RoboStreet – October 24, 2024

This past week in the financial markets was a whirlwind of activity, driven by a combination of economic data releases, corporate earnings reports, geopolitical tensions, and the ongoing debate over Federal Reserve policy. Investors navigated mixed signals, including strong performances from tech giants, the impact of rising Treasury yields, and the persistent undercurrent of inflation concerns. Here’s a detailed look at the major factors that shaped the stock market.

Economic data took center stage as investors absorbed reports on inflation, employment, and manufacturing. The Federal Reserve’s Beige Book provided an overview of economic growth across the U.S., showing steady expansion but highlighting vulnerabilities in some sectors. The release of initial jobless claims data indicated a slight increase in unemployment, hinting at a cooling labor market. However, it was not enough to ease inflation concerns, reinforcing the notion that the Fed may keep interest rates elevated longer than anticipated. Meanwhile, PMI data reflected strength in manufacturing, suggesting that the U.S. economy may be on track for a “soft landing,” a scenario where growth slows without triggering a recession.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Amid this, the VIX, a key gauge of market volatility, hovered around 20, reflecting the cautious mood among investors. With major averages sitting near all-time highs, there was growing uncertainty about whether the market could sustain its momentum, particularly given the conflicting economic signals and geopolitical risks.

Corporate earnings also played a significant role in influencing market movements. The spotlight was on Tesla ($TSLA), which delivered an impressive third-quarter earnings report. Tesla’s stock soared 22% after the company reported adjusted earnings of 72 cents per share, far surpassing analysts’ estimates of 60 cents. More importantly, Tesla’s operating profit margins improved to 10.8%, exceeding Wall Street expectations. The electric vehicle giant also projected that it would deliver at least 515,000 vehicles in the fourth quarter, setting a new record and outperforming market forecasts of 490,000. Tesla’s success provided a strong tailwind for the tech-heavy Nasdaq Composite, which gained 0.7% as investors flocked to tech stocks.

Netflix ($NFLX) and IBM ($IBM) also grabbed attention during the week. Netflix surprised the market with strong subscriber growth and robust earnings, which helped alleviate concerns about rising competition in the streaming industry. Conversely, IBM, despite beating expectations with adjusted earnings of $2.30 per share, saw its stock decline by 6.2%. The slight revenue miss, at $15 billion versus the expected $15.1 billion, sparked concern about the company’s future growth trajectory. Nevertheless, IBM remains optimistic about its artificial intelligence initiatives, which continue to gain momentum. CEO Arvind Krishna emphasized the growing trust in IBM’s AI models, which are designed to deliver performance leadership at a lower cost.

Retailers, on the other hand, experienced mixed results. Companies like Las Vegas Sands (LVS) and Seagate Technology (STX) performed well, but the broader retail sector struggled, weighed down by inflationary pressures and softening consumer demand. As inflation continues to affect household budgets, the outlook for the retail sector remains cautious.

Geopolitical tensions added further complexity to the market. Ongoing conflicts, particularly in Europe and Asia, led to fluctuations in energy prices and contributed to market volatility. These tensions have kept investors on edge, as rising energy prices feed directly into inflation concerns, potentially complicating the Federal Reserve’s decision-making process.

Despite the economic and geopolitical headwinds, the U.S. dollar remained strong, continuing to serve as a haven for investors seeking stability. However, the strength of the dollar posed challenges for multinational corporations, as it made their exports less competitive and weighed on earnings. Meanwhile, Treasury yields remained volatile, with the 10-year note fluctuating between 3.6% and 4.4%. While yields pulled back slightly, providing some relief to equities, the higher rates remain a concern, particularly for growth stocks that are sensitive to borrowing costs.

The outlook for gold remained bullish, as prices surged to all-time highs. Investors sought gold as a hedge against inflation and economic uncertainty, especially with the potential for rate cuts being pushed further into 2024. With the Federal Reserve expected to maintain a tight monetary policy stance, gold may continue to attract investor interest in the coming months.

The broader market saw mixed performance. The Dow Jones Industrial Average experienced some turbulence, falling as much as 0.8% earlier in the week due to rising bond yields. Stocks like Boeing and IBM weighed heavily on the index. Boeing faced pressure after its largest union rejected a new labor contract, extending a strike that has disrupted production. On the other hand, the tech sector led the market higher, with Nvidia and Super Micro Computer offsetting losses in other sectors.

As we look ahead, I’m shifting toward a bullish outlook. Despite the risks of inflation, geopolitical instability, and rising unemployment, the market fundamentals remain strong. The potential for rate cuts next year could provide further support to the markets. The S&P 500 is expected to rally to the 600–610 range over the next few months, with short-term support around 540–550. Investors should be prepared for shallow pullbacks, which may present attractive buying opportunities, particularly in sectors like technology that continue to demonstrate resilience.

In summary, while the risks of inflation and geopolitical tensions remain, the market appears to be on solid footing. The Federal Reserve’s monetary policy, corporate earnings strength, and market volatility indicators like the VIX all suggest that the market can continue to push toward new highs. However, investors should remain vigilant and monitor key economic data closely, as any surprises could shift the narrative quickly. The combination of strong tech earnings, a resilient economy, and the potential for future rate cuts creates a cautiously optimistic outlook for the rest of the year.

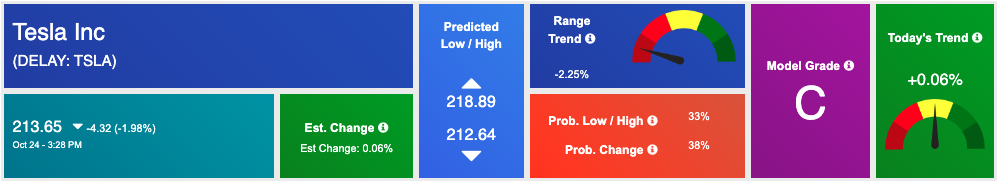

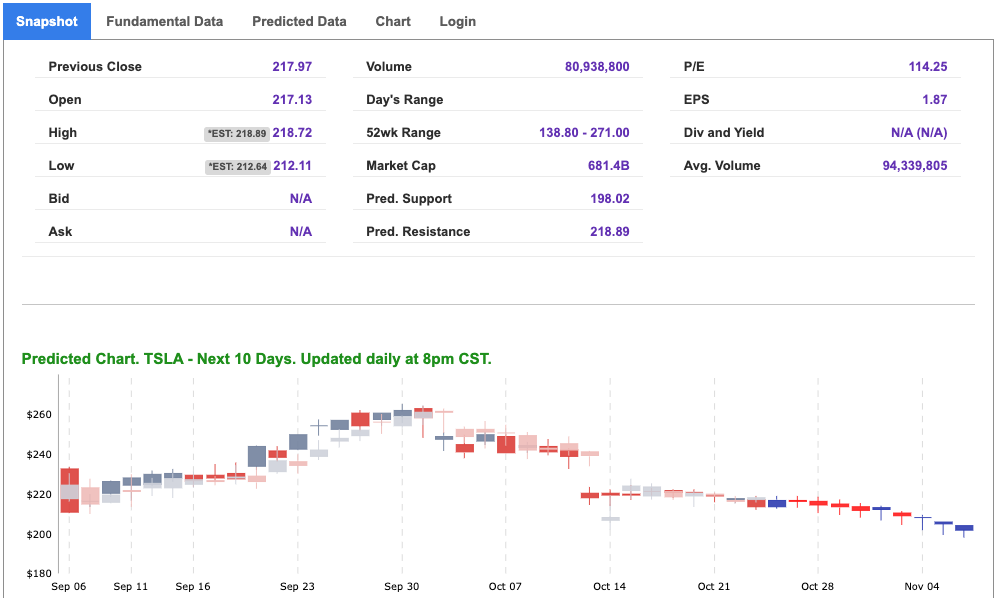

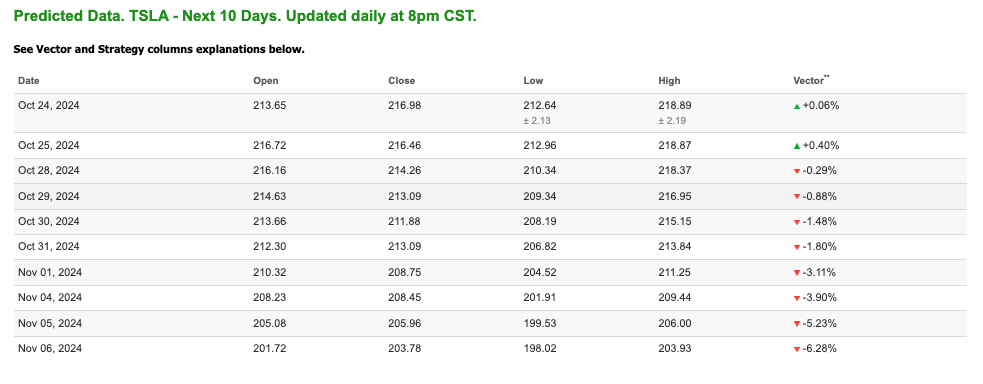

Amid this backdrop, one symbol that has particularly caught my attention is Tesla ($TSLA). Tesla stands out not only because of its broader market influence but also due to its stellar third-quarter performance.

Tesla ($TSLA) stands out as a symbol of interest for the upcoming week due to its exceptional performance in the latest earnings report and strong market positioning. The electric vehicle (EV) giant delivered impressive third-quarter results, reporting adjusted earnings of 72 cents per share, significantly beating analysts’ expectations of 60 cents. This robust earnings surprise reflects Tesla’s ability to navigate economic headwinds while maintaining strong profitability. Furthermore, its operating profit margins increased to 10.8%, well above the anticipated 8%, showcasing efficient cost management and operational strength.

Tesla’s forecast for record vehicle deliveries in the fourth quarter adds to the bullish outlook. The company expects to sell at least 515,000 vehicles, outpacing Wall Street’s projection of 490,000. This guidance underscores Tesla’s continued dominance in the EV space, even amid rising competition and supply chain challenges. Additionally, Tesla has announced plans to start production of a lower-priced vehicle in early 2025, further strengthening its growth trajectory and appeal to a broader market segment.

From a market sentiment perspective, Tesla’s 22% stock jump post-earnings reflects strong investor confidence, which has boosted the tech-heavy Nasdaq Composite. As part of the influential “Magnificent Seven” group of tech megacaps, Tesla’s solid earnings report has set the tone for other tech stocks, indicating that momentum in the sector could continue.

Given these factors—exceptional earnings, positive vehicle delivery forecasts, strong margins, and continued investor optimism—Tesla presents an attractive buying opportunity for the upcoming week. Its strong fundamentals, coupled with its market-leading position in the EV sector, make it a symbol worth considering for both short-term momentum and long-term growth.

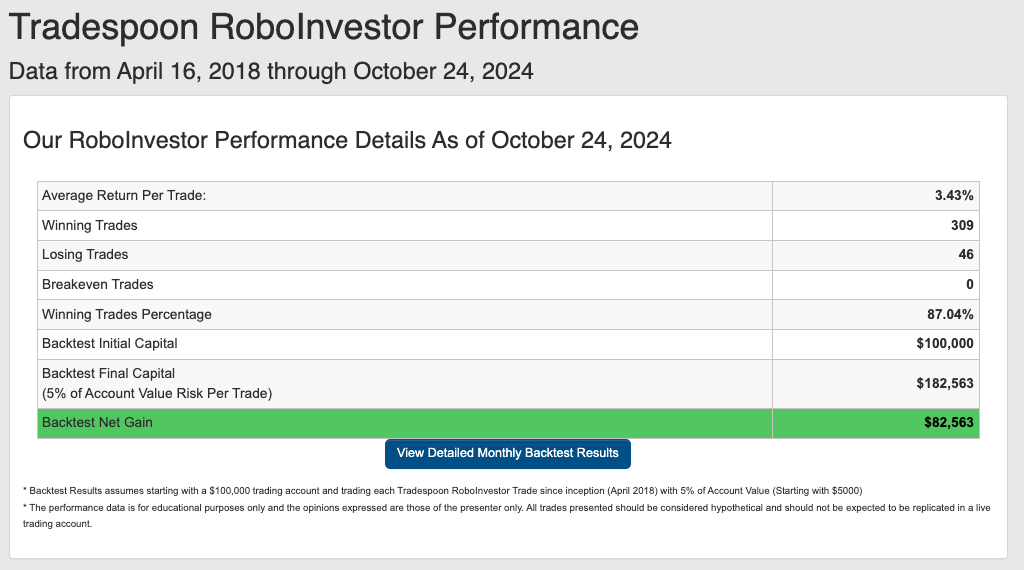

Enhance your investment decisions by leveraging the power of AI with our RoboInvestor stock and ETF advisory service. Utilizing advanced technology, this service identifies trades with a high probability of profitability. Our proprietary AI platform cuts through market noise and removes emotional biases, delivering clear, data-driven insights and strategies to help you succeed in today’s dynamic market environment.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 87.04% going back to April 2018.

As we advance further in Q4, investors face a complex market landscape marked by persistent inflationary pressures, shifting Federal policies, and ongoing geopolitical tensions, including the conflict in Ukraine. In this turbulent environment, having a trusted and knowledgeable investment partner is crucial for making well-informed decisions and effectively navigating the fluctuating market conditions.

That’s where RoboInvestor steps in – serving as your unwavering companion in the ever-changing financial terrain. With a wealth of resources and expert insights at your disposal, RoboInvestor equips you to steer through your portfolio with assurance and capitalize on emerging opportunities amidst the dynamic fluctuations of the market.

Whether you are a seasoned investor or just starting, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money for paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!