Thursday saw a blend of market reactions following the release of key inflation data. The Consumer Price Index (CPI) for June was lower than anticipated, prompting a rally in bond prices while stocks showed mixed performance. This week, attention was focused on Federal Reserve Chair Jerome Powell’s speech, the CPI and Producer Price Index (PPI) data, and the start of the earnings season. Global inflation trends lower, supported by cooling housing and retail data, suggesting a potential soft landing. However, rising unemployment remains a concern.

Stock Market and Powell’s Testimony

The stock market opened cautiously on Monday after the S&P 500 and Nasdaq reached record highs the previous week. Early U.S. stock futures indicated a dip as traders prepared for a week of critical economic reports and Federal Reserve commentary.

Federal Reserve Chair Jerome Powell delivered his semiannual address to Congress on Tuesday and Wednesday. In his remarks, Powell highlighted that economic risks are now more balanced, allowing for a broader focus beyond reducing inflation. He emphasized monitoring potential weaknesses in both the job market and the broader economy. Despite some vulnerabilities, Powell noted that the labor market remains strong but not overheated, with conditions resembling pre-pandemic levels. The June jobs report showed strong job creation but a rising unemployment rate of 4.1% and slower wage growth, suggesting a labor market moving towards better balance.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Inflation Cools as Markets React to Mixed Economic Signals

Thursday saw a blend of market reactions following the release of key inflation data. The Consumer Price Index (CPI) for June was lower than anticipated, prompting a rally in bond prices while stocks showed mixed performance. This week, attention was focused on Federal Reserve Chair Jerome Powell’s speech, the CPI and Producer Price Index (PPI) data, and the start of the earnings season. Global inflation trends lower, supported by cooling housing and retail data, suggesting a potential soft landing. However, rising unemployment remains a concern.

The CPI rose 3% year-over-year in June, indicating a steady decline towards the central bank’s 2% target. Surprisingly, headline inflation decreased by 0.1% month-over-month, contrary to economists’ expectations of a 0.1% increase. This follows flat price growth in May. This easing in inflationary pressures is crucial as it aligns with the Federal Reserve’s goals of maintaining stable economic growth without overheating, paving the way for potential adjustments in monetary policy.

Federal Reserve Chair Jerome Powell’s recent comments underscored this sentiment, noting that economic risks have become more balanced, allowing for a broader focus beyond merely reducing inflation. Powell emphasized the importance of monitoring potential weaknesses in both the job market and the broader economy, indicating a cautious approach to future rate adjustments.

Interest Rates and Market Expectations

The Federal Open Market Committee (FOMC) has held the federal-funds rate at 5.25% to 5.5% since July 2023, helping to reduce inflation. Powell reiterated that interest rate decisions will be made on a “meeting by meeting” basis, requiring more confidence that inflation is moving towards the 2% target before considering rate cuts.

Thursday’s CPI data supported the narrative of easing inflation. The overall CPI increased by 3% year-over-year in June, slightly below the expected 3.1%. Month-over-month, the index decreased by 0.1%, the first decline since May 2020, while the core price index rose by 3.3%, just under the anticipated 3.4%.

Slower-than-expected inflation in June has fueled hopes that the Federal Reserve might soon begin lowering interest rates. Traders are increasingly betting on a September rate cut, with Fed-funds futures indicating an 88.8% chance of at least one rate cut by then.

Labor Market and Economic Indicators

Labor market data presents a mixed picture. Initial claims for unemployment dropped by 17,000 to 222,000 in the week ending July 6, surpassing economists’ expectations. The four-week moving average also decreased to 233,500, and continuing claims fell slightly to 1.85 million.

These statistics follow the Bureau of Labor Statistics’ report that employers added 206,000 nonfarm payrolls in June, exceeding expectations but showing a slight decline from May’s numbers. Investors are closely watching labor data as the Federal Reserve aims to see a cooling job market before deciding on rate cuts.

Market Outlook

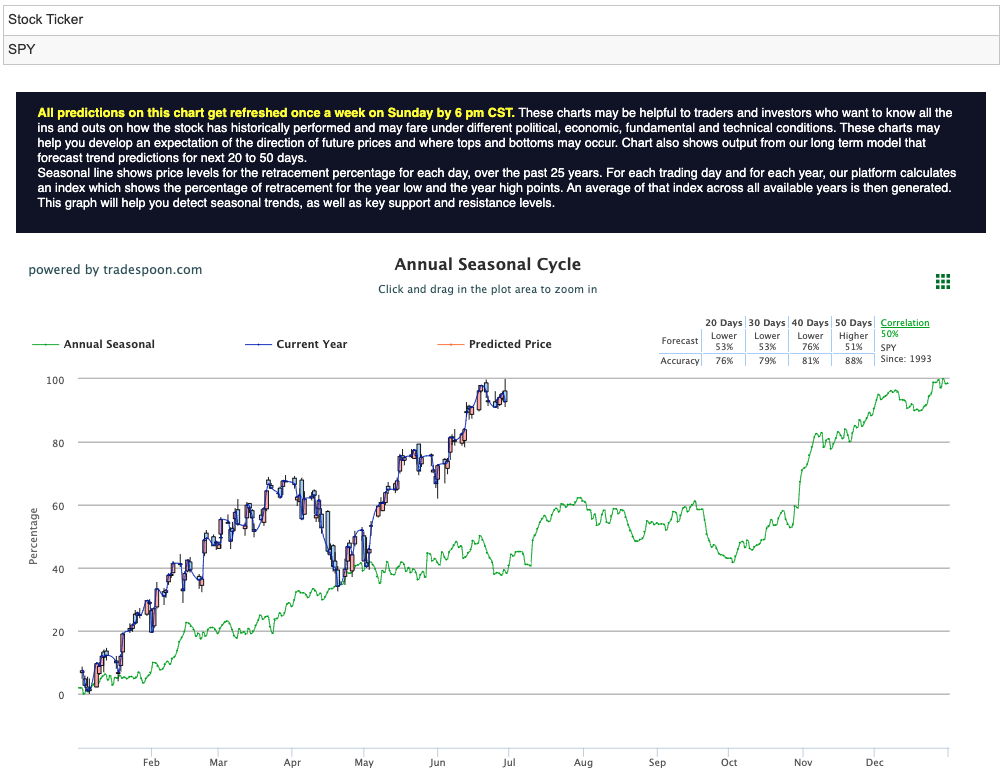

I remain bullish, as inflation aligns with expectations and the earnings season has started positively. However, the market faces risks, including a potential recession as the economy cools and unemployment rises, along with possible failures of small banks due to exposure to commercial and residential real estate. I anticipate the SPY rally to be capped at $560-$575 levels, with short support around $520-$530 for the next few months. Overall, I expect the market to continue posting higher highs and higher lows. For reference, the SPY Seasonal Chart is shown below:

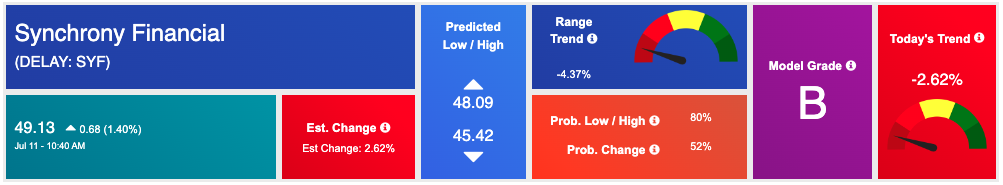

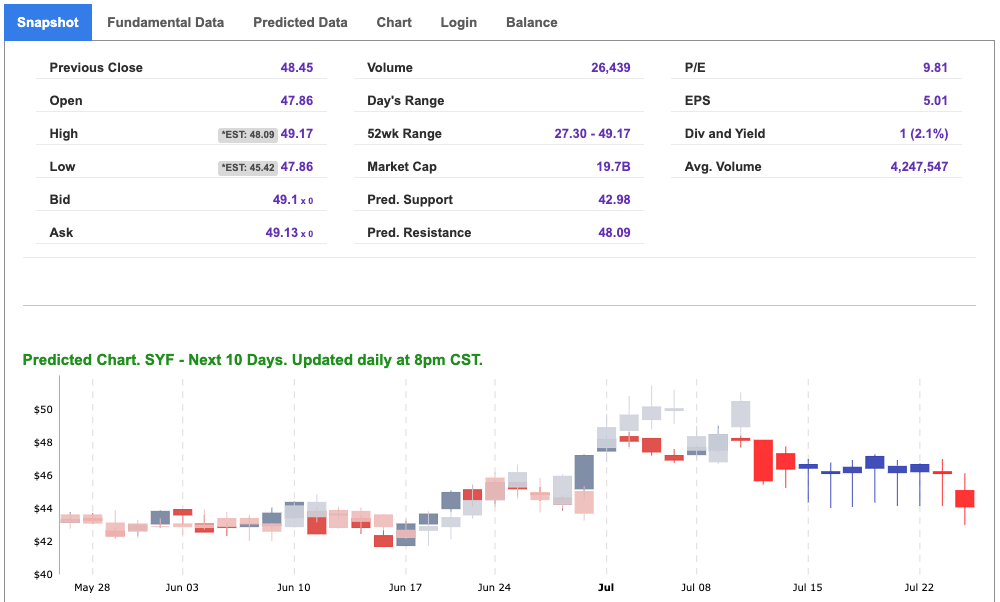

As market optimism grows with expectations of higher highs, Synchrony Financial (SYF) emerges as a compelling opportunity this week. Positioned amidst easing inflation and positive economic indicators, SYF stands ready to capitalize on strengthened consumer spending and favorable market conditions.

Synchrony Financial (SYF) is a leading consumer financial services company, offering a range of credit products through programs with retailers, merchants, manufacturers, buying groups, industry associations, and healthcare service providers. With a strong portfolio of private-label credit cards, dual cards, and installment loans, SYF supports both consumers and businesses. The company’s robust partnerships with well-known brands and retailers ensure a stable revenue stream and significant market presence.

Given the current market conditions, SYF presents a compelling buy opportunity. The June Consumer Price Index (CPI) data showed a year-over-year increase of 3%, which was lower than expected, and a month-over-month decline of 0.1%. This suggests that inflationary pressures are easing, moving closer to the Federal Reserve’s 2% target. Lower inflation generally benefits financial services companies like SYF, as it can lead to increased consumer spending and borrowing, driving revenue growth.

Federal Reserve Chair Jerome Powell, during his semiannual address to Congress, indicated that the risks to the economy have become more balanced, allowing for a broader focus beyond just reducing inflation. This balanced approach could signal a more stable interest rate environment, which is favorable for SYF’s lending business. Additionally, the possibility of an interest rate cut in September, as suggested by Fed-funds futures, could reduce borrowing costs and stimulate economic activity.

The June jobs report showed strong job creation with 206,000 nonfarm payrolls added, despite a rising unemployment rate of 4.1%. A strong labor market can boost consumer confidence and spending, leading to higher usage of SYF’s credit products. Furthermore, the decline in jobless claims to 222,000 in the week ending July 6 further supports the notion of a resilient job market.

The earnings season has begun on a positive note, typically boding well for consumer confidence and market sentiment. As a financial services provider with strong retail partnerships, SYF is well-positioned to benefit from increased consumer spending driven by positive earnings reports.

Overall market sentiment is bullish, with expectations of higher highs and higher lows in the coming months. SYF, as a key player in the financial sector, is likely to ride this wave of optimism. The anticipated SPY rally, expected to be capped at $560-$575 levels, indicates strong market support, which can positively impact SYF’s stock performance.

In summary, Synchrony Financial (SYF) stands out as a solid buy this week due to easing inflation, a balanced approach from the Federal Reserve, strong job market indicators, a positive start to the earnings season, and a bullish market outlook. These factors collectively create a favorable environment for SYF’s growth and stability, making it a promising addition to any investment portfolio.

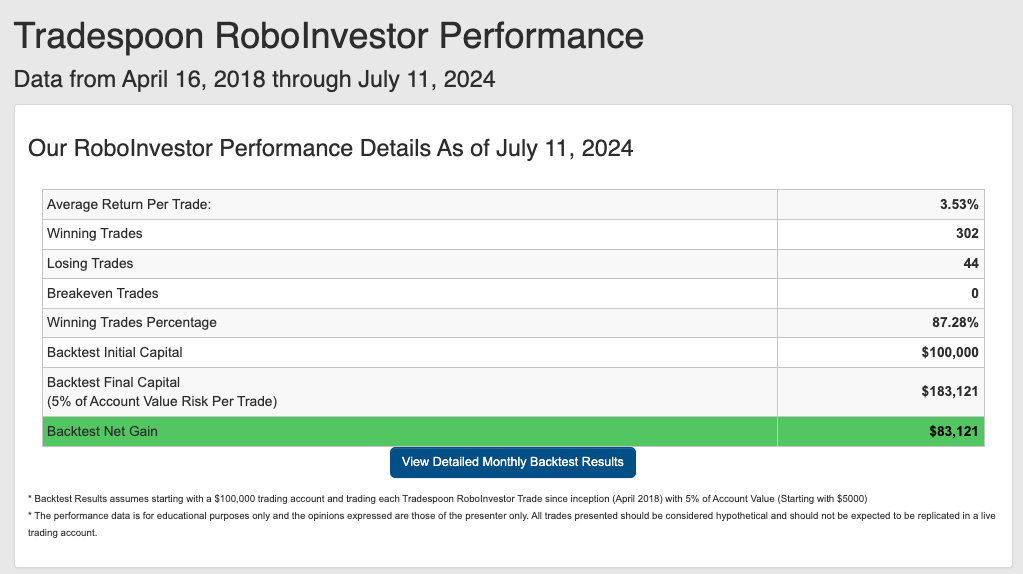

Harnessing the power of AI, our RoboInvestor stock and ETF advisory service leverages cutting-edge technology to pinpoint trades with a high probability of profitability. Our proprietary AI platform eliminates the noise and emotional factors that often influence investor decisions, providing our members with clear, data-driven insights and strategies for success.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.28% going back to April 2018.

As we move beyond the halfway mark of 2024 and into the dog days of summer, investors continue to navigate a challenging market landscape. Persistent issues like inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine, shape the current investment environment. In these uncertain times, the role of a reliable and knowledgeable investment partner becomes increasingly vital for making informed decisions amidst fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!