Ahead of next week’s FOMC meeting, the markets witnessed key economic data that continued to shape expectations for interest rates, while also reaching record highs. The S&P 500 and Nasdaq Composite surged to new records on Wednesday, fueled by strong performances in the tech sector. However, Thursday saw a pullback in stocks as investors grew cautious ahead of crucial economic data releases. This week’s key releases included unemployment data, PMI data, as well as the final batch of key earnings, and additional insights into the oil market.

The Labor Department reported an unexpected rise in jobless claims for the week ending June 1, with claims reaching 229,000—up 8,000 from the previous week’s revised level and higher than the forecasted 220,000. The four-week moving average, a more stable measure, decreased slightly by 750 to 222,250. Continuing claims increased by 2,000 to 1.79 million, aligning with economists’ expectations.

These labor market signals come just before the Bureau of Labor Statistics releases its May jobs report, which is anticipated to show an unchanged unemployment rate of 3.9%. Earlier in the week, data revealed that job openings fell to their lowest level in over three years, and ADP’s report indicated that private payroll growth slowed to 152,000 in May, down from April’s revised 188,000 and below market expectations.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

At the start of the week, all eyes were on the Institute for Supply Management’s (ISM) manufacturing Purchasing Managers’ Index (PMI) data, offering vital insights into the health of the manufacturing sector. The PMI for May declined to 48.7 from April’s 49.2, contrary to the expected rise to 49.5, indicating a contraction in manufacturing.

Several key aspects of the PMI raised concerns: new orders fell sharply to 45.4 from April’s 49.1, indicating a decline in demand, while prices paid decreased to 57.0 from 60.9, signaling a slowdown in input costs, possibly easing inflationary pressures. However, there was a silver lining as the employment index within the PMI improved to 51.1 from 48.6, suggesting that despite the overall contraction, manufacturing firms continued to add jobs, showing resilience in the labor market.

Globally, average prices for goods and services rose slightly in May, driven by high service prices and increasing manufacturing costs. Yet, there were signs of cooling inflation rates in Europe, aligning with broader trends of moderating price increases.

In the United States, the PMI data indicates inflation moving closer to the Federal Reserve’s target, offering optimism for achieving price stability in the coming months. This aligns with other economic indicators showing a gradual easing of inflationary pressures, despite ongoing labor market challenges and broader economic uncertainties.

In Europe, the European Central Bank made headlines by cutting interest rates for the first time since 2019, a move that was anticipated but significant. This action shifts focus onto the Federal Reserve, with investors speculating on potential rate cuts.

Meanwhile, crude oil futures rebounded after a steep early-week decline. This recovery was driven by OPEC ministers countering market reactions to their decision to taper output cuts post-September.

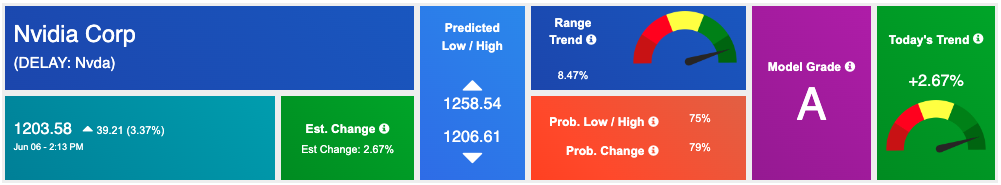

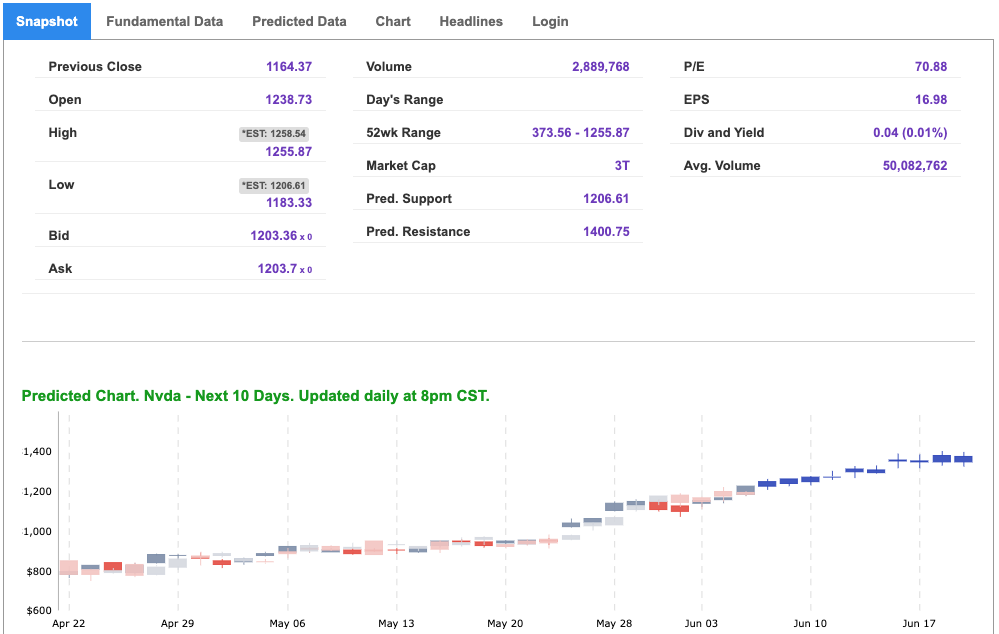

Wednesday marked a milestone for Nvidia, which surpassed a $3 trillion market value, joining Apple in this elite club of U.S. companies. Nvidia’s rapid ascent—reaching $3 trillion just three months after hitting $2 trillion—highlights market optimism despite a challenging economic backdrop.

CrowdStrike also impressed investors, with its shares soaring 11.3% following strong earnings results and an upbeat revenue forecast. The cybersecurity firm’s performance suggests a competitive edge that could pressure rivals in the sector.

The 10-year Treasury yield has been notably volatile, trading between 4.3% and 4.7%. This fluctuation indicates market concerns about a potential mild recession due to sustained higher interest rates. Value and interest-sensitive stocks are testing April lows, with value stocks falling below their 50-day moving average. Despite these concerns, the VIX index, a measure of market volatility, remains low at 14, signaling minimal investor fear.

Software stocks, including Salesforce (CRM), are facing pressure, even as tech stocks rally. The ongoing debate about interest rate cuts remains data-driven, with significant attention on economic indicators. The drop of the 10-year yield below the critical 4.5% level points to continued market volatility.

Precious metals like silver (SLV) and gold (GLD) have retracted from recent highs but maintain strong long-term trends. Treasury markets have been exceptionally volatile as participants adjust their expectations regarding the timing and extent of potential rate cuts.

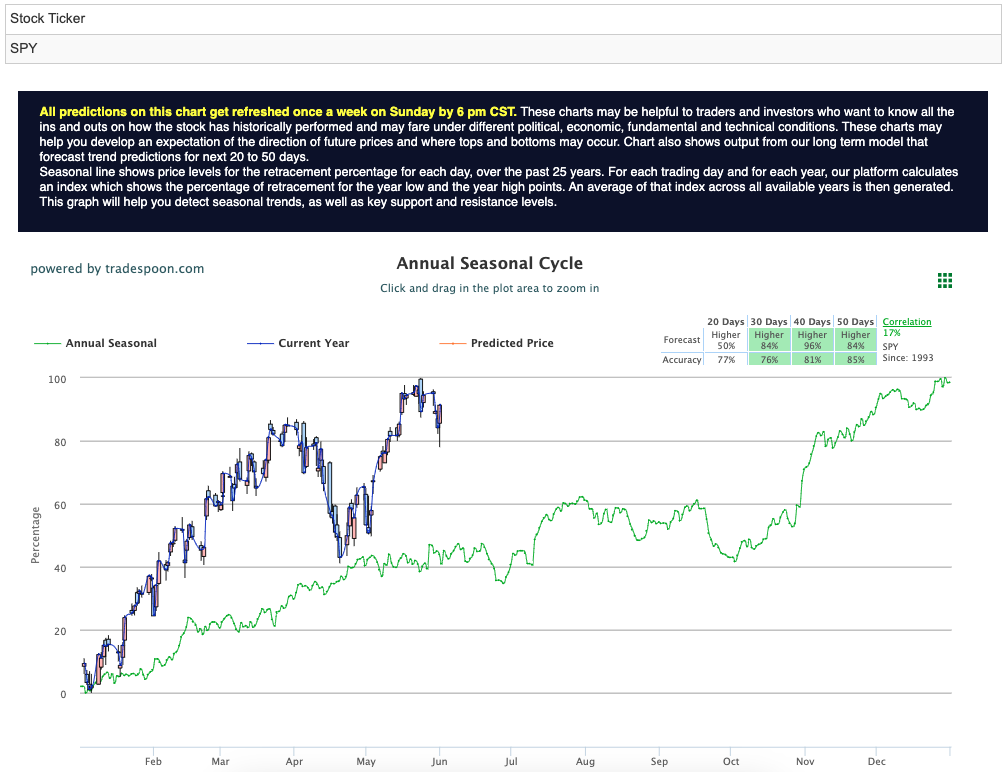

Despite mixed signals, there is a growing shift towards a bullish market outlook. Inflation appears to be aligning with expectations, and the earnings season has been better than anticipated. The SPY, a prominent S&P 500 ETF, faces resistance at the $540-$550 levels, with short-term support between $500 and $510. Expectations are for the market to continue achieving higher highs and higher lows in the upcoming months. For reference, the SPY Seasonal Chart is shown below:

While the market experiences fluctuations and investor caution persists, robust performances in the tech sector and improving economic fundamentals suggest a cautiously optimistic outlook for the near future. With this in mind, one symbol continues to stand out.

Nvidia Corporation (NVDA) is a leading technology company known for designing and manufacturing graphics processing units (GPUs) for gaming, professional markets, and artificial intelligence (AI). Nvidia’s innovative products have made it a pioneer in the gaming industry, AI research, data centers, and autonomous driving technology.

Given the current market conditions, Nvidia (NVDA) stands out as a compelling investment opportunity for the upcoming week.

Nvidia recently surpassed a $3 trillion market value, joining the ranks of elite companies like Apple. This milestone underscores strong investor confidence and the company’s robust market position, particularly in a high-interest rate environment. The tech sector has been a significant driver of recent market gains, with both the S&P 500 and Nasdaq Composite reaching record highs largely due to strong performances from leading tech companies. Nvidia’s rapid ascent from a $2 trillion to a $3 trillion valuation in just three months highlights its leading role in this sector.

Despite broader economic uncertainties, Nvidia has demonstrated remarkable resilience. The volatility in interest rates and mixed economic signals have not dampened the market’s enthusiasm for Nvidia, suggesting strong underlying business fundamentals and growth prospects. Nvidia’s continuous innovation in GPUs, AI technology, and data center solutions positions it well to capitalize on growing market demand. The company’s advancements in these areas not only drive its current success but also pave the way for future growth.

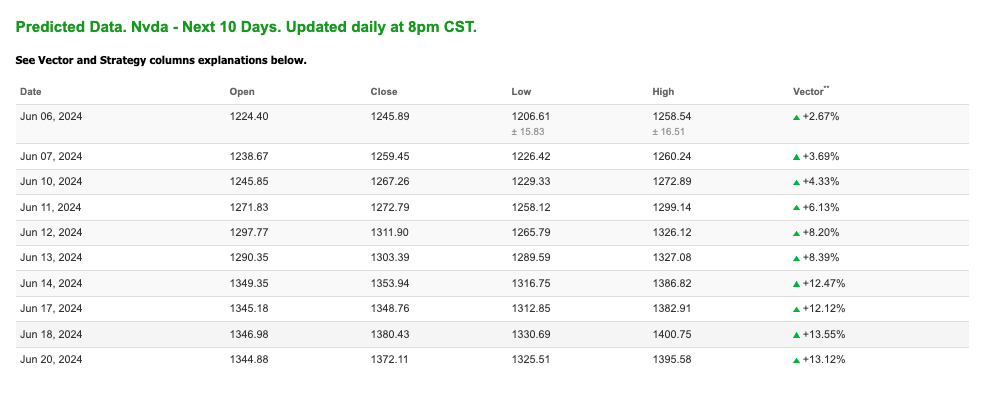

The general market sentiment remains cautiously optimistic, supported by better-than-expected earnings and improving inflation trends. Nvidia, with its strong earnings performance and innovative edge, is likely to benefit from this positive outlook. And just take a look at the 10-day Predicted Data for NVDA sourced from my Stock Forecast Toolbox:

In conclusion, Nvidia’s impressive market valuation, leadership in the tech sector, resilience amid economic challenges, and continuous innovation make it a strong buy for the upcoming week. Investors looking for robust growth opportunities in the tech industry should consider adding NVDA to their portfolios.

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

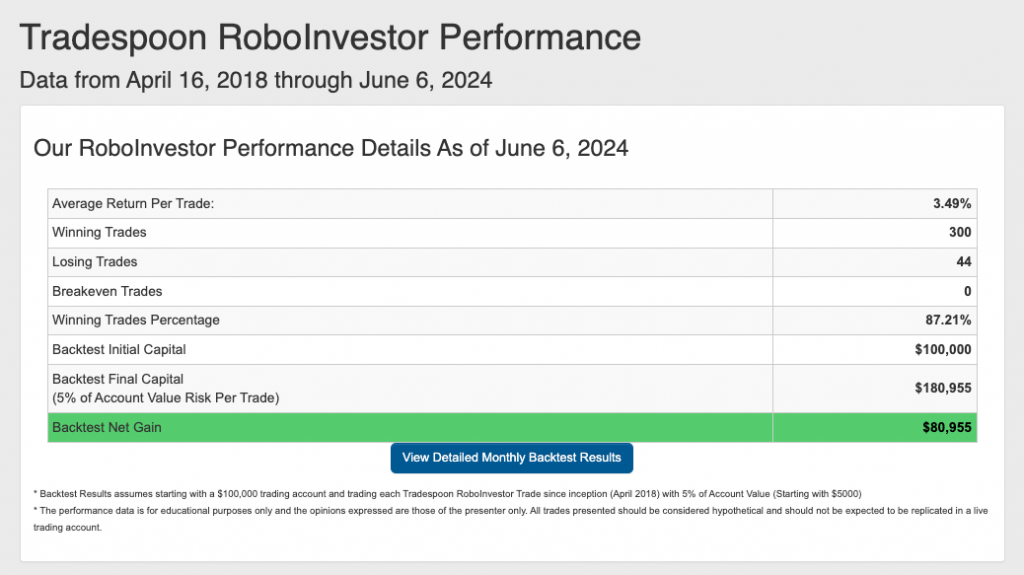

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.21% going back to April 2018.

As we reach the halfway point of 2024, investors find themselves grappling with a maze of market challenges that persist, from escalating inflationary pressures to the fluid landscape of Federal policies and geopolitical tensions, such as the ongoing conflict in Ukraine. In these uncertain times, the importance of having a reliable and knowledgeable investment partner cannot be overstated. That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!