In a thrilling Thursday afternoon, Wall Street witnessed a spirited surge in stock prices, fueled by a fresh influx of promising economic data. The United States stock market soared on the back of these numbers, instilling optimism about the continued resilience of the American consumer.

August saw producer prices rise by a remarkable 0.7%, outperforming expectations. Simultaneously, retail sales exhibited their strength with a month-over-month increase of 0.6%, far surpassing the anticipated 0.1% uptick. These robust figures are clear indicators of the enduring strength of the American consumer, even in the face of ongoing challenges.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

Across the Atlantic, the European Central Bank (ECB) made a move that raised eyebrows in financial circles. As expected, the ECB increased interest rates by a quarter point, but it offered a surprising hint that further rate hikes may not be in the pipeline. This subtle dovish stance from the ECB, in conjunction with stronger-than-anticipated U.S. economic data, gave the U.S. dollar a boost in international markets.

The ECB’s decision to raise rates by 25 basis points might not be the end of the story, as they signal a potential pause in their hiking cycle. Meanwhile, on American soil, labor and retail data continued to show resilience and strength.

All eyes are now firmly fixed on the forthcoming Consumer Price Index (CPI) data, which is shaping up to be less favorable than expected. This, combined with the Producer Price Index (PPI) data and the ECB’s decision, has set the stage for market turbulence. The Dollar Index (DXY) continues its ascent, while longer-dated treasuries are experiencing a remarkable rally, bringing them closer to retesting the yield highs last seen in October.

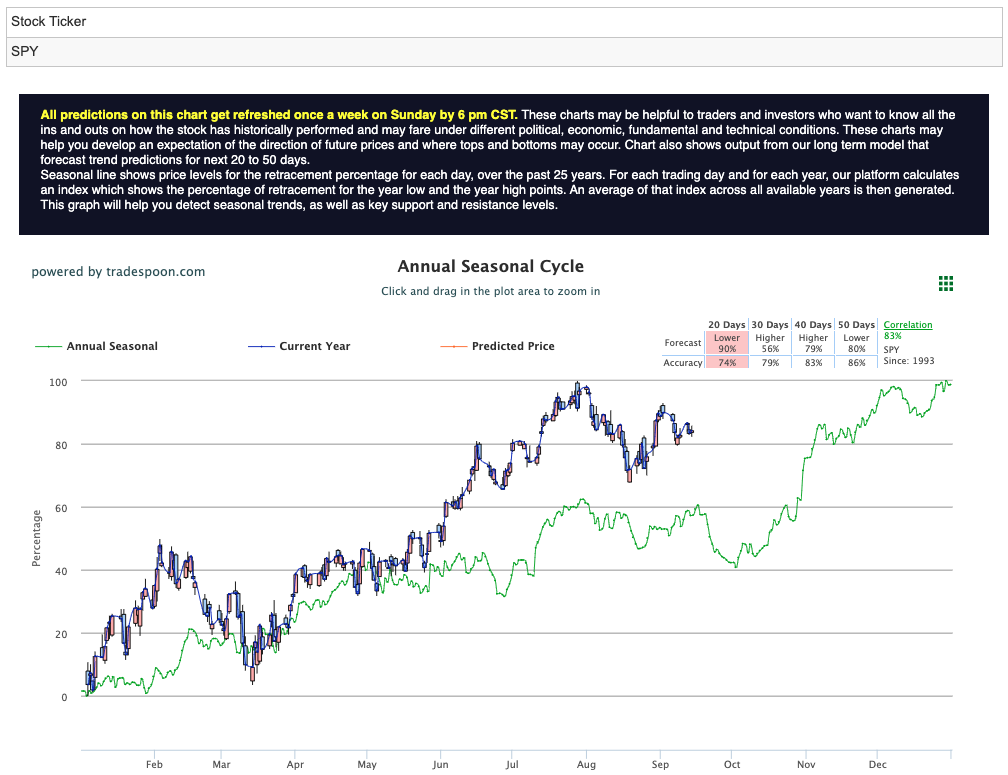

Nevertheless, some experts maintain a cautious outlook, believing that the SPY rally may be limited within the range of $450 to $470, with strong support levels at $400 to $430 in the months ahead. Currently, the market appears to favor further downside, with a retest of August lows already underway. For reference, the SPY Seasonal Chart is shown below:

At the beginning of the week, stocks started to climb as investors delved into the latest inflation statistics. Consumer prices showed a 3.7% year-over-year increase in August, with a 0.6% rise compared to the previous month. However, core prices, which exclude the volatile food and energy categories, exhibited a slowdown, easing from 4.7% in July to 4.3%.

Although the latest inflation report turned heads, it is unlikely to deter the Federal Reserve from maintaining interest rates at their current levels during its upcoming September meeting. Consumer prices rose 3.7% year-over-year in August and core prices inching up by 0.3% over July to a 4.3% annual pace suggesting some moderation in inflation.

Gasoline prices played a substantial role in elevating the headline consumer-price index, which saw a 0.6% jump, marking the largest increase in over a year. Consequently, the year-over-year increase reached 3.7%, slightly surpassing expectations. Additionally, shelter costs remained robust, registering a 0.3% increase for the 40th consecutive month.

These data points are in line with market expectations and reinforce the belief that the Federal Reserve is likely to maintain its current interest rate range of 5.25% to 5.5% during its September 19-20 meeting.

In various sectors, including Europe, small caps, technology, cyclicals, and regional banks, weakness persists. The technology sector and the SPY index are engaged in a tight struggle around the 50-day moving average, while the Dollar Index (DXY) continues its multi-month rally.

In the energy market, crude oil’s upward momentum seems to be losing steam, warranting caution among investors. Notably, Saudi Arabia’s efforts to control supply have kept a lid on oil prices. The U.S. crude oil benchmark, WTI, recently closed above $90 for the first time this year, marking a 1.9% increase to $90.16, the highest settlement price since 2022.

Also, it’s worth noting that labor strikes continue to spread across various industries, with the automotive sector, including the big three car makers in Michigan, now feeling the heat.

With the latest market events in mind, my A.I. system has identified a play that I also like for the upcoming week.

Recent market trends have witnessed regional banks and airlines facing a notable pullback. Regional banks, which are closely tied to economic conditions, have faced headwinds amidst concerns about rising interest rates and potential economic slowdowns. The pause in interest rate hikes by the European Central Bank (ECB) has caused some uncertainty in this sector.

Similarly, airlines have felt the pinch as higher fuel costs due to rising crude oil prices put pressure on their profit margins. The supply disruptions and labor strikes in various industries, including airlines, have further exacerbated the challenges.

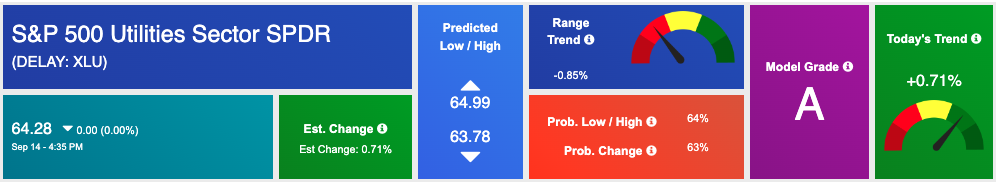

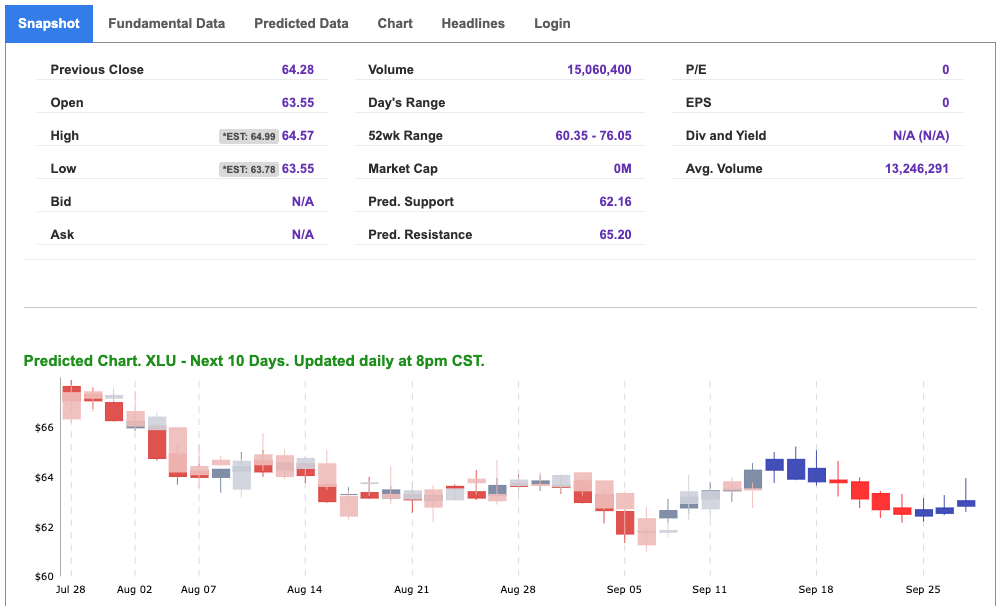

Amidst these developments, investors seeking stability and income potential often turn to utilities. One ETF that stands out in this space is the Utilities Select Sector SPDR Fund (XLU). This exchange-traded fund tracks the performance of the Utilities Select Sector Index and includes companies from the electric, gas, and water utility sectors.

Amidst the recent turbulence in regional banks and airlines, the Utilities Select Sector SPDR Fund (XLU) emerges as an attractive option for investors. XLU offers a haven of stability and income potential in a volatile market. Utilities are renowned for their defensive nature, often weathering economic downturns with resilience. XLU’s constituents provide essential services, ensuring a consistent demand stream even during challenging economic conditions.

What’s more, XLU typically offers a reliable and appealing dividend yield, making it an enticing prospect for income-oriented investors. In times of market uncertainty, this steady income can act as a reassuring cushion for investment portfolios. Furthermore, utilities often possess the ability to pass on increased costs to consumers through rate adjustments, rendering them an effective hedge against the current specter of inflation. As the Dollar Index (DXY) ascends and longer-dated treasuries rally, the stage is set for utilities like XLU to shine, making it an opportune moment to explore this resilient sector for potential investment.

While regional banks and airlines face challenges, utilities like those represented by XLU can provide stability and income potential to investors, making it a prudent choice to consider in the current market environment. This along with my A.I.’s forecast of XLU appears to line up perfectly!

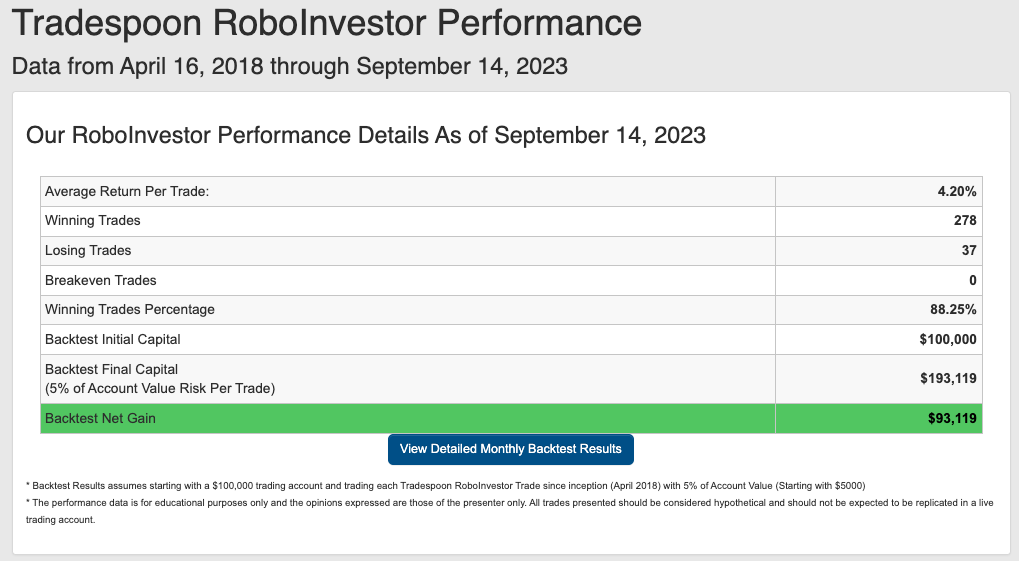

And that is what the power of AI can do for us, as well as for members of our RoboInvestor stock and ETF advisory service. Our proprietary AI platform identifies trades with a high probability of profits and cuts out all the noise and emotion that typically drives investor behavior.

We email subscribers an online newsletter every other week, over the weekend, that includes my fundamental commentary on the market landscape, a technical read on near-term market direction, an update on current positions, and one or two new recommendations to act on when the market opens Monday.

RoboInvesetor is an unrestricted investment service, in that I may recommend blue-chip stocks or ETFs that represent the major indexes, market sectors, sub-sectors, commodities, currencies, interest rates, volatility, and shorting opportunities through the use of inverse ETFs. Our model portfolio will hold between 12 and 25 positions, depending on market conditions. Lately, we’ve been entirely more cautious with a smaller number of stocks and ETFs.

Our track record is one of the very best in the retail advisory industry, where our Winning Trades Percentage is at 88.25% going back to April 2018.

As we inch closer to Q4 2023, investors are facing a dynamic and multifaceted market landscape, influenced by factors such as inflationary pressures, evolving Federal policies, and ongoing geopolitical tensions like the persistent conflict in Ukraine. In order to effectively navigate through this intricate environment, it is crucial to align with a reliable and well-informed investment platform. That’s where RoboInvestor comes in, serving as a trusted partner by offering a range of invaluable resources and expert guidance. With RoboInvestor by your side, you can confidently manage your portfolio and seize lucrative opportunities within the fast-paced market environment.

Whether you are a seasoned investor or just starting out, our team is here to help you every step of the way. Don’t face the challenges of tomorrow alone–join RoboInvestor today and take your investing to the next level.

And remember we’re not talking about day trading here. I’m looking for 50-100% gains within the next 3 months, so my weekly updates are timely enough for you to act.

*Please note: RoboStreet is part of your free subscription service. It is not included in any paid Tradespoon subscription service. Vlad Karpel only trades his own personal money in paid subscription services. If you are a paid subscriber, please review your Premium Member Picks, ActiveTrader, MonthlyTrader, or RoboInvestor recommendations. If you are interested in receiving Vlad’s personal picks, please click here.

Comments Off on

Tradespoon Tools make finding winning trades in minute as easy as 1-2-3.

Our simple 3 step approach has resulted in an average return of almost 20% per trade!