The stock market stumbled as major indexes pulled back from last week’s record levels, largely weighed down by rising bond yields. On Monday, the Dow Jones Industrial Average dropped by 0.8%, while the S&P 500 dipped 0.2%. Despite the broader downtrend, the Nasdaq Composite managed to eke out a 0.3% gain thanks to a late-session rally, driven primarily by strength in the technology sector. Nvidia and Super Micro Computer led the way, offsetting losses in other sectors. This set the stage for what could be a pivotal week as earnings season kicks into full gear and the market eyes fresh inflation data and an upcoming Federal Reserve decision.

The focus now turns to the companies reporting this week, with heavy hitters like 3M, General Motors, Lockheed Martin, and Verizon Communications kicking off the action. Expectations are high, and the market will be watching closely to see how these results impact broader sentiment, especially as traders adjust their expectations for the Fed’s next move on interest rates. Notably, there has been a dramatic shift in market pricing, with traders now anticipating a quarter-point Fed rate cut as the most likely outcome in November.

The earnings calendar for the week is packed with reports from major names across multiple industries. Some of the most anticipated releases include Tesla, Boeing, General Electric Aerospace, Verizon, United Parcel Service, Texas Instruments, Lockheed Martin, Coca-Cola, Philip Morris, Spotify, General Motors, AT&T, T-Mobile, IBM, Whirlpool, ServiceNow, Honeywell, Colgate-Palmolive, and Centene. Each of these reports has the potential to influence market direction, especially in an environment where investors are increasingly weighing corporate performance against broader macroeconomic concerns.

The bond market stole the spotlight Monday as yields surged worldwide. The yield on the 2-year Treasury note climbed to 4.03%, while the 10-year yield spiked to 4.19%. These rising yields reflect investor concerns about inflation and the potential implications of the 2024 U.S. presidential election. With both Congress and the White House up for grabs, traders are wary of the economic policies that might emerge, especially if one party gains control of both.

As bond prices fall and yields rise, equities are feeling the pressure, particularly in rate-sensitive sectors like real estate and utilities. The surge in yields is also complicating the outlook for growth stocks, which tend to struggle when borrowing costs increase.

Early Monday, stock futures indicated a bearish start to the week, following last week’s mixed performance. Futures for the Dow Jones Industrial Average were down by 95 points, or 0.2%, while S&P 500 futures were off by 0.3%. Nasdaq futures lagged behind, falling 0.6%, as the tech-heavy index was the only major benchmark not to finish last week at a record high.

Last week underscored the complexity of the current trading environment. Strong earnings reports from sectors like banking and technology provided a boost, but volatility in industries like semiconductors highlighted the fragility of the broader market. Economic indicators continue to point to consumer resilience, yet the combination of persistent inflation and a tight labor market leaves the Fed’s next policy decision looming large over investors.

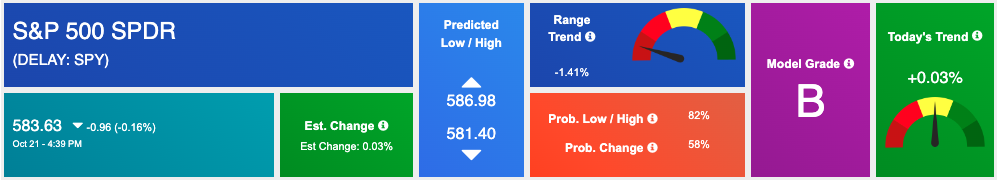

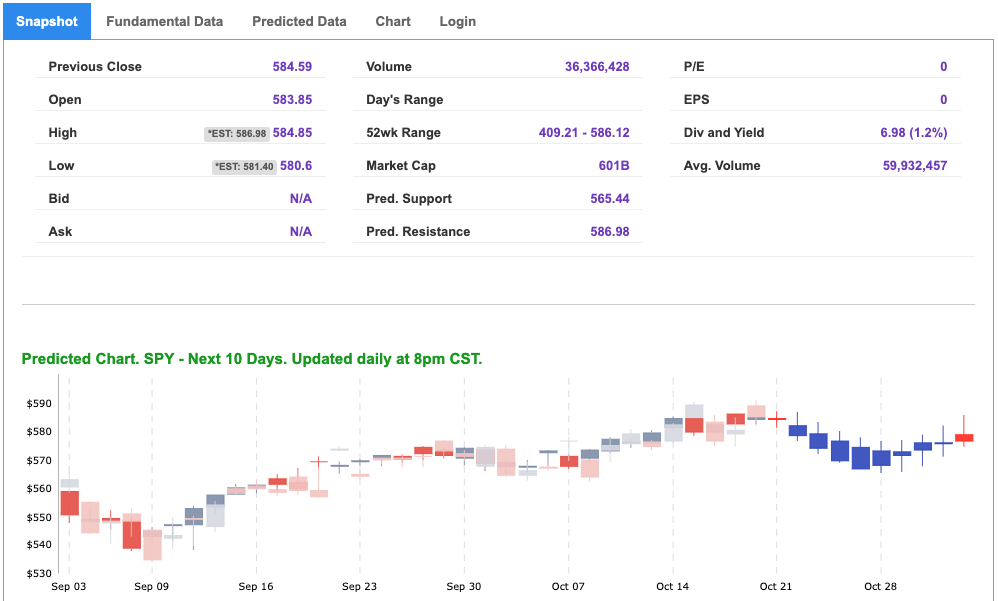

Looking ahead, the S&P 500 continues to exhibit strength, with technical indicators suggesting the potential for a rally to the 600–610 range over the coming months. Short-term support is anticipated at the 540–550 level, offering a cushion for investors wary of near-term volatility. Despite a cautious market sentiment, the long-term uptrend remains intact, bolstered by robust economic data and corporate earnings.

However, risks are ever-present. The possibility of an economic slowdown, along with concerns over exposure to commercial and residential real estate, could temper the market’s bullish momentum. Geopolitical tensions, especially in the Middle East, and economic struggles in China add layers of uncertainty. Investors will need to strike a balance between optimism in earnings growth and prudence in the face of broader economic and geopolitical risks.

As earnings season unfolds, all eyes will remain on the Fed, whose next move could define the trajectory of both the stock and bond markets in the weeks to come. For now, market participants will likely continue to adopt a cautious, yet opportunistic, approach to navigate these turbulent times.

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

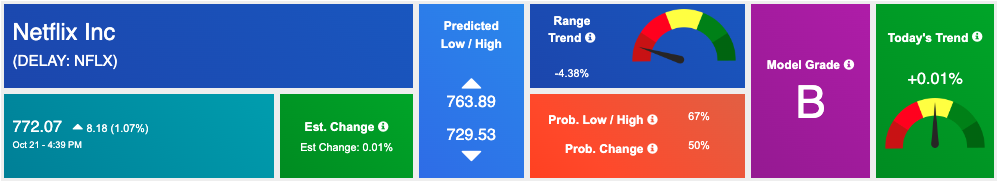

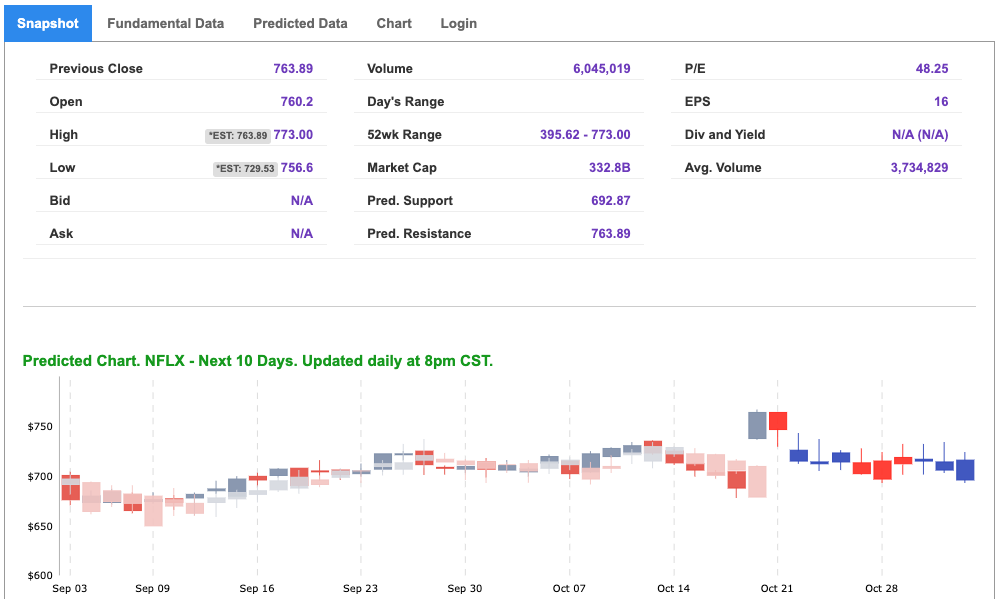

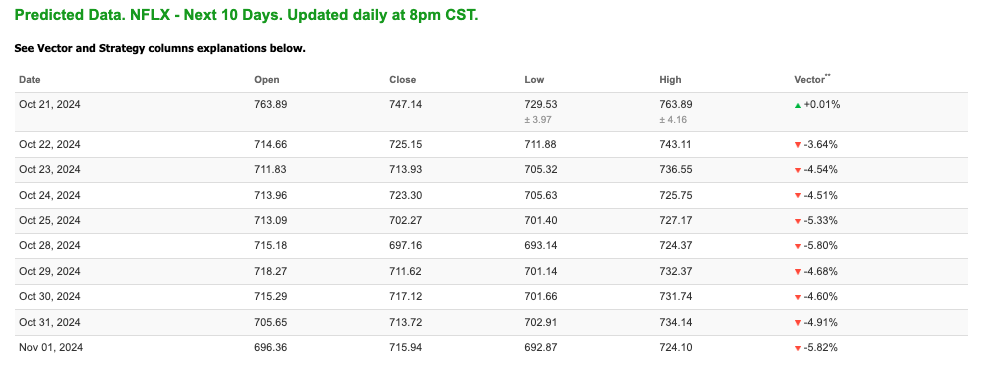

Our featured symbol for Tuesday is Neflix Inc – NFLX is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $772.07 with a vector of +0.01% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, nflx. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

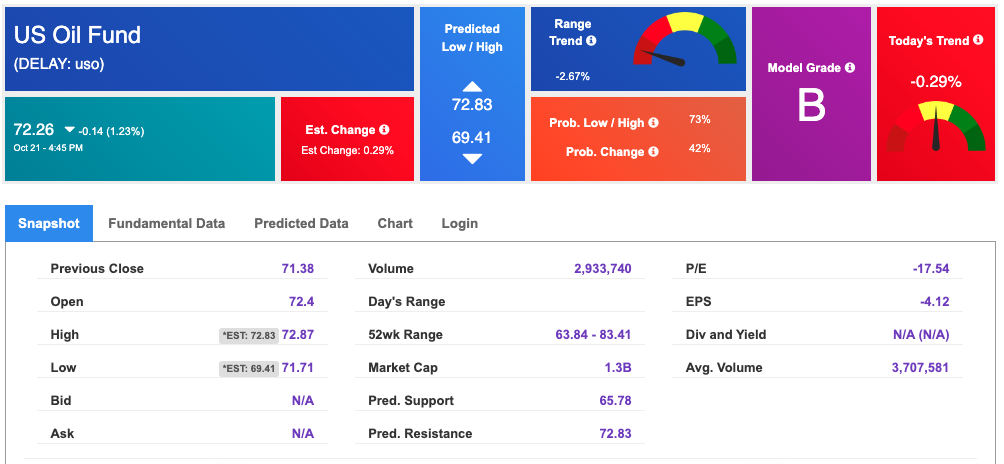

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $70.30 per barrel, up 1.08%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $72.26 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

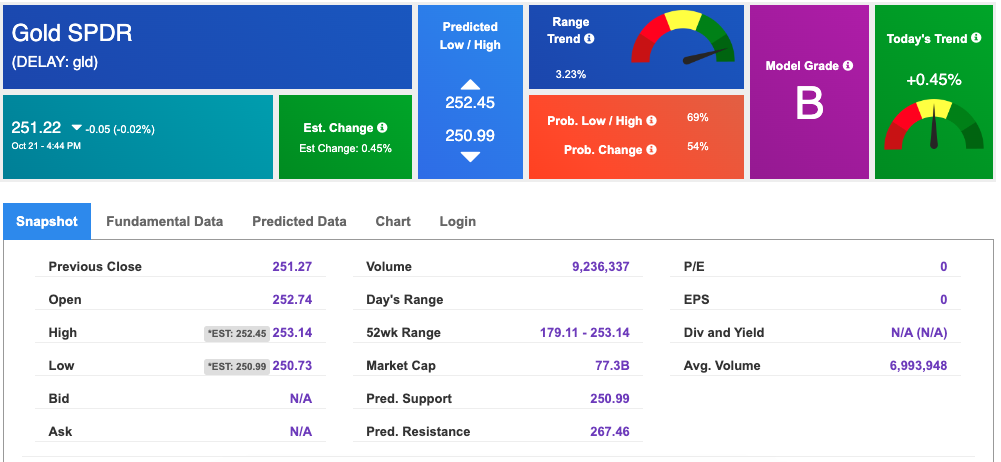

The price for the Gold Continuous Contract (GC00) is up 0.16% at $2,734.50 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $251.22 at the time of publication. Vector signals show +0.45% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

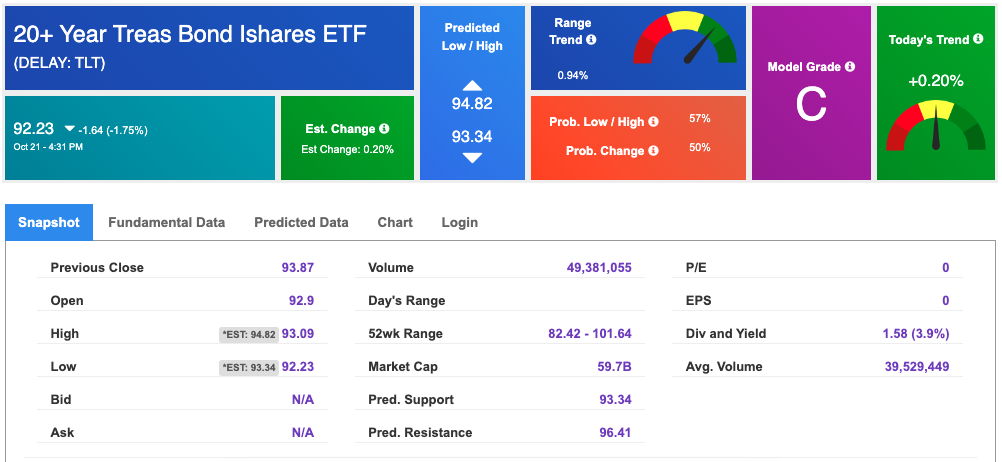

The yield on the 10-year Treasury note is up at 4.206% at the time of publication.

The yield on the 30-year Treasury note is up at 4.504% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

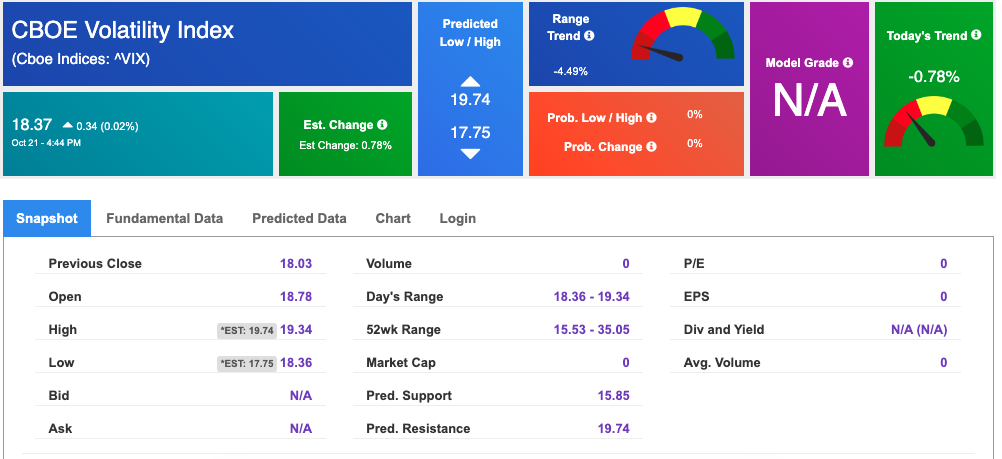

The CBOE Volatility Index (^VIX) is priced at $18.37 up 0.02% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!