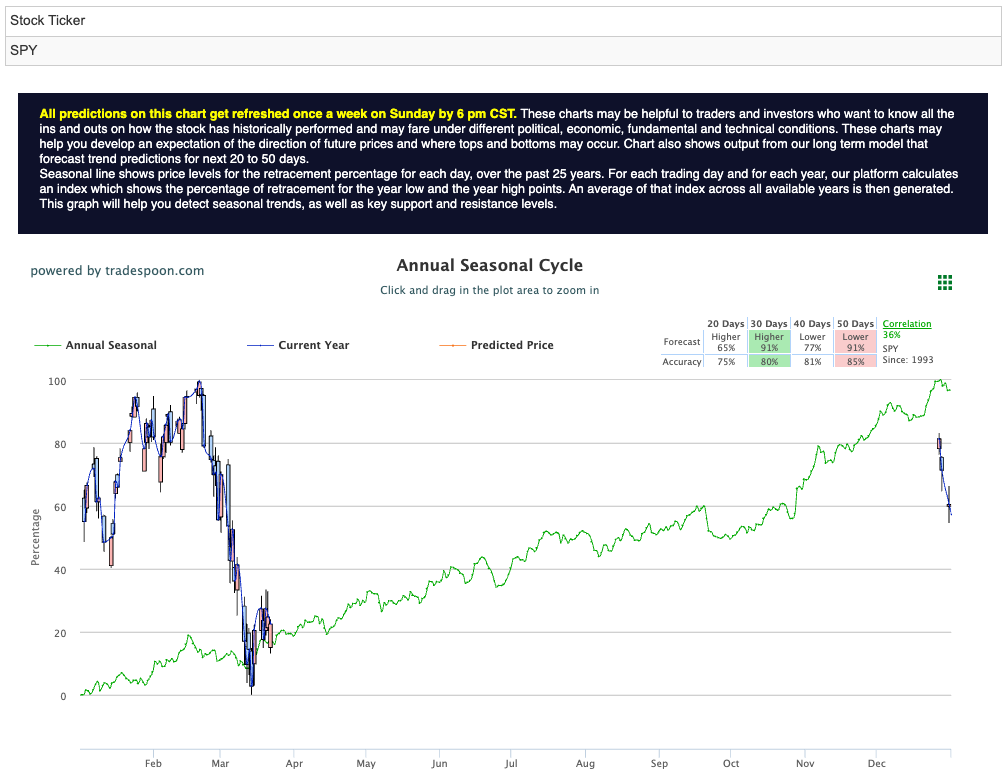

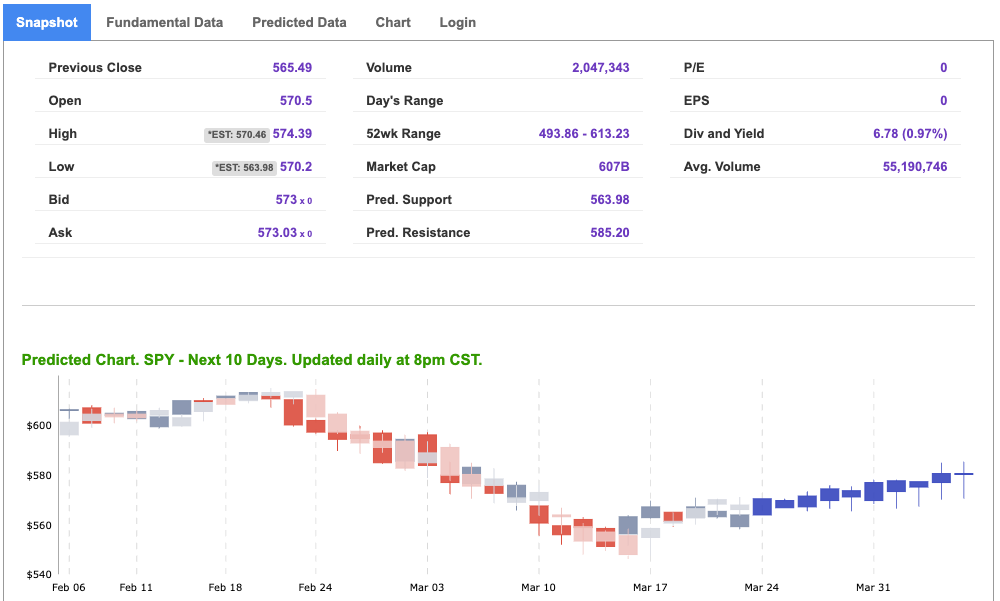

In the near term, the S&P 500 is expected to trade within a defined range, with support in the $530–$550 zone and resistance in the $580–$600 range. While inflation data and earnings results have aligned with expectations, investors remain cautious as interest rates are expected to stay elevated longer than initially anticipated. For reference, the SPY Seasonal Chart is shown below:

Monday’s rally was fueled in part by reports that President Donald Trump may be scaling back his tariff plans, easing trade concerns. Meanwhile, crude oil futures advanced following Trump’s announcement that the U.S. would impose secondary tariffs of 25% on imports from countries purchasing oil and gas from Venezuela.

Tech stocks also participated in the rally, with Nvidia (NVDA) and Meta Platforms (META) gaining over 3% each. Amazon.com (AMZN) climbed 2.8%, while Alphabet (GOOGL) added 2%. Even Apple (AAPL) and Microsoft (MSFT), which lagged behind their peers, still managed to post gains of 0.4% each.

Tesla’s 10% surge to $273.76 was a key highlight of the day. While the stock gained 5.3% on Friday, it wasn’t enough to prevent Tesla from closing its ninth consecutive week of losses. Investors responded positively to reports from Reuters that Tesla is preparing to roll out its most advanced driver-assistance system, Full Self-Driving (FSD), in China.

Nvidia also benefited from reports that U.S. tariffs on semiconductor chips may be delayed, at least in the short term. According to The Wall Street Journal, sector-specific tariffs—particularly on chips—are unlikely to be announced next week, providing a boost to the leading AI chipmaker’s stock.

Treasury yields and the U.S. dollar strengthened after flash U.S. PMI data indicated resilience in an economy that many feared was slowing under the weight of tariffs.

Meanwhile, investors engaged in strong month-end dollar buying, particularly against the euro, as quarter-end rebalancing took place. While U.S. equities have underperformed significantly, resilient market conditions in January helped offset first-quarter losses, limiting the extent of dollar purchases.

Monday’s earnings reports will feature KB Home (KBH) and Oklo (OKLO) after the closing bell. Later in the week, major names set to report include McCormick (MKC), GameStop (GME), Lululemon Athletica (LULU), Walgreens Boots Alliance (WBA), Core & Main (CNM), Smithfield Foods, Pony AI, Cintas (CTAS), Paychex (PAYX), Dollar Tree (DLTR), Chewy (CHWY), Jefferies Financial Group (JEF), and SailPoint.

As the market continues to navigate economic uncertainty, investors will be closely watching upcoming inflation data, corporate earnings, and the Fed’s evolving policy stance. With stocks consolidating within a neutral range and the Fed maintaining a cautious outlook, the next few weeks will be pivotal in determining the market’s direction.

While Monday’s rally provided a much-needed boost, long-term trends will depend on whether economic data supports the case for rate cuts and whether corporate earnings can sustain momentum amid persistent macroeconomic challenges.

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

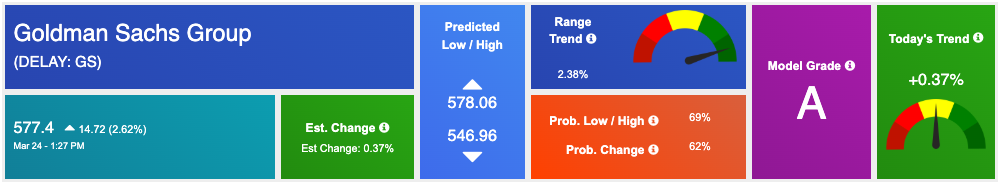

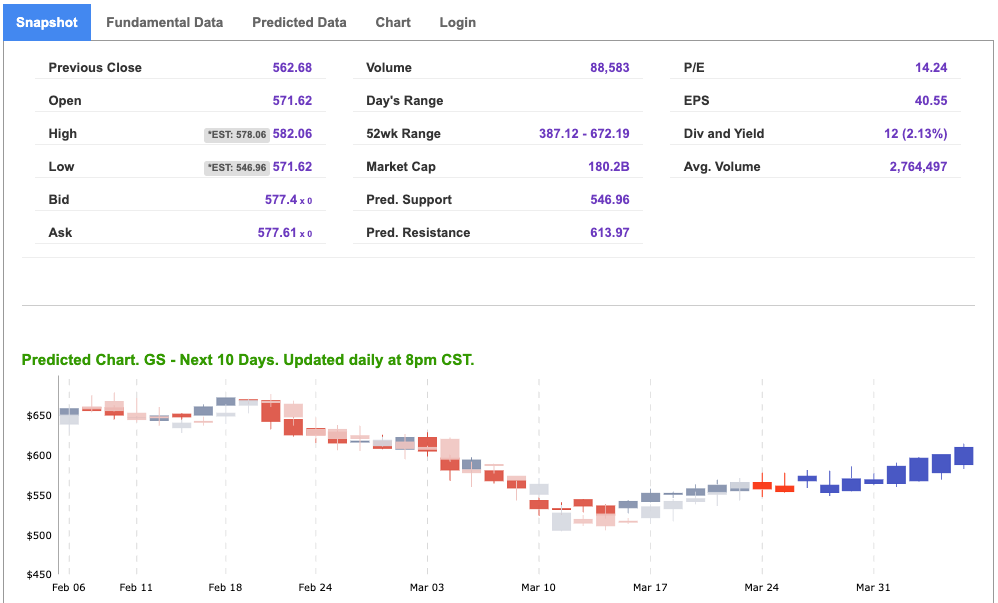

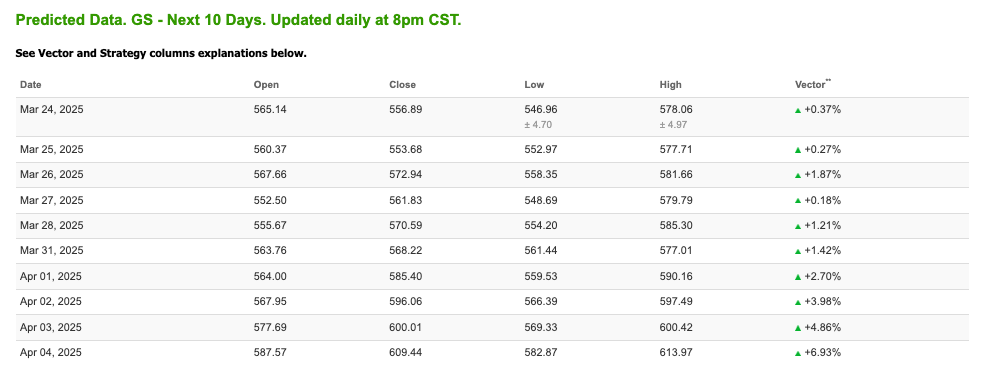

Our featured symbol for Tuesday is GS. Goldman Sachs Group – GS is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $577.4 with a vector of +0.37% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, GS. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

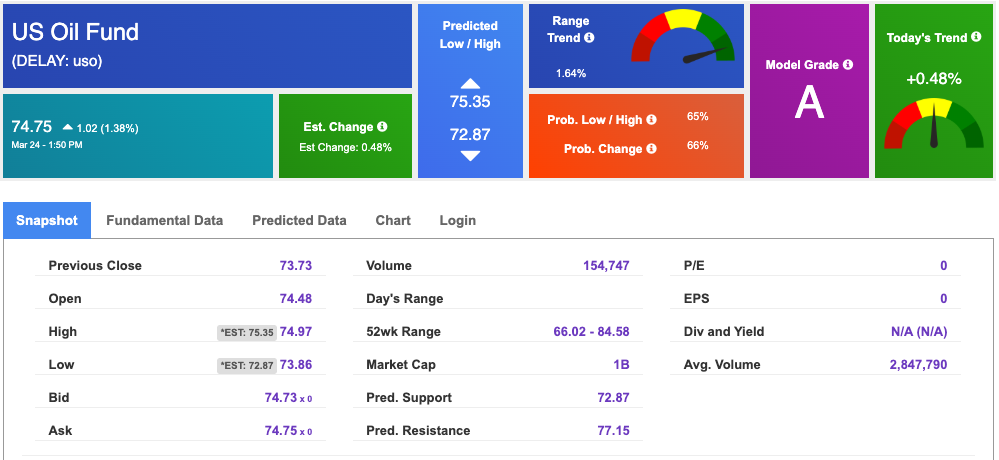

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $69.10 per barrel, up 1.20%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $72.8 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

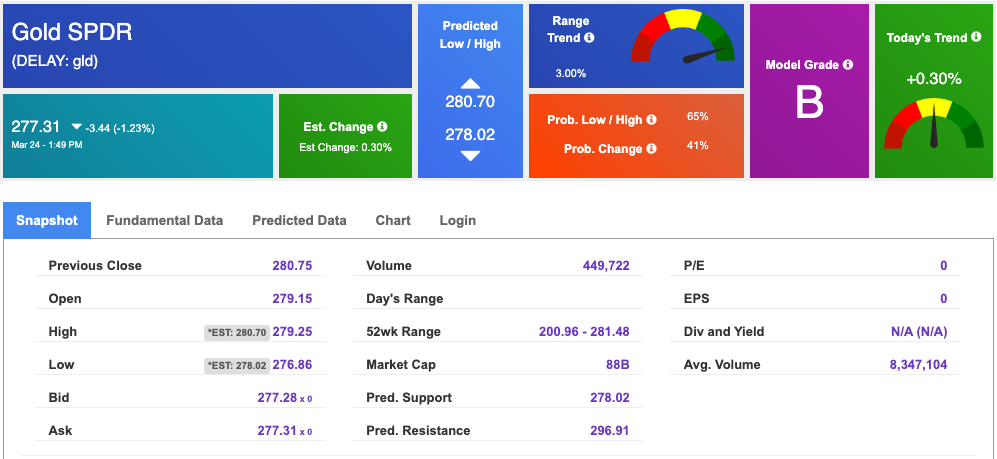

The price for the Gold Continuous Contract (GC00) is down 0.26% at $3,013.60 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $277.31 at the time of publication. Vector signals show +0.30% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

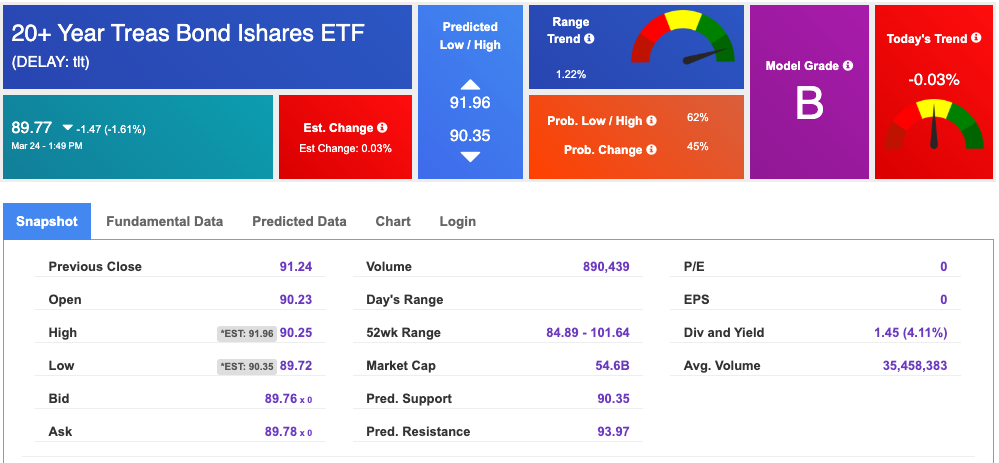

The yield on the 10-year Treasury note is up at 4.332% at the time of publication.

The yield on the 30-year Treasury note is up at 4.654% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

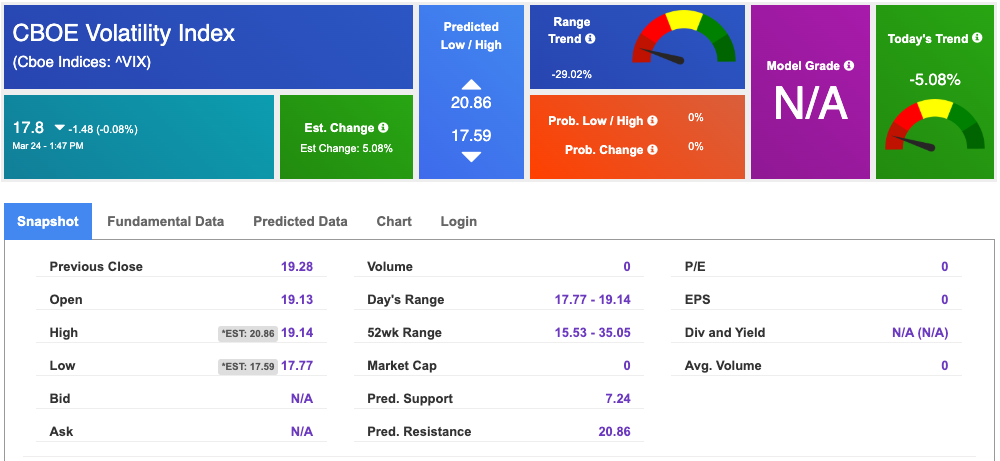

The CBOE Volatility Index (^VIX) is priced at $17.8 down 0.08% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!