In a week marked by pivotal events, financial markets witnessed significant volatility as investors navigated U.S. election uncertainty, a Federal Reserve rate decision, and mixed economic data. Here’s a deep dive into the primary factors influencing the market and what may lie ahead.

The Federal Open Market Committee (FOMC) opted for a quarter-point rate cut this past Thursday, shifting the federal funds rate to a target range of 4.5%–4.75%. This move came as part of the Fed’s continued strategy to counter inflationary pressures while managing a cooling labor market. Federal Reserve Chair Jerome Powell emphasized the Fed’s cautious stance, describing this cut as a “further recalibration,” but stopped short of ruling out future rate hikes. The decision, although largely expected, signals the Fed’s readiness to balance growth with inflationary risks as the economy slows down.

Key economic indicators, such as a dip in factory orders and a downturn in nonfarm payrolls, underscore the Fed’s cautious approach. The Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation measure, rose by 0.2% in September, with core inflation still slightly above the target. Investors are now watching closely to see if additional cuts might occur, especially as Bloomberg data projects up to 50 basis points in cuts this year and potentially 125 basis points through 2025.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

With the U.S. presidential race narrowing between Vice President Kamala Harris and former President Donald Trump, election-related tension gripped the markets. Leading up to Election Day, the S&P 500 posted its second consecutive weekly loss amid heightened volatility. Despite early-week losses, the “Red Wave” rally pushed stocks higher post-election, with the S&P 500 and Russell 2000 recovering off session lows as investor sentiment turned cautiously optimistic.

As the election results unfolded, Treasury bond yields spiked, reflecting investor expectations of potential inflationary pressures under another Trump administration. Traders anticipated fiscal policies that could accelerate inflation, potentially prompting a hawkish response from the Fed in the coming years. The bond market remains sensitive, with the 10-year Treasury yield trading between 3.6% and 4.4% as markets seek to price in the election’s long-term impact.

Economic reports presented a mixed picture this week. The U.S. labor market showed signs of deceleration, with job openings declining to a three-year low at 7.44 million, down from August’s 7.86 million, highlighting softer labor dynamics. Despite this, consumer confidence rose sharply, with the Conference Board’s index reaching 108.7, its highest level since early 2021, signaling underlying consumer resilience.

The robust consumer activity, combined with resilient retail sales, contributed to an upward revision in the Atlanta Fed’s GDP forecast for Q3 to an estimated 3.4%. Analysts, however, remain cautious, as the softer labor market may hinder sustained consumer spending in the months ahead. Additionally, the latest nonfarm payroll data revealed job market vulnerabilities, partly due to labor strikes and natural disasters affecting October’s numbers.

Earnings season continued to set the tone for market sentiment, with tech heavyweights like Palantir (PLTR) and Qualcomm (QCOM) posting strong results that both energized and raised caution among investors. While impressive, these earnings also highlighted growing AI-related capital expenditures, prompting some to question the sustainability of growth. As the season winds down, attention shifts to upcoming reports from CVS, Shopify, and Arm Holdings, which are expected to provide insights into broader economic health and sector-specific trends.

Adding further significance to market sentiment, key economic indicators, including the trade deficit and ISM Services data, are due this week and could shed light on the economic landscape. Meanwhile, the Federal Reserve’s commentary remains pivotal; any hints on policy direction may heavily influence investor positioning.

Palantir Technologies: Palantir shares climbed following strong quarterly results and an optimistic outlook for the remainder of the year, largely driven by substantial growth in government contracts, which now make up a major part of its revenue. However, some analysts expressed concerns over Palantir’s heavy reliance on government contracts, questioning whether this growth model allows for enough diversification moving forward.

Qualcomm: The chipmaker reported earnings that surpassed both revenue and EPS expectations, with promising guidance reinforcing demand strength in its core markets. Still, investors are keeping a close watch on potential headwinds, including ongoing supply chain issues and regulatory challenges in global markets, that could impact the company’s long-term growth trajectory.

Arm Holdings: Arm also reported strong quarterly earnings that beat market forecasts. Despite the positive results, investor sentiment was mixed, as some appeared to take profits after Arm’s significant rally earlier in the year. The company’s optimistic revenue forecast was well-received, though the stock’s slight pullback hints at a potential revaluation as Arm navigates an increasingly competitive semiconductor landscape.

These earnings reports reflect the nuanced environment tech companies face. Strong performances from industry leaders have bolstered market optimism in the short term, yet investors remain measured, carefully weighing the economic conditions and growth challenges that may shape these tech giants’ future.

With inflation warmer than expected and fiscal spending concerns growing, bond yields rose to multi-month highs this week. This increase reflects market adjustments to expected tariffs and inflationary policies post-election, creating headwinds for equities. Despite these challenges, major indices managed to rally post-election, with the S&P 500 climbing above its 20-day Simple Moving Average (SMA) and finding support near all-time highs.

The Russell 2000 index, often a bellwether for investor sentiment toward smaller U.S. businesses, faced pressure from higher yields but showed resilience by closing near record highs. This trend underscores the market’s optimism surrounding a post-election economic recovery, even as inflation remains a concern. The S&P 500 could see further gains, potentially testing new highs in the $600–610 range, though the immediate support remains around $540–550.

While inflation has come within expectations, market risks remain, and the economy shows signs of cooling. Fed Chair Powell’s recent remarks highlight a commitment to manage inflation carefully, yet the Fed’s path may hinge on upcoming economic data and policy developments under a Trump administration.

From an investment perspective, the outlook leans bullish as inflation stabilizes and earnings surpass expectations. However, with a potential recession on the horizon and vulnerabilities in sectors like real estate, investors may approach rallies with caution. Long-term support for the S&P 500 remains solid, and shallow pullbacks could offer buying opportunities as the market inches toward higher levels. The narrative of a “soft landing” remains in focus, with the Fed’s gradual normalization strategy helping to cushion economic impacts.

The past week has underscored the intricate balance between political dynamics, Federal Reserve policy, and economic signals shaping market sentiment. As investors weigh these factors, volatility is likely to persist, with long-term trends potentially favoring a steady climb. Whether positioning for a bull market or hedging against potential risks, staying informed and agile will be crucial for navigating the months ahead.

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

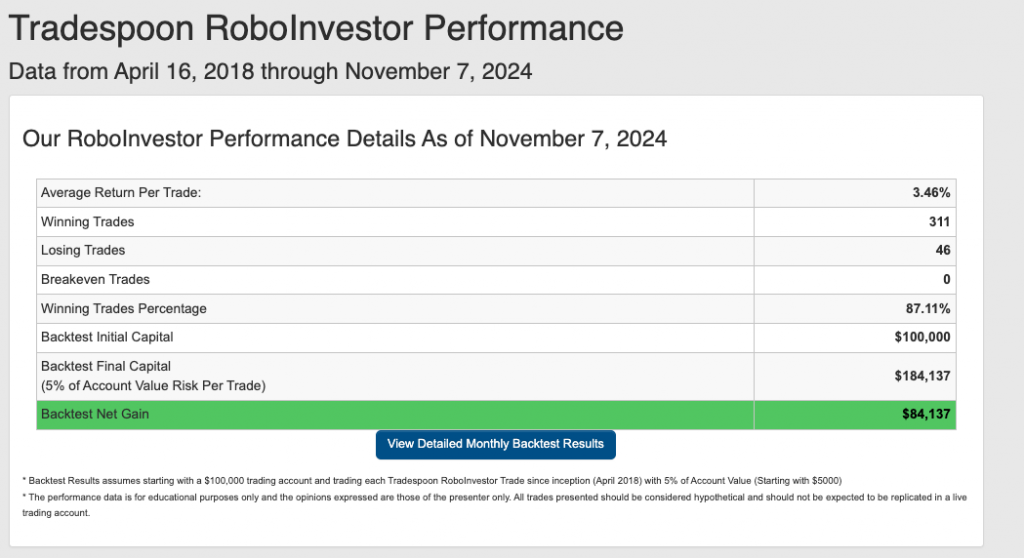

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.11% going back to April 2018.

As we advance further in Q4, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!