Following a robust performance in the previous week, particularly for the S&P 500, which achieved a record close on Friday, the market sustained its positive momentum, with a 0.2% increase on Monday. Notably, the S&P 500 equal-weighted index, emphasizing equal importance for each stock, exhibited even greater momentum, reaching new highs. The surge in stock values was attributed to the continued outperformance of tech stocks driven by optimism about artificial intelligence demand.

The week started with stocks opening higher on Monday, as the S&P 500 extended its record highs from the previous week. Earnings season unfolded amid discussions about the trajectory of the federal fund rate. The market faced minimal obstacles to its rally, with no major economic data on the horizon, and the Federal Reserve maintaining a silent period. The spotlight remained on earnings until Thursday’s release of fourth-quarter gross domestic product (GDP) data and jobless claims.

The Dow Jones Industrial Average experienced a significant surge on Monday, propelled by gains in technology and financial stocks. The index rose nearly 200 points or 0.5%, achieving a new intraday record. The Federal Reserve’s quiet period before its upcoming monetary policy decision shifted focus to influential quarterly earnings and key economic indicators, including fourth-quarter U.S. GDP data and personal-consumption expenditures (PCE).

Amidst these developments, the yield on the 10-year U.S. Treasury dropped below 4.1%, providing additional support to risk sentiment. Market expectations for the initial interest-rate cut by the Fed shifted from March to May due to recent data indicating an economy still experiencing potential inflation risks.

U.S. stock futures indicated fresh highs on Monday, with tech stocks leading the way. Futures for the Dow Jones Industrial Average rose 0.2%, following a 395-point rally on Friday. The S&P 500 futures increased by 0.4%, while Nasdaq futures, tracking tech-heavy stocks, surged by 0.7%. The 10-year U.S. Treasury yield’s fall below 4.1% further contributed to positive market sentiment.

Concerns about economic activity weakening in the U.S., though at a slower pace, arose as weak manufacturing and consumer sectors hinted at a possible recession in 2024. The Conference Board reported a 0.1% decline in its Leading Economic Index for December, following a 0.5% drop in November. The index’s contraction by 2.9% in the second half of the year marked a slowdown from the previous six months.

In the international scene, the iShares MSCI China exchange-traded fund experienced a 3.05% decline on Monday after the People’s Bank of China left interest rates unchanged. This decision, coupled with pressure from a stronger dollar, a property sales slump, and the crackdown on Chinese technology companies in the U.S., led to the fund’s lowest close since October 31, 2022.

Spirit Airlines announced its intention to appeal a federal judge’s decision blocking the $3.8 billion merger of the airlines. Despite the setback, Spirit shares rose by 21%, supported by a positive update on fourth-quarter revenue and strong holiday bookings. JetBlue also saw a 1.5% increase.

The upcoming week promises influential earnings reports, including United Airlines and Logitech after the stock market closes. Later in the week, reports are expected from Johnson & Johnson, Procter & Gamble, Netflix, Verizon, General Electric, Lockheed Martin, Tesla, AT&T, International Business Machines, Texas Instruments, Comcast, Visa, American Airlines, Southwest Airlines, Intel, and American Express.

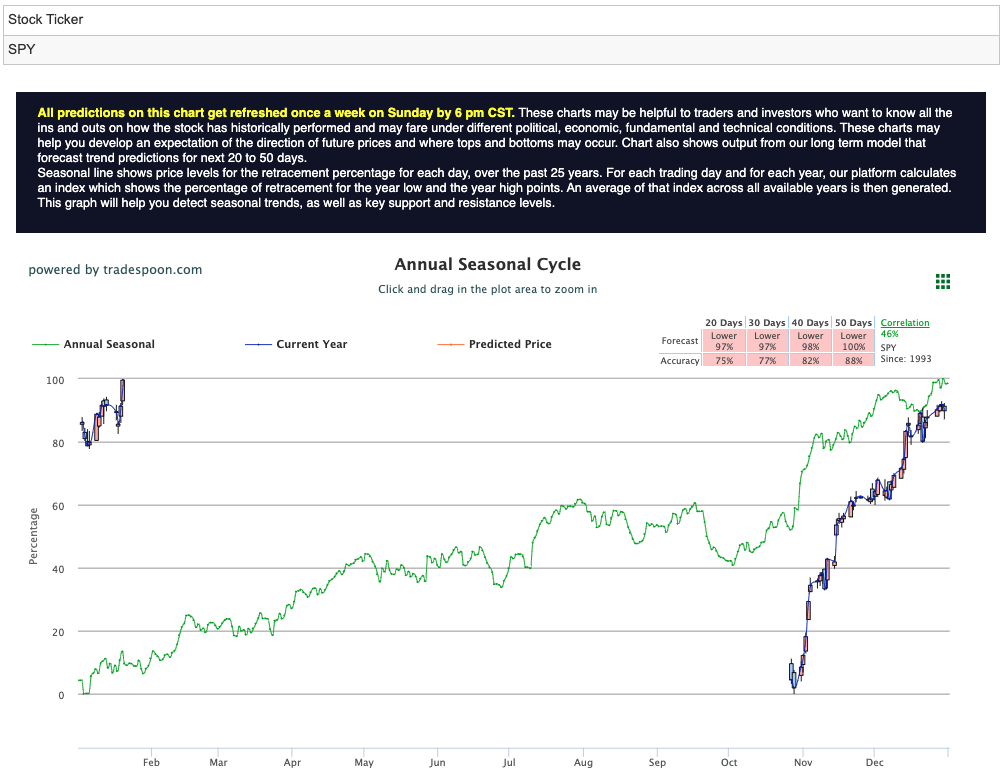

Looking ahead, market analysts anticipate a potential cap in the $SPY rally within the $470-490 range, with short-term support projected between $430-450 in the coming months. For reference, the SPY Seasonal Chart is shown below:

While expectations favor lower yields in the first half of 2024, a deviation from this scenario could indicate prolonged higher inflation and delayed interest rate cuts until the second half of 2025. Market sentiment leans towards the Federal Reserve refraining from further rate hikes in the current and next year, with a high likelihood of initiating rate cuts in the first half of 2024, presenting a bullish outlook for the market. However, any challenges to this narrative, especially concerning the ‘Magnificent 7’ stocks, could trigger sell-offs.

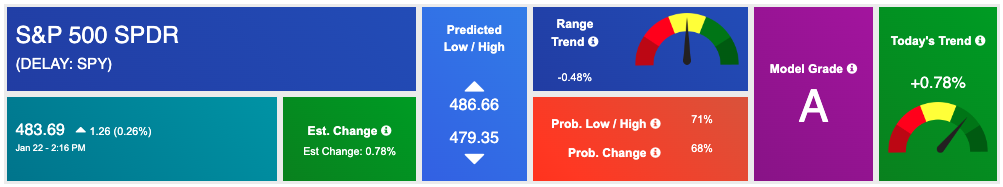

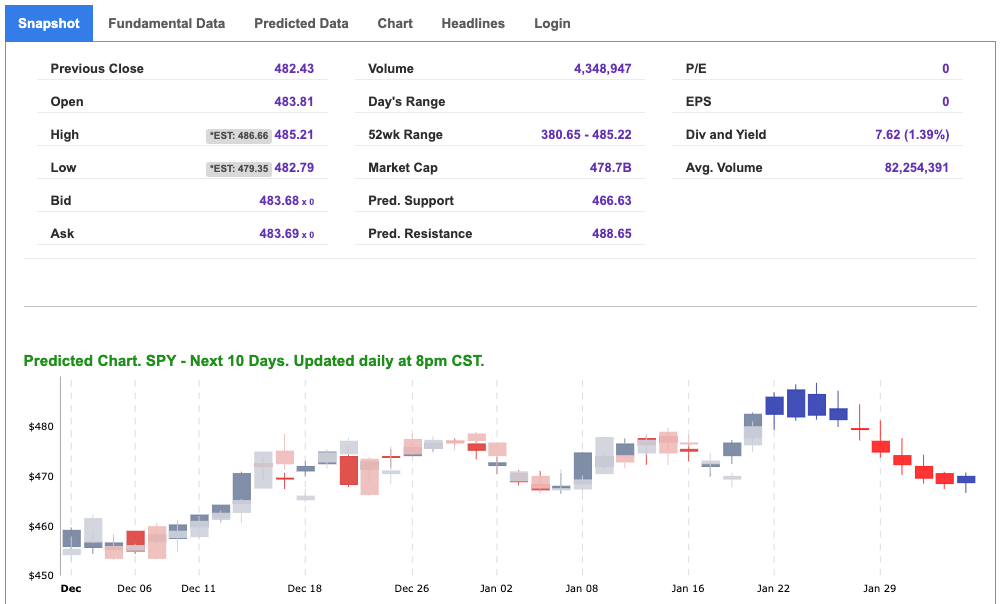

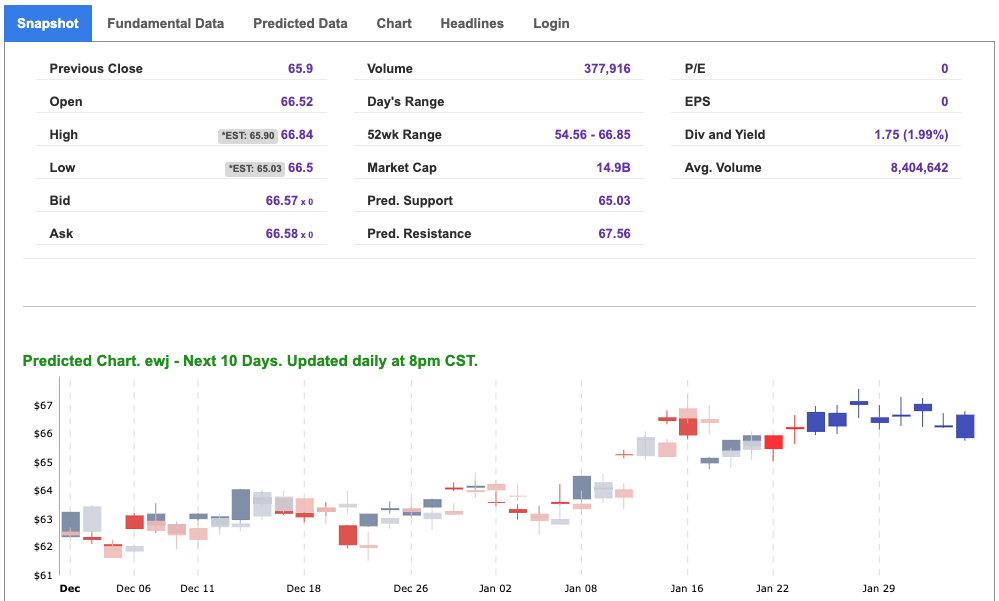

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

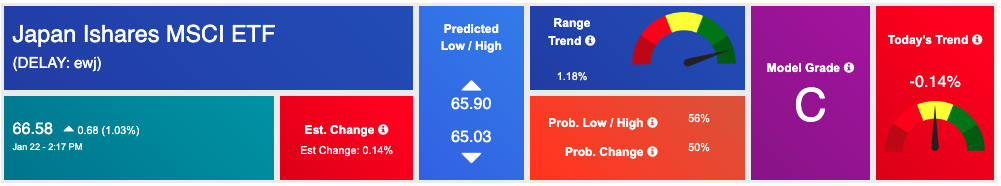

*Please note: At the time of publication Vlad Karpel does NOT have a position in the featured symbol, EWJ. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

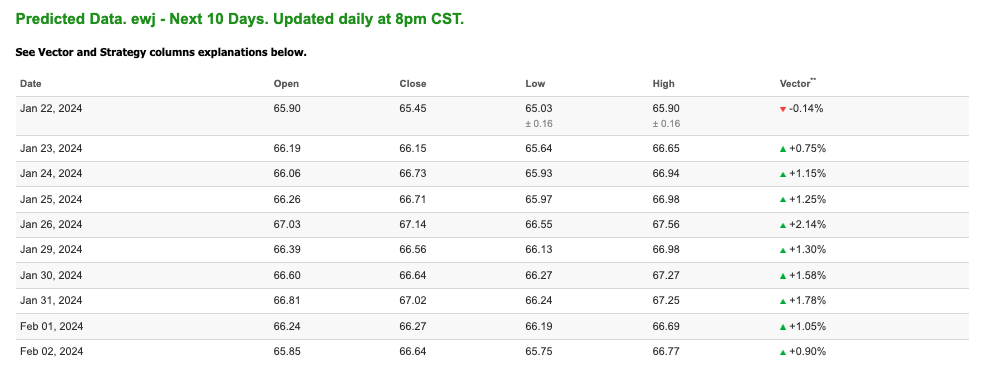

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $75.01 per barrel, up 2.18%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $69.89 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

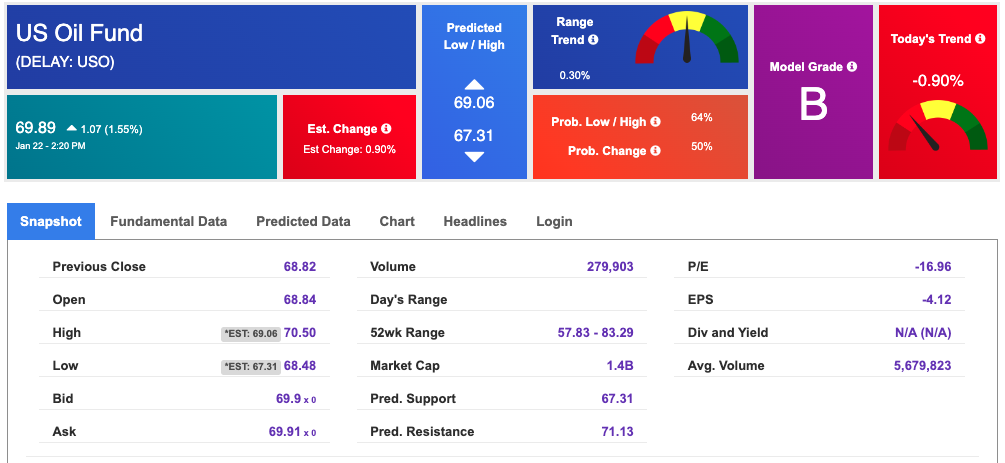

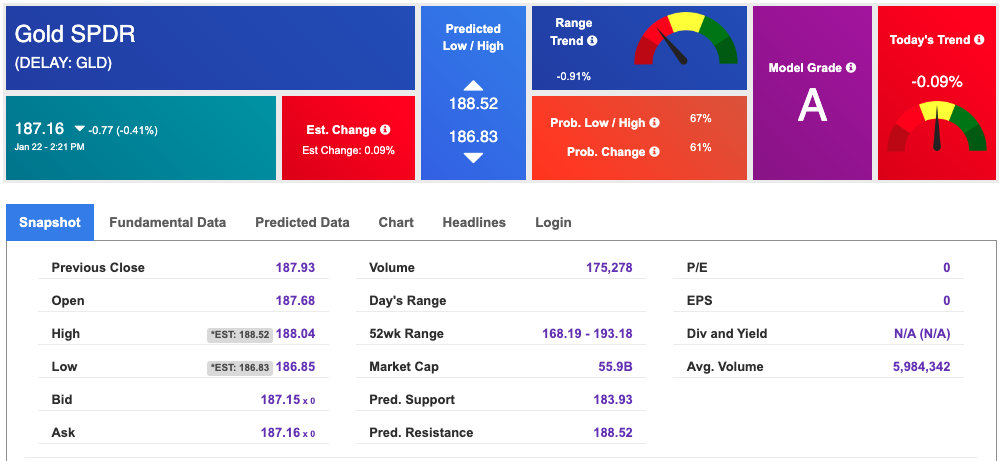

The price for the Gold Continuous Contract (GC00) is down 0.42% at $2020.80 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $187.16 at the time of publication. Vector signals show -0.09% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

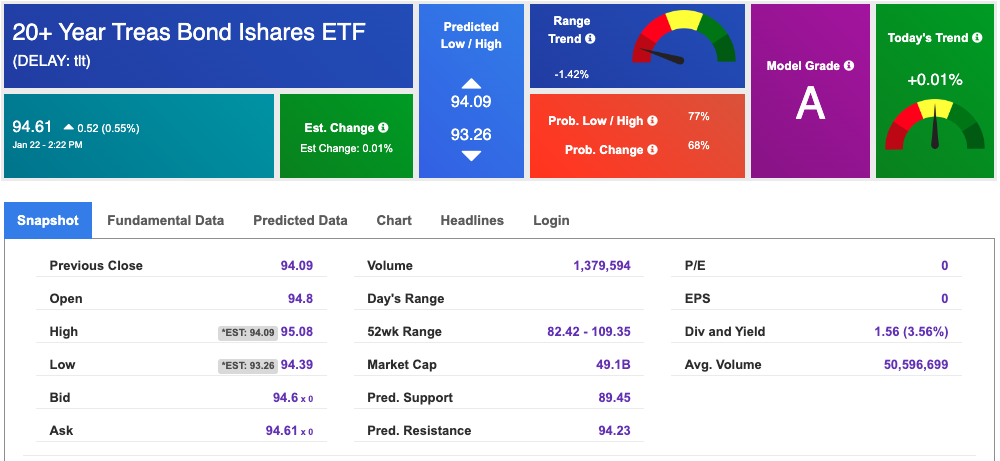

The yield on the 10-year Treasury note is down at 4.103% at the time of publication.

The yield on the 30-year Treasury note is down at 4.324% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

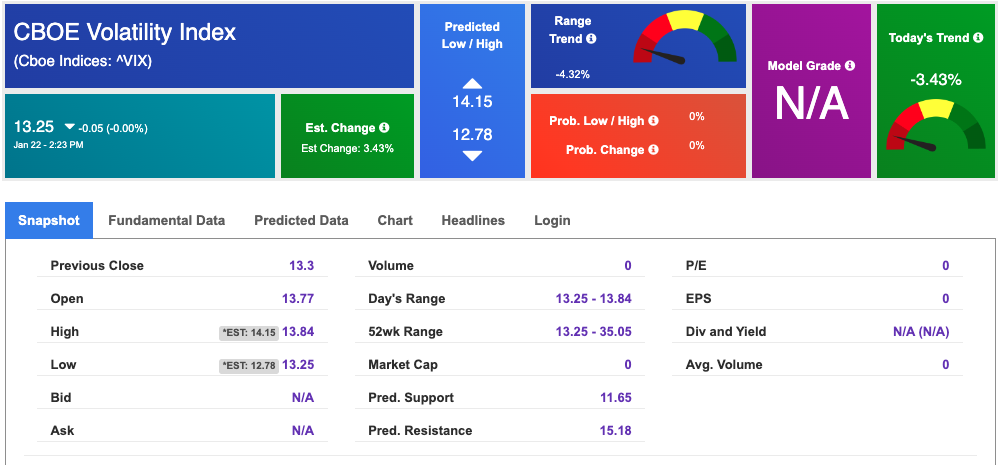

The CBOE Volatility Index (^VIX) is priced at $13.25 down 0.01% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!