On Wednesday, the S&P 500 and Nasdaq Composite closed at record levels, wrapping up the holiday-shortened session on a high note. In contrast, the Dow Jones Industrial Average ended slightly lower. All U.S. markets were closed on Thursday in observance of the Fourth of July but resumed normal trading hours on Friday, with investors eagerly awaiting the June employment report from the Labor Department.

As we enter the third quarter, several factors are capturing investor attention. Key among them are the latest Federal Reserve speeches, including remarks from Chair Jerome Powell, along with unemployment, manufacturing, and inflation data from Europe. The upcoming earnings season also looms large. Globally, inflation is trending lower, and there are signs of a cooling economy based on housing and retail data, although manufacturing remains stable. These indicators suggest a potential soft landing, with the primary risk being an uptick in unemployment.

Last Friday, government data revealed that the personal consumption expenditures price index—the Fed’s preferred inflation measure—remained practically unchanged in May. This return to the inflation pace last seen in the fall of 2023 was a welcome sign for those hoping for interest rate cuts in 2024.

Federal Reserve Chair Jerome Powell recently noted that while the latest inflation data is promising, more evidence is needed to confirm a sustainable trend before considering interest rate cuts. This week, global monetary policymakers, including Powell, gathered in Portugal for the European Central Bank’s annual Forum on Central Banking.

Powell emphasized the importance of accurately understanding underlying inflation, citing the strength of the U.S. economy and labor market as reasons for a cautious approach. The Federal Open Market Committee (FOMC) has maintained the federal funds rate target between 5.25% and 5.5% since July 2023, with their next meeting on July 30-31. Current market pricing suggests less than a 10% chance of a rate cut in July, but a 69% chance of a reduction in September.

Additionally, Powell highlighted that a gradual cooling of the labor market is positive and does not anticipate a sudden spike in unemployment. However, he acknowledged that a faster-than-expected weakening in the labor market could prompt rate cuts.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Heading into Thursday, global government bond yields fell amid cooling inflation data from the eurozone and weakened U.S. economic data. This decline in bond yields reflects growing expectations for central banks to lower interest rates, boosting stock markets on both sides of the Atlantic. Mining stocks outperformed due to a surge in commodity prices, spurred by a weakened U.S. dollar, while technology shares also performed strongly amid the ongoing AI frenzy.

The U.S. services sector unexpectedly declined in June, suggesting a broader cooling of the economy. The Institute for Supply Management’s services-activity index decreased to 48.8 from 53.8 in May, falling below the 50 mark that divides expansion from contraction for the second time in three months.

The 10-year Treasury yield continues to be volatile, trading in a range between 4.2% and 4.7%. This week, it is retesting the 4.3% level as markets remain near all-time highs. Bond yields pulled back after the latest economic data came in mostly cooler than expected.

Value stocks and interest-sensitive stocks are rebounding, with the QQQ and SPY near all-time highs. Debate continues around potential interest rate cuts this year, driven by data. The 10-year yield broke below the key 4.5% level and continues to trade between 4.3% and 4.7%. Recent U.S. data indicates labor markets could be cooling faster than forecast, with ADP’s employment report coming in lower than expected and weekly jobless claims—a proxy for layoffs—higher than forecast.

Crude oil futures gained traction late in a light trading session ahead of the U.S. July 4 holiday. There was little initial reaction to the EIA’s report of a larger-than-expected 12.2 million barrel drop in U.S. crude stocks last week, accompanied by draws in gasoline and diesel stocks as demand rose ahead of the heavy travel week.

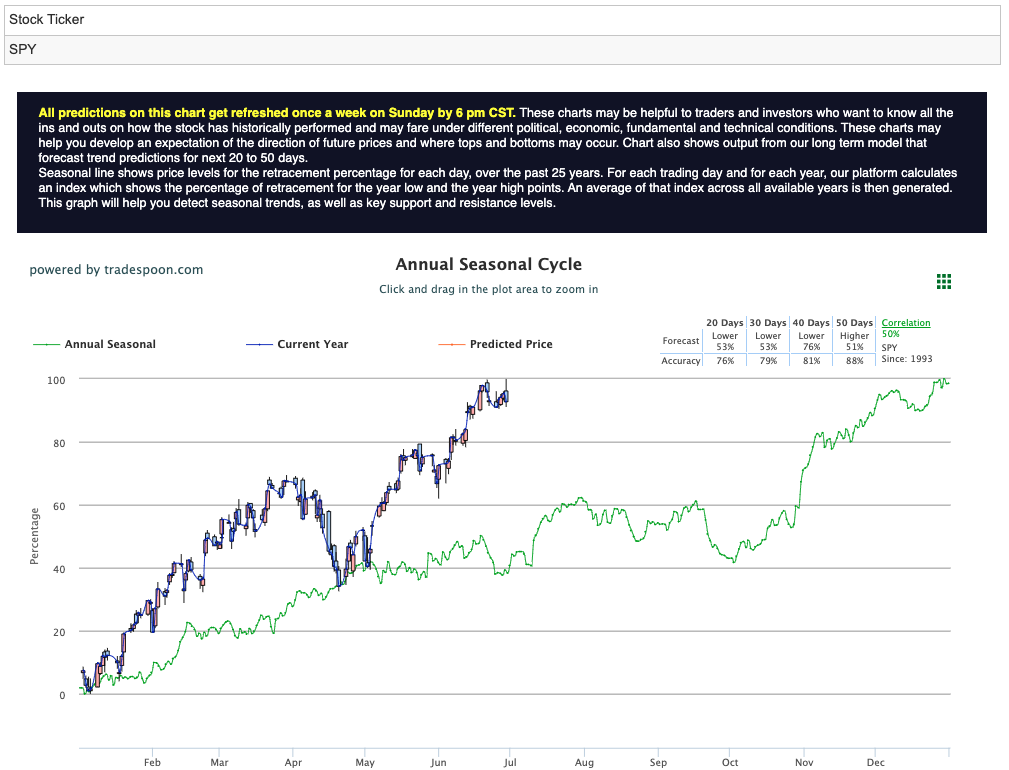

Despite the mixed signals, I remain in the bullish camp. Inflation is coming within expectations, and the earnings season is proving to be better than anticipated. However, risks persist as the economy cools, unemployment ticks up, and there is potential for small banks to fail due to exposure to commercial and residential real estate. I expect the SPY rally to be capped at $550-$560 levels, with short-term support at $520-$530 over the next few months. Overall, I anticipate the market to post higher highs and higher lows, driven by favorable economic data and robust corporate earnings. For reference, the SPY Seasonal Chart is shown below:

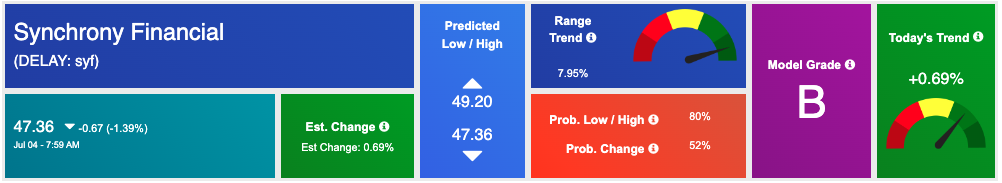

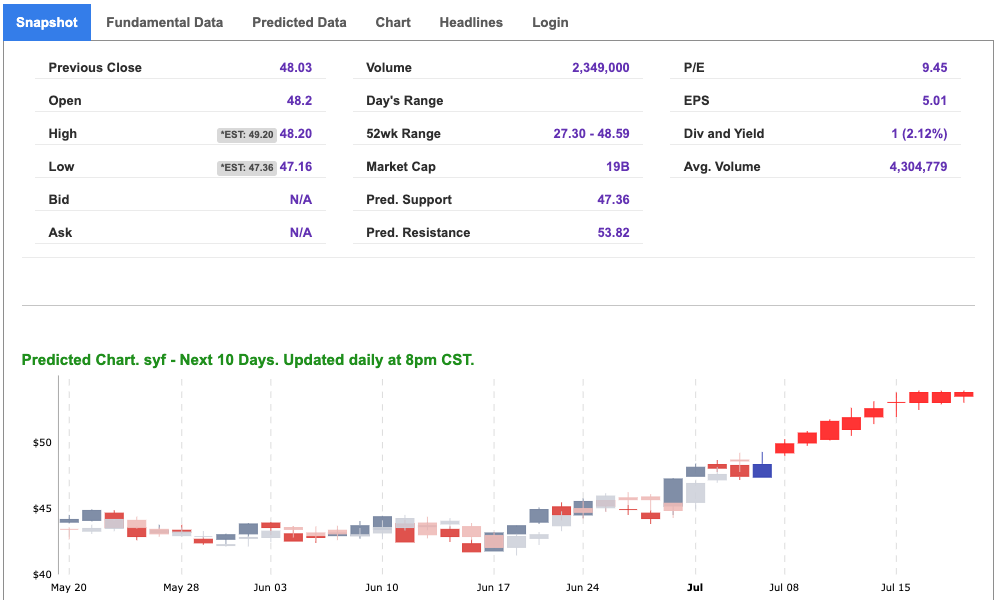

Given the current market conditions, one stock that stands out as promising for the upcoming week is Synchrony Financial (SYF).

Synchrony Financial is one of the largest providers of private label credit cards in the United States. The company partners with various retailers, healthcare providers, manufacturers, and more to offer credit products tailored to their customers’ needs. SYF provides a range of credit products, including private-label credit cards, dual cards, and small to medium-sized business credit products. Founded in 2003 and headquartered in Stamford, Connecticut, Synchrony Financial has a robust portfolio and a strong presence in the financial services industry.

Synchrony Financial is well-positioned to capitalize on the prevailing economic landscape. Despite broader economic concerns, consumer spending has remained relatively resilient. As one of the leading providers of consumer credit, Synchrony is well-positioned to benefit from continued consumer spending, especially with its strong partnerships in the retail sector.

With global inflation trending lower and signs of a cooling economy, interest rates are likely to stabilize or even decline. This environment is favorable for financial companies like SYF, as lower interest rates can stimulate borrowing and spending, leading to increased credit card usage and growth in Synchrony’s loan portfolio.

Moreover, Synchrony Financial has demonstrated resilience amid economic volatility. The company’s diversified portfolio across various sectors, including retail, healthcare, and home improvement, provides a buffer against sector-specific downturns. This diversification helps mitigate risks associated with economic fluctuations.

The start of the earnings season brings optimism, and Synchrony Financial is expected to report strong results. Historically, SYF has shown robust performance in its earnings reports, and with the current economic indicators suggesting a soft landing, the company is likely to meet or exceed market expectations.

Technology shares have performed strongly amid the ongoing AI frenzy, and Synchrony has been investing in technological advancements to enhance its offerings. The integration of AI and other advanced technologies in credit assessment and customer service can drive efficiency and improve customer satisfaction, further boosting SYF’s market position.

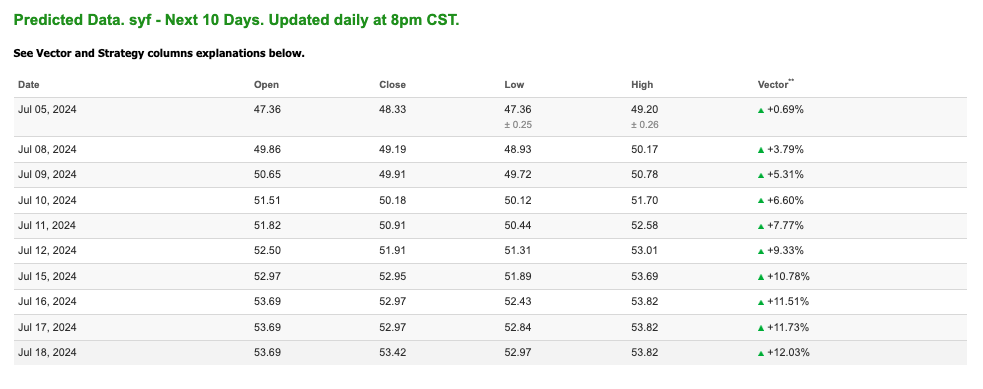

Additionally, SYF’s stock is currently trading at an attractive valuation compared to its peers, offering a compelling entry point for investors. The company also provides a solid dividend yield, offering an attractive income stream for investors in a low-yield environment. And my Stock Forecast Toolbox 10-day Predicted Data seems to agree:

Synchrony Financial (SYF) is well-positioned to capitalize on the current market conditions, with its strong consumer credit offerings, resilience amid economic volatility, and strategic investments in technology. Given the favorable macroeconomic trends, robust earnings outlook, and attractive valuation, SYF is a compelling buy for the upcoming week. Investors looking for exposure to the financial sector with a focus on consumer credit should consider adding SYF to their portfolios.

Harnessing the power of AI, our RoboInvestor stock and ETF advisory service leverages cutting-edge technology to pinpoint trades with a high probability of profitability. Our proprietary AI platform eliminates the noise and emotional factors that often influence investor decisions, providing our members with clear, data-driven insights and strategies for success.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

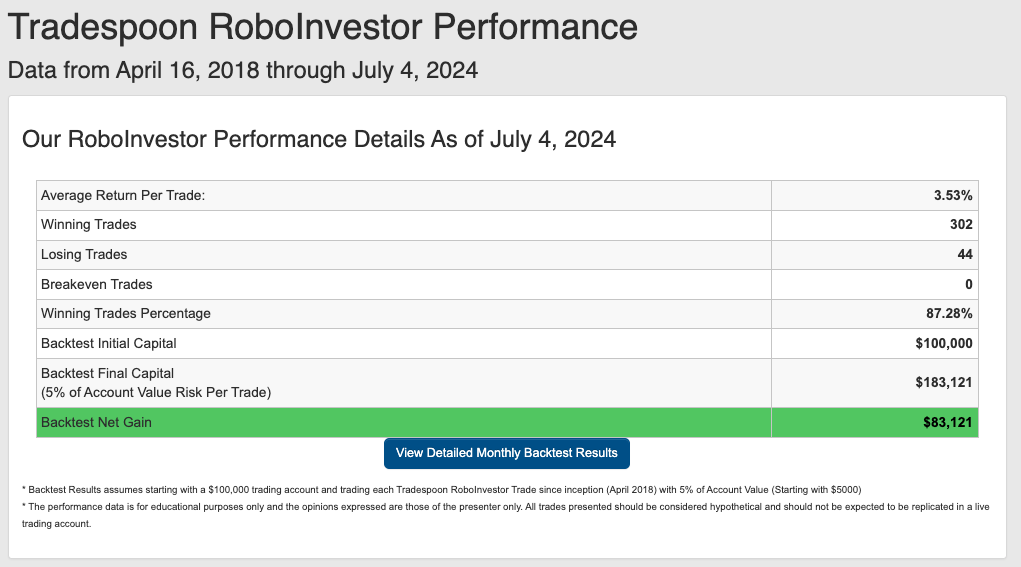

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.28% going back to April 2018.

As we reach the halfway point of 2024, investors find themselves grappling with a maze of market challenges that persist, from escalating inflationary pressures to the fluid landscape of Federal policies and geopolitical tensions, such as the ongoing conflict in Ukraine. In these uncertain times, the importance of having a reliable and knowledgeable investment partner cannot be overstated.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!