Global stock markets faced a wave of intense selling, as rising recession fears triggered a sharp decline across major indices. The Dow Jones Industrial Average, S&P 500, and Nasdaq all ended the day significantly lower. Despite a partial recovery from their worst intraday losses, the Dow dropped 2.6%, the S&P 500 fell 3%, and the Nasdaq Composite declined 3.4%, leaving investors on edge about the economic outlook.

The technology sector, especially the “Magnificent Seven” stocks, was hit hardest. This group, which includes Nvidia, Apple, Alphabet, Tesla, Amazon, Microsoft, and Meta Platforms, has been a driving force behind market gains in recent years. However, widespread panic and profit-taking led to a dramatic loss in market value, with the group shedding an astounding $653 billion in market cap on Monday. This marked the largest one-day decline since July 24, when the group lost $744 billion.

Among these tech giants, Nvidia experienced the steepest decline, plunging 6.4% and losing $167 billion in market capitalization. Apple fell 4.8%, Alphabet 4.5%, Tesla 4.2%, Amazon 4.1%, and Microsoft 3.3%. Meta Platforms, though down, was the most resilient with a decline of 2.5%.

The selloff was intensified by a sharp drop in Tokyo’s Nikkei 225, which plummeted over 10%—its largest one-day percentage drop since the Black Monday crash of October 1987. This global market upheaval was fueled by growing concerns that the Federal Reserve may have waited too long to cut interest rates, sparking fears that the economy is already in a downturn.

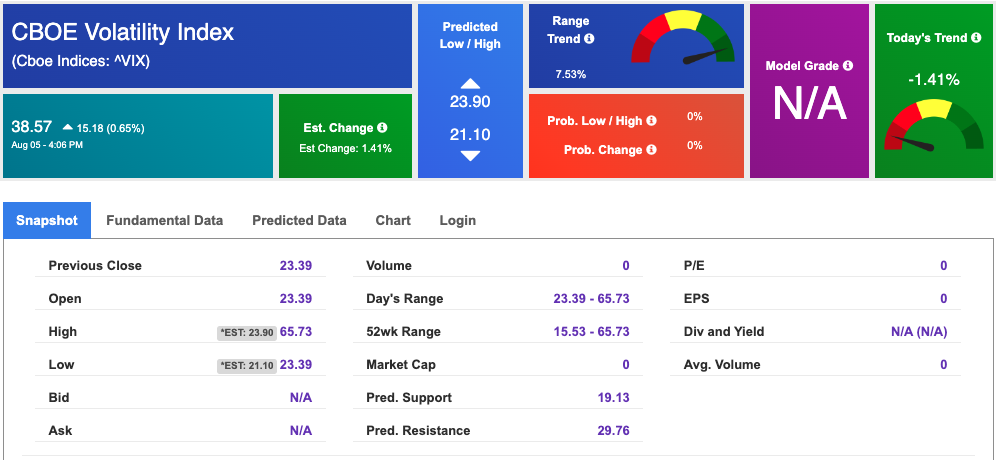

In response, investors rushed to the safety of U.S. government debt, causing bond yields to fluctuate wildly. The 2-year Treasury yield ended the day at 3.88%, while the 10-year yield closed at 3.782%, despite dipping earlier. The market’s fear gauge, the CBOE Volatility Index (VIX), surged to its highest level since 2020, reaching as high as 65.73 before settling at a still-elevated 38.76.

Last week’s weak jobs report continues to weigh heavily on market sentiment. The July jobs report revealed that the U.S. economy added only 114,000 nonfarm payrolls, significantly below the expected 175,000. This slowdown in the labor market, combined with recent data on U.S. manufacturing, has heightened concerns that the Federal Reserve’s anticipated rate cuts may not be sufficient to avert a potential recession.

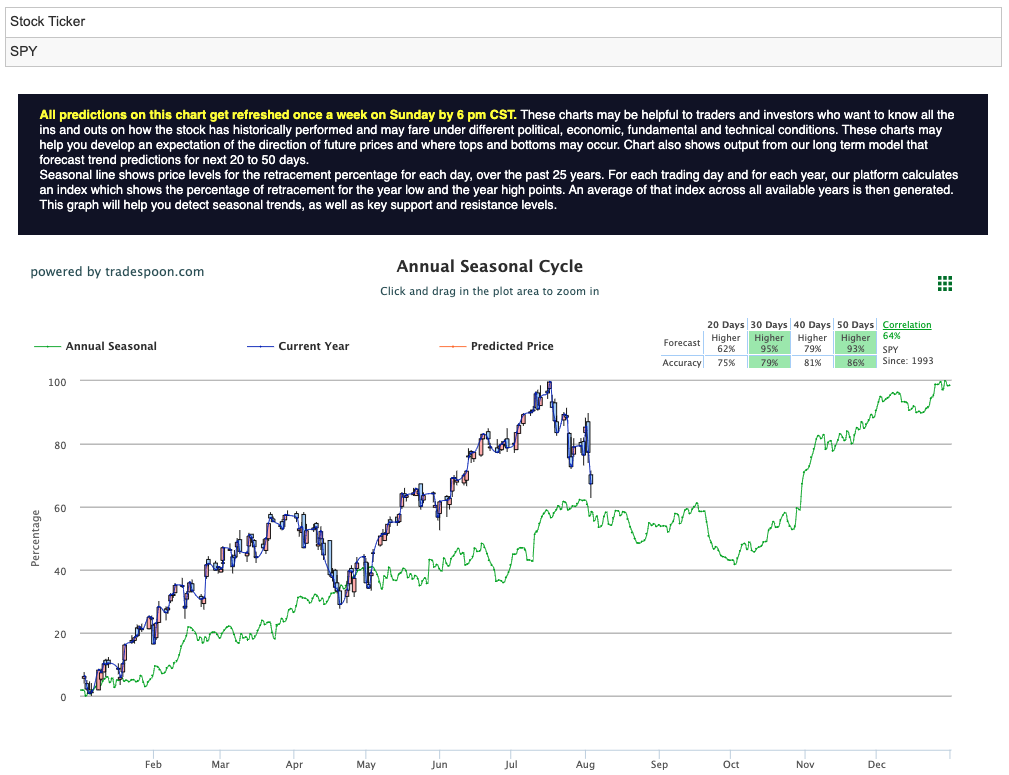

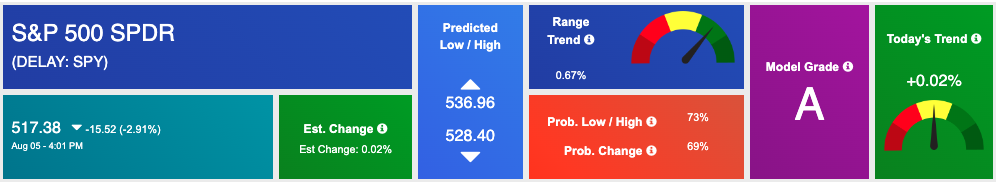

This uncertainty has capped the SPY rally at $560-$575, with short-term support levels identified at $520-$530. In light of these developments, I am adopting a market-neutral stance, anticipating sideways trading in the short to medium term while acknowledging the long-term trend remains intact. For reference, the SPY Seasonal Chart is shown below:

This week, investors will closely monitor key earnings reports from major companies, which could shed light on the health of the economy and the resilience of corporate America. Eli Lilly (LLY) is expected to reveal its growth trajectory in the pharmaceutical sector, while Disney’s (DIS) earnings will be scrutinized for signs of recovery in its theme parks and media divisions amid the streaming wars and shifting consumer behavior. Caterpillar (CAT), a bellwether for global industrial activity, will offer insights into demand in the construction and mining sectors, reflecting broader economic trends. Uber’s (UBER) results will be crucial for understanding consumer spending dynamics in the gig economy and the company’s path to profitability. Additionally, key economic data releases—including ISM Services, Services PMI, Consumer Credit, and the U.S. Trade Deficit—will provide further context on the economic landscape.

Despite inflation aligning with expectations and a better-than-expected earnings season, risks persist as the economy shows signs of cooling, unemployment rises, and small banks face potential failures due to exposure to commercial and residential real estate. These factors underscore the need for a cautious and balanced approach to navigating the current market environment.

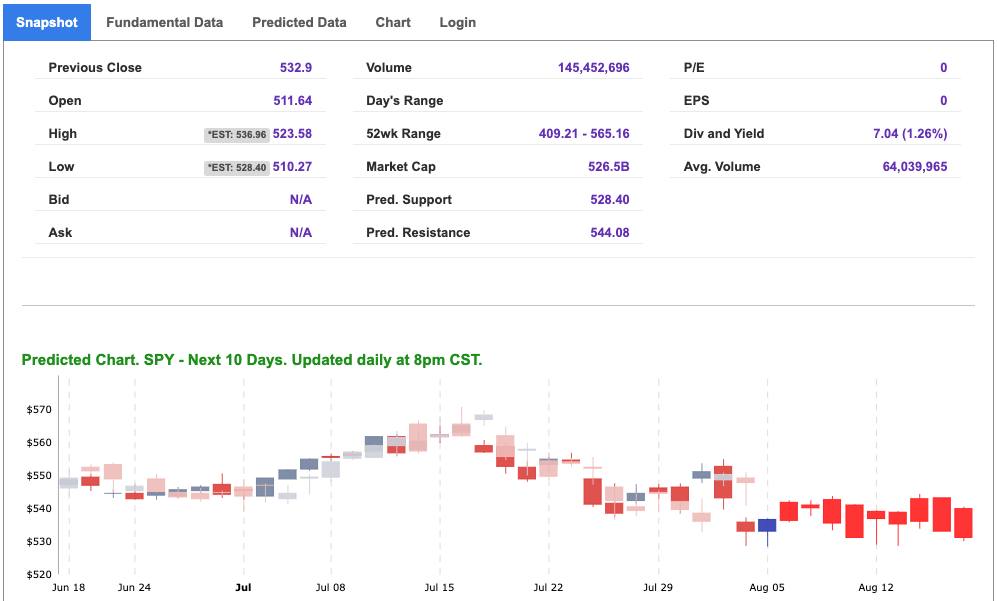

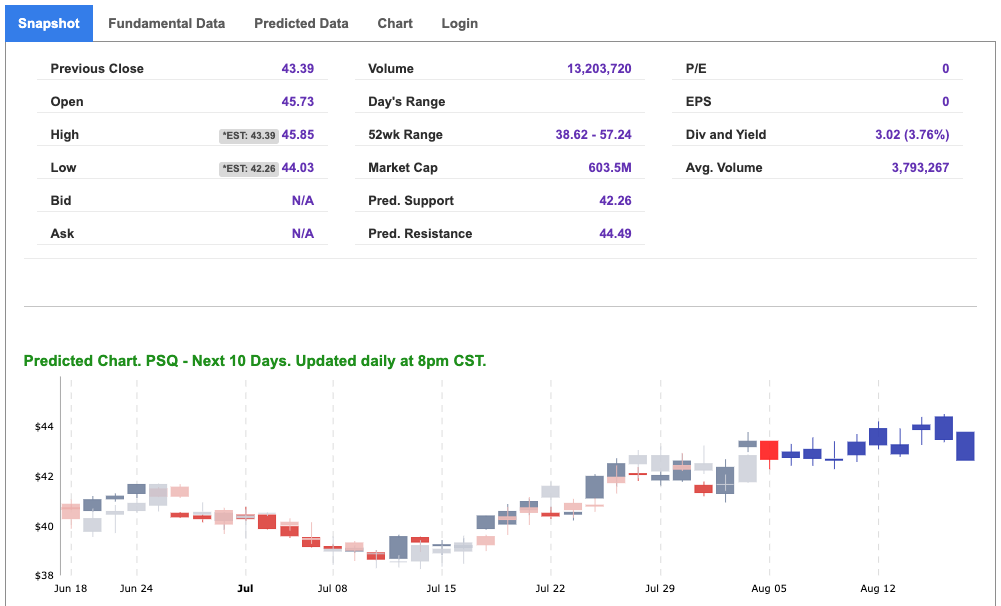

Using the “SPY” symbol to analyze the S&P 500 our 10-day prediction window shows a near-term positive outlook. Prediction data is uploaded after the market closes at 6 p.m. CST. Today’s data is based on market signals from the previous trading session.

Note: The Vector column calculates the change of the Forecasted Average Price for the next trading session relative to the average of actual prices for the last trading session. The column shows the expected average price movement “Up or Down”, in percent. Trend traders should trade along the predicted direction of the Vector. The higher the value of the Vector the higher its momentum.

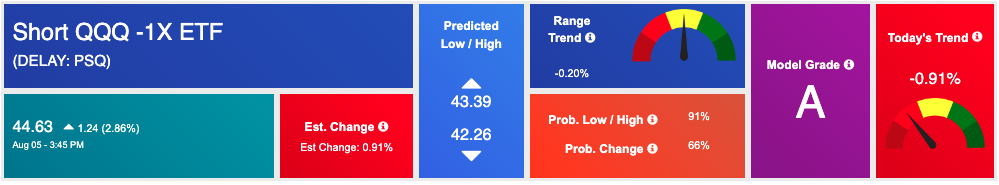

*Please note: At the time of publication Vlad Karpel does have a position in the featured symbol, PSQ. Our featured symbol is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, or MonthlyTrader recommendations. If you are interested in receiving Vlad’s picks, please click here.

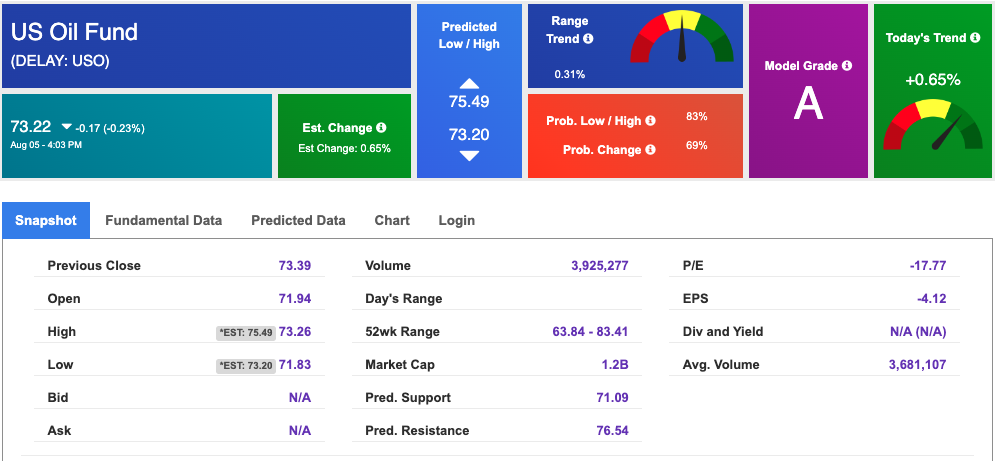

West Texas Intermediate for Crude Oil delivery (CL.1) is priced at $73.92 per barrel, up 0.54%, at the time of publication.

Looking at USO, a crude oil tracker, our 10-day prediction model shows mixed signals. The fund is trading at $73.22 at the time of publication. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

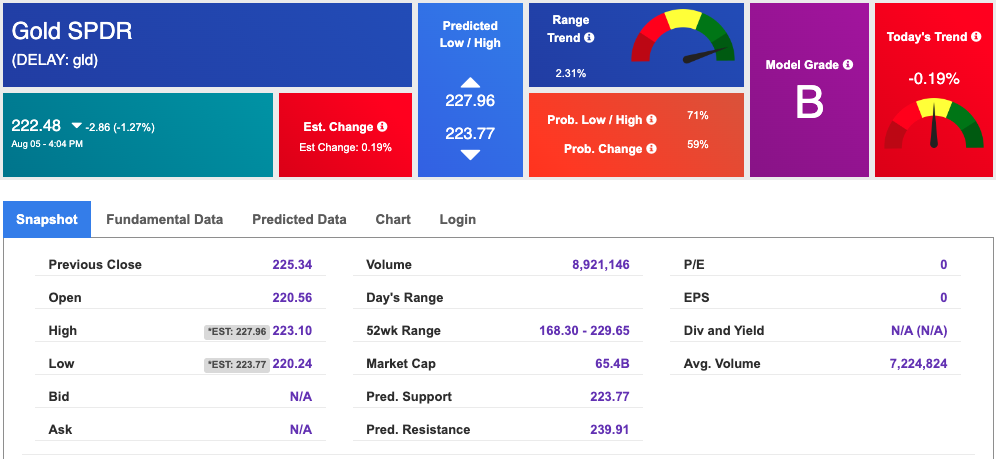

The price for the Gold Continuous Contract (GC00) is down 0.72% at $2,452.10 at the time of publication.

Using SPDR GOLD TRUST (GLD) as a tracker in our Stock Forecast Tool, the 10-day prediction window shows mixed signals. The gold proxy is trading at $222.48 at the time of publication. Vector signals show -0.19% for today. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

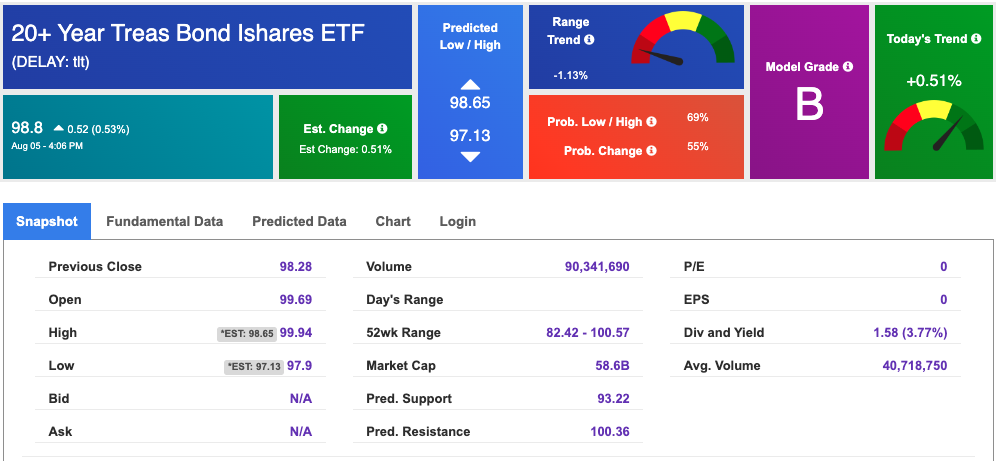

The yield on the 10-year Treasury note is up at 3.798% at the time of publication.

The yield on the 30-year Treasury note is down at 4.078% at the time of publication.

Using the iShares 20+ Year Treasury Bond ETF (TLT) as a proxy for bond prices in our Stock Forecast Tool, we see mixed signals in our 10-day prediction window. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

The CBOE Volatility Index (^VIX) is priced at $38.57 up 0.65% at the time of publication, and our 10-day prediction window shows mixed signals. Prediction data is uploaded after the market close at 6 p.m., CST. Today’s data is based on market signals from the previous trading session.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!