This week, global markets have been captivated by a flurry of economic data and corporate developments, as investors navigate a landscape shaped by key indicators and pivotal corporate shifts.

At the outset of the week, major U.S. stock indexes surged on Monday, extending their string of record closes. The S&P 500 and Nasdaq led the charge, buoyed by robust performances in consumer discretionary, technology, and industrial sectors. Tesla’s stock notably bolstered consumer discretionary shares, while chip stocks like Super Micro Computer and Broadcom propelled the tech sector. Despite some volatility, Nvidia remains in the spotlight with ongoing Wall Street upgrades, underscoring its pivotal role in the market landscape.

Bond markets experienced heightened volatility as the 10-year Treasury yield fluctuated between 4.2% and 4.7%, retesting key levels amid speculation over future interest rate cuts. Concurrently, gold prices faced downward pressure amidst strengthening dollar dynamics and evolving interest rate expectations.

Tuesday saw further market milestones as Nvidia briefly eclipsed Microsoft to become the world’s most valuable publicly traded company, driven by a 3.2% increase in its stock price. Federal Reserve officials also took center stage with a flurry of speeches, reflecting cautious optimism about economic prospects. Despite acknowledging lingering inflation concerns, policymakers signaled a patient approach toward potential rate adjustments, emphasizing the need for sustained economic progress.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

The economic pulse was also measured through retail sales data, revealing a modest 0.1% increase in May, falling short of expectations amid declines in auto and gas station receipts. This report tempered some market exuberance, prompting increased speculation among traders about potential Federal Reserve actions in response to evolving economic conditions.

Wednesday’s closure for the Juneteenth holiday provided a brief respite, allowing investors to digest recent developments. As markets reopened, a mix of optimism and caution prevailed, driving renewed highs in exchange-traded funds like QQQ and SPY, while discussions around interest rate cuts continued to influence investor sentiment.

Looking ahead, market analysts maintain cautious optimism, noting that although inflation seems to be stabilizing near target levels, underlying economic pressures persist. Earnings season has pleasantly surprised, contributing to a positive outlook despite concerns surrounding cooling economic growth and potential risks in sectors like banking and real estate.

The current market climate remains favorable, supported by inflation levels staying within expected ranges and corporate earnings consistently surpassing projections. This stability continues to bolster equity markets, fostering a positive sentiment among investors.

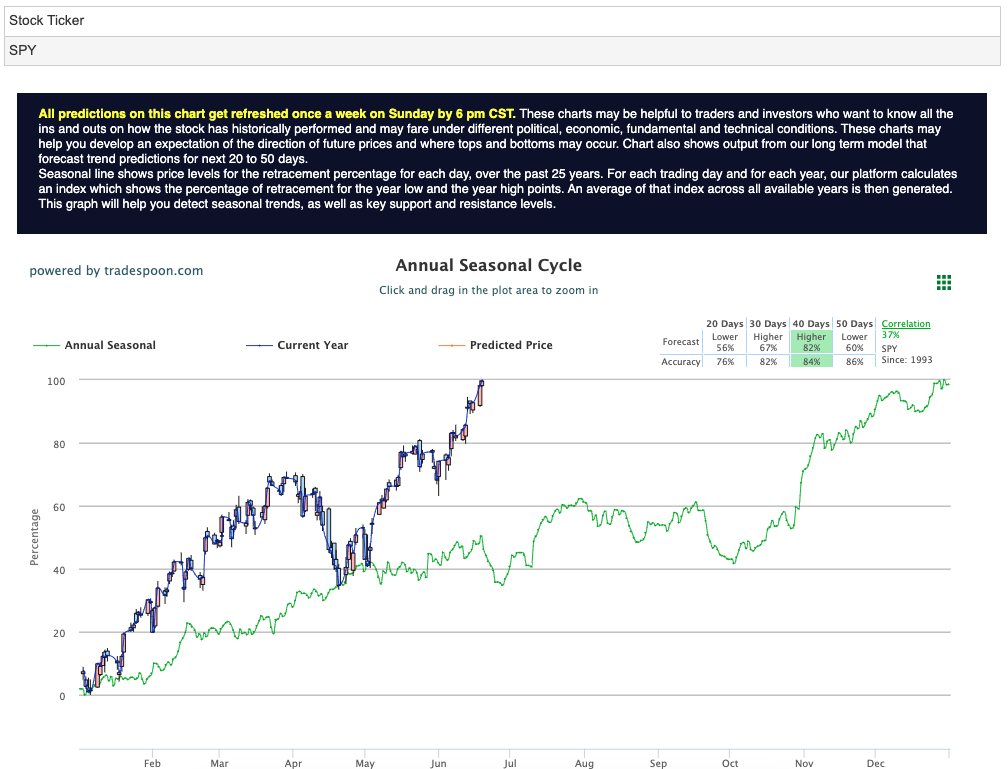

Looking forward, while the SPY may encounter resistance in the $540-$550 range, it finds support at $500-$510 in the short term. These levels indicate promising opportunities for ongoing market progress, driven by anticipated sustained upward momentum over the coming months. For reference, the SPY Seasonal Chart is shown below:

This optimistic perspective reflects ongoing confidence in economic resilience and corporate performance, establishing a robust foundation for potential growth in the near term.

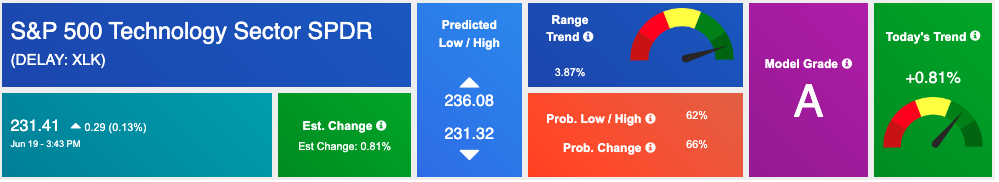

Amidst the volatility and record highs seen in the market this week, the technology sector stands out as a beacon of strength. Bolstered by robust performances from key players like Nvidia and ongoing advances in semiconductor stocks, technology stocks have continued to lead the charge in recent sessions.

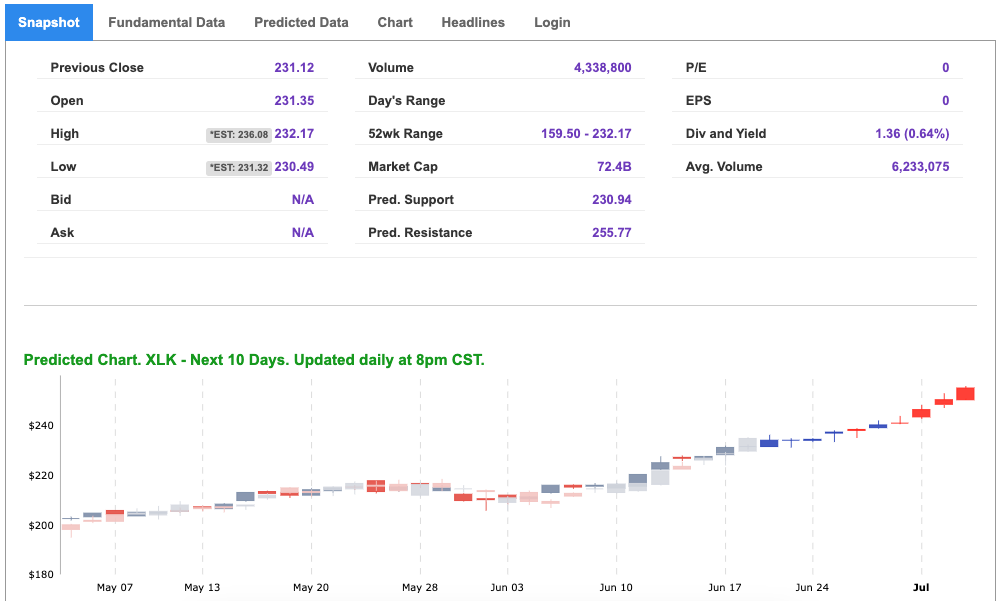

The Technology Select Sector SPDR Fund (XLK) serves as a prime example of the sector’s resilience and potential for further growth. XLK tracks a diverse array of technology companies, including giants like Apple, Microsoft, and Nvidia, offering investors exposure to some of the most innovative and influential firms driving global technological advancements.

Tech stocks within XLK have demonstrated significant momentum, fueled by strong quarterly earnings reports and bullish sentiment from Wall Street analysts. Nvidia’s ascent to become the world’s most valuable publicly traded company underscores the sector’s dynamism and investor confidence. Additionally, advancements in semiconductor technology, highlighted by companies like Broadcom and Super Micro Computer, continue to propel the tech sector forward despite broader market fluctuations.

Looking ahead to the upcoming week, investors and analysts are gearing up to closely monitor XLK and other tech-related assets. The sector is bolstered by sustained optimism surrounding technological innovation and ongoing advancements in semiconductors, which position tech stocks favorably amid evolving economic conditions and ongoing Federal Reserve policy discussions.

In summary, despite persistent challenges and uncertainties in global markets, the technology sector, represented by ETFs like XLK, offers an attractive opportunity for investors seeking growth and resilience amidst market volatility.

As the market continues to achieve new highs, maintaining vigilance remains crucial in light of ongoing economic shifts and policy developments. Investors should carefully assess data-driven signals and corporate performances, navigating these dynamic market conditions with a thorough understanding of evolving economic narratives and strategic risk management.

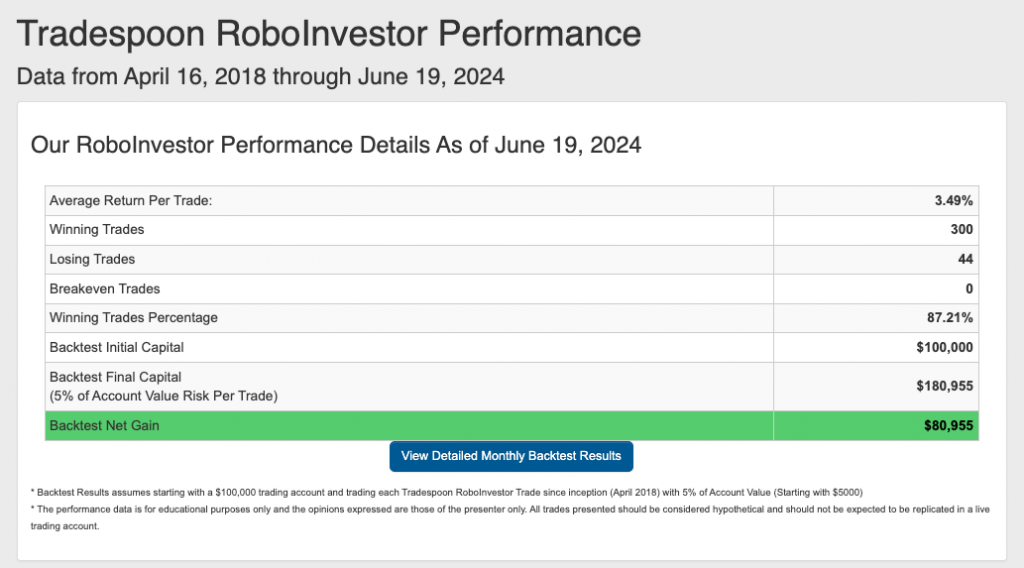

Harnessing the power of AI, our RoboInvestor stock and ETF advisory service leverages cutting-edge technology to pinpoint trades with a high probability of profitability. Our proprietary AI platform eliminates the noise and emotional factors that often influence investor decisions, providing our members with clear, data-driven insights and strategies for success.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.21% going back to April 2018.

As we reach the halfway point of 2024, investors find themselves grappling with a maze of market challenges that persist, from escalating inflationary pressures to the fluid landscape of Federal policies and geopolitical tensions, such as the ongoing conflict in Ukraine. In these uncertain times, the importance of having a reliable and knowledgeable investment partner cannot be overstated. That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!