RoboStreet – February 6, 2025

The stock market has been on a rollercoaster ride, with investors navigating a whirlwind of trade policy tensions, earnings surprises, and economic data shifts. Monday’s sharp volatility set the stage for a tumultuous week, as Wall Street reacted to former President Donald Trump’s renewed tariff threats. The Dow Jones Industrial Average initially plummeted over 600 points before rebounding, while the S&P 500 and Nasdaq Composite also declined amid growing uncertainty. As traders assess the impact of geopolitical moves, inflation data, and corporate earnings, the key question remains: Is this the start of a larger market correction or just another bump in the road?

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Markets opened lower following the White House’s confirmation of a looming Tuesday deadline for 25% tariffs on imports from Mexico and Canada, alongside a 10% tariff on imports from China. However, a partial recovery followed after Trump and Mexican President Claudia Sheinbaum Pardo announced a temporary truce, delaying the tariffs by a month to allow for further negotiations. As part of the agreement, Mexico pledged to deploy 10,000 troops to the U.S. border to address immigration concerns—an effort to ease tensions with policymakers.

Amid this uncertainty, the CBOE Volatility Index (VIX), often referred to as Wall Street’s “fear gauge,” surged over 20%, briefly surpassing the critical threshold of 20—a level typically associated with heightened market stress. However, by midweek, the VIX settled near 18 as major indices consolidated close to all-time highs.

Economic data also played a significant role in shaping sentiment. The U.S. manufacturing sector, a key economic indicator, posted its first expansion in months. The Institute for Supply Management’s (ISM) Purchasing Managers Index (PMI) rose to 50.9 in January, up from 49.2 in December, surpassing expectations of 49.6. A reading above 50 signals growth in the sector, offering a glimmer of optimism. However, lingering tariff concerns and rising supply chain costs continue to threaten long-term stability.

In labor market news, initial jobless claims increased to 219,000 for the week ending February 1, up from 208,000 the prior week and slightly above the forecast of 214,000. Continuing claims also edged higher to 1.89 million, suggesting a gradual softening in the labor market. However, broader employment trends remain stable, with the upcoming January jobs report expected to provide further clarity. Economists anticipate 169,000 new jobs added, with the unemployment rate holding steady at 4.1%.

Earnings season remained a significant market driver, with mixed results from major corporations. Microsoft, Tesla, and Meta Platforms all contributed to volatility. Microsoft’s Azure cloud business reported slower-than-expected growth, while Meta exceeded revenue expectations but issued cautious forward guidance. Tesla missed earnings estimates but sought to reassure investors with plans for more affordable electric vehicle models. Qualcomm posted strong fiscal first-quarter earnings, beating estimates, but shares fell 4.7% as revenue from intellectual property licensing disappointed.

Other corporate earnings also stirred market movement. Arm Holdings declined 4.4% despite surpassing earnings estimates, as its forward guidance merely met expectations. Ford Motor dropped 6.8% after reporting solid fourth-quarter profits but issued a lackluster full-year outlook. Meanwhile, Honeywell International announced plans to split into three companies to enhance shareholder value, though shares fell 5.5% on underwhelming 2025 profit guidance.

Tech stocks remained in focus as developments in artificial intelligence influenced sentiment. The emergence of a low-cost Chinese AI model, DeepSeek, prompted investors to reassess U.S. tech competitiveness. Despite this, Meta Platforms extended its record-breaking winning streak to 14 consecutive sessions, closing at $707.22 after reaching an intraday high of $718.14. Investor confidence in Meta’s AI initiatives remains strong.

Inflation data also played a role in market positioning. The U.S. personal consumption expenditures (PCE) price index rose 0.3% in January, aligning with expectations and suggesting inflation remains contained. The 10-year Treasury yield fluctuated between 3.6% and 4.8%, but edged lower following the inflation report. Additionally, the Treasury Department helped ease market concerns by announcing it would maintain the current size of bond sales for the foreseeable future.

By Thursday, stocks turned lower as lackluster corporate earnings dampened sentiment. The Dow Jones Industrial Average dropped about 222 points, or 0.5%, while the S&P 500 and Nasdaq Composite remained relatively flat. Investors looked ahead to earnings reports from Amazon, Cloudflare, and Take-Two Interactive Software, with Amazon expected to post fourth-quarter earnings of $1.49 per share on $187.3 billion in revenue. Amazon’s cloud segment, AWS, remains under scrutiny after disappointing reports from industry peers.

Among individual stock moves, Eli Lilly gained 3.4% after delivering strong fourth-quarter earnings and issuing a solid profit forecast for 2025. In contrast, Bristol Myers Squibb fell 4% despite exceeding earnings estimates, as forward guidance underwhelmed investors. Peloton Interactive surged 8.6% after reporting better-than-expected revenue and raising its full-year outlook. Meanwhile, Bitcoin-related stocks, including MicroStrategy, declined as the company posted a quarterly loss of $670.8 million despite increasing its Bitcoin holdings.

Given current conditions, sideways trading appears likely as investors digest economic data, earnings, and central bank policy decisions. The S&P 500 could extend its rally to the 620-640 level, while short-term support sits in the 560-580 range. For reference, the SPY Seasonal Chart is shown below:

Looking ahead, the market remains in a consolidation phase, trading within a defined range as inflation data meets expectations and earnings season delivers mixed results. While the long-term uptrend remains intact, risks persist, particularly regarding the Federal Reserve’s monetary policy path and the potential for prolonged higher interest rates.

As the week draws to a close, markets remain in cautious consolidation. With earnings reports, trade policies, and Federal Reserve decisions continuing to shape sentiment, investors must remain vigilant. The ongoing tug-of-war between bullish momentum and macroeconomic headwinds suggests volatility may persist. As AI advancements, inflation metrics, and central bank maneuvers come into focus, the market’s next move remains uncertain. Investors would be wise to prepare for more twists and turns ahead.

For investors, the outlook remains neutral, as the market wrestles with the interplay of these factors. While there are signs of stabilization, uncertainties surrounding inflation, corporate earnings, and global monetary policies will likely continue to shape market direction in the weeks ahead. Whether the market breaks out of its current range or continues to trade sideways will depend on how these key factors evolve over time.

Unlock smarter investment decisions with our RoboInvestor stock and ETF advisory service, powered by advanced AI. This cutting-edge technology identifies trades with high-profit potential, cutting through market noise and eliminating emotional bias. With clear, data-driven insights and strategies, RoboInvestor helps you navigate today’s ever-changing market with confidence and precision.

Every other weekend, subscribers receive an exclusive newsletter packed with my market analysis, technical outlook, updates on existing positions, and one or two fresh trade recommendations to act on when the market opens on Monday.

RoboInvestor is a flexible, unrestricted service. I may recommend blue-chip stocks or ETFs representing major indexes, market sectors, commodities, currencies, interest rates, and even shorting opportunities using inverse ETFs. Our model portfolio typically holds between 12 to 25 positions, adjusting based on market conditions. Recently, we’ve adopted a more cautious approach, focusing on a smaller, more selective set of stocks and ETFs.

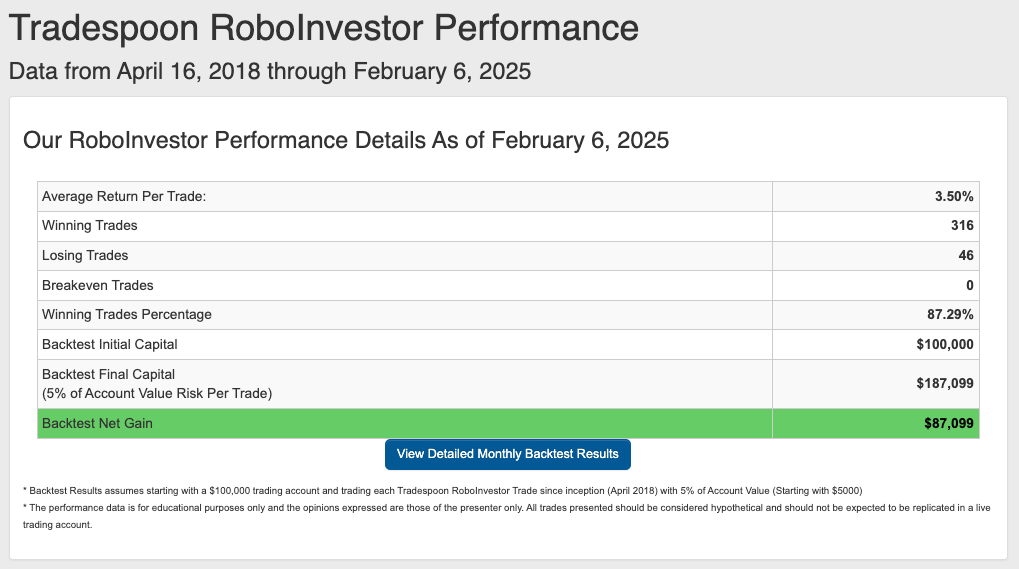

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.29% going back to April 2018.

As we enter 2025, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!