In a tumultuous start to the week, the stock market struggled to maintain momentum on Monday, ultimately succumbing to downward pressure amidst a cloud of economic uncertainty. Investors brace themselves for what promises to be a whirlwind week, with a plethora of economic data on the horizon both in Asia and the U.S. The impending release of the February jobs report on Friday looms large, expected to cast a decisive shadow over market sentiment, particularly regarding the trajectory of inflation and interest rates.

Throughout the week, all eyes are on Federal Reserve officials, who are slated to deliver remarks, including Philadelphia Fed president Patrick Harker on Monday. Investors will dissect these comments meticulously, hungry for any crumbs of insight into the Fed’s stance on inflation and interest rates. Moreover, a deluge of economic indicators, most notably the U.S. jobs report for February, will be scrutinized for clues on the Fed’s path forward regarding interest rates.

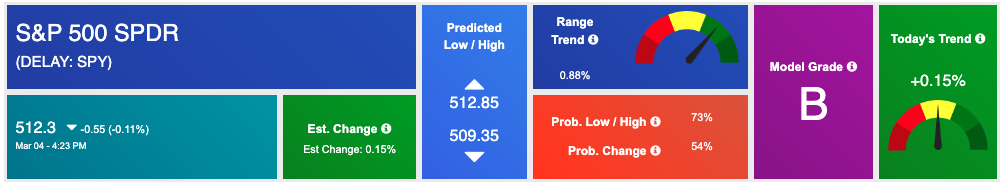

As the dust settles on another earnings season, investors pivot their attention to pivotal economic indicators, particularly inflation data, against the backdrop of fluctuating interest rates and market ambiguity. Key levels in the S&P 500 (SPY) serve as a barometer of market sentiment and potential price movements.

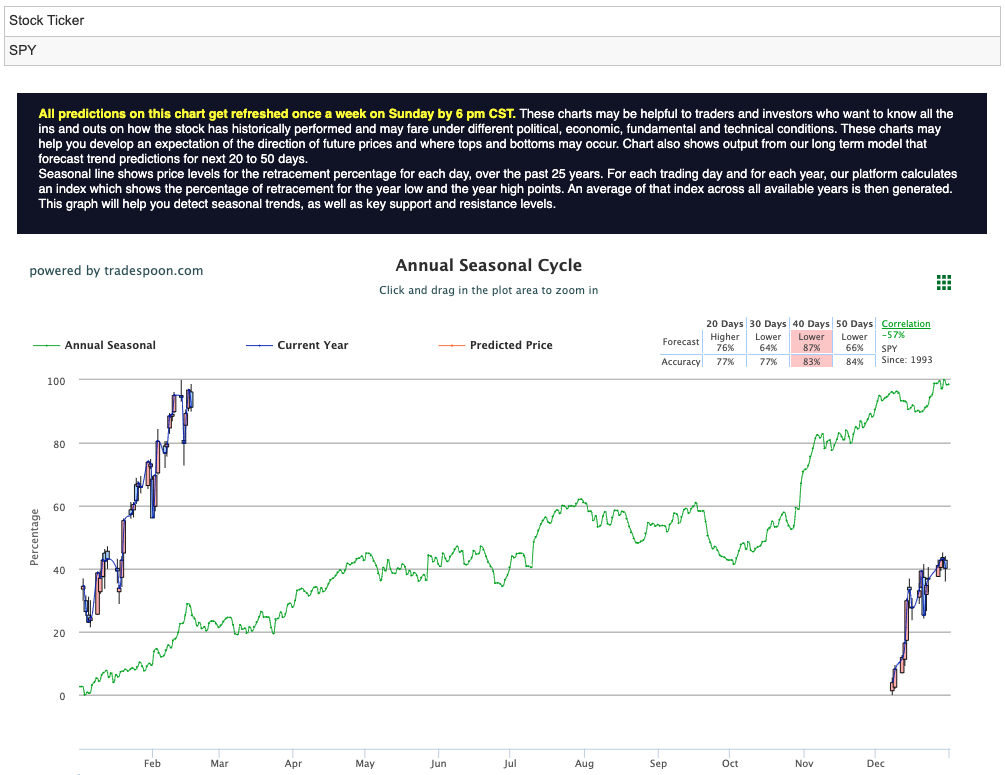

Hovering near all-time highs, the index reflects cautious optimism in the economic recovery. Crucial support levels at 480-490 are vital for market stability, while resistance at $510-520 could usher in selling pressure. These levels serve as signposts for market sentiment, guiding investment strategies amidst economic uncertainties and policy decisions. For reference, the SPY Seasonal Chart is shown below:

The recent surge in both the Consumer Price Index (CPI) and Producer Price Index (PPI) reports has sent interest rates soaring, with the 10-year Treasury yield hovering around 4.3%. Simultaneously, the US Dollar Index ($DXY) faces resistance between $105 and $107, underlining cautious market sentiment as investors await forthcoming unemployment data.

In contrast, the cryptocurrency market saw a surge on Monday, with Bitcoin and other digital assets marching higher as the crypto rally continued unabated. Record highs appear tantalizingly close as digital assets bask in the glow of inflows into recently approved spot Bitcoin exchange-traded funds.

Bitcoin, in particular, surged nearly 7% over the past 24 hours, edging towards the $67,500 mark, inching closer to its record peak above $69,000 reached in November 2021. The cryptocurrency’s ascent, which has been steady since last summer, witnessed a turbocharged trajectory in recent weeks amidst exuberant sentiment across broader markets, with both the S&P 500 and Nasdaq stock indexes hitting record levels, buoyed by the impact of spot Bitcoin ETFs.

Looking ahead, investors are keeping a keen eye on key events scheduled for this week, including factory orders and ISM services on Tuesday, ADP employment data on Wednesday, and consumer credit on Thursday. Moreover, additional employment data on Friday, alongside commentary from several Fed officials, notably Powell on Wednesday, are poised to have a substantial impact on market movements. As the economic landscape continues to evolve, investors are advised to remain vigilant and adapt their strategies accordingly to navigate the prevailing uncertainty.

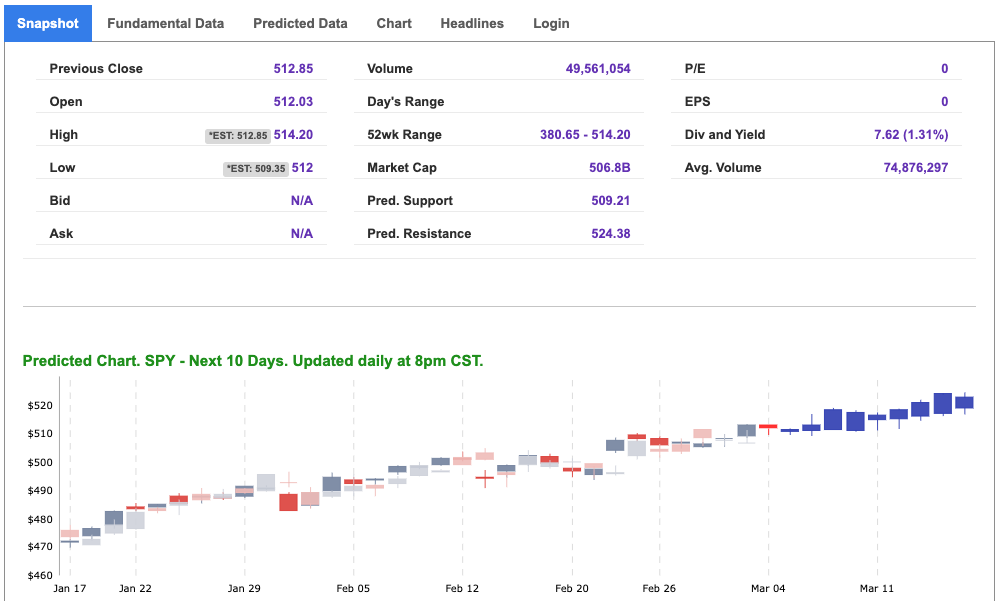

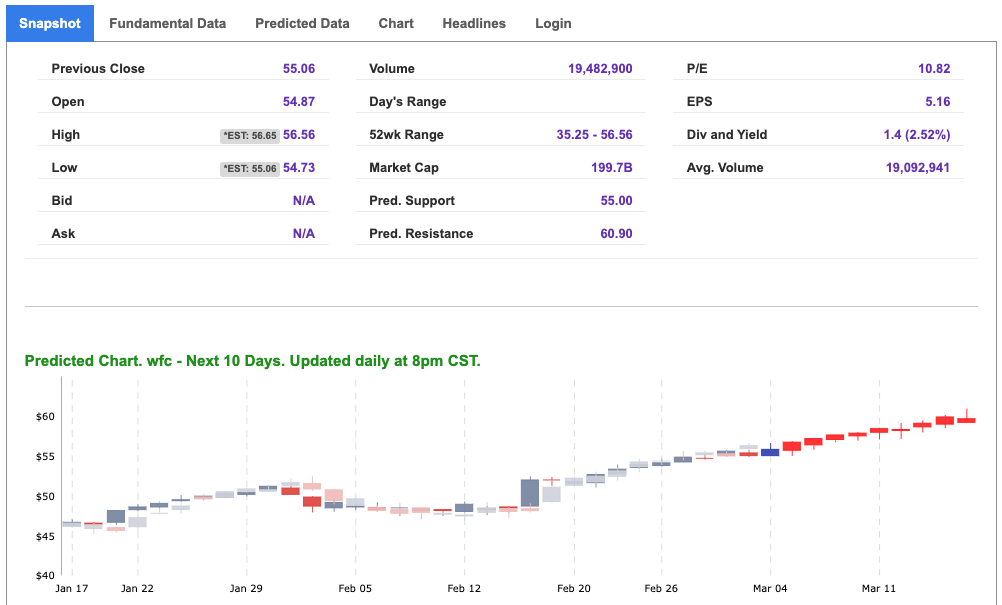

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

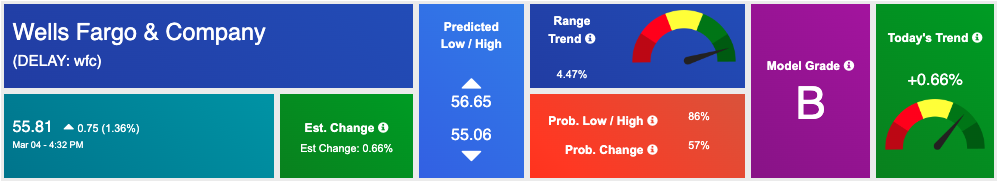

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, WFC. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

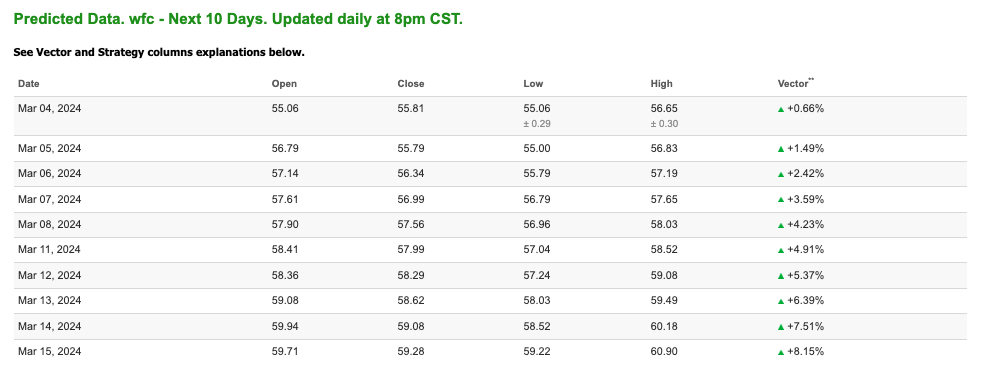

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $78.76 per barrel, down 1.51%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $74.01 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

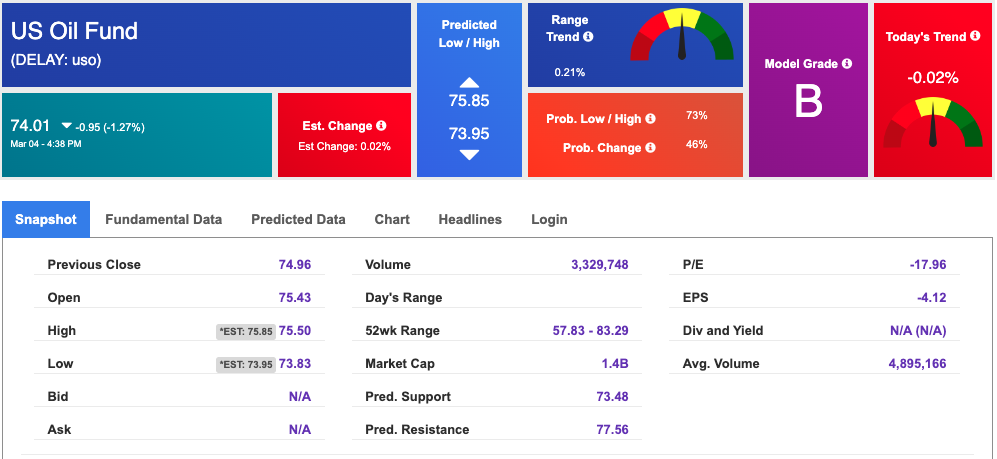

The price for the Gold Continuous Contract (GC00) is up 1.31% at $2123.10 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $196.01 at the time of publication. Vector signals show +0.45% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The yield on the 10-year Treasury note is up at 4.219% at the time of publication.

The yield on the 30-year Treasury note is up at 4.353% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

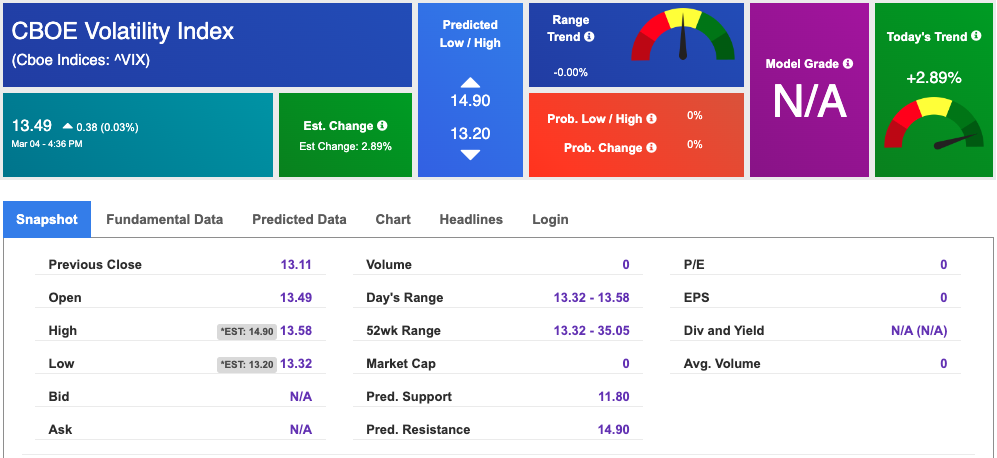

The CBOE Volatility Index (^VIX) is priced at $13.49 up 0.03% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!