Following last week’s robust employment and PMI data, stocks edged higher on Monday after an initial period of wavering. The strong jobs report from Friday diminished hopes that the Federal Reserve might lower interest rates this year, prompting investors to shift their focus to this week’s critical events: the Federal Open Market Committee (FOMC) meeting and the Consumer Price Index (CPI) report.

The FOMC meeting, scheduled for Tuesday and Wednesday, is the highlight of the week, with Federal Reserve Chair Jerome Powell set to announce the policy update on Wednesday. While a rate hike is considered unlikely, market participants will closely analyze Powell’s comments for insights into the future of monetary policy and the broader U.S. economic outlook.

Adding to the week’s significance, the CPI report, a vital indicator of inflation, is also due on Wednesday. With the likelihood of a rate cut near zero, Powell’s press conference will be the pivotal event, potentially offering crucial guidance on how the Fed plans to manage inflation and economic growth.

In the tech sector, Apple’s Worldwide Developers Conference began on Monday. Investors are keenly awaiting updates on Apple’s advancements in artificial intelligence (AI), an area where the company is perceived to be lagging behind its peers. A substantive update on AI could boost Apple’s stock, which has underperformed compared to other major tech companies this year.

Meanwhile, Nvidia started trading on a split-adjusted basis on Monday following a 10-for-1 stock split that took effect after the close of trading on Friday. Nvidia, a leader in AI chip technology, saw its stock rise, having already surged 148% in 2024. In contrast, shares of Advanced Micro Devices (AMD) fell after being downgraded, highlighting the diverging fortunes within the chip sector.

Treasury yields spiked to session highs on Monday following a surprisingly weak demand for U.S. government debt ahead of the key inflation report. A three-year Treasury note auction saw yields reach 4.659%, exceeding both the pre-bidding yield and the average of recent auctions. This increase indicates that the government had to offer higher returns to attract buyers.

Yields rose across the board, with the 10-year yield at 4.482% and the 30-year yield at 4.607%, both marking their highest points of the session and surpassing Friday’s closing levels. Higher yields generally negatively impact the fixed-income market as they reduce the value of existing bonds. The 10-year yield remains volatile, trading between 4.3% and 4.7%, suggesting the bond market might be pricing in a mild recession due to sustained high interest rates.

On Monday, the Nasdaq Composite led major stock indexes, buoyed by strong performances from chip stocks. The Nasdaq rose 0.2% in late trading, while the S&P 500 edged up slightly, with about 194 of its members showing gains. The Dow Jones Industrial Average, which has fewer tech firms, dipped by 84 points, or 0.2%.

Energy was the top-performing sector in the S&P 500, with a 1% gain. Utilities followed, rising 0.9%, with Constellation Energy and Vistra among the best performers. The technology sector also showed strength, climbing 0.5%, driven by gains in First Solar, Super Micro Computer, Lam Research, and Enphase Energy. The iShares Semiconductor ETF increased by 1.2%, with Nvidia stock rising 0.7%.

The labor market continues to show strength, with a monthly gauge of employment trends indicating ongoing job growth for the year. This follows Labor Department data from last week showing the U.S. added 272,000 jobs in May, significantly exceeding expectations despite a slight rise in the unemployment rate.

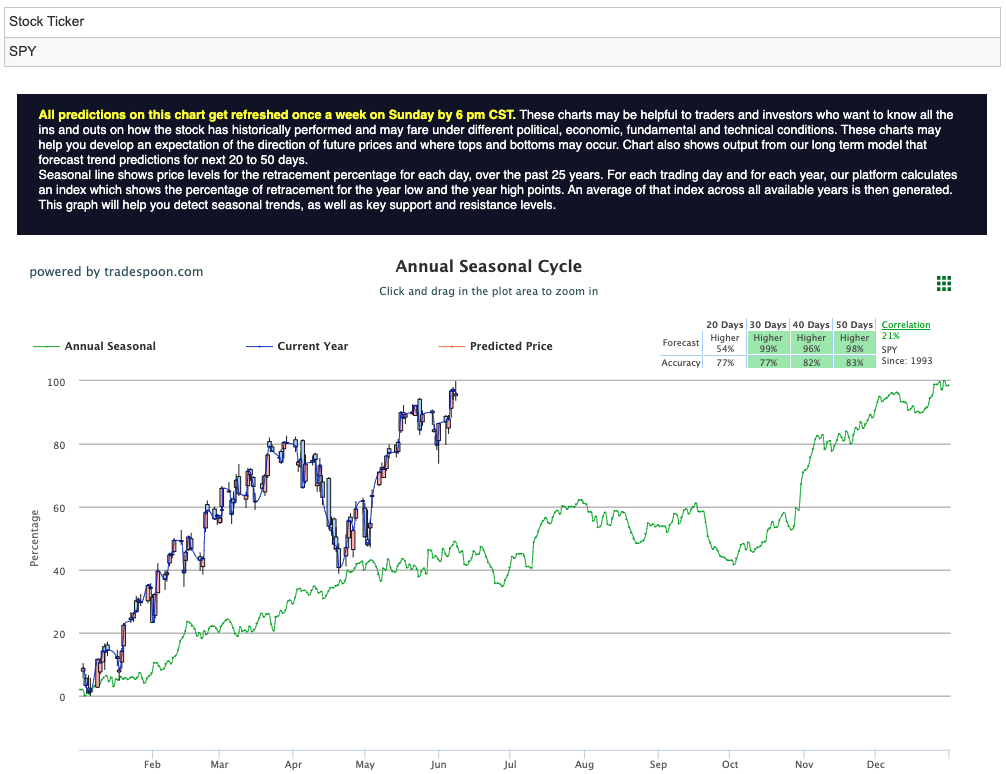

In the stock market, the SPY faces resistance at the $540-$550 levels, with short-term support between $500 and $510. Despite mixed signals, there is a growing bullish sentiment, with expectations for the market to achieve higher highs and higher lows in the coming months. Investors are closely watching key economic data and Fed policy decisions that will shape market dynamics in the near term. For reference, the SPY Seasonal Chart is shown below:

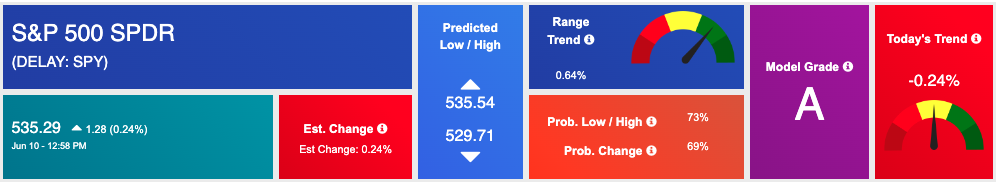

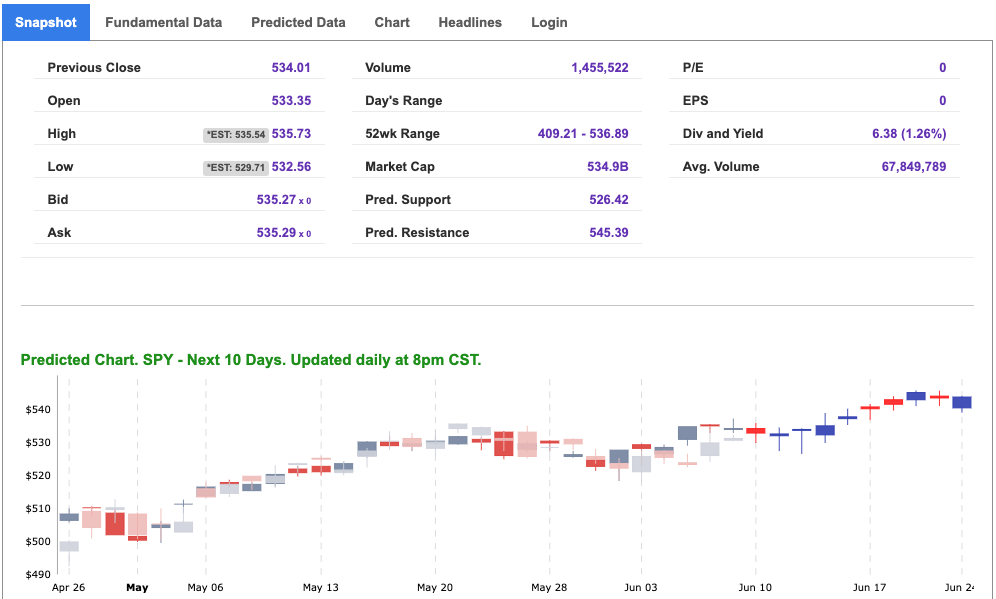

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

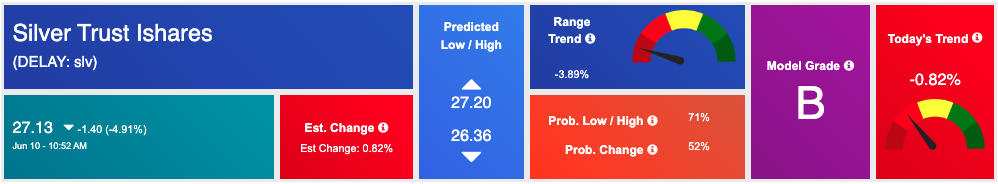

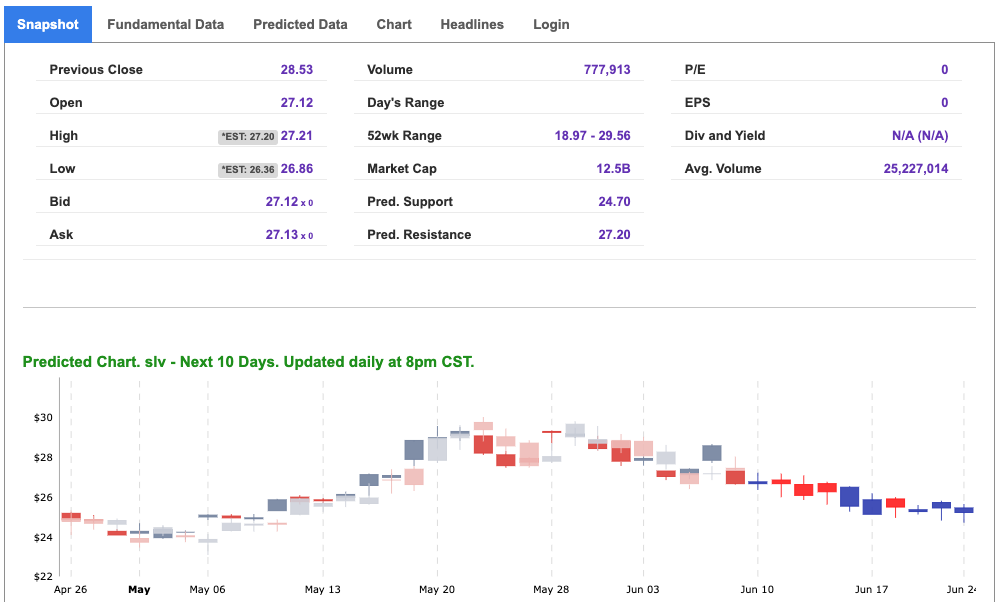

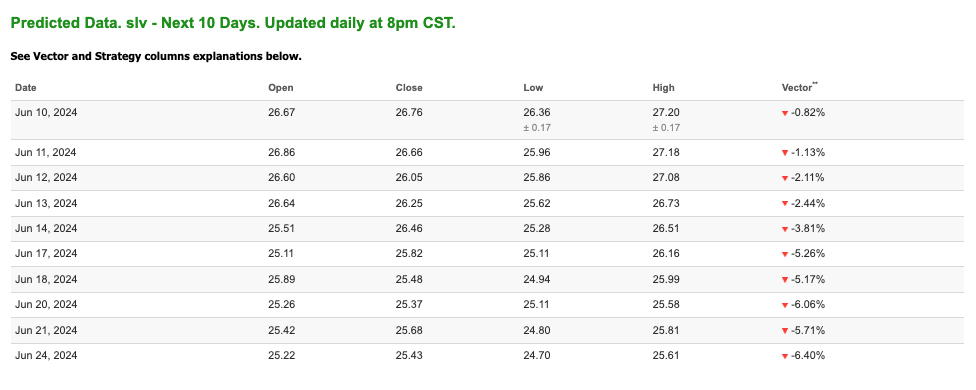

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, SLV. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

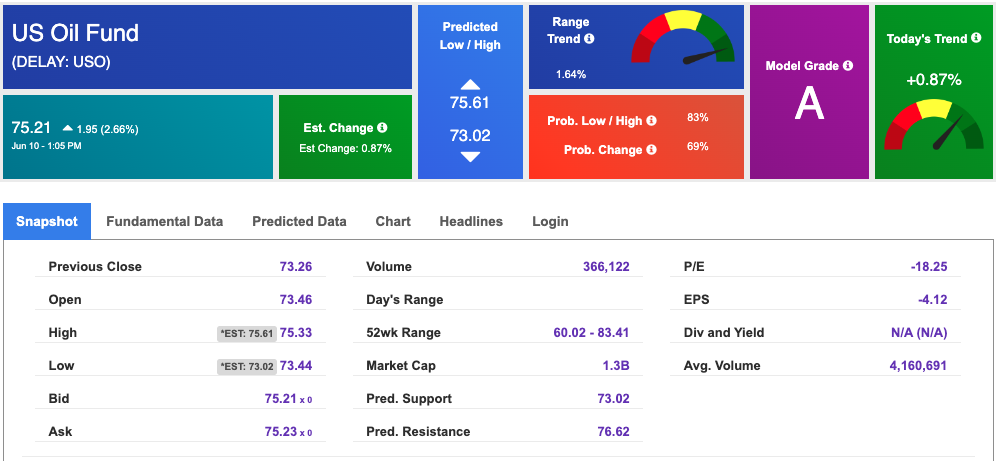

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $77.68 per barrel, up 2.86%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $75.21 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

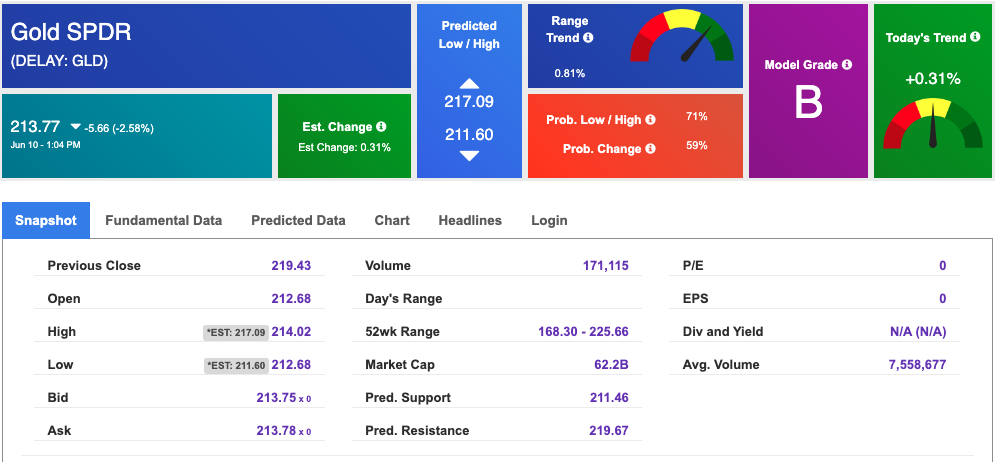

The price for the Gold Continuous Contract (GC00) is up 0.13% at $2328.10 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $213.77 at the time of publication. Vector signals show +0.31% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

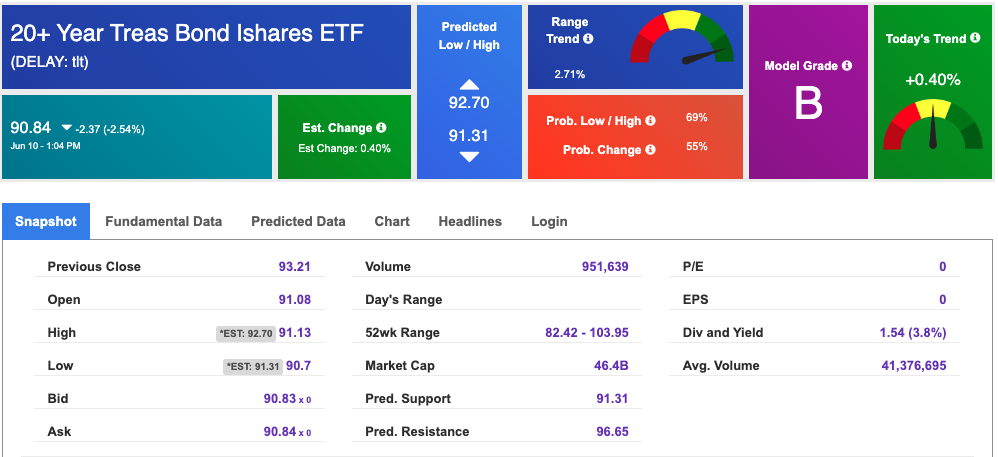

The yield on the 10-year Treasury note is up at 4.474% at the time of publication.

The yield on the 30-year Treasury note is up at 4.599% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

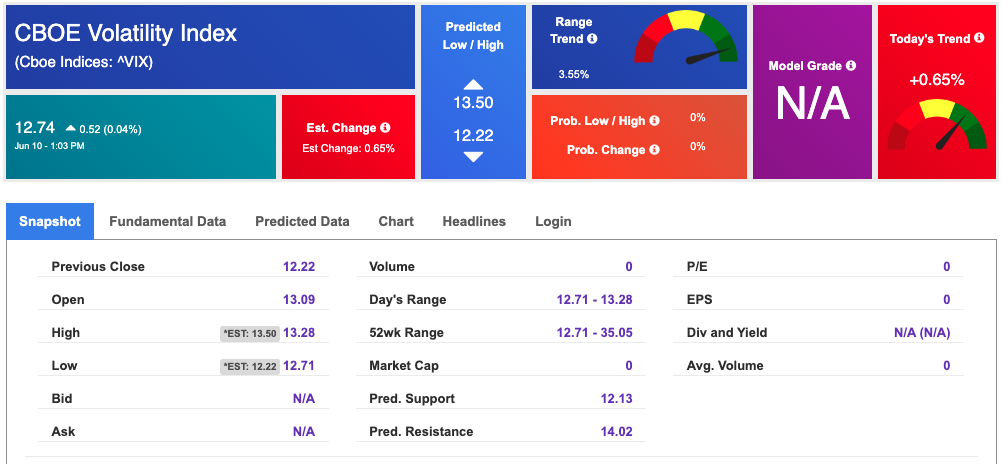

The CBOE Volatility Index (^VIX) is priced at $13.11 up 0.01% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!