As the calendar turns to December, U.S. markets kicked off the final month of 2024 with mixed performances, highlighting divergent sentiment across sectors. While the S&P 500 and Nasdaq Composite are on track to extend their record-setting streaks, driven by strong gains in large technology stocks, the Dow Jones Industrial Average is struggling, slipping into the red. This divergence underscores a broader market unease as traders digest November’s economic data and brace for a critical week of new reports and Federal Reserve commentary.

Today’s key economic report came from the U.S. manufacturing sector, which has been in a persistent slump for months. The Institute for Supply Management (ISM) Purchasing Managers Index (PMI) for November landed at 48.4, marking a slight improvement from October’s 46.5 and surpassing economists’ expectations of 47.5. While the sub-50 reading signals contraction, the uptick hints at a modest recovery. Notably, new orders—a leading indicator for future growth—are beginning to show signs of improvement, offering a glimmer of optimism to investors.

Despite this bright spot, the manufacturing sector remains a weak link in the broader economy. Continued struggles here could amplify concerns about slowing growth, even as the services sector and consumer spending remain more resilient.

Economic data released last week painted a nuanced picture for markets. The Personal Consumption Expenditures (PCE) inflation report, the Fed’s preferred gauge, revealed that core inflation rose 2.8% year-over-year in October, exceeding the central bank’s 2% target. Yet, the modest pace of price growth coupled with signs of a cooling economy—rising unemployment and tightening credit conditions—has strengthened market expectations for a December interest rate cut.

This mixed backdrop has been constructive for equities. With inflation largely in line with expectations and corporate earnings exceeding forecasts, bullish sentiment has been bolstered. However, vulnerabilities remain, including concerns over a potential recession and the stability of smaller regional banks.

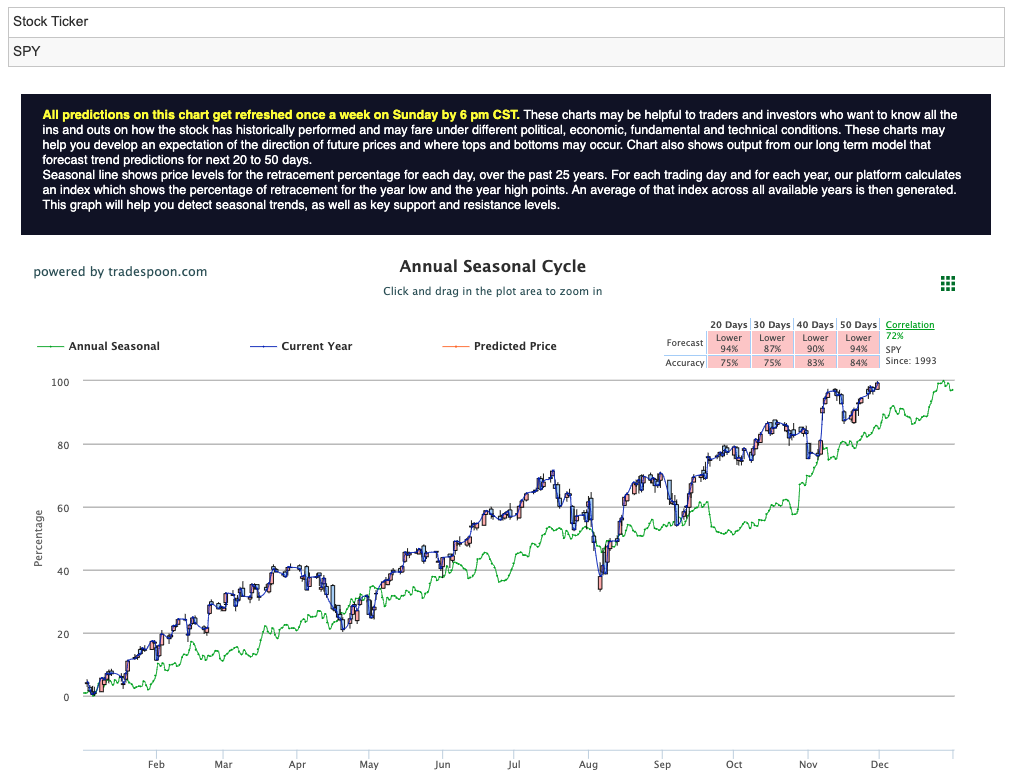

Looking ahead, the S&P 500 (SPY) appears poised to maintain its uptrend, with analysts targeting levels of $600-$610 in the coming months, supported by strong earnings and resilient consumer demand. Short-term support is pegged at $540-$550, and shallow pullbacks may present opportunities for disciplined buyers to enter the market. For reference, the SPY Seasonal Chart is shown below:

On the global stage, the U.S. dollar continued its ascent as geopolitical tensions between the U.S. and BRICS nations (Brazil, Russia, India, China, and South Africa) garnered attention. Strength in the dollar often creates headwinds for U.S. exports, further challenging the manufacturing sector but bolstering the appeal of dollar-denominated assets for global investors.

This week’s jam-packed calendar promises to shape the market narrative for December. Key economic reports include:

Additionally, several speeches from Federal Reserve officials will provide clues on the trajectory of monetary policy.

On the corporate front, the earnings calendar features an eclectic mix of companies across sectors, with notable reports from Salesforce (CRM), Marvell Technology (MRVL), Pure Storage (PSTG), Lululemon Athletica (LULU), Dollar Tree (DLTR), and Ulta Beauty (ULTA). These updates will offer insights into consumer demand, corporate health, and sector-specific dynamics heading into 2024.

Despite the market’s uneven start, the tech-heavy Nasdaq continues to shine, fueled by gains in megacap stocks. This reflects investor confidence in the sector’s ability to thrive even amid economic uncertainty. However, broader market struggles suggest traders remain cautious as they weigh the implications of upcoming data releases and Fed commentary.

The resilience of equities, even in the face of lingering headwinds, demonstrates the market’s capacity to climb a wall of worry. With strong earnings momentum and expectations of a dovish Fed tilt, disciplined investors may find opportunities in targeted pullbacks. As the final month of the year unfolds, all eyes remain on the data to gauge whether the rally has more room to run—or if caution will prevail.

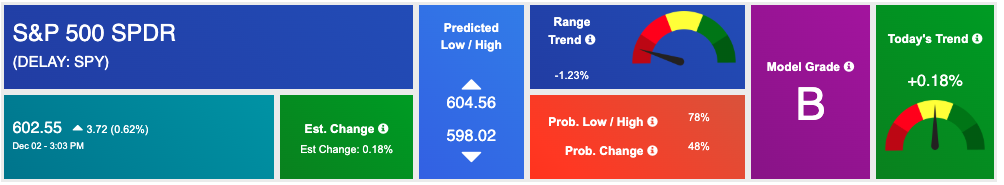

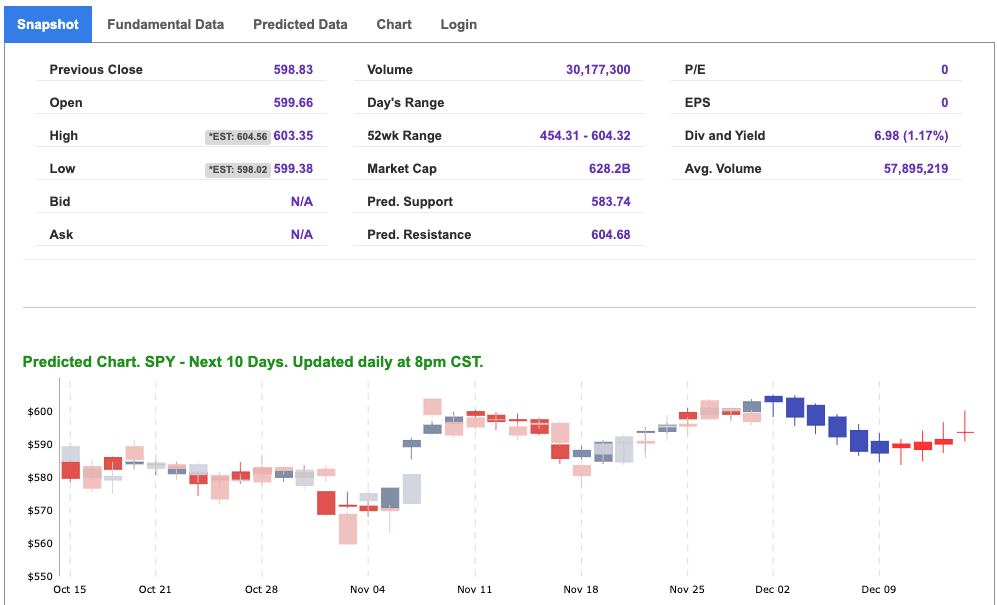

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

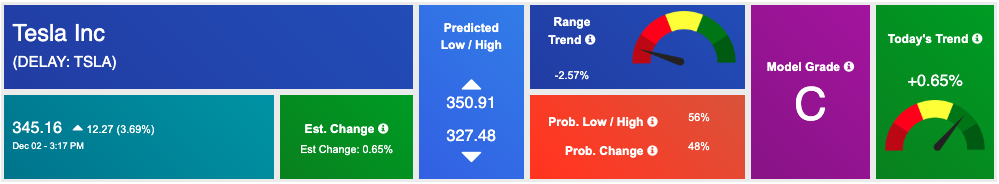

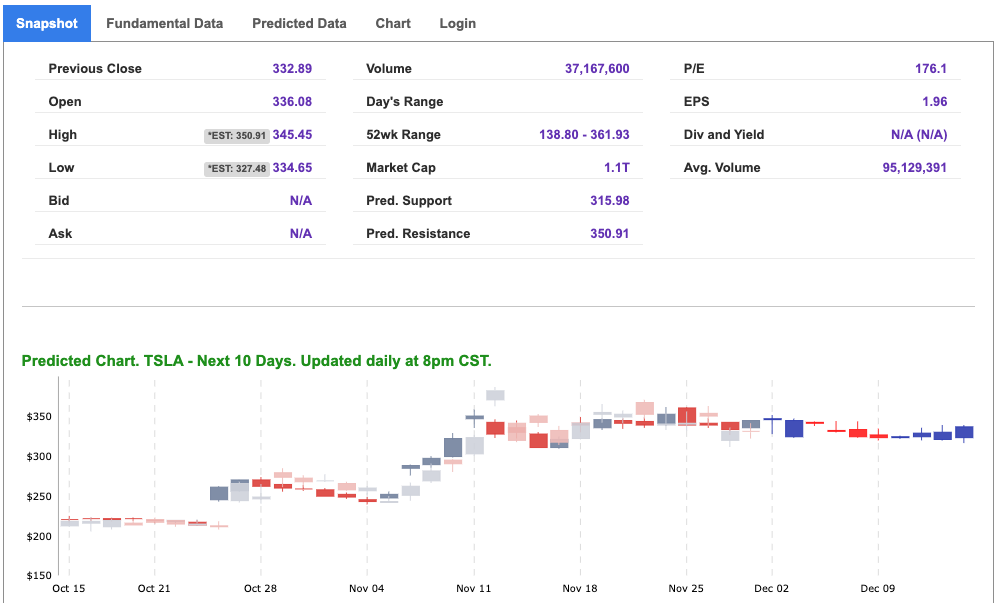

Our featured symbol for Tuesday is Tesla Inc – TSLA is showing a steady vector in our Stock Forecast Toolbox’s 10-day forecast.

The symbol is trading at $345.16 with a vector of +0.65% at the time of publication.

10-Day Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, tsla. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

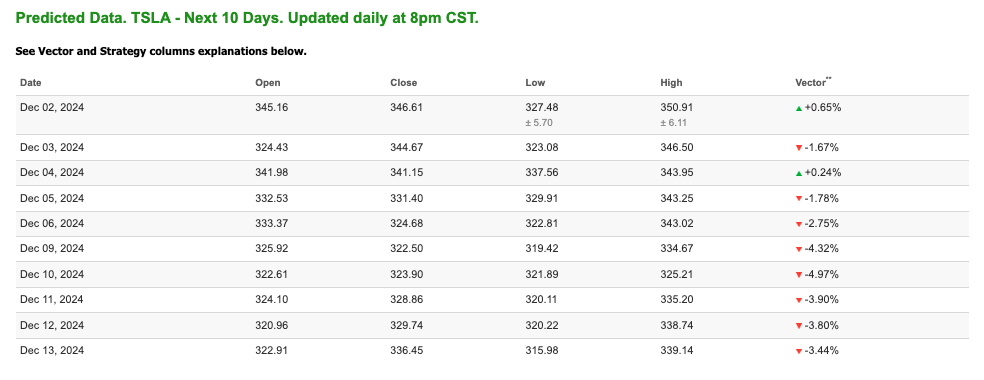

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $68.14 per barrel, up 0.21%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $71.61 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

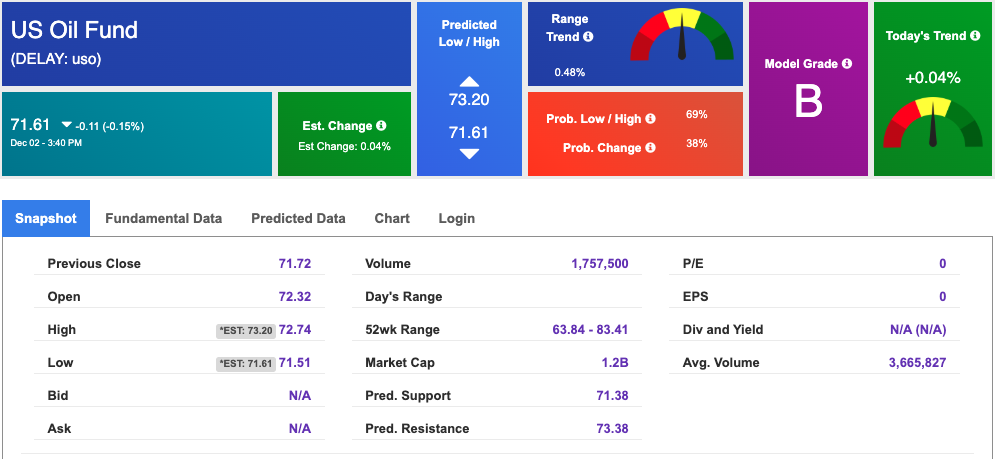

The price for the Gold Continuous Contract (GC00) is down 0.71% at $2662.00 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $245.59 at the time of publication. Vector signals show +0.28% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

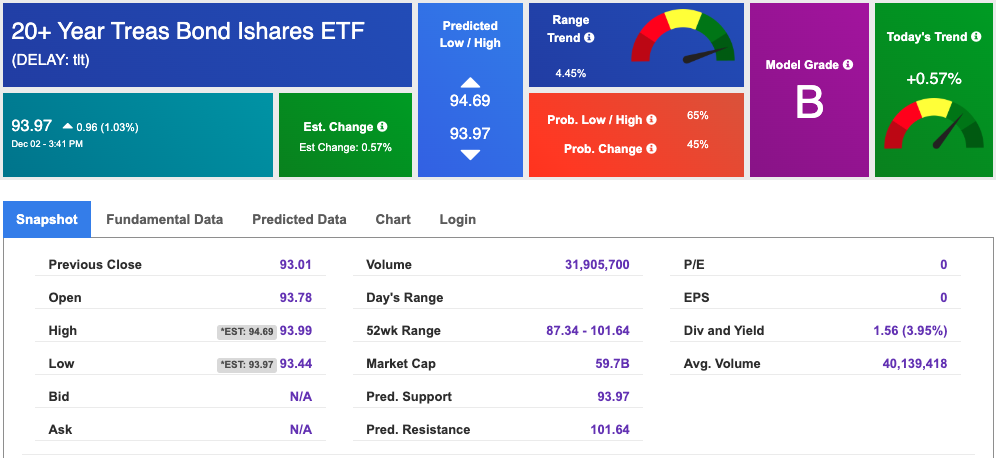

The yield on the 10-year Treasury note is up at 4.196% at the time of publication.

The yield on the 30-year Treasury note is up at 4.366% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

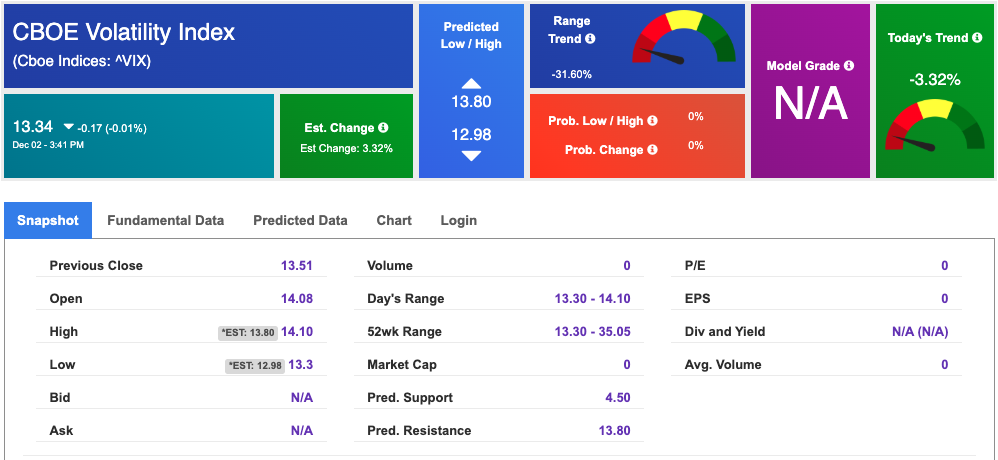

The CBOE Volatility Index (^VIX) is priced at $13.34 down 0.01% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!